As filed with the SEC on November 9, 2023

Registration No. 333__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

____________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

ONEOK, Inc.

(Exact name of registrant as specified in its charter)

____________________

|

Oklahoma

|

|

73-1520922

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

100 West Fifth Street

Tulsa, Oklahoma 74103

(918) 588-7000

(Address, including zip code and telephone number, including area code,

of registrant’s principal executive offices)

____________________

ONEOK, Inc. Employee Stock Purchase Plan

(Full title of the plan)

Lyndon C. Taylor

Executive Vice President, Chief Legal Counsel

and Assistant Secretary

100 West Fifth Street

Tulsa, Oklahoma 74103

(918) 588-7000

(Name, address, and telephone number, including area code, of agent for service)

_____________________________

Copies to:

|

Jeffrey T. Haughey

GABLEGOTWALS

110 North Elgin Street, Suite 200

Tulsa, Oklahoma 74120

(918) 595-4800

|

|

Patrick W. Cipolla

Vice President, Associate General Counsel —

Compliance and Corporate Secretary

100 West Fifth Street

Tulsa, Oklahoma 74103

(918) 588-7000

|

_____________________________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

(Check one):

|

Large accelerated filer

|

|

☒

|

|

|

|

Accelerated filer

|

|

☐

|

|

Non-accelerated filer

|

|

☐

|

|

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

| |

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Pursuant to General Instruction E of Form S-8 under the Securities Act, this registration statement of the Company on Form S-8 is being filed in order to register 1,500,000 additional shares of the Company’s Common Stock, par value $0.01 per share (the “Common Stock”), which may be issued from time to time under the ONEOK, Inc. Employee Stock Purchase Plan (the “ESP Plan”). The contents of the earlier registration statements on Form S-8, filed on August 1, 2012 (SEC File No. 333-182991), August 4, 2008 (SEC File No. 333-152748), December 1, 2005 (SEC File No. 333-130067), July 24, 2000 (SEC File No. 333-42094), January 20, 2000 (SEC File No. 333-95039) and November 28, 1997 (SEC File No. 333-41265), respectively, are incorporated by reference into this registration statement, and are supplemented by the information set forth below.

i

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual Information.*

* The documents containing the information specified in Part I of Form S-8 will be sent or given to participants in the ESP Plan as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”). Such documents are not being filed with the Securities and Exchange Commission (the “SEC”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

I-1

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which have been previously filed by the Company with the SEC pursuant to the Securities Act and pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated by reference herein and shall be deemed to be a part hereof:

(a) The Company’s Annual Report on Form 10-K filed with the SEC on February 28, 2023;

(b) The portions of the Company’s Definitive Proxy Statement on Schedule 14A for the 2023 annual meeting of shareholders that are specifically incorporated by reference into the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on April 5, 2023;

(c) All other reports filed by the Company pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Company’s Form 10-K referred to in (a) above, but excluding in each portions of those reports and the exhibits related thereto that were furnished under Items 2.02 or 7.01; and

(d) the description of our Common Stock contained in our Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Securities Exchange Act of 1934 incorporated by reference to Exhibit 4.43 to our Annual Report on Form 10-K for the year ended December 31, 2020, filed on February 23, 2021.

In addition, all documents subsequently filed by the Company with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all securities remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents. Notwithstanding the foregoing, unless specifically stated to the contrary, none of the information that the Company discloses under Items 2.02 or 7.01 of any Current Report on Form 8-K that it may from time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this Registration Statement.

Any statement, including financial statements, contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or therein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Named Experts and Counsel.

The Company, as an Oklahoma corporation, is empowered by Section 1031 of the Oklahoma General Corporation Act, subject to the procedures and limitations stated therein, to indemnify any person against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with any threatened, pending or completed action, suit or proceeding (whether civil, criminal or administrative) in which such person is made or threatened to be made a party by reason of his being or having been a director, officer, employee or agent of the Company or is or was serving at its request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, if he acted in good

II-1

faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Company, and with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. However, in an action by or in the right of the Company, Section 1031 prohibits indemnification if such person is adjudged to be liable to the Company, unless such indemnification is allowed by a court of competent jurisdiction. The statute provides that indemnification pursuant to its provisions is not exclusive of other rights of indemnification to which a person may be entitled under any bylaw, agreement, vote of shareholders, or disinterested directors, or otherwise.

