Douglas Dynamics, Inc. (NYSE: PLOW), North America’s premier

manufacturer and upfitter of work truck attachments and

equipment, today announced financial results for the fourth quarter

and full year ended December 31, 2023.

“The improved performance of our Solutions

segment was clearly the highlight of 2023,” commented Bob

McCormick, President and CEO. “I want to commend the Solutions team

for their dedication and ingenuity and am pleased the 2024 outlook

remains positive, with more opportunities to grow and improve ahead

of us.”

“The weather was not in our favor in 2023, which

is shown in the Attachments segment results this year. The

unprecedented lack of snowfall means our operational discipline has

been put to full use and we took the proactive steps to implement

significant budget cuts and other cost saving measures throughout

2023, to minimize the impact on our bottom line. At the start of

2024, we made tough decisions to align our structure to the current

demand environment. We look forward to improved weather conditions

and driving volumes as demand returns.”

Consolidated Results

|

$ in millions(except Margins & EPS) |

Q4 2023 |

Q4 2022 |

FY 2023 |

FY 2022 |

|

Net Sales |

$134.3 |

|

$159.8 |

|

$568.2 |

|

$616.1 |

|

|

Gross Profit Margin |

22.0% |

|

23.7% |

|

23.6% |

|

24.6% |

|

|

|

|

|

|

|

|

Income from Operations |

$12.6 |

|

$16.7 |

|

$44.9 |

|

$58.8 |

|

|

Net Income |

$7.1 |

|

$11.5 |

|

$23.7 |

|

$38.6 |

|

|

Diluted EPS |

$0.29 |

|

$0.49 |

|

$0.98 |

|

$1.63 |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$14.9 |

|

$22.9 |

|

$68.1 |

|

$86.8 |

|

|

Adjusted EBITDA Margin |

11.1% |

|

14.3% |

|

12.0% |

|

14.1% |

|

|

Adjusted Net Income |

$4.5 |

|

$12.3 |

|

$24.4 |

|

$43.5 |

|

|

Adjusted Diluted EPS |

$0.19 |

|

$0.52 |

|

$1.01 |

|

$1.84 |

|

- Fourth quarter and Full Year 2023

results were lower compared to the previous year, primarily due to

the significant impact of lack of snowfall in core markets on Work

Truck Attachments results, which was partially offset by both top

and bottom-line improvements at Work Truck Solutions.

- Full year gross margins remained

relatively stable, based on price realization and cost control

measures implemented throughout the year, plus improvements at

Solutions.

- Full year Net Income decreased to

$23.7 million in 2023 when compared to full year Net Income of

$38.6 million in 2022 due to a lack of snowfall in core markets in

both the first and fourth quarters of the year, partially offset by

the factors described above favorably impacting gross margin.

- Full year selling, general and

administrative expenses decreased 4.1% to $78.8 million for 2023

compared to $82.2 million for the prior year.

- Interest expense was $15.7 million

for 2023 compared to $11.3 million in 2022, which was primarily due

to higher borrowings on the revolving line of credit and higher

variable interest rates compared to last year.

- The effective tax rate for 2023 was

18.9% compared to 18.5% for 2022. The rate for 2023 was impacted by

a tax benefit related to the purchase of investment tax credits.

The rate for 2022 was lower than historical averages due to higher

tax credits and state income tax rate changes.

- Total backlog at the start of 2024

was approximately $296 million and remains significantly elevated

compared to historical averages.

Work Truck Attachments

|

$ in millions (except Adjusted EBITDA Margin) |

Q4 2023 |

Q4 2022 |

FY 2023 |

FY 2022 |

|

Net Sales |

$55.4 |

|

$97.9 |

|

$291.7 |

|

$382.3 |

|

|

Adjusted EBITDA |

$6.2 |

|

$18.6 |

|

$50.6 |

|

$78.2 |

|

|

Adjusted EBITDA Margin |

11.1% |

|

19.0% |

|

17.3% |

|

20.5% |

|

- The Attachments segment experienced

record low snowfall on the east coast during the 2022-23 snow

season, and the trend continued as the fourth quarter 2023 snowfall

totals were nearly 70% below the ten-year average.

