The Board of Trustees (the “Board”) of PIMCO Dynamic Income

Strategy Fund (the “Fund”) (NYSE: PDX)1 has declared the next two

distributions for the Fund’s common shares, as summarized below. In

addition, the Board has approved a change in the Fund’s

distribution frequency, from quarterly to monthly, starting with

the April Distribution (as defined below).

A quarterly distribution for the Fund’s common

shares is payable on April 1, 2024 to shareholders of record on

March 11, 2024, with an ex-dividend date of March 8, 2024 (the

“March Distribution”). The March Distribution reflects an increase

of $0.040000 per common share as compared to the Fund’s prior

quarterly distribution that was paid on January 2, 2024 to

shareholders of record on December 11, 2023.

March Distribution Per

Common Share

|

Fund |

NYSE Symbol |

Amount |

Change From Previous Quarter |

Percentage Change From Previous Quarter |

|

PIMCO Dynamic Income Strategy Fund |

(NYSE: PDX) |

$0.260000 |

$0.040000 |

18.18% |

The Fund’s first monthly distribution is payable

on May 1, 2024 to shareholders of record on April 11, 2024, with an

ex-dividend date of April 10, 2024 (the “April Distribution”). As

noted above, starting with the April Distribution, the Fund intends

to make distributions monthly instead of quarterly.

April Distribution Per

Common Share

|

Fund |

NYSE Symbol |

Amount |

Hypothetical Change From March

Distribution2 |

Hypothetical Percentage Change From March

Distribution2 |

|

PIMCO Dynamic Income Strategy Fund |

(NYSE: PDX) |

$0.1133 |

$0.026633 |

30.73% |

Fund Distribution Information as of

January 31, 2024:

|

Fund |

NYSE Symbol |

March distribution |

Annualized March Distribution rate expressed as a

percentage of NAV as of 1/31/2024 |

Annualized March Distribution rate expressed as a

percentage of Market Price as of 1/31/2024 |

|

PIMCO Dynamic Income Strategy Fund |

(NYSE: PDX) |

$0.260000 |

4.62% |

5.38% |

|

Fund |

NYSE Symbol |

April distribution |

Annualized April Distribution rate expressed as a

percentage of NAV as of 1/31/2024 |

Annualized April Distribution rate expressed as a

percentage of Market Price as of 1/31/2024 |

|

PIMCO Dynamic Income Strategy Fund |

(NYSE: PDX) |

$0.1133 |

6.04% |

7.04% |

Distribution rates are not performance and are

calculated by annualizing the current distribution per share

announced in this press release and dividing by the net asset value

(“NAV”) or Market Price, as applicable, as of the reported date.

The Fund’s distribution rate may be affected by numerous factors,

including changes in realized and projected market returns, Fund

performance, and other factors. There can be no assurance that a

change in market conditions or other factors will not result in a

change in the Fund’s distribution rate at a future time.

Distributions may be comprised of ordinary income, net capital

gains, and/or a return of capital (“ROC”) of your investment in the

Fund. Because the distribution rate may include a ROC, it should

not be confused with yield or income.

Average Annual Total Returns Based on

NAV and Market Price (“MKT”) of Common Shares as of January 31,

2024:

|

Fund |

NYSE Symbol |

Inception Date |

|

1 Year |

5 Year |

Since Inception |

|

PIMCO Dynamic Income Strategy Fund |

(NYSE: PDX) |

2/01/2019 |

NAV |

26.56% |

9.82% |

9.82% |

|

MKT |

29.67% |

7.80% |

7.80% |

Performance for periods of more than one year is

annualized.

