0000784977false00007849772023-10-272023-10-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 27, 2023

| | | | | | | | |

| | |

| PORTLAND GENERAL ELECTRIC COMPANY |

| (Exact name of registrant as specified in its charter) |

| | |

| | |

| Oregon | 001-5532-99 | 93-0256820 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

121 SW Salmon Street, Portland, Oregon 97204

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (503) 464-8000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| (Title of class) | (Trading Symbol) | (Name of exchange on which registered) |

| Common Stock, no par value | POR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 2.02 Results of Operations and Financial Condition.

The following information is furnished pursuant to Item 2.02.

On October 27, 2023, Portland General Electric Company (the Company) issued a press release announcing its financial results for the three and nine months ended September 30, 2023. The press release is furnished herewith as Exhibit 99.1 to this Report.

Item 7.01 Regulation FD Disclosure.

The following information is furnished pursuant to Item 7.01.

At 11:00 a.m. ET on Friday, October 27, 2023, the Company will hold its quarterly earnings call and webcast, and will use a slide presentation in conjunction with the earnings call. A copy of the slide presentation is furnished herewith as Exhibit 99.2 to this Report.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) | | Exhibits. |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover page information from Portland General Electric Company’s Current Report on Form 8-K filed October 27, 2023, formatted in iXBRL (Inline Extensible Business Reporting Language). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | PORTLAND GENERAL ELECTRIC COMPANY |

| | | | (Registrant) |

| | | | |

| Date: | October 27, 2023 | | By: | /s/ Joseph R. Trpik |

| | | | Joseph R. Trpik |

| | | | Senior Vice President, Finance

and Chief Financial Officer |

Exhibit 99.1

| | | | | | | | |

| Portland General Electric One World Trade Center

121 S.W. Salmon Street

Portland, Oregon 97204

News Release |

|

| | |

| October 27, 2023 | | |

| | |

| Media Contact: | | Investor Contact: |

| Sarah Hamaker | | Nick White |

| Corporate Communications | | Investor Relations |

| Phone: 435-513-0799 | | Phone: 503-464-8073 |

Portland General Electric Announces Third Quarter 2023 Results

•Reached constructive global settlement stipulation in 2024 GRC, including updates to the power cost recovery framework

•Third quarter results reflect challenging weather, power market volatility, and continued investment to support grid resiliency, customer growth and decarbonization

•Narrowing 2023 adjusted earnings guidance from $2.60 to $2.75 to $2.60 to $2.65 per diluted share to reflect the impact of third quarter power cost results

PORTLAND, Ore. -- Portland General Electric Company (NYSE: POR) today reported net income based on generally accepted accounting principles (GAAP) of $47 million, or $0.46 per diluted share, for the third quarter of 2023. This compares with GAAP net income of $58 million, or $0.65 per diluted share, for the third quarter of 2022.

“While challenging power market conditions impacted our results in the quarter, we made important progress to reduce risk and reinforce our long-term growth trajectory,” said Maria Pope, PGE President and CEO. “In particular, we were pleased to reach a constructive settlement in our General Rate Case, which improved power cost risk management. We also received exciting news that the Department of Energy awarded three grants that reinforce the work we are doing to advance the clean energy transition in collaboration with regional partners.”

Third Quarter 2023 Compared to Third Quarter 2022

Total revenues increased due to higher demand from digital customers and increased recovery of power costs, partially offset by lower residential and commercial usage. Purchased power and fuel expense increased primarily due to less favorable power market conditions resulting from periods of extreme summer heat. Operating and administrative expenses increased due to higher grid maintenance and resiliency costs and higher generation maintenance costs. Depreciation and amortization expense and interest expense increased due to ongoing capital investment. Other income decreased due to a prior year settlement gain from the buyout of a portion of PGE's post-retirement medical plan that did not recur.

Company Updates

2024 General Rate Case Global Settlement Stipulation

On October 6, 2023, PGE and stakeholders reached a settlement that resolves remaining issues in PGE's general rate case. Terms of the agreement and the resulting stipulation were submitted to the Oregon Public Utility Commission (OPUC) in Docket UE 416. After adjusting for the effects of settled items, PGE's adjusted annual revenue requirement increase is $391 million.

Key issues resolved include a provision allowing recovery of certain costs during Reliability Contingency Events (as defined in the settlement) at an 80/20 sharing ratio, inclusions of incremental Net Variable Power Costs (NVPC) for additional capacity contracts, the establishment of a balancing account for the recovery of routine vegetation management expenses, a tariff filing for residential and small commercial customers weather-normalized decoupling, withdrawal of the proposal for associated storage from the Renewable Adjustment Clause, and updates to PGE’s Income Qualified Bill Discount program.

The stipulations remain subject to OPUC approval, with new customer prices effective January 1, 2024.

Wildfire Mitigation Automatic Adjustment Clause

On October 18, 2023, the OPUC adopted a stipulation agreed to by PGE and certain parties that allows PGE to begin amortizing $27 million of deferred wildfire mitigation costs, comprised of $23 million related to the September 30, 2023 deferred operating expense balance of $31 million and $4 million for capital related revenue requirement. The $27 million will be amortized over a one-year period beginning October 20, 2023. PGE will recover the remaining deferred expense balance in future periods to be determined in a later proceeding. In January 2024, PGE will begin collecting forecasted wildfire mitigation costs under the wildfire mitigation automatic adjustment clause.