The certificate of incorporation of the Company provides that a director of the corporation shall not be personally liable to the corporation or its shareholders for monetary damages for breach of fiduciary duty as a director, except for liability for (i) any breach of the director’s duty of loyalty to the corporation or its shareholders, (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) payment of unlawful dividends or unlawful stock purchases or redemptions or (iv) any transaction from which the director derived an improper personal benefit.

Article VIII of the Company’s bylaws provides that directors and officers of the Company shall be indemnified by the Company to the fullest extent permitted by the Oklahoma General Corporation Act, including the advance of related expenses. Pursuant to Article VIII of the bylaws of the Company, upon authorization and determination (i) by the board of directors by a majority of a quorum consisting of directors who were not parties to the action, suit, or proceeding involved; (ii) by a committee of directors designated by a majority vote of directors, even though less than a quorum; (iii) if a quorum of disinterested directors is not obtainable, or even if obtainable and a quorum of disinterested directors so directs, by independent counsel in a written opinion; or (iv) by the shareholders, the Company is obligated to indemnify any person who incurs liability by reason of the fact that he is or was a director, officer, employee or agent of the Company, or is or was serving at its request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, or as a member of any committee or similar body, if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Company, and with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. However, in an action by or in the right of the Company, no indemnification will be made if such person shall be adjudged to be liable to the Company, unless such indemnification is allowed by a court of competent jurisdiction.

The Company has entered into indemnification agreements with certain of its directors and executive officers. These indemnification agreements provide that the Company is obligated to indemnify the specified director or executive officer to the fullest extent permitted by law. The agreements provide that, upon request by a director or executive officer, the Company is obligated to advance expenses for defense of a claim made against the director or executive officer. The obligation of the Company to indemnify the director or executive officer is subject to applicable law and the determination by a “reviewing party” selected by the board of directors that the director or executive officer is entitled to indemnification. In addition, the agreements obligate the Company to indemnify the specified executive officer or director to the extent of the Company’s recoveries under insurance policies regardless of whether the director or executive officer is ultimately determined to be entitled to indemnification. The agreements also provide for partial indemnification if a portion of a claim for indemnification is not allowed by the reviewing party appointed by the board of directors.

The Company provides liability insurance for its directors and officers which provides for coverage against loss from claims made against officers and directors in their capacity as such, including, subject to certain exceptions, liabilities under the federal securities laws.

It is recognized that the above-summarized provisions of the Company’s bylaws, the indemnification agreements and the applicable provisions of the Oklahoma General Corporation Act may be sufficiently broad to indemnify officers, directors and controlling persons of the Company against liabilities arising under such act.

Item 7. Exemption from Registration Claimed.

Not applicable.

II-2

Item 8. Exhibits.

|

Exhibit No.

|

|

Description

|

|

4.1

|

|

Amended and Restated Certificate of Incorporation of ONEOK, Inc., dated July 3, 2017, as amended (incorporated by reference from Exhibit 3.2 to ONEOK, Inc.’s Quarterly Report on Form 10-Q for the quarter ended September, 30, 2017, filed November 1, 2017 (File No. 1-13643)).

|

|

4.2

|

|

Amended and Restated Bylaws of ONEOK, Inc. (incorporated by reference from Exhibit 3.1 to ONEOK, Inc.’s Current Report on Form 8-K filed February 24, 2023 (File No. 1-13643)).

|

|

5.1

|

|

Opinion of GABLEGOTWALS.

|

|

23.1

|

|

Consent of GABLEGOTWALS (included in Exhibit 5.1).

|

|

23.2

|

|

Consent of PricewaterhouseCoopers LLP

|

|

23.3

|

|

Consent of Ernst & Young LLP

|

|

24.1

|

|

Powers of Attorney (included on signature page).

|

|

99.1

|

|

The ONEOK, Inc. Employee Stock Plan, as amended and restated, effective May 24, 2023.

|

|

107.1

|

|

Filing Fee Table.

|

Item 9. Undertakings.