Past performance is not a guarantee or a

reliable indicator of future results. There can be no assurance

that the Fund or any investment strategy will achieve its

investment objectives or structure its investment portfolio as

anticipated. An investment in the Fund involves risk,

including loss of principal. Investment return and the value of

shares will fluctuate. Shares may be worth more or less than

original purchase price. Due to market volatility, current

performance may be lower or higher than average annual returns

shown. Returns are calculated by determining the percentage change

in NAV or market price (as applicable) of the Fund’s common shares

in the specific period. The calculation assumes that all dividends

and distributions, if any, have been reinvested. NAV and market

price returns do not reflect broker sales charges or commissions in

connection with the purchase or sales of Fund shares and includes

the effect of any expense reductions. Returns for a period of less

than one year are not annualized. Returns for a period of more than

one year represent the average annual return. Performance at market

price will differ from results at NAV. Although market price

returns typically reflect investment results over time, during

shorter periods returns at market price can also be influenced by

factors such as changing views about the Fund, market conditions,

supply and demand for the Fund’s shares or changes in Fund

dividends and distributions.

Additional Information

Distributions may include ordinary income, net

capital gains and/or returns of capital. Generally, a return of

capital occurs when the amount distributed by the Fund includes a

portion of (or is comprised entirely of) your investment in the

Fund in addition to (or rather than) your pro-rata portion of the

Fund’s net income or capital gains. The Fund’s distributions in any

period may be more or less than the net return earned by the Fund

on its investments, and therefore should not be used as a measure

of performance or confused with “yield” or “income.” A return of

capital is not taxable; rather it reduces a shareholder’s tax basis

in his or her shares of the Fund.

If the Fund estimates that a portion of a

distribution may be comprised of amounts from sources other than

net investment income, as determined in accordance with its

internal accounting records and related accounting practices, the

Fund will notify shareholders of the estimated composition of such

distribution through a Section 19 Notice. For these purposes, the

Fund estimates the source or sources from which a distribution is

paid, to the close of the period as of which it is paid, in

reference to its internal accounting records and related accounting

practices. If, based on such accounting records and practices, it

is estimated that a particular distribution does not include

capital gains or paid-in surplus or other capital sources, a

Section 19 Notice generally would not be issued. It is important to

note that differences exist between the Fund’s daily internal

accounting records and practices, the Fund’s financial statements

presented in accordance with U.S. GAAP, and recordkeeping practices

under income tax regulations. For instance, the Fund’s internal

accounting records and practices may take into account, among other

factors, tax-related characteristics of certain sources of

distributions that differ from treatment under U.S. GAAP. Examples

of such differences may include, among others, the treatment of

paydowns on mortgage-backed securities purchased at a discount and

periodic payments under interest rate swap contracts. Accordingly,

among other consequences, it is possible that the Fund may not

issue a Section 19 Notice in situations where the Fund’s financial

statements prepared later and in accordance with U.S. GAAP and/or

the final tax character of those distributions might later report

that the sources of those distributions included capital gains

and/or a return of capital. Please visit www.pimco.com for the most

recent Section 19 Notice, if applicable, and most recent

shareholder reports for additional information regarding the

estimated composition of distributions. Final determination of a

distribution’s tax character will be provided to shareholders when

such information is available.

The tax treatment and characterization of the

Fund’s distributions may vary significantly from time to time

because of the varied nature of the Fund’s investments. The Fund

may enter into opposite sides of multiple interest rate swaps or

other derivatives with respect to the same underlying reference

instrument (e.g., a 10-year U.S. treasury) that have different

effective dates with respect to interest accrual time periods also

for the principal purpose of generating distributable gains

(characterized as ordinary income for tax purposes) that are not

part of the Fund’s duration or yield curve management strategies.

In such a “paired swap transaction”, the Fund would generally enter

into one or more interest rate swap agreements whereby the Fund

agrees to make regular payments starting at the time the Fund

enters into the agreements equal to a floating interest rate in

return for payments equal to a fixed interest rate (the “initial

leg”). The Fund would also enter into one or more interest rate

swap agreements on the same underlying instrument, but take the

opposite position (i.e., in this example, the Fund would make

regular payments equal to a fixed interest rate in return for

receiving payments equal to a floating interest rate) with respect

to a contract whereby the payment obligations do not commence until

a date following the commencement of the initial leg (the “forward

leg”).