U.S. Department of Energy Awards

In October 2023, PGE and partner organizations were awarded the following:

•U.S. Department of Energy (DOE) Regional Clean Hydrogen Hub—The U.S DOE selected the Pacific Northwest Hydrogen Association’s PNWH2 Hub for award negotiations as one of the Regional Clean Hydrogen Hubs. PGE and partner organizations’ project concept proposed as part of the PNWH2 Hub would utilize the site of the former Boardman Coal Plant to locate a potential new facility to produce green hydrogen to generate clean electricity. DOE and the Pacific Northwest Hydrogen Association will negotiate the final funding and scope for the hub beginning this fall as part of a multi-year process.

•U.S. DOE Bethel-Round Butte Transmission Line Upgrade—The U.S. DOE selected the Confederated Tribes of Warm Springs (CTWS), in partnership with PGE, for a $250 million grant to upgrade the existing 230 kV Bethel-Round Butte Transmission line to 500 kV. The added capacity will increase resiliency of the transmission system and enable new carbon-free generation in Central Oregon.

•U.S. DOE Smart Grid Chip—The U.S. DOE selected a PGE led consortium for a $50 million grant for the Smart Grid Chip project. The project will enable real-time information at each meter to improve the visibility of the electrical system and enhance reliability and grid management.

PGE continues to pursue multiple areas under federal legislative programs for potential grant funding of projects.

Voluntary Renewable Energy Program

For the 14th year, PGE's voluntary renewable energy program, Green Future, was ranked number one by the U.S. Department of Energy’s National Renewable Energy Laboratory for the largest participation of business and residential customers in a renewables program of any electric utility in the U.S.

Quarterly Dividend

As previously announced, on October 20, 2023, the board of directors of Portland General Electric Company approved a quarterly common stock dividend of $0.475 per share. The quarterly dividend is payable on or before January 15, 2024 to shareholders of record at the close of business on December 26, 2023.

2023 Earnings Guidance

PGE is narrowing its estimate for full-year 2023 adjusted earnings guidance from $2.60 to $2.75 to $2.60 to $2.65 per diluted share based on the following assumptions:

•An increase in energy deliveries of 2%, weather adjusted;

•Normal temperatures in its utility service territory;

•Hydro conditions for the year that reflect current estimates;

•Wind generation based on five years of historical levels or forecast studies when historical data is not available;

•Normal thermal plant operations;

•Operating and maintenance expense between $695 million and $715 million which includes approximately $40 million of storm, wildfire and related deferral and other expenses that are offset in revenue and other income statement lines;

•Depreciation and amortization expense between $445 million and $465 million;

•Effective tax rate of 15% to 20%;

•Cash from operations of $500 to $550 million;

•Capital expenditures of $1,475 million; and

•Average construction work in progress balance of $540 million.

Third Quarter 2023 Earnings Call and Webcast — October 27, 2023

PGE will host a conference call with financial analysts and investors on Friday, October 27, 2023, at 11 a.m. ET. The conference call will be webcast live on the PGE website at investors.portlandgeneral.com. A webcast replay will also be available on PGE’s investor website "Events & Presentations" page beginning at 2 p.m. ET on October 27, 2023.

Maria Pope, President and CEO and Joe Trpik, Senior Vice President of Finance and CFO, will participate in the call. Management will respond to questions following formal comments.

The attached unaudited condensed consolidated statements of income and comprehensive income, balance sheets and statements of cash flows, as well as the supplemental operating statistics, are an integral part of this earnings release.

# # #

About Portland General Electric Company

Portland General Electric (NYSE: POR) is a fully integrated energy company that generates, transmits and distributes electricity to over 900,000 customers in 51 cities across the state of Oregon. For more than 130 years, Portland General Electric (PGE) has powered the advancement of society, delivering safe, affordable, reliable and increasingly clean energy. To deliver on its strategy and meet state targets, PGE and its approximately 3,000 employees are committed to collaborating with stakeholders to achieve at least an 80% reduction in greenhouse gas emissions from power served to customers by 2030 and 100% reduction by 2040. PGE customers set the standard for prioritizing clean energy with the No. 1 voluntary renewable energy program in the country. Additionally, for the fifth year in a row, PGE was recognized by the Bloomberg Gender-Equality Index which highlights companies committed to creating a more equal and inclusive workplace. As a reflection of the company's commitment to the community it serves, in 2022, PGE employees, retirees and the PGE Foundation donated nearly $5.5 million and volunteered more than 18,000 hours with more than 400 nonprofits across Oregon. For more information visit www.PortlandGeneral.com/news.

Safe Harbor Statement

Statements in this press release that relate to future plans, objectives, expectations, performance, events and the like may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent our estimates and assumptions as of the date of this report. The Company assumes no obligation to update or revise any forward-looking statement as a result of new information, future events or other factors.

Forward-looking statements include statements regarding the Company's full-year earnings guidance (including expectations regarding annual retail deliveries, hydro conditions, wind generation, normal thermal plant operations, operating and maintenance expense and depreciation and amortization expense) as well as other statements containing words such as "anticipates," "based on," "believes," "conditioned upon," "considers," “could,” "estimates," "expects," “expected,” "forecast," "goals," "intends," "needs," "plans," "predicts," "projects," "promises," "seeks," "should," "subject to," "targets,“ “will likely result”, “will continue,” or similar expressions.

Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including, without limitation: the timing or outcome of various legal and regulatory actions; changing customer expectations and choices that may reduce demand for electricity; the sale of excess energy during periods of low demand or low wholesale market prices; operational risks relating to the Company's generation and battery storage facilities, including hydro conditions, wind conditions, disruption of transmission and distribution, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; delays in the supply chain and increased supply costs (including application of tariffs impacting solar module imports), failure to complete capital projects on schedule or within budget, inability to complete negotiations on contracts for capital projects, failure of counterparties to perform under agreement, or the abandonment of capital projects, which could result in the Company's inability to recover project costs, or impact our competitive position, market share, revenues and project margins in material ways; default or nonperformance of counterparties from whom PGE purchases capacity or energy, which require the purchase of replacement power and renewable attributes at increased costs; complications arising from PGE's jointly-owned plant, including ownership changes, regulatory outcomes or operational failures; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric and energy market conditions, which could affect the availability and cost of purchased power and fuel; the development of alternative technologies; changes in capital and credit market conditions, including volatility of equity markets, reductions in demand for investment-grade commercial paper or interest rates, which could affect the access to and availability or cost of capital and result in delay or cancellation of capital projects or execution of the Company's strategic plan as currently envisioned; general economic and financial market conditions, including inflation; the effects of climate change, whether global or local in nature; unseasonable or severe weather conditions, wildfires, and other natural phenomena and natural disasters that could result in operational disruptions, unanticipated restoration costs, third party liability or that may affect energy costs or consumption; the effectiveness of PGE's risk management policies and procedures; PGE's ability to effectively implement Public Safety Power Shutoffs (PSPS) and de-energize its system in the event of heightened wildfire risk; cyber security attacks, data security breaches, physical attacks and security breaches, or other malicious acts, which could disrupt operations, require significant expenditures, or result in claims against the Company; employee workforce factors, including potential strikes, work stoppages, transitions in senior management, and the ability to recruit and retain key employees and other talent and turnover due to macroeconomic trends; PGE business activities are concentrated in one region and future performance may be affected by events and factors unique to Oregon; widespread health emergencies or outbreaks of infectious diseases such as COVID-19, which may affect our financial position, results of operations and cash flows; failure to achieve the Company's greenhouse gas emission goals or being perceived to have either failed to act responsibly with respect to the environment or effectively responded to legislative requirements concerning greenhouse gas emission reductions; social attitudes regarding the electric utility and power industries; political and economic conditions; acts of war or terrorism; and risks and uncertainties related to All-Source RFP projects, including regulatory processes, transmission capabilities, system interconnections, permitting and construction delays, legislative uncertainty, inflationary impacts, supply costs and supply chain constraints. As a result, actual results may differ materially from those projected in the forward-looking statements.

Risks and uncertainties to which the Company are subject are further discussed in the reports that the Company has filed with the United States Securities and Exchange Commission (SEC). These reports are available through the

EDGAR system free-of-charge on the SEC's website, www.sec.gov and on the Company's website, investors.portlandgeneral.com. Investors should not rely unduly on any forward-looking statements.

PORTLAND GENERAL ELECTRIC COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

AND COMPREHENSIVE INCOME

(Dollars in millions, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Revenues, net | $ | 801 | | | $ | 742 | | | $ | 2,192 | | | $ | 1,955 | |

| Alternative revenue programs, net of amortization | 1 | | | 1 | | | 6 | | | 5 | |

| Total revenues | 802 | | | 743 | | | 2,198 | | | 1,960 | |

| Operating expenses: | | | | | | | |

| Purchased power and fuel | 386 | | | 337 | | | 910 | | | 707 | |

| Generation, transmission and distribution | 85 | | | 83 | | | 279 | | | 258 | |

| Administrative and other | 89 | | | 84 | | | 262 | | | 257 | |

| Depreciation and amortization | 116 | | | 108 | | | 340 | | | 310 | |

| Taxes other than income taxes | 41 | | | 39 | | | 124 | | | 118 | |

| Total operating expenses | 717 | | | 651 | | | 1,915 | | | 1,650 | |

| Income from operations | 85 | | | 92 | | | 283 | | | 310 | |

| Interest expense, net | 42 | | | 39 | | | 127 | | | 115 | |

| Other income: | | | | | | | |

| Allowance for equity funds used during construction | 5 | | | 4 | | | 12 | | | 10 | |

| Miscellaneous income, net | 5 | | | 13 | | | 22 | | | 13 | |

| Other income, net | 10 | | | 17 | | | 34 | | | 23 | |

| Income before income tax expense | 53 | | | 70 | | | 190 | | | 218 | |

| Income tax expense | 6 | | | 12 | | | 30 | | | 36 | |

| Net income | 47 | | | 58 | | | 160 | | | 182 | |

| Other comprehensive income | — | | | — | | | 1 | | | 1 | |

| Net income and Comprehensive income | $ | 47 | | | $ | 58 | | | $ | 161 | | | $ | 183 | |

| | | | | | | |

| Weighted-average common shares outstanding (in thousands): | | | | | | | |

| Basic | 100,849 | | | 89,263 | | | 96,625 | | | 89,294 | |

| Diluted | 101,103 | | | 89,447 | | | 96,830 | | | 89,448 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

Basic | $ | 0.47 | | | $ | 0.65 | | | $ | 1.65 | | | $ | 2.04 | |

| Diluted | $ | 0.46 | | | $ | 0.65 | | | $ | 1.65 | | | $ | 2.04 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