- This resulted in the lowest fourth

quarter order activity on record and confirmed the equipment

replacement cycle has lengthened.

- For example, until January 2024,

there was a record 700 plus day gap between measurable snowfalls in

important east coast markets.“As we noted last month, the lack of

snowfall was the reason our 2023 results came in well below our

expectations. Due to the unprecedented nature of the weather

patterns we’ve experienced, it will likely take us more than one

snow season to return to an average demand environment. Based on

the actions we have taken to control our costs, we believe we are

well positioned to manage through this environment.”

Work Truck Solutions

|

$ in millions (except Adjusted EBITDA Margin) |

Q4 2023 |

Q4 2022 |

FY 2023 |

FY 2022 |

|

Net Sales |

$78.9 |

|

$61.9 |

|

$276.5 |

|

$233.8 |

|

|

Adjusted EBITDA |

$8.8 |

|

$4.3 |

|

$17.6 |

|

$8.6 |

|

|

Adjusted EBITDA Margin |

11.1% |

|

6.9% |

|

6.4% |

|

3.7% |

|

- The Solutions segment completed a

strong finish to 2023 driven by higher volumes and price

realization, plus improved production efficiencies.

- Fourth quarter 2023 Net Sales

increased 28%, and Adjusted EBITDA increased approximately 100%

compared to the previous year, which produced double digit EBITDA

margins.

- On a full year basis, the segment

delivered Net Sales growth of 18% and adjusted EBITDA growth of

approximately 100% when compared to 2022 results, which is a

testament to the progress made on margin improvement and baseline

profit initiatives.

McCormick noted, “The Solutions team showed

significant improvement in 2023 and delivered on its goal of

mid-single digit EBITDA margins. Our recent performance bodes well

for the coming year, especially as overall demand remains positive,

and we still have a strong backlog to work through. We believe the

2023 UAW strike did not have a material impact on our fourth

quarter results, but we expect to see some impact in the first

quarter of 2024, which has been taken into account with our

guidance.”

2024 Cost Savings Program

- The previously announced 2024 Cost

Savings Program is expected to yield annual pre-tax savings of $8

million to $10 million, with approximately 75% of the

anticipated annualized savings expected to be realized in

2024.

- The program focuses on both the

Work Truck Attachments segment and corporate functions, primarily

in the form of headcount reductions, and is expected to lead to

approximately $2 million in pre-tax restructuring charges, incurred

primarily in the first quarter of 2024.

Capital Allocation &

Liquidity

Sarah Lauber, Executive Vice President and CFO,

explained, “While the dividend remains our top capital allocation

priority, based on 2023 results, management and the Board have

decided it is prudent to maintain the current dividend at $0.295

for the time being, with the aim of increasing the dividend when

conditions allow.”

- A quarterly cash dividend of $0.295

per share of the Company's common stock was declared on December 6,

2023, and paid on December 29, 2023, to stockholders of record as

of the close of business on December 19, 2023.

- The Board of Directors also

approved and declared a quarterly cash dividend of $0.295 per share

for the first quarter of 2024. The declared dividend will be paid

on March 29, 2024, to stockholders of record as of the close of

business on March 18, 2024.

- Net Cash Provided by Operating

Activities for 2023 decreased to $12.5 million from $40.0 million

in 2022 and Free Cash Flow for 2023 decreased to $1.9 million from

$28.0 million in 2022. Both are a result of the earnings impact

from the lower volumes in Work Truck Attachments.

- As of December 31, 2023, liquidity

comprised of approximately $24.2 million in cash and cash

equivalents and borrowing availability of approximately $102.5

million under the revolving credit facility.

Amended Credit Facility

- As previously reported, the Company

amended its credit facility, on January 29, 2024, to provide

greater financial flexibility by increasing the leverage ratio

covenant from 3.5X to 4.25X at December 31, 2023, and 4.0X at March

31, 2024 and June 30, 2024, returning to 3.5X at September 30,

2024.

- The Company’s leverage ratio at

December 31, 2023 was slightly below 3.5X.

2024 Outlook

The projected earnings growth in 2024 includes

continued baseline profit improvements, the 2024 Cost Savings

Program, and projected higher volumes in Attachments.