The Fund may engage in investment strategies,

including those that employ the use of derivatives, to, among

other things, seek to generate current, distributable income,

even if such strategies could potentially result in declines

in the Fund’s NAV. The Fund’s income and gain-generating

strategies, including certain derivatives strategies, may

generate current income and gains taxable as ordinary income

sufficient to support monthly distributions even in situations

when the Fund has experienced a decline in net assets due to,

for example, adverse changes in the broad U.S. or non-U.S.

equity markets or the Fund’s debt investments, or arising from

its use of derivatives. Because some or all of these

transactions may generate capital losses without

corresponding offsetting capital gains, portions of the Fund’s

distributions recognized as ordinary income for tax purposes

(such as from paired swap transactions) may be economically

similar to a taxable return of capital when

considered together with such capital losses. The tax

treatment of certain derivatives in which the Fund invests may

be unclear and thus subject to recharacterization. Any

recharacterization of payments made or received by the Fund

pursuant to derivatives potentially could affect the amount,

timing or character of Fund distributions. In addition, the

tax treatment of such investment strategies may be changed by

regulation or otherwise.

The common shares of the Fund trade on the New

York Stock Exchange. As with any stock, the price of the Fund’s

common shares will fluctuate with market conditions and other

factors. If you sell your common shares of the Fund, the price

received may be more or less than your original investment. Shares

of closed-end investment management companies, such as the Fund,

frequently trade at a discount from their net asset value and may

trade at a price that is less than the initial offering price

and/or the net asset value of such shares. Further, if the Fund’s

shares trade at a price that is more than the initial offering

price and/or the net asset value of such shares, including at a

substantial premium and/or for an extended period of time, there is

no assurance that any such premium will be sustained for any period

of time and will not decrease, or that the shares will not trade at

a discount to net asset value thereafter.

The Fund may apply for an order granting an

exemption from Section 19(b) of the Investment Company Act of 1940

(the “1940 Act”) and Rule 19b-1 thereunder to permit the Fund to

include realized long-term capital gains as a part of its regular

distributions to common shareholders more frequently than would

otherwise be permitted by the 1940 Act (generally once per taxable

year). There is no assurance that the Securities and Exchange

Commission will grant the Fund’s request for such an exemptive

order if such a request is made. If the Fund were to receive the

exemptive order discussed above, the Fund may, but will not

necessarily, seek to pay distributions generally at a rate based on

a fixed percentage of the common shares’ net asset value at a

particular time (a “managed distribution policy”). Any such managed

distribution policy may be modified by the Board of Trustees of the

Fund from time to time. If the Fund were to seek to make

distributions under a managed distribution policy, it would

typically be intended to result in the payment of approximately the

same percentage of the Fund’s net asset value to common

shareholders each period.

The Fund’s daily New York Stock Exchange closing

market prices, net asset values per share, as well as other

information, including updated portfolio statistics and performance

are available at pimco.com/closedendfunds or by calling the Fund’s

shareholder servicing agent at (844) 33-PIMCO. Updated portfolio

holdings information about the Fund will be available approximately

15 calendar days after the Fund’s most recent fiscal quarter end,

and will remain accessible until the Fund files a shareholder

report or a publicly-available Form N-PORT for the period that

includes the date of the information.

The Fund’s shares do not represent a deposit or

obligation of, and are not guaranteed or endorsed by, any bank or

other insured depository institution, and are not insured by the

FDIC, the Federal Reserve Board or any other government agency. You

may lose money by investing in the Fund. Certain risks associated

with investing in the Fund are summarized below.

An investor should consider, among other

things, the Fund’s investment objectives, risks, charges and

expenses carefully before investing. The Fund’s annual report

contains (or will contain) this and other information about the

Fund.