PORTLAND GENERAL ELECTRIC COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 47 | | | $ | 165 | |

| Accounts receivable, net | 364 | | | 398 | |

| | | |

| Inventories | 109 | | | 95 | |

| | | |

| Regulatory assets—current | 55 | | | 54 | |

| Other current assets | 149 | | | 498 | |

| Total current assets | 724 | | | 1,210 | |

| Electric utility plant, net | 9,078 | | | 8,465 | |

| Regulatory assets—noncurrent | 546 | | | 473 | |

| Nuclear decommissioning trust | 34 | | | 39 | |

| Non-qualified benefit plan trust | 33 | | | 38 | |

| Other noncurrent assets | 188 | | | 234 | |

| Total assets | $ | 10,603 | | | $ | 10,459 | |

| | | |

PORTLAND GENERAL ELECTRIC COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS, continued

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 187 | | | $ | 457 | |

| Liabilities from price risk management activities—current | 73 | | | 118 | |

| | | |

| Current portion of long-term debt | — | | | 260 | |

| Current portion of finance lease obligation | 20 | | | 20 | |

| Accrued expenses and other current liabilities | 356 | | | 641 | |

| Total current liabilities | 636 | | | 1,496 | |

| Long-term debt, net of current portion | 3,786 | | | 3,386 | |

| Regulatory liabilities—noncurrent | 1,418 | | | 1,389 | |

| Deferred income taxes | 445 | | | 439 | |

| Unfunded status of pension and postretirement plans | 172 | | | 170 | |

| Liabilities from price risk management activities—noncurrent | 120 | | | 75 | |

| Asset retirement obligations | 261 | | | 257 | |

| Non-qualified benefit plan liabilities | 78 | | | 83 | |

| Finance lease obligations, net of current portion | 291 | | | 294 | |

| Other noncurrent liabilities | 101 | | | 91 | |

| Total liabilities | 7,308 | | | 7,680 | |

| | | |

| Shareholders’ Equity: | | | |

| Preferred stock, no par value, 30,000,000 shares authorized; none issued and outstanding as of September 30, 2023 and December 31, 2022 | — | | | — | |

| Common stock, no par value, 160,000,000 shares authorized; 101,123,903 and 89,283,353 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 1,744 | | | 1,249 | |

| Accumulated other comprehensive loss | (3) | | | (4) | |

| Retained earnings | 1,554 | | | 1,534 | |

| | | |

| | | |

| Total shareholders’ equity | 3,295 | | | 2,779 | |

| Total liabilities and shareholders’ equity | $ | 10,603 | | | $ | 10,459 | |

|

PORTLAND GENERAL ELECTRIC COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 160 | | | $ | 182 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 340 | | | 310 | |

| | | |

| | | |

| | | |

| Deferred income taxes | (3) | | | 9 | |

| Pension and other postretirement benefits | 4 | | | 7 | |

| Other post retirement benefits settlement gain | — | | | (11) | |

| Allowance for equity funds used during construction | (12) | | | (10) | |

| | | |

| Decoupling mechanism deferrals, net of amortization | (6) | | | (5) | |

| | | |

| | | |

| Regulatory assets | 10 | | | (44) | |

| Regulatory liabilities | 17 | | | 8 | |

| | | |

| | | |

| 2020 Labor Day wildfire earnings test reserve | — | | | 15 | |

| Other non-cash income and expenses, net | 46 | | | 41 | |

| Changes in working capital: | | | |

| Accounts receivable, net | 23 | | | (21) | |

| Inventories | (14) | | | (14) | |

| Margin deposits | 87 | | | (8) | |

| Accounts payable and accrued liabilities | (181) | | | 80 | |

| Margin deposits from wholesale counterparties | (133) | | | 44 | |

| Other working capital items, net | 20 | | | 24 | |

| | | |

| | | |

| | | |

| Other, net | (27) | | | (33) | |

| Net cash provided by operating activities | 331 | | | 574 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

PORTLAND GENERAL ELECTRIC COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS, continued

(In millions)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (931) | | | (541) | |

| | | |

| | | |

| Sales of Nuclear decommissioning trust securities | 1 | | | 3 | |

| Purchases of Nuclear decommissioning trust securities | (1) | | | (3) | |

| | | |

| | | |

| | | |

| Proceeds from sale of properties | 2 | | | 13 | |

| Other, net | (3) | | | — | |

| Net cash used in investing activities | (932) | | | (528) | |

| | | |

|

| | | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of common stock | $ | 485 | | | $ | — | |

| Proceeds from issuance of long-term debt | 400 | | | — | |

| Payments on long-term debt | (260) | | | — | |

| | | |

| | | |

| Issuance of commercial paper, net | — | | | 40 | |

| Proceeds from Pelton/Round Butte financing arrangement | — | | | 25 | |

| Dividends paid | (131) | | | (117) | |

| | | |

| | | |

| Repurchase of common stock | — | | | (18) | |

| Other | (11) | | | (10) | |

| Net cash provided by (used in) financing activities | 483 | | | (80) | |

Change in cash and cash equivalents | (118) | | | (34) | |

| Cash and cash equivalents, beginning of period | 165 | | | 52 | |

| Cash and cash equivalents, end of period | $ | 47 | | | $ | 18 | |

| | | |

| Supplemental cash flow information is as follows: | | | |

| Cash paid for interest, net of amounts capitalized | $ | 91 | | | $ | 81 | |

| Cash paid for income taxes | 25 | | | 18 | |

| Non-cash investing and financing activities: | | | |

| Assets obtained under leasing arrangements | — | | | 29 | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