Ms. Lauber stated, “Following the dismal

snowfall totals seen during calendar year 2023, and subsequent

lengthened equipment replacement cycle, under this scenario we are

assuming approximately half of the weather driven volume decline

experienced in 2023 will be recovered in 2024, assuming we see a

return to average snowfall.”

“Solutions enters 2024 seeing the best

conditions since the pandemic, with continued positive demand and

backlog trends combined with improved operating performance. With

chassis supply expected to remain steady in 2024, the need to

replace aging trucks and equipment indicates continued

opportunities in the years ahead.”

2024 outlook:

- Net Sales are expected to be

between $600 million and $660 million.

- Adjusted EBITDA is predicted to

range from $70 million to $100 million.

- Adjusted Earnings Per Share are

expected to be in the range of $1.20 per share to $2.10 per

share.

- Adjusted Earnings Per Share are

expected to grow between 50% and 100% compared to 2023 results,

with further improvement as a multi-year return to average demand

takes place in Attachments, and a continued focus on baseline

profit improvements and margin expansion.

- The effective tax rate is expected

to be approximately 24% to 25%.

The long-term financial targets for both

segments remain intact:

- Work Truck Attachments:

- Sales growth – low to mid-single

digit percentages

- Adjusted EBITDA margin – mid to

high 20%’s

- Work Truck Solutions:

- Sales growth – mid to high-single

digit percentages

- Adjusted EBITDA margin– double

digit to low teens

Ms. Lauber explained, “For Attachments, we

believe the 2024 Cost Savings Program will drive Adjusted EBITDA

margin back close to 20%, leaving us well positioned to push for

mid to high 20s margins as a multi-year return to average demand

takes place. For Solutions, we expect to deliver mid to high single

digit sales growth in 2024, with continued improvement towards low

double digit EBITDA margins. We also forecast that baseline profit

improvement and greater price realization will continue throughout

2024.”

The 2024 outlook and long-term financial targets

assume the following:

- Relatively stable economic

conditions

- Stable to slightly improving supply

of chassis and components

- Core markets will experience below

average or better snowfall in the first quarter of 2024, and

average snowfall in the fourth quarter of 2024

With respect to the Company’s preliminary 2024

guidance, the Company is not able to provide a reconciliation of

the non-GAAP financial measures to GAAP because it does not provide

specific guidance for the various extraordinary, nonrecurring, or

unusual charges and other certain items. These items have not yet

occurred, are out of the Company’s control and/or cannot be

reasonably predicted. As a result, reconciliation of the non-GAAP

guidance measures to GAAP is not available without unreasonable

effort and the Company is unable to address the probable

significance of the unavailable information.

Earnings Conference Call

Information

The Company will host a conference call on

Tuesday, February 27, 2024, at 10:00 a.m. Eastern Time (9:00 a.m.

Central Time). To join the conference call, please dial (833)

634-5024 domestically, or (412) 902-4205 internationally. The call

will also be available via the Investor Relations section of the

Company’s website at www.douglasdynamics.com. For those who cannot

listen to the live broadcast, replays will be available for one

week following the call.

About Douglas Dynamics

Home to the most trusted brands in the industry,

Douglas Dynamics is North America’s premier manufacturer and

up-fitter of commercial work truck attachments and equipment. For

more than 75 years, the Company has been innovating products that

not only enable people to perform their jobs more efficiently and

effectively, but also enable businesses to increase profitability.

Through its proprietary Douglas Dynamics Management System (DDMS),

the Company is committed to continuous improvement aimed at

consistently producing the highest quality products, at

industry-leading levels of service and delivery that ultimately

drive shareholder value. The Douglas Dynamics portfolio of products

and services is separated into two segments: First, the Work Truck

Attachments segment, which includes commercial snow and ice control

equipment sold under the FISHER®, SNOWEX® and WESTERN® brands.

Second, the Work Truck Solutions segment, which includes the up-fit

of market leading attachments and storage solutions under the

HENDERSON® brand, and the DEJANA® brand and its related

sub-brands.

