Owl Rock Capital Corp false 0001655888 0001655888 2023-07-06 2023-07-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 6, 2023

BLUE OWL CAPITAL CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Maryland |

|

814-01190 |

|

47-5402460 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

| 399 Park Avenue, New York, NY |

|

10022 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (212) 419-3000

Owl Rock Capital Corporation

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

OBDC |

|

The New York Stock Exchange |

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On July 6, 2023, Blue Owl Capital Corporation (the “Company”) entered into a license agreement (the “License Agreement”) with Blue Owl Capital Holdings LLC, an affiliate of Blue Owl Capital, Inc., the parent company of the Company’s investment adviser (the “Licensor”), pursuant to which the Licensor granted the Company a non-exclusive, royalty free license to use the “Blue Owl” name. Under the License Agreement, the Company has the right to use such name for so long as the Licensor, or one of its affiliates, remains the Company’s investment adviser. Other than with respect to this limited license, the Company has no legal right to the “Blue Owl” name or logo.

The description above is only a summary of the material provisions of the License Agreement, and is qualified in its entirety by reference to the full text of the License Agreement, a copy of which is filed as Exhibit 10.1 to this current report on Form 8-K, and by this reference incorporated herein.

Investors and others should note that Blue Owl Capital Corporation (the “Company”) may announce material financial information to investors using its website (www.blueowlcapitalcorporation.com), SEC filings, press releases, public conference calls and webcasts. The Company expects to update investor presentations and similar materials on a regular basis and will continue to post such updates on its website each quarter. The Company encourages investors, the media, and others interested in the Company to review the information it posts from time to time on its website.

On July 6, 2023, the Company issued a press release entitled “Owl Rock Capital Corporation Renamed to Blue Owl Capital Corporation”. A copy of such Press Release is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 8.01 by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Blue Owl Capital Corporation |

|

|

|

|

| July 6, 2023 |

|

|

|

By: |

|

/s/ Jonathan Lamm |

|

|

|

|

Name: |

|

Jonathan Lamm |

|

|

|

|

Title: |

|

Chief Financial Officer and Chief Operating Officer |

LICENSE AGREEMENT

This LICENSE AGREEMENT (this “Agreement”) is made and effective as of July 6, 2023 (the “Effective

Date”) by and between Blue Owl Capital Holdings LLC, a Delaware limited liability company (the “Licensor”), on the one hand, and Blue Owl Capital Corporation, a Maryland corporation (the “Licensee”), on the

other hand (each a “party,” and collectively, the “parties”).

RECITALS

WHEREAS, the Licensor has certain common law rights in the trade name “Blue Owl” (the “Licensed Name”);

WHEREAS, the Licensor has registered the Licensed Name as a trademark in the United States and the Licensor has registered the Licensed Name

as a trademark in various other countries;

WHEREAS, the Licensee is a closed-end management

investment company that intends to elect to be treated as a business development company under the Investment Company Act of 1940, as amended;

WHEREAS, pursuant to the Third Amended and Restated Investment Advisory Agreement, dated as of May 18, 2021, by and between Blue Owl

Credit Advisors LLC (the “Adviser”) and the Licensee (the “Advisory Agreement”), the Licensee has engaged the Adviser to act as the investment adviser to the Licensee;

WHEREAS, the Adviser is an indirect subsidiary of the Licensor; and

WHEREAS, the Licensee desires to use the Licensed Name in connection with the operation of its business, and the Licensor is willing to permit

the Licensee to use the Licensed Name, subject to the terms and conditions of this Agreement.

NOW, THEREFORE, in consideration of the

mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE 1

LICENSE GRANT

1.1 License. Subject to the terms and conditions of this Agreement, the Licensor hereby grants to the Licensee, and the

Licensee hereby accepts from Licensor, a personal, non-exclusive, royalty-free right and license to use the Licensed Name solely and exclusively as an element of the Licensee’s own company name and in

connection with the conduct of its business. Except as provided above, neither the Licensee nor any affiliate, owner, director, officer, employee, or agent thereof shall otherwise use the Licensed Name or any derivative thereof without the

prior express written consent of the Licensor to be provided in the Licensor’s sole and absolute discretion. All rights not expressly granted to the Licensee hereunder shall remain the exclusive property of the Licensor.

1.2 Licensor’s Use. Nothing in this Agreement shall preclude the Licensor, its affiliates, or any of its respective

successors or assigns from using or permitting other entities to use the Licensed Name whether or not such entity directly or indirectly competes or conflicts with the Licensee’s business in any manner.

ARTICLE 2

OWNERSHIP

2.1

Ownership. The Licensee acknowledges and agrees that Licensor is the owner of all right, title, and interest in and to the Licensed Name, and all such right, title, and interest shall remain with the Licensor. The Licensee shall not

otherwise contest, dispute, or challenge the Licensor’s right, title, and interest in and to the Licensed Name.

2.2

Goodwill. All goodwill and reputation generated by Licensee’s use of the Licensed Name shall inure to the benefit of the Licensor. The Licensee shall not by any act or omission use the Licensed Name in any manner that

disparages or reflects adversely on the Licensor or its business or reputation. Except as expressly provided herein, neither the Licensor nor the Licensee may use any trademark or service mark of the other without the other’s prior written

consent, which consent shall be given or withheld in the other’s sole discretion.