(a) The Company hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Company pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement;

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

II-3

(b) The Company hereby further undertakes that, for the purposes of determining any liability under the Securities Act, each filing of the Company’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act that is incorporated by reference in this Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act, ONEOK, Inc. certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Tulsa, State of Oklahoma, on November 9, 2023.

|

|

|

ONEOK, INC.

|

| |

|

By:

|

|

/s/ Walter S. Hulse III

|

| |

|

Name:

|

|

Walter S. Hulse III

|

| |

|

Title:

|

|

Chief Financial Officer, Treasurer and Executive Vice President, Investor Relations and Corporate Development

|

POWER OF ATTORNEY

Each person whose signature appears below authorizes Pierce H. Norton II, Walter S. Hulse III and Patrick W. Cipolla, and each of them, each of whom may act without joinder of the other, to execute in the name of each such person who is then an officer or director of the Company and to file any amendments to this registration statement, including post effective amendments, and to do any and all acts they or either of them determines may be necessary or advisable to enable the Company to comply with the Securities Act of 1933, as amended, and any rules, regulations and requirements of the Securities and Exchange Commission in respect thereof, in connection with the registration of the securities which are the subject of this registration statement.

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities indicated globally on this 9th day of November, 2023.

|

Signature

|

|

Title

|

|

/s/ Julie H. Edwards

|

|

Board Chair

|

|

Julie H. Edwards

|

|

|

|

/s/ Pierce H. Norton II

|

|

Director, Chief Executive Officer and President

|

|

Pierce H. Norton II

|

|

(Principal Executive Officer)

|

| |

|

Chief Financial Officer, Treasurer, Executive Vice President,

|

|

/s/ Walter S. Hulse III

|

|

Investor Relations and Corporate Development

|

|

Walter S. Hulse III

|

|

(Principal Financial Officer)

|

|

/s/ Mary M. Spears

|

|

Senior Vice President and Chief Accounting Officer, Finance and Tax

|

|

Mary M. Spears

|

|

(Principal Accounting Officer)

|

|

/s/ Brian L. Derksen

|

|

Director

|

|

Brian L. Derksen

|

|

|

II-5

|

Signature

|

|

Title

|

|

/s/ Lori A. Gobillot

|

|

Director

|

|

Lori A. Gobillot

|

|

|

|

/s/ Mark W. Helderman

|

|

Director

|

|

Mark W. Helderman

|

|

|

|

/s/ Randall J. Larson

|

|

Director

|

|

Randall J. Larson

|

|

|

|

/s/ Steven J. Malcolm

|

|

Director

|

|

Steven J. Malcolm

|

|

|

|

/s/ Jim W. Mogg

|

|

Director

|

|

Jim W. Mogg

|

|

|

|

/s/ Pattye L. Moore

|

|

Director

|

|

Pattye L. Moore

|

|

|

|

/s/ Eduardo A. Rodriguez

|

|

Director

|

|

Eduardo A. Rodriguez

|

|

|

|

/s/ Gerald B. Smith

|

|

Director

|

|

Gerald B. Smith

|

|

|

|

/s/ Wayne T. Smith

|

|

Director

|

|

Wayne T. Smith

|

|

|

II-6

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

4.1

|

|

Amended and Restated Certificate of Incorporation of ONEOK, Inc., dated July 3, 2017, as amended (incorporated by reference from Exhibit 3.2 to ONEOK, Inc.’s Quarterly Report on Form 10-Q for the quarter ended September, 30, 2017, filed November 1, 2017 (File No. 1-13643)).

|

|

4.2

|

|

Amended and Restated Bylaws of ONEOK, Inc. (incorporated by reference from Exhibit 3.1 to ONEOK, Inc.’s Current Report on Form 8-K filed February 24, 2023 (File No. 1-13643)).

|

|

5.1

|

|

Opinion of GABLEGOTWALS.

|

|

23.1

|

|

Consent of GABLEGOTWALS (included in Exhibit 5.1).

|

|

23.2

|

|

Consent of PricewaterhouseCoopers LLP

|

|

23.3

|

|

Consent of Ernst & Young LLP

|

|

24.1

|

|

Powers of Attorney (included on signature page).

|

|

99.1

|

|

The ONEOK, Inc. Employee Stock Plan, as amended and restated, effective May 24, 2023

|

|

107.1

|

|

Filing Fee Table.

|

II-7

Exhibit 5.1

|

|

|

|

|

110 N Elgin Ave. Suite 200

Tulsa, Oklahoma 74120

Telephone (918) 595-4800

Fax (918) 595-4990

www.gablelaw.com |

|

BOK Park Plaza, 22nd Fl

499 W Sheridan Ave Suite 2200

Oklahoma City, Oklahoma 73102

Telephone: (405) 235-5500

Fax: (405) 235-2875

www.gablelaw.com |

| |

|

|

| |

November

9, 2023 |

|

ONEOK, Inc.