A word about risk: Investing in

the bond market is subject to risks,

including market, interest rate, issuer, credit, inflation risk,

and liquidity risk. The value of most bonds and bond strategies are

impacted by changes in interest rates. Bonds and bond strategies

with longer durations tend to be more sensitive and volatile than

those with shorter durations; bond prices generally fall as

interest rates rise, and low interest rate environments increase

this risk. Reductions in bond counterparty capacity may contribute

to decreased market liquidity and increased price volatility. Bond

investments may be worth more or less than the original cost when

redeemed. Mortgage and asset-backed

securities may be sensitive to changes in interest

rates, subject to early repayment risk, and their value may

fluctuate in response to the market’s perception of issuer

creditworthiness; while generally supported by some form of

government or private guarantee there is no assurance that private

guarantors will meet their obligations. Investing

in foreign-denominated and/or -domiciled

securities may involve heightened risk due to

currency fluctuations, and economic and political risks, which may

be enhanced in emerging markets. Corporate debt

securities are subject to the risk of the issuer’s

inability to meet principal and interest payments on the obligation

and may also be subject to price volatility due to factors such as

interest rate sensitivity, market perception of the

creditworthiness of the issuer and general market

liquidity. Collateralized Loan Obligations

(CLOs) may involve a high degree of risk and are

intended for sale to qualified investors only. Investors may lose

some or all of the investment and there may be periods where no

cash flow distributions are received. CLOs are exposed to risks

such as credit, default, liquidity, management, volatility,

interest rate and credit risk. High-yield,

lower-rated, securities involve greater risk than

higher-rated securities; portfolios that invest in them may be

subject to greater levels of credit and liquidity risk than

portfolios that do not. Real estate investment trusts (or

REITs) are subject to risk, such as poor performance by the

manager, adverse changes to tax laws or failure to qualify for

tax-free pass-through of income. Residential or

commercial mortgage loans and commercial

real estate debt are subject to risks that include

prepayment, delinquency, foreclosure, risks of loss, servicing

risks and adverse regulatory developments, which risks may be

heightened in the case of non-performing loans. Investing

in distressed loans and bankrupt

companies is speculative and the repayment of default obligations

contains significant uncertainties. Distressed and

Defaulted Securities involve substantial risks,

including the risk of default. Such investments may be in default

at the time of investment. In addition, these securities may

fluctuate more in price, and are typically less

liquid. Commodities contain heightened

risk, including market, political, regulatory and natural

conditions, and may not be appropriate for all investors. Many

energy sector master limited partnerships (or MLPs) and other

companies in which the Fund may invest operate natural gas, natural

gas liquids, crude oil, refined products, coal, or other facilities

within the energy sector and will be

susceptible to adverse economic, environmental, or regulatory

occurrences affecting the sector including sharp decreases in crude

oil or natural gas prices. Energy Sector

Risk. The Fund will be concentrated in the energy sector,

and will therefore be susceptible to adverse economic,

environmental, or regulatory occurrences affecting that sector.

Private credit involves an investment in

non-publicly traded securities which may be subject to illiquidity

risk. Portfolios that invest in private credit may be leveraged and

may engage in speculative investment practices that increase the

risk of investment loss. Leveraging transactions, including

borrowing, typically will cause a portfolio to be more volatile

than if the portfolio had not been leveraged. Leveraging

transactions typically involve expenses, which could exceed the

rate of return on investments purchased by a Fund with such

leverage and reduce Fund returns. The use of

leverage may cause a portfolio to liquidate

positions when it may not be advantageous to do so. Leveraging

transactions may increase a Fund’s duration and sensitivity to

interest rate movements. Derivatives may

involve certain costs and risks such as liquidity, interest rate,

market, credit, management and the risk that a position could not

be closed when most advantageous. Investing in derivatives could

lose more than the amount invested.