Use of Non-GAAP Financial

Measures

This press release contains financial

information calculated other than in accordance

with U.S. Generally Accepted Accounting Principles

(“GAAP”). The non-GAAP measures used in this press release

are Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings Per

Share, The Company believes that these non-GAAP measures are useful

to investors and other external users of its consolidated financial

statements in evaluating the Company’s operating performance as

compared to that of other companies. Reconciliations of these

non-GAAP measures to the nearest comparable GAAP measures can be

found at the end of this press release.

Adjusted EBITDA represents net income before

interest, taxes, depreciation, and amortization, as further

adjusted for certain charges consisting of unrelated legal and

consulting fees, stock-based compensation, severance, restructuring

charges, and incremental costs incurred in 2022 related to the

COVID-19 pandemic. Such COVID-19 related costs include increased

expenses directly related to the pandemic, and do not include

either production related overhead inefficiencies or lost or

deferred sales. We believe these costs are out of the ordinary,

unrelated to our business and not representative of our results.

The Company uses Adjusted EBITDA in evaluating the Company’s

operating performance because it provides the Company and its

investors with additional tools to compare its operating

performance on a consistent basis by removing the impact of certain

items that management believes do not directly reflect the

Company’s core operations. The Company’s management also uses

Adjusted EBITDA for planning purposes, including the preparation of

its annual operating budget and financial projections, and to

evaluate the Company’s ability to make certain payments, including

dividends, in compliance with its senior credit facilities, which

is determined based on a calculation of “Consolidated Adjusted

EBITDA” that is substantially similar to Adjusted EBITDA.

Adjusted Net Income and Adjusted Earnings Per

Share (calculated on a diluted basis) represents net income and

earnings per share (as defined by GAAP), excluding the impact of

stock based compensation, severance, restructuring charges, certain

charges related to unrelated legal fees and consulting fees,

incremental costs incurred in 2022 related to the COVID-19

pandemic, and adjustments on derivatives not classified as hedges,

net of their income tax impact. Such COVID-19 related costs include

increased expenses directly related to the pandemic, and do not

include either production related overhead inefficiencies or lost

or deferred sales. We believe these costs are out of the ordinary,

unrelated to our business and not representative of our results.

Adjustments on derivatives not classified as hedges are non-cash

and are related to overall financial market conditions; therefore,

management believes such costs are unrelated to our business and

are not representative of our results. Management believes

that Adjusted Net Income and Adjusted Earnings Per Share are useful

in assessing the Company’s financial performance by eliminating

expenses and income that are not reflective of the underlying

business performance.

Forward Looking Statements

This press release contains certain

forward-looking statements within the meaning of Section 21E of the

Securities Exchange Act of 1934, as amended. These statements

include information relating to future events, future financial

performance, strategies, expectations, competitive environment,

regulation, product demand, the payment of dividends, and

availability of financial resources. These statements are

often identified by use of words such as "anticipate," "believe,"

"intend," "estimate," "expect," "continue," "should," "could,"