100 West Fifth Street

Tulsa, Oklahoma 74103

| Re: | Registration Statement on Form S-8 |

Ladies and Gentlemen:

We have acted as legal counsel

to ONEOK, Inc., an Oklahoma corporation (the “Company”), in connection with the registration statement on Form S-8

(the “Registration Statement”) under the Securities Act of 1933, as amended (the “Act”), covering

1,500,000 shares of the common stock of the Company, par value $0.01 per share (the “Shares”), under the ONEOK, Inc.

Employee Stock Purchase Plan (the “Plan”). This opinion is being furnished to you as a supporting document in connection

with the Registration Statement.

For purposes of this opinion,

we have examined the following documents:

(a)

the Registration Statement;

(b)

the Plan;

(c)

the corporate actions taken by the Board of Directors of the Company in connection with the Registration Statement and related

matters;

(d)

the Amended and Restated Certificate of Incorporation of the Company, as amended, and the related certificate of correction;

(e)

the Amended and Restated By-laws of the Company; and

(f) an executed copy of

the Secretary’s Certificate of the Company dated November 9, 2023.

In our examination of the

aforesaid documents, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity and

completeness of all documents submitted to us as original documents, and the conformity to original documents of all documents submitted

to us as copies thereof.

|

ONEOK, Inc.

November

9, 2023

Page 2 |

Based on the foregoing and

subject to the qualifications, assumptions and limitations set forth herein, we are of the opinion that the Shares have been duly authorized

and, when issued and delivered in accordance with the Plan upon receipt of requisite consideration therefor as provided therein, will

be validly issued, fully paid and non-assessable, provided that the consideration for the Shares is at least equal to the stated par value

thereof.

Each of the matters set forth

in this letter is as of the date hereof, and we undertake no, and hereby disclaim any, obligation to advise you of any change in any of

the matters set forth herein or in any matters upon which the opinions and views set forth in this letter are based.

Our opinions expressed above

are limited to the laws of the State of Oklahoma.

We hereby consent to the filing

of this opinion as Exhibit 5.1 to the Registration Statement. In giving this consent, we do not thereby admit that we are within the category

of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Securities and Exchange Commission

promulgated thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ GableGotwals |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference

in this Registration Statement on Form S-8 of ONEOK, Inc. of our report dated February 28, 2023, relating to the financial statements and

the effectiveness of internal control over financial reporting, which appears in ONEOK, Inc.’s Annual Report on Form 10-K for the

year ended December 31, 2022.

/s/ PricewaterhouseCoopers LLP

Tulsa, Oklahoma

November 9, 2023

Exhibit 23.3

Consent of Independent Registered Public Accounting

Firm

We consent to the use of our reports dated February

21, 2023, with respect to the consolidated financial statements of Magellan Midstream Partners, L.P. incorporated by reference in this

Registration Statement (Form S-8) of ONEOK, Inc.

/s/ Ernst & Young LLP

Tulsa, Oklahoma

November 9,

2023

Exhibit 99.1

ONEOK, INC.

EMPLOYEE STOCK PURCHASE PLAN

Amended and Restated February 22, 2023

(effective May 24, 2023)

The purpose of this Plan is to provide eligible

employees the opportunity to purchase Common Stock at a discount on a basis that qualifies for the tax treatment prescribed by Section

423 of the Code.

The following terms, when used in the Plan, shall

have the following meanings:

| (a) | Base Compensation means, with respect to any offering period: (i) in the case of an employee normally paid an hourly rate, the employee’s

hourly rate at the inception of the offering period multiplied by 2,080, (ii) in the case of an employee normally paid at a weekly rate,

the employee’s weekly rate at the inception of the offering period multiplied by 52, (iii) in the case of an employee normally paid

at a bi-weekly rate, the employee’s bi-weekly rate at the inception of the offering period multiplied by 26, (iv) in the case of

an employee normally paid at a monthly rate, the employee’s monthly rate at the inception of the offering period multiplied by 12;

and (v) in the case of an employee normally paid at an annual rate, the employee’s annual rate at the inception of the offering

period. Base compensation shall be determined by reference to the applicable rate before any deductions pursuant to a salary reduction

agreement under any plan qualified under Section 401(k) of the Code or any cafeteria plan under Code Section 125 and shall exclude any

bonuses, commissions, overtime pay, fringe benefits, stock options and other special compensation payable to an employee. |

| (b) | Board or Board of Directors means the Board of Directors of the Company, as constituted from time to time. |

| (c) | Code means the Internal Revenue Code of 1986, as amended from time to time. References to the Code or to a particular section of the