Limited Term Risk. Unless the

limited term provision of the Fund’s Amended and Restated Agreement

and Declaration of Trust (the “Declaration of Trust”) is amended by

shareholders in accordance with the Declaration of Trust, or unless

the Fund completes a tender offer, as of a date within twelve

months preceding the Dissolution Date (as defined below), to all

common shareholders to purchase 100% of the then outstanding common

shares of the Fund at a price equal to the NAV per common share on

the expiration date of the tender offer (an “Eligible Tender

Offer”), and converts to perpetual existence, the Fund will

terminate on or about January 29, 2031 (the “Dissolution

Date”). The Fund is not a “target term” Fund whose investment

objective is to return its original net asset value on the

Dissolution Date or in an Eligible Tender Offer. Because the assets

of the Fund will be liquidated in connection with the dissolution,

the Fund will incur transaction costs in connection with

dispositions of portfolio securities. The Fund does not limit its

investments to securities having a maturity date prior to the

Dissolution Date and may be required to sell portfolio securities

when it otherwise would not, including at times when market

conditions are not favorable, which may cause the Fund to lose

money. In particular, the Fund’s portfolio may still have large

exposures to illiquid securities as the Dissolution Date

approaches, and losses due to portfolio liquidation may be

significant. Beginning one year before the Dissolution Date (the

“Wind-Down Period”) the Fund may begin liquidating all or a portion

of the Fund’s portfolio, and the Fund may deviate from its

investment strategy and may not achieve its investment objectives.

As a result, during the Wind-Down Period, the Fund’s distributions

may decrease, and such distributions may include a return of

capital. The Fund’s investment objectives and policies are not

designed to seek to return investors’ original investment upon

termination of the Fund, and investors may receive more or less

than their original investment upon termination of the Fund. As the

assets of the Fund will be liquidated in connection with its

termination, the Fund may be required to sell portfolio securities

when it otherwise would not, including at times when market

conditions are not favorable, which may cause the Fund to lose

money.

Closed-end funds, unlike open-end funds, are not

continuously offered. After the initial public offering, shares are

sold on the open market through a stock exchange. Closed-end funds

may be leveraged and carry various risks depending upon the

underlying assets owned by a fund. Investment policies, management

fees and other matters of interest to prospective investors may be

found in each closed-end fund annual and semi-annual report. For

additional information, please contact your investment professional

or call 1-844-337-4626.

About PIMCO

PIMCO was founded in 1971 in Newport Beach,

California and is one of the world’s premier fixed income

investment managers. Today we have offices across the globe and

3,000+ professionals united by a single purpose: creating

opportunities for investors in every environment. PIMCO is owned by

Allianz S.E., a leading global diversified financial services

provider.

Except for the historical information and

discussions contained herein, statements contained in this news

release constitute forward-looking statements. These statements may

involve a number of risks, uncertainties and other factors that

could cause actual results to differ materially, including the

performance of financial markets, the investment performance of

PIMCO's sponsored investment products and separately managed

accounts, general economic conditions, future acquisitions,

competitive conditions and government regulations, including

changes in tax laws. Readers should carefully consider such

factors. Further, such forward-looking statements speak only on the

date at which such statements are made. PIMCO undertakes no

obligation to update any forward-looking statements to reflect

events or circumstances after the date of such statement.

This material has been distributed for

informational purposes only and should not be considered as

investment advice or a recommendation of any particular security,

strategy or investment product. No part of this material may be

reproduced in any form, or referred to in any other publication,

without express written permission. PIMCO is a trademark of Allianz

Asset Management of America L.P. in the United States and

throughout the world. ©2024, PIMCO

For information on PIMCO Closed-End

Funds:Financial Advisors: (800) 628-1237Shareholders: (844)

337-4626 or (844) 33-PIMCOPIMCO Media Relations: (212) 597-1054

1 Prior to November 21, 2023, PIMCO Dynamic

Income Strategy Fund (NYSE: PDX) was named PIMCO Energy and

Tactical Credit Opportunities Fund (NYSE: NRGX).2 Based on amounts

per common share for the March Distribution calculated as if the

March Distribution had been paid monthly instead of quarterly. As

noted above, the April Distribution will be the first monthly

distribution by the Fund. In order to show the amount and

percentage change of the April Distribution relative to the March

Distribution, a monthly amount per common share for the March

Distribution has been calculated by dividing the March Distribution

by three.

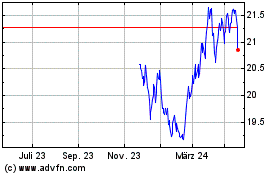

PIMCO Dynamic Income Str... (NYSE:PDX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

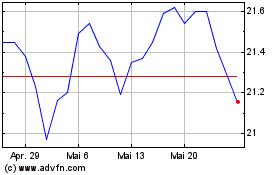

PIMCO Dynamic Income Str... (NYSE:PDX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025