Putnam Closed-End Fund Shareholders Vote to Keep Funds Closed-End

30 Juni 2006 - 10:21PM

Business Wire

The following five Putnam closed-end funds held their annual

meetings of shareholders on June 29, 2006: -- Putnam High Income

Securities Fund (NYSE: PCF) -- Putnam Investment Grade Municipal

Trust (NYSE: PGM) -- Putnam Managed Municipal Income Trust (NYSE:

PMM) -- Putnam Master Intermediate Income Trust (NYSE: PIM) --

Putnam Premier Income Trust (NYSE: PPT) At the meetings,

shareholders of Putnam Investment Grade Municipal Trust, Putnam

Master Intermediate Income Trust and Putnam Premier Income Trust

voted against converting the funds from closed-end to open-end

form. The proposal to convert to open-end form was submitted to the

shareholders of each fund as a result of provisions in each fund's

Agreement and Declaration of Trust that require that, if the fund's

shares trade at a certain discount to net asset value during the

last 12 weeks of the fund's fiscal year, a proposal to convert the

fund to open-end form must be presented to shareholders at the

fund's next annual meeting. As discussed in the definitive proxy

statement that the funds filed with the Securities and Exchange

Commission on May 12, 2006, the Trustees concluded that the funds

are afforded significant investment advantages as a result of their

closed-end status. The Trustees accordingly recommended that

shareholders of each fund vote to defeat the proposal. The

affirmative vote of more than 50% of the shares outstanding as of

the record date, April 3, 2006, was required to pass the proposal.

Fewer than 16% of each fund's outstanding shares were voted in

favor of the proposal. These results are consistent with the

results of shareholder voting on open-ending proposals in previous

years by these and other Putnam closed-end funds. At the annual

meeting, shareholders also elected each of the 11 nominees for

Trustees, who all currently serve as Trustees. In addition,

shareholders of Putnam High Income Securities Fund also voted, in

line with the Trustees' recommendations, to eliminate the fund's

investment restriction concerning investments in restricted

securities. Shareholders of Putnam High Income Securities Fund also

voted to defeat a proposal submitted by a shareholder calling for

the adoption of cumulative voting in the election of the fund's

Trustees. Shareholders of Putnam Premier Income Trust voted to

defeat a shareholder proposal to reduce the size of the fund's

Board of Trustees by one-third. About Putnam Investments: At Putnam

Investments, our top priority remains prudently managing money for

our more than 10 million individual and institutional investors

worldwide. Since 1937, our values have been rooted in a profound

sense of responsibility for the money entrusted to us. We use a

research-driven team approach to seek consistent, dependable,

superior investment results over time, although there is no

guarantee a fund will meet its objectives. We are committed to

doing what's right for investors, including maintaining stringent

investor protections for every Putnam fund. Founded in 1937, Putnam

Investments is one of the nation's oldest and largest money

management firms. As of May 31, 2006, Putnam managed $182 billion

in assets, of which $120 billion is for mutual fund investors and

$62 billion is for institutional accounts. Putnam has offices in

Boston, London and Tokyo. For more information, go to

www.putnam.com.

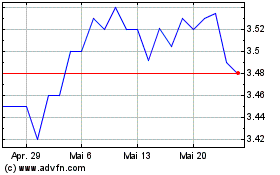

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024