ARTICLE 3

COMPLIANCE

3.1 Quality

Control. In order to preserve the inherent value of the Licensed Name, the Licensee agrees to use reasonable efforts to ensure that it maintains the quality of the Licensee’s business and the operation thereof equal to the standards

prevailing in the operation of the Licensor’s and the Licensee’s business as of the date of this Agreement. The Licensee further agrees to use the Licensed Name in accordance with such quality standards as may be reasonably

established by the Licensor and communicated to the Licensee from time to time in writing, or as may be agreed to by the Licensor and the Licensee from time to time in writing.

3.2 Compliance With Laws. The Licensee agrees that the business operated by it in connection with the Licensed Name shall comply

in all material respects with all laws, rules, regulations, and requirements of any governmental body in the United States of America or elsewhere as may be applicable to the operation, advertising, and promotion of the business, and that it shall

notify the Licensor of any action that must be taken by the Licensee to comply with such law, rules, regulations, or requirements.

3.3

Notification of Infringement. The Licensor and the Licensee shall immediately notify the other and provide to the other all relevant background facts upon becoming aware of (i) any registrations of, or applications for registration

of, marks that do or may conflict with the Licensed Name, and (ii) any infringements, imitations, or illegal use or misuse of the Licensed Name.

ARTICLE 4

REPRESENTATIONS AND

WARRANTIES

4.1 Mutual Representations. Each of the Licensor and the Licensee hereby represents and warrants to the other

as follows:

(a) Due Authorization. Such party is duly formed and in good standing as of the Effective Date, and the

execution, delivery and performance of this Agreement by such party have been duly authorized by all necessary action on the part of such party.

(b) Due Execution. This Agreement has been duly executed and delivered by such party and, with due authorization, execution, and

delivery by the other party, constitutes a legal, valid, and binding obligation of such party, enforceable against such party in accordance with its terms.

(c) No Conflict. Such party’s execution, delivery, and performance of this

Agreement does not: (i) violate, conflict with or result in the breach of any provision of the organizational documents of such party; (ii) conflict with or violate any law or governmental order applicable to such party or any of its

assets, properties, or businesses; or (iii) conflict with, result in any breach of, constitute a default (or event which with the giving of notice or lapse of time, or both, would become a default) under, require any consent under, or give to

others any rights of termination, amendment, acceleration, suspension, revocation, or cancellation of any contract, agreement, lease, sublease, license, permit, franchise, or other instrument or arrangement to which it is a party.

ARTICLE 5

TERM AND TERMINATION

5.1 Term. This Agreement shall remain in effect only for so long as an affiliate of the Licensor remains the

Licensee’s investment adviser.

5.2 Upon Termination. Upon expiration or termination of this Agreement, all rights

granted to the Licensee under this Agreement with respect to the Licensed Name shall cease, and the Licensee shall immediately discontinue use of the Licensed Name.

ARTICLE 6

MISCELLANEOUS

6.1 Assignment. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective

successors and permitted assigns. Neither the Licensor nor the Licensee may assign, delegate, or otherwise transfer this Agreement or any of its rights or obligations hereunder without the prior written consent of the other; provided, however,

that the Licensor may assign this Agreement to an affiliate without Licensee’s consent. No assignment by either party permitted hereunder shall relieve the applicable party of its obligations under this Agreement. Any assignment by

either party in accordance with the terms of this Agreement shall be pursuant to a written assignment agreement in which the assignee expressly assumes the assigning party’s rights and obligations hereunder. Notwithstanding anything to the

contrary contained in this Agreement, the rights and obligations of the Licensee under this Agreement shall be deemed to be assigned to a newly-formed entity in the event of the merger of the Licensee into, or conveyance of all of the assets of the

Licensee to, such newly-formed entity; provided, further, however, that the sole purpose of that merger or conveyance is to effect a mere change in the Licensee’s legal form into another limited liability entity.

6.2 Independent Contractor. This Agreement does not give any party, or permit any party to represent that it has any power, right,

or authority to bind the other party to any obligation or liability, or to assume or create any obligation or liability on behalf of the other party.

6.3 Notices. All notices, requests, claims, demands, and other communications hereunder shall be in writing and shall be given or

made (and shall be deemed to have been duly given or made upon receipt) by delivery in person, by overnight courier service (with signature required), by facsimile, or by registered or certified mail (postage prepaid, return receipt requested) to

the recipient party at its principal office.

6.4 Governing Law. This Agreement shall be governed by and construed in accordance

with the laws of the State of New York applicable to contracts formed and to be performed entirely within the State of New York, without regarding the conflicts of law principles or rules thereof to the extent such principles would require or permit

the application of the laws of another jurisdiction. The parties unconditionally and irrevocably consent to the exclusive jurisdiction of the courts located in the State of New York and waive any objection with respect thereto, for the purpose of

any action, suit, or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby.