Code shall include references to any related Treasury Regulations and rulings and to successor provisions. |

| (d) | Committee means the committee appointed by the Board of Directors to administer the Plan pursuant to the provisions of Section 3(a)

below. |

| (e) | Common Stock means common stock, par value $0.01, of the Company. |

| (f) | Company means ONEOK, Inc., an Oklahoma corporation, its successors and assigns. |

| (g) | Exchange Act means the Securities Exchange Act of 1934, as amended from time to time. |

| (h) | Fair Market Value on a particular date means the average of the high and low sale prices of the Common Stock in consolidated trading

on the date in question as reported by The Wall Street Journal or another reputable source designated by the Committee; provided that

if there were no sales on such date reported as provided above, the respective prices on the most recent prior day for which a sale was

so reported. If the foregoing method of determining fair market value should be inconsistent with Section 423 of the Code, “Fair

Market Value” shall be determined by the Committee in a manner consistent with such section of the Code and shall mean the value

as so determined. |

| (i) | General Counsel means the General Counsel of the Company serving from time to time. |

| (j) | Plan means the ONEOK, Inc. Employee Stock Purchase Plan set forth in these pages, as amended from time to time. |

| (k) | SEC Rule 16b-3 means Rule 16b-3 of the Securities and Exchange Commission promulgated under the Exchange Act, as such rule or any

successor rule may be in effect from time to time. |

| (l) | Section 16 Person means a person subject to Section 16(b) of the Exchange Act with respect to transactions involving equity securities

of the Company. |

| (m) | Subsidiary means a subsidiary as defined in Section 424(f) of the Code, including a corporation which becomes such a subsidiary in

the future. |

| (a) | The Plan shall be administered by a committee of the Board consisting of two or more directors appointed from time to time by the

Board. No person shall be appointed to or shall serve as a member of such committee unless at the time of such appointment and service

he or she shall be a Non-Employee Director, as defined in SEC Rule 16b-3. The Committee may delegate discretionary authority for day-to-day

administration of the Plan to other entities or persons, including the Company and its employees, pursuant to a duly adopted resolution

or a memorandum of action signed by all members of the Committee or approved via electronic transmission. All actions taken by any such

delegate shall have the same legal effect and shall be entitled to the same deference as if taken by the Committee itself. |

| (b) | Subject to the provisions of the Plan, the powers of the Committee shall include having the authority, in its discretion, to: |

| (i) | define, prescribe, amend and rescind rules, regulations, procedures, terms and conditions relating to the Plan; |

| (ii) | make all other determinations necessary or advisable for the administration of the Plan, including but not limited to interpreting

the Plan, correcting defects, reconciling inconsistencies and resolving ambiguities; and |

| (iii) | approve any transaction involving a grant, award or other transaction from the Company to a Section 16 Person (other than a Discretionary

Transaction, as defined in SEC Rule 16b-3), so as to exempt such transaction under SEC Rule 16b-3; provided, that any transaction under

the Plan involving a Section 16 Person also may be approved by the Board of Directors, or may be approved or ratified by the stockholders

of the Company, in the manner that exempts such transaction under SEC Rule 16b-3. |

| (c) | The interpretation by the Committee of the terms and provisions of the Plan, and its administration of the Plan, and all action taken

by the Committee, shall be final, binding and conclusive on the Company, its stockholders, Subsidiaries, all participants and employees,

and upon their respective successors and assigns, and upon all other persons claiming under or through any of them. |

| (d) | Members of the Board and members of the Committee acting under this Plan shall be fully protected in relying in good faith upon the

advice of counsel and shall incur no liability except for gross or willful misconduct in the performance of their duties. |

| 4. | Stock Subject to the Plan |

| (a) | Subject to paragraph (c) below, the aggregate number of shares of Common Stock which may be sold under the Plan is 13,100,000. |

| (b) | If the number of shares of Common Stock that participating employees become entitled to purchase is greater than the number of shares

of Common Stock that are offered in a particular offering or that remain available under the Plan, the available shares of Common Stock

shall be allocated by the Committee among such participating employees in such manner as it deems fair and equitable. |

| (c) | In the event of any change in the Common Stock, through recapitalization, merger, consolidation, stock dividend or split, combination

or exchange of shares, spinoff or otherwise, the Committee may make such equitable adjustments in the Plan and the then outstanding offerings

as it deems necessary and appropriate including, but not limited to, changing the number of shares of Common Stock reserved under the