|

PORTLAND GENERAL ELECTRIC COMPANY AND SUBSIDIARIES

SUPPLEMENTAL OPERATING STATISTICS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Revenues (dollars in millions): | | | | | | | |

| Retail: | | | | | | | |

| Residential | $ | 942 | | | 43 | % | | $ | 841 | | | 43 | % |

| Commercial | 606 | | | 27 | | | 540 | | | 29 | |

| Industrial | 258 | | | 12 | | | 216 | | | 11 | |

| Direct Access | 20 | | | 1 | | | 26 | | | 1 | |

| Subtotal Retail | 1,826 | | | 83 | | | 1,623 | | | 84 | |

| Alternative revenue programs, net of amortization | 6 | | | — | | | 5 | | | — | |

| Other accrued revenues, net | (2) | | | — | | | 6 | | | — | |

| Total retail revenues | 1,830 | | | 83 | | | 1,634 | | | 84 | |

| Wholesale revenues | 323 | | | 15 | | | 281 | | | 14 | |

| Other operating revenues | 45 | | | 2 | | | 45 | | | 2 | |

| Total revenues | $ | 2,198 | | | 100 | % | | $ | 1,960 | | | 100 | % |

| | | | | | | |

| Energy deliveries (MWhs in thousands): | | | | | | | |

| Retail: | | | | | | | |

| Residential | 5,949 | | | 28 | % | | 5,880 | | | 29 | |

| Commercial | 4,995 | | | 23 | | | 4,981 | | | 24 | |

| Industrial | 3,380 | | | 16 | | | 3,072 | | | 15 | |

| Subtotal | 14,324 | | | 67 | | | 13,933 | | | 68 | |

| Direct access: | | | | | | | |

| Commercial | 442 | | | 2 | | | 412 | | | 2 | |

| Industrial | 1,307 | | | 6 | | | 1,325 | | | 7 | |

| Subtotal | 1,749 | | | 8 | | | 1,737 | | | 9 | |

| Total retail energy deliveries | 16,073 | | | 75 | | | 15,670 | | | 77 | |

| Wholesale energy deliveries | 5,295 | | | 25 | | | 4,807 | | | 23 | |

| Total energy deliveries | 21,368 | | | 100 | % | | 20,477 | | | 100 | % |

| | | | | | | |

| Average number of retail customers: | | | | | | | |

| Residential | 814,773 | | | 88 | % | | 808,632 | | 88 | % |

| Commercial | 112,210 | | | 12 | | | 112,015 | | 12 | |

| Industrial | 195 | | | — | | | 192 | | — | |

| Direct access | 538 | | | — | | | 552 | | — | |

| Total | 927,716 | | | 100 | % | | 921,391 | | | 100 | % |

PORTLAND GENERAL ELECTRIC COMPANY AND SUBSIDIARIES

SUPPLEMENTAL OPERATING STATISTICS, continued

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Sources of energy (MWhs in thousands): | | | | | | | |

| Generation: | | | | | | | |

| Thermal: | | | | | | | |

| Natural gas | 7,746 | | | 38 | % | | 5,610 | | | 29 | % |

| Coal | 1,629 | | | 8 | | | 1,576 | | | 8 | |

| Total thermal | 9,375 | | | 46 | | | 7,186 | | | 37 | |

| Hydro | 865 | | | 4 | | | 762 | | | 4 | |

| Wind | 1,644 | | | 8 | | | 1,410 | | | 7 | |

| Total generation | 11,884 | | | 58 | | | 9,358 | | | 48 | |

| Purchased power: | | | | | | | |

| Hydro | 3,622 | | | 18 | | | 5,107 | | | 26 | |

| Wind | 699 | | | 3 | | | 640 | | | 3 | |

| Solar | 935 | | | 4 | | | 585 | | | 3 | |

| Natural Gas | 145 | | | 1 | | | 27 | | | — | |

| Waste, Wood, and Landfill Gas | 116 | | | 1 | | | 122 | | | 1 | |

| Source not specified | 3,056 | | | 15 | | | 3,809 | | | 19 | |

| Total purchased power | 8,573 | | | 42 | | | 10,290 | | | 52 | |

| Total system load | 20,457 | | | 100 | % | | 19,648 | | | 100 | % |

| Less: wholesale sales | (5,295) | | | | | (4,807) | | | |

| Retail load requirement | 15,162 | | | | | 14,841 | | | |

The following table indicates the number of heating and cooling degree-days for the three and nine months ended September 30, 2023 and 2022, along with 15-year averages based on weather data provided by the National Weather Service, as measured at Portland International Airport:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Heating Degree-days | | Cooling Degree-days | | | | | | | | |

| 2023 | | 2022 | | Avg. | | 2023 | | 2022 | | Avg. | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| First Quarter | 1,927 | | | 1,761 | | | 1,840 | | | — | | | — | | | — | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Second Quarter | 554 | | | 761 | | | 629 | | | 195 | | | 75 | | | 101 | | | | | | | | | |

| July | — | | | — | | | 7 | | | 269 | | | 279 | | | 192 | | | | | | | | | |

| August | 1 | | | — | | | 5 | | | 327 | | | 321 | | | 216 | | | | | | | | | |

| September | 44 | | | 6 | | | 52 | | | 91 | | | 145 | | | 85 | | | | | | | | | |

| Third Quarter | 45 | | | 6 | | | 64 | | | 687 | | | 745 | | | 493 | | | | | | | | | |

| Year-to-date | 2,526 | | | 2,528 | | | 2,533 | | | 882 | | | 820 | | | 594 | | | | | | | | | |

