Putnam Investments CEO Reynolds Urges Action – This Year – to Strengthen All of America’s Retirement Savings Systems

02 Februar 2010 - 4:25PM

Business Wire

Speaking at the National Institute on Retirement Security in

Washington, D.C. today, Robert L. Reynolds, President and Chief

Executive Officer, Putnam Investments, urged Congress and the Obama

administration to launch a comprehensive effort this year to

strengthen all of America’s retirement savings systems, public and

private.

Reynolds called for the establishment of a bipartisan commission

to deliver an action plan to make Social Security solvent by the

day after the 2010 election — to generate a more thoughtful, less

polarizing outcome. Additionally, Reynolds urged Congress to

concurrently extend workplace savings coverage to all American

workers, make all existing workplace plans more automatic and

support robust competition among lifetime income solutions — both

annuities and non-annuity variants.

In his remarks shared at the industry event, Reynolds noted that

if no action is taken soon, today’s retirement savings status quo

threatens to inflict severe financial stress on future generations

of retirees — even to pay for food, housing and medicine.

“Americans know we need to transition our country away from debt

and leverage, moving toward a greater reliance on savings,

investment and new business formation to reboot sustainable

economic growth.” Reynolds continued, “Creating a robust, resilient

and truly secure public and private retirement system should be at

the heart of that effort.”

Solving America’s retirement savings challenge calls for new

alliances and collaboration between political parties, social

groups, financial industries and private industry explained

Reynolds. “We’re all in this together,” he noted, “Democrats and

Republicans, wealthy, middle-class and lower-income, public and

private sectors. This is not something one party or industry can

solve. This is an American challenge we need to meet.”

Reynolds, a 30-year veteran of the retirement savings industry,

suggested that retirement reform should include the following key

elements:

Make Social Security Solvent:

- Appoint a bipartisan commission

to develop a compromise plan to make Social Security solvent and

deliver it to Congress by November 3, 2010.

- The plan should not include an

increase in payroll taxes, and it must ensure that the retirement

benefit levels of lower-income Americans be maintained. All other

steps to enhance solvency should be open for compromise.

Extend Access to Workplace Savings Plans to All

Workers

- Offer the 78 million Americans,

roughly half the country’s work force, who do not have a workplace

saving plan coverage through either a universal IRA or a

significantly simplified low-cost version of the 401(k) plan or

both.

- Among existing workplace plans,

speed the implementation of the core elements of the Pension

Protection Act of 2006 including automatic enrollment, savings

escalation, and guidance to qualified default investment options.

These elements should be made mandatory.

Build in Lifetime Income Options

- Create an optional national

insurance charter and a new regulatory body empowered to approve,

or deny approval to, qualified lifetime income products including

annuity and non-annuity products.

- Create a new lifetime income

security fund, comparable to the FDIC in banking, to back up

lifetime income guarantees from insurers whether offered “in-plan”

or as choices people make when rolling over from a workplace

savings plan to individual accounts.

- Require all workplace savings

plan providers to offer such options to all employees, but leave

employees free to choose or reject lifetime income options.

- Provide strong tax incentives to

employees who invest in insured lifetime income products, since

converting life savings into lifelong income is even more

challenging than accumulating a nest egg.

- Provide strong legal protection

to employers who offer automatic enrollment, as well as access to

advice, guidance and lifetime income guarantee products in their

savings plans.

“Ensuring the solvency of the Social Security system and

extending the workplace savings system to nearly all working

Americans, not just half, are the best ways to tackle America’s

retirement challenge and raise America’s national confidence,”

Reynolds suggested. “If we move this year — and finish the job in

2011, we can genuinely solve this issue. Future generations of

working Americans could then feel more secure and more empowered in

their work lives: more willing to change jobs, learn skills, start

a business, or pursue a dream. And we Americans could show the

world — and ourselves — that we can control our destiny. That’s a

goal worth struggling for, and 2010 is the year to start making it

a reality.”

Putnam Investments and Retirement

Reynolds most recent remarks continue a drive he launched in May

2009, when he outlined a vision of what he termed “Workplace

Savings 3.0.” Reynolds then proposed changing the focus of

retirement policy and industry practice from just accumulating

assets to generating lifelong income in retirement, the details of

which can be found at the retirement savings challenge Web

site.

Since beginning that campaign, Putnam has since launched a

series of retirement initiatives, including the Roth IRA Resource

Center which offers a full range of information about individual

retirement account (IRA) conversions, how to evaluate whether they

make sense, and how to perform them. The Roth IRA Resource Center

is aimed at financial advisors, who are dealing with a flood of

demand from their clients for advice on conversions since a tax law

change took effect on January 1, 2010, eliminating income caps that

restricted higher-income investors from converting traditional IRA

assets to Roth IRAs.

Putnam also has expanded the services it offers to 401(k)

retirement plans and developed products to meet the needs of those

planning for or already in retirement. The firm has created a

platform that provides flexible and scalable services and solutions

for advisors, consultants, and their plan sponsor clients in every

segment of the retirement market.

Putnam RetirementReady® Funds, the firm’s suite of 10

target-date/lifecycle retirement funds, recently added target

Absolute Return Funds* to its mix of underlying investments. By

doing so, RetirementReady Funds became the only suite of lifecycle

funds in the country to integrate absolute return strategies.

Employed in retirement portfolios, Putnam Absolute Return Funds are

intended to pursue positive returns, over a period of three years

or more, in up and down markets, to protect against the harmful

effects of adverse investment returns and to seek to reduce

volatility, particularly for investors in or near retirement.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. The

firm was recently ranked #1 out of 61 fund families based on its

funds’ performance during 2009 in a Lipper/Barron’s Fund Families

Survey. At the end of January 2010, Putnam had $113 billion in

assets under management. Putnam has offices in Boston, London,

Frankfurt, Amsterdam, Tokyo, Singapore, and Sydney. For more

information, visit putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

* Putnam’s target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

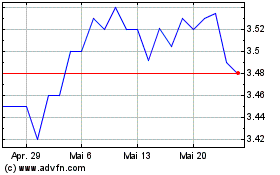

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024