Plan, and the price of the current offering; provided that any such adjustments shall be consistent with Sections 423 and 424 of the Code. |

| (d) | Shares of Common Stock which are to be delivered under the Plan may be obtained by the Company from its treasury, by purchases on

the open market or from private sources, or by issuing authorized but unissued shares of its Common Stock. Shares of authorized but unissued

Common Stock may not be delivered under the Plan if the purchase price thereof is less than the par value (if any) of the Common Stock

at the time. The Committee may (but need not) provide at any time or from time to time (including without limitation upon or in contemplation

of a change in control) for a number of shares of Common Stock equal in number to the number of shares then subject to options under this

Plan, or expected to be subject to options under this Plan in the then pending offering(s), to be issued or transferred to, or acquired

by, a trust (including but not limited to a grantor trust) for the purpose of satisfying the Company’s obligations under such options,

and, unless prohibited by applicable law, such shares held in trust shall be considered authorized and issued shares with full dividend

and voting rights, notwithstanding that the options to which such shares relate might not be exercisable at the time. |

All employees of the Company and any Subsidiaries

designated by the Committee from time to time will be eligible to participate in the Plan, in accordance with and subject to such rules

and regulations as the Committee may prescribe; provided, however, that (a) such rules shall neither permit nor deny participation in

the Plan contrary to the requirements of the Code (including but not limited to Section 423(b)(3), (4) and (8) thereof), (b) no employee

shall be eligible to participate in the Plan if his or her customary employment is for not more than 5 months in any calendar year, unless

the Committee determines otherwise on a uniform and non-discriminatory basis, (c) no employee may be granted an option under the Plan

if such employee, immediately after the option is granted, owns stock possessing 5% or more of the total combined voting power or value

of all classes of stock of his or her employer corporation or any parent or Subsidiary corporation (within the meaning of Section 423(b)(3)

of the Code). For purposes of the preceding sentence, the rules of Section 424(d) of the Code shall apply in determining the stock ownership

of an employee, and stock which the employee may purchase under outstanding options (whether or not such options qualify for the special

tax treatment afforded by Code Section 421(a)) shall be treated as stock owned by the employee; and (d) all participating employees shall

have the same rights and privileges except as otherwise permitted by Section 423(b)(5) of the Code.

| 6. | Offerings; Participation. |

The Company may make offerings of up to 27 months’

duration each, to eligible employees to purchase Common Stock under the Plan, until all shares authorized to be delivered under the Plan

have been exhausted or until the Plan is sooner terminated by the Board. Subject to the preceding sentence, the duration and commencement

date of any offerings shall be determined by the Committee in its sole discretion; provided that, unless the Committee determines otherwise,

a new offering shall commence on the first day of the Company’s first payroll period coinciding with or next following each January

1 and July 1 and shall extend through and include the payroll period immediately preceding the payroll period in which the next offering

commences. Subject to such rules, procedures and forms as the Committee may prescribe, an eligible employee may participate in an offering

at such time(s) as the Committee may permit by authorizing a payroll deduction for such purpose of at least 1 percent and up to a maximum

of 10 percent of the portion of his or her Base Compensation earned during each payroll period or such lesser amount as the Committee

may prescribe. An eligible employee’s initial payroll deduction election will remain in effect for successive offering periods unless

modified or terminated in accordance with Article 7 below. The Committee may at any time suspend or accelerate the completion of an offering

if required by law or deemed by the Committee to be in the best interests of the Company, including in the event of a change in ownership

or control of the Company or any Subsidiary. The Company’s obligation to sell and deliver Common Stock under this Plan shall be

subject to the approval of any governmental authority whose approval the General Counsel determines is necessary or advisable to obtain

in connection with the authorization, issuance or sale of such Common Stock.