Increase from the 15-year average | — | % | | — | % | | | | 48 | % | | 38 | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Portland General Electric EARNINGS CONFERENCE CALL THIRD QUARTER 2023 Exhibit 99.2

Cautionary statement Information Current as of October 27, 2023 Except as expressly noted, the information in this presentation is current as of October 27, 2023 — the date on which PGE filed its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 — and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update this presentation, except as may be required by law. Forward-Looking Statement Statements in this presentation that relate to future plans, objectives, expectations, performance, events and the like may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward- looking statements represent our estimates and assumptions as of the date of this report. The Company assumes no obligation to update or revise any forward-looking statement as a result of new information, future events or other factors. Forward-looking statements include statements regarding the Company's full-year earnings guidance (including expectations regarding annual retail deliveries, hydro conditions, wind generation, normal thermal plant operations, operating and maintenance expense and depreciation and amortization expense) as well as other statements containing words such as "anticipates," "based on," "believes," "conditioned upon," "considers," “could,” "estimates," "expects," “expected,” "forecast," "goals," "intends," "needs," "plans," "predicts," "projects," "promises," "seeks," "should," "subject to," "targets,“ “will likely result”, “will continue,” or similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including, without limitation: the timing or outcome of various legal and regulatory actions; changing customer expectations and choices that may reduce demand for electricity; the sale of excess energy during periods of low demand or low wholesale market prices; operational risks relating to the Company's generation and battery storage facilities, including hydro conditions, wind conditions, disruption of transmission and distribution, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; delays in the supply chain and increased supply costs (including application of tariffs impacting solar module imports), failure to complete capital projects on schedule or within budget, inability to complete negotiations on contracts for capital projects, failure of counterparties to perform under agreement, or the abandonment of capital projects, which could result in the Company's inability to recover project costs, or impact our competitive position, market share, revenues and project margins in material ways; default or nonperformance of counterparties from whom PGE purchases capacity or energy, which require the purchase of replacement power and renewable attributes at increased costs; complications arising from PGE's jointly-owned plant, including ownership changes, regulatory outcomes or operational failures; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric and energy market conditions, which could affect the availability and cost of purchased power and fuel; the development of alternative technologies; changes in capital and credit market conditions, including volatility of equity markets, reductions in demand for investment-grade commercial paper or interest rates, which could affect the access to and availability or cost of capital and result in delay or cancellation of capital projects or execution of the Company's strategic plan as currently envisioned; general economic and financial market conditions, including inflation; the effects of climate change, whether global or local in nature; unseasonable or severe weather conditions, wildfires, and other natural phenomena and natural disasters that could result in operational disruptions, unanticipated restoration costs, third party liability or that may affect energy costs or consumption; the effectiveness of PGE's risk management policies and procedures; PGE's ability to effectively implement Public Safety Power Shutoffs (PSPS) and de-energize its system in the event of heightened wildfire risk; cyber security attacks, data security breaches, physical attacks and security breaches, or other malicious acts, which could disrupt operations, require significant expenditures, or result in claims against the Company; employee workforce factors, including potential strikes, work stoppages, transitions in senior management, and the ability to recruit and retain key employees and other talent and turnover due to macroeconomic trends; PGE business activities are concentrated in one region and future performance may be affected by events and factors unique to Oregon; widespread health emergencies or outbreaks of infectious diseases such as COVID-19, which may affect our financial position, results of operations and cash flows; failure to achieve the Company's greenhouse gas emission goals or being perceived to have either failed to act responsibly with respect to the environment or effectively responded to legislative requirements concerning greenhouse gas emission reductions; political and economic conditions; and risks and uncertainties related to All-Source RFP projects, including regulatory processes, transmission capabilities, system interconnections, permitting and construction delays, legislative uncertainty, inflationary impacts, supply costs and supply chain constraints. As a result, actual results may differ materially from those projected in the forward-looking statements. Risks and uncertainties to which the Company are subject are further discussed in the reports that the Company has filed with the United States Securities and Exchange Commission (SEC). These reports are available through the EDGAR system free-of-charge on the SEC’s website, www.sec.gov and on the Company’s website, investors.portlandgeneral.com. Investors should not rely unduly on any forward-looking statements. 2

Topics for today’s call 3 Business Update Maria Pope, President and CEO • Financial and operational results • Quarterly highlights Financial Update Joe Trpik, Senior VP of Finance and CFO • Economy and load trends • Third quarter 2023 earnings • General rate case update • Capital investments and resource planning update • Liquidity and financing