"may," "plan," "project," "predict," "will" and similar expressions

and include references to assumptions and relate to our future

prospects, developments, and business strategies. Such

statements involve known and unknown risks, uncertainties and other

factors that could cause our actual results, performance, or

achievements to be materially different from any future results,

performance or achievements expressed or implied by these

forward-looking statements. Factors that could cause or contribute

to such differences include, but are not limited to, weather

conditions, particularly lack of or reduced levels of snowfall and

the timing of such snowfall, expected annualized savings to be

achieved by the 2024 Cost Savings Program, our ability to manage

general economic, business and geopolitical conditions, including

the impacts of natural disasters, labor strikes, global political

instability, pandemics and outbreaks of contagious diseases and

other adverse public health developments, such as the COVID-19

pandemic, our inability to maintain good relationships with our

distributors, our inability to maintain good relationships with the

original equipment manufacturers with whom we currently do

significant business, lack of available or favorable financing

options for our end-users, distributors or customers, increases in

the price of steel or other materials, including as a result of

tariffs, necessary for the production of our products that cannot

be passed on to our distributors, increases in the price of fuel or

freight, a significant decline in economic conditions, the

inability of our suppliers and original equipment manufacturer

partners to meet our volume or quality requirements, inaccuracies

in our estimates of future demand for our products, our inability

to protect or continue to build our intellectual property

portfolio, the effects of laws and regulations and their

interpretations on our business and financial condition, our

inability to develop new products or improve upon existing products

in response to end-user needs, losses due to lawsuits arising out

of personal injuries associated with our products, factors that

could impact the future declaration and payment of dividends, our

inability to compete effectively against competition, as well as

those discussed in the section entitled “Risk Factors” in our

annual report on Form 10-K for the year ended December 31,

2022. You should not place undue reliance on these forward-looking

statements. In addition, the forward-looking statements in

this release speak only as of the date hereof and we undertake no

obligation, except as required by law, to update or release any

revisions to any forward-looking statement, even if new information

becomes available in the future.