6.5

Amendment. This Agreement may not be amended or modified except by an instrument in writing signed by all parties hereto.

6.6

No Waiver. The failure of either party to enforce at any time for any period the provisions of or any rights deriving from this Agreement shall not be construed to be a waiver of such provisions or rights or the right of such party

thereafter to enforce such provisions, and no waiver shall be binding unless executed in writing by all parties hereto.

6.7

Severability. If any term or other provision of this Agreement is invalid, illegal, or incapable of being enforced by any law or public policy, all other terms and provisions of this Agreement shall nevertheless remain in full force and

effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner materially adverse to any party. Upon such determination that any term or other provision is invalid, illegal, or incapable

of being enforced, the parties hereto shall negotiate in good faith to modify this Agreement so as to effect the original intent of the parties as closely as possible in an acceptable manner in order that the transactions contemplated hereby are

consummated as originally contemplated to the greatest extent possible.

6.8 Headings. The descriptive headings contained in

this Agreement are for convenience of reference only and shall not affect in any way the meaning or interpretation of this Agreement.

6.9

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, and all of which together shall be deemed to be one and the same instrument. Any party may deliver an

executed copy of this Agreement and of any documents contemplated hereby by facsimile or other electronic transmission to another party and such delivery shall have the same force and effect as any other delivery of a manually signed copy of this

Agreement or of such other documents.

6.10 Entire Agreement. This Agreement constitutes the entire agreement of the parties

with respect to the subject matter hereof and supersedes all prior agreements and undertakings, both written and oral, among the parties with respect to such subject matter.

6.11 Third-Party Beneficiaries. Nothing in this Agreement, either express or implied, is intended to or shall confer upon any

third party any legal or equitable right, benefit, or remedy of any nature whatsoever under or by reason of this Agreement.

[Remainder

of Page Intentionally Blank]

IN WITNESS WHEREOF, each party has caused this Agreement to be executed as of the Effective Date

by its duly authorized officer.

|

|

|

| LICENSOR: |

| Blue Owl Capital Holdings LLC |

|

|

| By: |

|

/s/ Neena Reddy |

|

|

Name: Neena Reddy |

|

|

Title: General Counsel and Secretary |

|

| LICENSEE: |

| Blue Owl Capital Corporation |

|

|

| By: |

|

/s/ Neena Reddy |

|

|

Name: Neena Reddy |

|

|

Title: Vice President and Secretary |

Owl Rock Capital Corporation Renamed to Blue Owl Capital Corporation

NEW YORK — July 6, 2023 — Effective today, Owl Rock Capital Corporation is renamed to Blue Owl Capital Corporation (the “Company”)

and, beginning with today’s trading session, its ticker symbol on the New York Stock Exchange will be “OBDC”. CUSIPs for the equity and unsecured notes of the Company will not change and its outstanding unsecured notes will also trade

under “OBDC”. Additionally, the Company’s new website address is www.blueowlcapitalcorporation.com. The Company’s day-to-day business remains

unchanged.

Blue Owl Capital Corporation is managed by an investment adviser that is an indirect affiliate of Blue Owl Capital Inc. (NYSE: OWL). Effective

today, the Company’s investment adviser is renamed as “Blue Owl Credit Advisors LLC”.

ABOUT BLUE OWL CAPITAL CORPORATION

Blue Owl Capital Corporation is a specialty finance company focused on lending to U.S. middle-market companies. As of March 31, 2023, the Company had

investments in 187 portfolio companies with an aggregate fair value of $13.2 billion. The Company has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. The Company is externally

managed by Blue Owl Credit Advisors LLC, an SEC-registered investment adviser that is an indirect affiliate of Blue Owl Capital Inc. (NYSE: OWL) and part of Blue Owl’s Credit platform, which focuses on

direct lending and has approximately $71.6 billion of assets under management as of March 31, 2023.

Certain information contained herein may

constitute “forward-looking statements” that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These

forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about the Company, its current and prospective portfolio investments, its industry, its beliefs and opinions, and its

assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,”

“would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify

forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the Company’s control and difficult to predict and could cause actual

results to differ materially from those expressed or forecasted in the forward-looking statements including, without limitation, the risks, uncertainties and other factors identified in the Company’s filings with the SEC. Investors should not

place undue reliance on these forward-looking statements, which apply only as of the date on which the Company makes them. The Company does not undertake any obligation to update or revise any forward-looking statements or any other information

contained herein, except as required by applicable law.

INVESTOR CONTACTS

Investor Contact:

Dana Sclafani

212-419-3000

credit-ir@blueowl.com

Media Contact:

Prosek Partners

Josh Clarkson

pro-blueowl@prosek.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

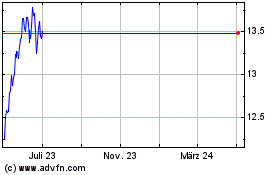

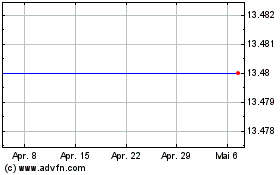

Owl Rock Capital (NYSE:ORCC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Owl Rock Capital (NYSE:ORCC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024