$0.80 $0.39 $0.46 Q1 Q2 Q3 Q4 Quarterly Diluted EPS $0.44(2) $0.90 - $0.95(4) $0.67 $0.72 $0.65 $0.56 Q1 Q2 Q3 Q4 Quarterly Diluted EPS $0.81(2) Q3 2023 Q3 2022 2023 YTD 2022 YTD GAAP net income (in millions) $47 $58 $160 $182 GAAP diluted earnings per share (EPS) $0.46 $0.65 $1.65 $2.04 Exclusion of 2020 Boardman revenue requirement refund charge (2) - - $0.07 - Exclusion of 2020 Wildfire and COVID deferral reversal (2) - - - $0.19 Tax effect (3) - - ($0.02) ($0.05) Non-GAAP adjusted diluted earnings per share $0.46 $0.65 $1.70 $2.18 (1) The amount and timing of dividends payable and the dividend policy are at the sole discretion of the Portland General Electric Board of Directors and, if declared and paid, dividends may be in amounts that are less than projected (2) PGE believes that excluding the effects of the previously disclosed Boardman revenue requirement refund deferral charge and the 2020 Wildfire and COVID deferral reversal provide a meaningful representation of the Company’s comparative earnings and reflects the present operating financial performance (see appendix for important information about non-GAAP measures) (3) Tax effects were determined based on the Company’s full-year blended federal and state statutory tax rate (4) Q4 2023 estimate based on 2023 non-GAAP adjusted earnings guidance of $2.60 to $2.65 Third quarter 2023 financial results 4 Updating • 2023 adjusted earnings guidance from $2.60 to $2.75 to $2.60 to $2.65 per diluted share • 2023 load growth guidance from 2.5% to 3% to 2%, weather adjusted Reaffirming • Long-term load growth of 2%, through 2027 • Long-term EPS growth of 5% to 7% off 2022 non-GAAP adjusted base year • 5% to 7% long-term dividend growth (1) Q3 2022 GAAP Diluted EPS $2.60 2022 Non-GAAP Diluted EPS $2.74 2023 Adjusted Earnings Guidance $2.60 - $2.65

Third quarter highlights 5 High Tech Investment in Oregon Expected job creation from state-wide semiconductor investment from recent legislative incentives Expected state-wide semiconductor investment resulting from recent legislative incentives$40B+ 6,300 Oregon CHIPS Fund (SB 4) grants and loans$240M U.S. Department of Energy Awards Pacific Northwest Hydrogen Association’s Hub selected for award negotiations, including proposed utilization of the former Boardman Coal Plant site to locate a potential new facility to produce green hydrogen Grant to PGE led consortium for the Smart Grid Chip project$50M PNWH2 Grant to the Confederated Tribes of Warm Springs (CTWS), in partnership with PGE, to upgrade the Bethel-Round Butte Transmission Line $250M New System Peak Load Megawatts of demand reduction from customer actions during mid-August heat event96 Megawatts of demand recorded during new peak load event in August4,498 Regulatory Updates Received OPUC approval to amortize $27 million in wildfire mitigation deferrals and collection of forecasted wildfire mitigation costs under the wildfire mitigation automatic adjustment clause (AAC) AAC Reached global settlement with parties for remaining issues in the 2024 General Rate CaseGRC

Q3 2023 earnings bridge 6 Q3 2022 GAAP EPS Note: Dollar values are earnings per diluted share Interest expense OtherPrior year net variable power costs Dilutive impact of equity draws Depreciation and amortization expense Q3 2023 GAAP EPS Operating expense Current year net variable power costs Load and customer composition

2024 General Rate Case Rate Case Key Terms- Through 6th Stipulation Rate Base $6.2 billion Rate Base Increase $742 million, 14% ROE 9.5% Capital Structure 50/50 Cost of Debt 4.485% Cost of Capital 6.993% Revenue Requirement Increase $391 million, including $183 million for power costs Other Key Terms • Recovery of certain costs during Reliability Contingency Events (as defined in the settlement) at an 80/20 sharing ratio • Inclusions of incremental Net Variable Power Costs (NVPC) for the procurement of additional capacity • Establishment of a balancing account for the recovery of routine vegetation management expenses • Tariff filing for residential and small non-residential customers weather-normalized decoupling • Withdrawal of the proposal for associated storage from the Renewable Adjustment Clause • Updates to PGE’s Income Qualified Bill Discount program 7• Regulatory review of the 2024 GRC will continue, with a final OPUC order expected to be issued by the end of 2023 • Management cannot predict the outcome of the rate case and all items are subject to OPUC approval

Note: Dollar values in millions. Capital expenditures exclude allowance for funds used during construction. These are projections based on assumptions of future investment. Actual amounts expended will depend on various factors and may differ materially from the amounts reflected in this capital expenditure forecast (1) Values presented do not include incremental potential investments for future RFP cycles Reliability and resiliency investments Capital expenditures forecast(1) $165 $150 $150 $150 $150 $600 $560 $570 $570 $570 $180 $100 $80 $80 $80 $415 $40 $110 $75 $130 $155 2023 2024 2025 2026 2027 Generation T&D General, Technology, Strategic Clearwater Wind Constable (fka Evergreen) Battery Seaside Battery $800$800 $1,475 $1,050 $955 8