For further information contact:Douglas

Dynamics, Inc.Nathan

Elwell847-530-0249investorrelations@douglasdynamics.com

Financial Statements

|

Douglas Dynamics, Inc. |

|

Consolidated Balance Sheets |

|

(In thousands) |

| |

|

|

|

|

December 31, |

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

(unaudited) |

(unaudited) |

|

|

|

|

|

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ |

24,156 |

|

$ |

20,670 |

|

|

Accounts receivable, net |

|

83,760 |

|

|

86,765 |

|

|

Inventories |

|

140,390 |

|

|

136,501 |

|

|

Inventories - truck chassis floor plan |

|

2,217 |

|

|

1,211 |

|

|

Refundable income taxes paid |

|

4,817 |

|

|

- |

|

|

Prepaid and other current assets |

|

6,898 |

|

|

7,774 |

|

|

Total current assets |

|

262,238 |

|

|

252,921 |

|

|

|

|

|

|

Property, plant, and equipment, net |

|

67,340 |

|

|

68,660 |

|

|

Goodwill |

|

113,134 |

|

|

113,134 |

|

|

Other intangible assets, net |

|

121,070 |

|

|

131,589 |

|

|

Operating lease - right of use asset |

|

18,008 |

|

|

17,432 |

|

|

Non-qualified benefit plan assets |

|

9,195 |

|

|

8,874 |

|

|

Other long-term assets |

|

2,433 |

|

|

4,281 |

|

|

Total assets |

$ |

593,418 |

|

$ |

596,891 |

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

Current liabilities: |

|

|

|

Accounts payable |

$ |

31,374 |

|

$ |

49,252 |

|

|

Accrued expenses and other current liabilities |

|

25,817 |

|

|

30,484 |

|

|

Floor plan obligations |

|

2,217 |

|

|

1,211 |

|

|

Operating lease liability - current |

|

5,347 |

|

|

4,862 |

|

|

Income taxes payable |

|

- |

|

|

3,485 |

|

|

Short term borrowings |

|

47,000 |

|

|

- |

|

|

Current portion of long-term debt |

|

6,762 |

|

|

11,137 |

|

|

Total current liabilities |

|

118,517 |

|

|

100,431 |

|

|

|

|

|

|

Retirement benefits and deferred compensation |

|

13,922 |

|

|

14,650 |

|

|

Deferred income taxes |

|

27,903 |

|

|

29,837 |

|

|

Long-term debt, less current portion |

|

181,491 |

|

|

195,299 |

|

|

Operating lease liability - noncurrent |

|

13,887 |

|

|

14,025 |

|

|

Other long-term liabilities |

|

6,133 |

|

|

5,547 |

|

|

|

|

|

|

Total stockholders' equity |

|

231,565 |

|

|

237,102 |

|

|

Total liabilities and stockholders' equity |

$ |

593,418 |

|

$ |

596,891 |

|

|

Douglas Dynamics, Inc. |

|

Consolidated Statements of Income |

|

(In thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

Three Month Period Ended |

|

Twelve Month Period Ended |

|

|

December 31,2023 |

December 31,2022 |

|

December 31,2023 |

December 31,2022 |

|

|

(unaudited) |

|

(unaudited) |

|

|

|

|

|

|

|

|

Net sales |

$ |

134,245 |

|

$ |

159,806 |

|

|

$ |

568,178 |

|

$ |

616,068 |

|

|

Cost of sales |

|

104,742 |

|

|

121,916 |

|

|

|

433,908 |

|

|

464,612 |

|

|

Gross profit |

|

29,503 |

|

|

37,890 |

|

|

|

134,270 |

|

|

151,456 |

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expense |

|

14,229 |

|

|

18,605 |

|

|

|

78,841 |

|

|

82,183 |

|

|

Intangibles amortization |

|

2,630 |

|

|

2,630 |

|

|

|

10,520 |

|

|

10,520 |

|

|

|

|

|

|

|

|

|

Income from operations |

|

12,644 |

|

|

16,655 |

|

|

|

44,909 |

|

|

58,753 |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(4,468 |

) |

|

(3,401 |

) |

|

|

(15,675 |

) |

|

(11,253 |

) |

|

Other income (expense), net |

|

19 |

|

|

(233 |

) |

|

|

- |

|

|

(139 |

) |

|

Income before taxes |

|

8,195 |

|

|

13,021 |

|

|

|

29,234 |

|

|

47,361 |

|

|

|

|

|

|

|

|

|

Income tax expense |

|

1,118 |

|

|

1,509 |

|

|

|

5,511 |

|

|

8,752 |

|

|

|

|

|

|

|

|

|

Net income |

$ |

7,077 |

|

$ |

11,512 |

|

|

$ |

23,723 |

|

$ |

38,609 |

|

| |

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

Basic |

|

22,983,965 |

|

|

22,886,793 |

|

|

|

22,962,591 |

|

|

22,915,543 |

|

|

Diluted |

|

22,983,965 |

|

|

22,886,793 |

|

|

|

22,962,591 |

|

|

22,916,824 |

|

| |

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

Basic earnings per common share attributable to common

shareholders |

$ |

0.30 |

|

$ |

0.49 |

|

|

$ |

1.01 |

|

$ |

1.65 |

|

|

Earnings per common share assuming dilution attributable to common

shareholders |

$ |

0.29 |

|

$ |

0.49 |

|

|

$ |

0.98 |

|

$ |

1.63 |

|

|

Cash dividends declared and paid per share |

$ |

0.30 |

|

$ |

0.29 |

|

|

$ |

1.18 |

|

$ |

1.16 |

|

|