Ratings S&P Moody’s Senior Secured A A1 Senior Unsecured BBB+ A3 Commercial Paper A-2 P-2 Outlook Stable Stable Credit Facilities $750 Letters of Credit $128 Total Liquidity: $925 million as of September 30, 2023 (dollars in millions) Cash $47 Liquidity and financing Actual and expected 2023 debt financings (dollars in millions) Q1 Q2 Q3 Q4 Long-term debt $100(1) - $300 $200 Short-term debt $140 9 Equity financings (dollars in millions) Total facility Settled to-date 2022 Equity Forward Sale Agreement(2) $484 $484 At-The-Market Offering Program(3) $300 - (1) Bond purchase agreement was entered on November 30, 2022, and Bonds were issued and funded in full on January 13, 2023 (2) In 2022, PGE entered into an equity forward sale agreement (EFSA) in connection with a public offering of 11,615,000 shares (including 1,515,000 shares in connection with the underwriters’ exercise of their option to purchase additional shares) of its common stock. In March 2023, the Company issued 7,178,016 shares pursuant to the EFSA and received net proceeds of $300 million. In June 2023, the Company issued 2,212,610 shares pursuant to the EFSA and received net proceeds of $92 million. In July, the Company issued 2,224,374 shares pursuant to the EFSA and received net proceeds of $92 million. Amounts presented are net of underwriting discount of $1.23625 per share (3) PGE entered into an at-the-market offering program in the second quarter of 2023. As of September 30, 2023, pursuant to the terms of the equity distribution agreement, PGE entered into separate forward sale agreements with forward counterparties and under such agreements, the Company could have physically settled by delivering 1,237,033 shares to the counterparties in exchange for cash of $58 million. Any proceeds from the issuances of common stock will be used for general corporate purposes and investments in renewables and non-emitting dispatchable capacity.

Q4 2023 adjusted earnings outlook 10 Q4 2022 GAAP EPS Note: Dollar values are earnings per diluted share (1) See appendix for important information about non-GAAP measures Q4E 2023 Non-GAAP EPS(1) Prior year net variable power costs Current year net variable power costs Revenue, O&M, D&A, interest expense, other $0.27 - $0.32 $0.90 - $0.95 Dilution

Appendix

This presentation contains certain non-GAAP measures, such as adjusted earnings, adjusted EPS and adjusted earnings guidance. These non-GAAP financial measures exclude significant items that are generally not related to our ongoing business activities, are infrequent in nature, or both. PGE believes that excluding the effects of these items provides a meaningful representation of the Company’s comparative earnings per share and enables investors to evaluate the Company’s ongoing operating financial performance. Management utilizes non-GAAP measures to assess the Company’s current and forecasted performance, and for communications with shareholders, analysts and investors. Non-GAAP financial measures are supplementary information that should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Items in the periods presented, which PGE believes impact the comparability of comparative earnings and do not represent ongoing operating financial performance, include the following: • 2022: Non-cash Wildfire and COVID deferral reversal charge associated with the year ended 2020, resulting from the OPUC’s 2022 GRC Final Order earnings test • 2023: Boardman revenue requirement settlement charge associated with the year ended 2020, resulting from the OPUC’s 2022 GRC Final Order Due to the forward-looking nature of PGE’s non-GAAP adjusted earnings guidance, management is unable to estimate specific items requiring adjustment, which could potentially impact the Company’s GAAP earnings (such as potential adjustments described above) for future periods and therefore cannot provide a reconciliation of non-GAAP adjusted earnings per share guidance to the most comparable GAAP financial measure without unreasonable effort. PGE’s reconciliation of non-GAAP earnings for the three months ended June 30, 2023, the nine months ended September 30, 2023, the three months ended March 31, 2022, the nine months ended September 31, 2022, and the year ended December 31, 2022, are on the following slide. 12 Non-GAAP financial measures

Non-GAAP Earnings Reconciliation for the three months ended March 31, 2022 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the three months ended March 31, 2022 $60 $0.67 Exclusion of 2020 Wildfire and COVID deferral reversal 17 0.19 Tax effect (1) (5) (0.05) Non-GAAP as reported for the three months ended March 31, 2022 $72 $0.81 Non-GAAP Earnings Reconciliation for the year ended December 31, 2022 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the year ended December 31, 2022 $233 $2.60 Exclusion of released deferrals related to 2020 17 0.19 Tax effect (1) (5) (0.05) Non-GAAP as reported for the year ended December 31, 2022 $245 $2.74 Non-GAAP financial measures (1) Tax effects were determined based on the Company’s full-year blended federal and state statutory tax rate 13 Non-GAAP Earnings Reconciliation for the three months ended June 30, 2023 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the three months ended June 30, 2023 $39 $0.39 Exclusion of Boardman revenue requirement settlement charge 7 0.07 Tax effect (1) (2) (0.02) Non-GAAP as reported for the three months ended June 30, 2023 $44 $0.44 Non-GAAP Earnings Reconciliation for the nine months ended September 30, 2023 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the nine months ended September 30, 2023 $160 $1.65 Exclusion of Boardman revenue requirement settlement charge 7 0.07 Tax effect (1) (2) (0.02) Non-GAAP as reported for the nine months ended September 30, 2023 $165 $1.70 Non-GAAP Earnings Reconciliation for the nine months ended September 30, 2022 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the nine months ended September 30, 2022 $182 $2.04 Exclusion of released deferrals related to 2020 17 0.19 Tax effect (1) (5) (0.05) Non-GAAP as reported for the nine months ended September 30, 2022 $194 $2.18

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

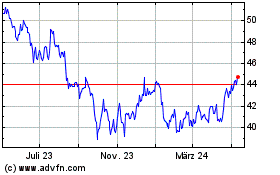

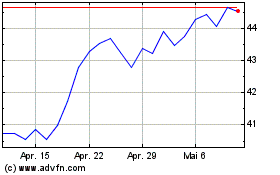

Portland General Electric (NYSE:POR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Portland General Electric (NYSE:POR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024