Douglas Dynamics, Inc. |

|

Consolidated Statements of Cash Flows |

|

(In thousands) |

| |

|

|

|

|

Twelve Month Period Ended |

|

|

December 31,2023 |

December 31,2022 |

|

|

(unaudited) |

|

|

|

|

|

Operating activities |

|

|

|

Net income |

$ |

23,723 |

|

$ |

38,609 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

Depreciation and amortization |

|

21,662 |

|

|

20,938 |

|

|

Loss (gain) on disposal of fixed assets |

|

(56 |

) |

|

111 |

|

|

Amortization of deferred financing costs and debt discount |

|

588 |

|

|

491 |

|

|

Stock-based compensation |

|

953 |

|

|

6,730 |

|

|

Adjustments on derivatives not designated as hedges |

|

(688 |

) |

|

(688 |

) |

|

Provision (credit) for losses on accounts receivable |

|

320 |

|

|

(1,476 |

) |

|

Deferred income taxes |

|

7,561 |

|

|

(3,268 |

) |

|

Non-cash lease expense |

|

5,097 |

|

|

1,030 |

|

|

Changes in operating assets and liabilities, net of

acquisitions: |

|

|

|

Accounts receivable |

|

2,684 |

|

|

(14,253 |

) |

|

Inventories |

|

(3,888 |

) |

|

(32,483 |

) |

|

Prepaid assets, refundable income taxes paid and other assets |

|

(14,010 |

) |

|

3,422 |

|

|

Accounts payable |

|

(17,123 |

) |

|

21,522 |

|

|

Accrued expenses and other current liabilities |

|

(8,154 |

) |

|

1,321 |

|

|

Benefit obligations and other long-term liabilities |

|

(6,200 |

) |

|

(1,976 |

) |

|

Net cash provided by operating activities |

|

12,469 |

|

|

40,030 |

|

|

|

|

|

|

Investing activities |

|

|

|

Capital expenditures |

|

(10,521 |

) |

|

(12,047 |

) |

|

Net cash used in investing activities |

|

(10,521 |

) |

|

(12,047 |

) |

|

|

|

|

|

Financing activities |

|

|

|

Repurchase of common stock |

|

-- |

|

|

(6,001 |

) |

|

Proceeds from life insurance policy loans |

|

750 |

|

|

-- |

|

|

Payments of financing costs |

|

(334 |

) |

|

-- |

|

|

Dividends paid |

|

(27,441 |

) |

|

(27,026 |

) |

|

Net revolver borrowings |

|

47,000 |

|

|

-- |

|

|

Repayment of long-term debt |

|

(18,437 |

) |

|

(11,250 |

) |

|

Net cash provided by (used in) financing activities |

|

1,538 |

|

|

(44,277 |

) |

|

Change in cash and cash equivalents |

|

3,486 |

|

|

(16,294 |

) |

|

Cash and cash equivalents at beginning of year |

|

20,670 |

|

|

36,964 |

|

|

Cash and cash equivalents at end of year |

$ |

24,156 |

|

$ |

20,670 |

|

|

|

|

|

|

Non-cash operating and financing activities |

|

|

|

Truck chassis inventory acquired through floorplan obligations |

$ |

7,875 |

|

$ |

4,725 |

|

|

Douglas Dynamics, Inc. |

|

Segment Disclosures (unaudited) |

|

(In thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedDecember 31, 2023 |

|

Three Months EndedDecember 31, 2022 |

|

Twelve Months EndedDecember 31, 2023 |

|

Twelve Months EndedDecember 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Work Truck Attachments |

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

$ |

55,377 |

|

|

$ |

97,921 |

|

|

$ |

291,723 |

|

|

$ |

382,296 |

|

|

Adjusted EBITDA |

$ |

6,170 |

|

|

$ |

18,649 |

|

|

$ |

50,563 |

|

|

$ |

78,211 |

|

|

Adjusted EBITDA Margin |

|

11.1 |

% |

|

|

19.0 |

% |

|

|

17.3 |

% |

|

|

20.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Work Truck Solutions |

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

$ |

78,868 |

|

|

$ |

61,885 |

|

|

$ |

276,455 |

|

|

$ |

233,772 |

|

|

Adjusted EBITDA |

$ |

8,752 |

|

|

$ |

4,262 |

|

|

$ |

17,559 |

|

|

$ |

8,569 |

|

|

Adjusted EBITDA Margin |

|

11.1 |

% |

|

|

6.9 |

% |

|

|

6.4 |

% |

|

|

3.7 |

% |

| Douglas

Dynamics, Inc. |

| Free Cash

Flow reconciliation (unaudited) |

| (In

thousands) |

| |

| |

|

Three month period ended December 31, |

|

Twelve month period ended December 31, |

| |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| Net cash

provided by operating activities |

|

$ |

76,617 |

|

|

$ |

114,516 |

|

|

$ |

12,469 |

|

|

$ |

40,030 |

|

|

Acquisition of property and equipment |

|

(2,798 |

) |

|

|

(3,123 |

) |

|

|

(10,521 |

) |

|

|

(12,047 |

) |

| Free cash

flow |

|

$ |

73,819 |

|

|

$ |

111,393 |

|

|

$ |

1,948 |

|

|

$ |

27,983 |

|

|

Douglas Dynamics, Inc. |

|

Net Income to Adjusted EBITDA reconciliation

(unaudited) |

|

(In thousands) |

|

|

| |

|

Three month period ended December 31, |

|

Twelve month period ended December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,077 |

|

|

$ |

11,512 |

|

|

$ |

23,723 |

|

|

$ |

38,609 |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense - net |

|

|

4,468 |

|

|

|

3,401 |

|

|

|

15,675 |

|

|

|

11,253 |

|

|

Income tax expense |

|

|

1,118 |

|

|

|

1,509 |

|

|

|

5,511 |

|

|

|

8,752 |

|

|

Depreciation expense |

|

|

2,852 |

|

|

|

2,682 |

|

|

|

11,142 |

|

|

|

10,418 |

|

|

Intangibles amortization |

|

|

2,630 |

|

|

|

2,630 |

|

|

|

10,520 |

|

|

|

10,520 |

|

|

EBITDA |

|

|

18,145 |

|

|

|

21,734 |

|

|

|

66,571 |

|

|

|

79,552 |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

(3,283 |

) |

|

|

1,167 |

|

|

|

953 |

|

|

|

6,730 |

|

|

Other charges (1) |

|

|

60 |

|

|

|

10 |

|

|

|

598 |

|

|

|

498 |

|

|

Adjusted EBITDA |

|

$ |

14,922 |

|

|

$ |

22,911 |

|

|

$ |

68,122 |

|

|

$ |

86,780 |

|

|

|

|

|

|

|

|

|

|

|

|

(1) Reflects unrelated legal, severance, restructuring, and

consulting fees, and, in 2022, incremental costs incurred related

to the COVID-19 pandemic for the periods presented. |

| |

|

|

|

|

|

|

|

|

|

Douglas Dynamics, Inc. |

|

Reconciliation of Net Income to Adjusted Net Income

(unaudited) |

|

(In thousands, except share and per share

data) |

|

|

| |

|

Three month period ended December 31, |

|

Twelve month period ended December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,077 |

|

|

$ |

11,512 |

|

|

$ |

23,723 |

|

|

$ |

38,609 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Stock based compensation |

|

(3,283 |

) |

|

|

1,167 |

|

|

|

953 |

|

|

|

6,730 |

|

|

Adjustments on derivative not classified as hedge (1) |

|

(172 |

) |

|

|

(172 |

) |

|

|

(688 |

) |

|

|

(688 |

) |

|

Other charges (2) |

|

|

60 |

|

|

|

10 |

|

|

|

598 |

|

|

|

498 |

|

|

Tax effect on adjustments |

|

|

849 |

|

|

|

(251 |

) |

|

|

(216 |

) |

|

|

(1,635 |

) |

|

Adjusted net income |

|

$ |

4,531 |

|

|

$ |

12,266 |

|

|

$ |

24,370 |

|

|

$ |

43,514 |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average basic common shares outstanding |

|

22,983,965 |

|

|

|

22,886,793 |

|

|

|

22,962,591 |

|

|

|

22,915,543 |

|

|

Weighted average common shares outstanding assuming dilution |

|

|

22,983,965 |

|

|

|

22,886,793 |

|

|

|

22,962,591 |

|

|

|

22,916,824 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings per common share - dilutive |

$ |

0.19 |

|

|

$ |

0.52 |

|

|

$ |

1.01 |

|

|

$ |

1.84 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted earnings (loss) per share |

$ |

0.29 |

|

|

$ |

0.49 |

|

|

$ |

0.98 |

|

|

$ |

1.63 |

|

|

Adjustments net of income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock based compensation |

|

(0.09 |

) |

|

|

0.04 |

|

|

|

0.03 |

|

|

|

0.21 |

|

|

Adjustments on derivative not classified as hedge (1) |

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

|

(0.02 |

) |

|

Other charges (2) |

|

|

- |

|

|

|

- |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted earnings per share |

$ |

0.19 |

|

|

$ |

0.52 |

|

|

$ |

1.01 |

|

|

$ |

1.84 |

|

| |

|

|

|

|

|

|

|

|

|

(1) Reflects non-cash mark-to-market and amortization adjustments

on an interest rate swap not classified as a hedge for the periods

presented. |

|

(2) Reflects unrelated legal, severance, restructuring, and

consulting fees, and, in 2022, incremental costs incurred related

to the COVID-19 pandemic for the periods presented. |

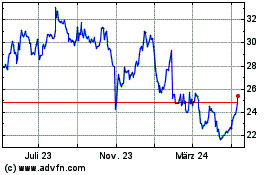

Douglas Dynamics (NYSE:PLOW)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

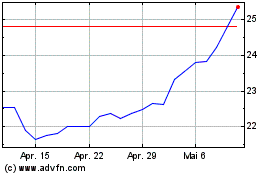

Douglas Dynamics (NYSE:PLOW)

Historical Stock Chart

Von Nov 2023 bis Nov 2024