| (a) | The Company will maintain payroll deduction accounts on its books for all participating employees. All employee contributions shall

be credited to such accounts. Employee contributions credited to the payroll deduction accounts of participating employees need not be

segregated from other corporate funds and may be used for any corporate purpose. |

| (b) | At such times as the Committee may permit and subject to such rules, procedures and forms as the Committee may prescribe, an employee

may increase, decrease or suspend his or her payroll deduction during an offering, or may withdraw the balance of his or her payroll deduction

account and thereby withdraw from participation in an offering. However, an employee may at any time waive in writing the right or privilege

to decrease or suspend his or her payroll deductions or withdraw from participation in a particular offering. Any such waiver shall be

irrevocable with respect to the remainder of such offering period and shall end as of the beginning of the first offering period commencing

after the employee files a superseding written revocation of such waiver (or a new payroll deduction election) with the Company. |

| (c) | No employee shall make any elective contribution or employee contribution to the Plan (within the meaning of Treasury Regulation Section

1.401(k)-1(d)(2)(iv)(B)(4)) during the balance of the offering period after the employee’s receipt of a hardship distribution from

a plan of the Company or a related party within the provisions of Code Section 414(b), (c), (m) or (o) containing a cash or deferred arrangement

under Section 401(k) of the Code, or during the following offering period. The foregoing sentence shall not apply if and to the extent

the General Counsel determines it is not necessary to qualify any such plan as a cash or deferred arrangement under Section 401(k) of

the Code. |

| (d) | Any balance remaining in any employee’s payroll deduction account at the end of an offering period will be carried forward into

the employee’s payroll deduction account for the following offering period. In no event will the balance carried forward be equal

to or greater than the purchase price of one share of Common Stock as determined under Section 8(c) below. Any excess shall be refunded

to the participant. Upon termination of the Plan, all amounts in the accounts of participating employees shall be carried forward into

their payroll deduction accounts under a successor plan, if any, or refunded to them, as the Committee may decide. |

| (e) | Except as the Committee may otherwise determine in its sole discretion, in the event

of the termination of a participating employee’s employment for any reason, his or her participation in any offering under the Plan

shall cease, no further amounts shall be deducted pursuant to the Plan and the balance in the employee’s account shall be paid to

the employee, or, in the event of the employee’s death, to the employee’s beneficiary under the Company’s basic group

life insurance program. |

| (a) | Within the limitations of Section 8(d) below, each employee participating in any offering under the Plan will be granted an option,

upon the effective date of such offering, for as many full shares of Common Stock as the amount of his or her payroll deduction account

(including any contributions made by means other than payroll deductions in a prior offering period that remain in the employee’s

payroll deduction account pursuant to Section 7(d) above) at the end of the offering can purchase. |

| (b) | As of the last day of the offering period, the payroll deduction account of each participating employee shall be totaled. Subject

to the provisions of Section 7(b) above and 8(d) below, if such account contains sufficient funds as of that date to purchase one or more

shares of Common Stock at the price determined under Section 8(c) below, the employee shall be deemed to have exercised an option to purchase

the largest number of shares of Common Stock at the price determined under Section 8(c) below that his or her payroll deduction account

will permit; such employee’s account will be charged for the amount of the purchase and for all purposes under the Plan the employee

will be deemed to have acquired the shares on that date; and either a stock certificate representing such shares will be issued to him

or her, or the Company’s registrar will make an entry on its books and records evidencing that such shares have been duly issued

or transferred as of that date, as the Committee may direct. Notwithstanding any provision of the Plan to the contrary, the Committee may but need not permit fractional shares to be purchased under

the Plan. |

| (c) | Unless the Committee determines before the effective date of an offering that a higher price that complies with Section 423 of the

Code shall apply, the purchase price of the shares of Common Stock which are to be sold under the offering shall be the lesser of (i)

an amount equal to 85 percent of the Fair Market Value of the Common Stock at the time such option is granted, or (ii) an amount equal

to 85 percent of the Fair Market Value of the Common Stock at the time such option is exercised. |

| (d) | In addition to any other limitations set forth in the Plan, (i) no employee may purchase in any offering period more than the number

of shares of Common Stock determined by dividing the employee’s annual Base Compensation as of the first day of the offering period,

or $25,000, whichever is less, by the Fair Market Value of a share of Common Stock at such day, and (ii) no employee may be granted an

option under the Plan which permits his or her rights to purchase stock under the Plan, and any other stock purchase plan of his or her

employer corporation and its parent and subsidiary corporations that is qualified under Section 423 of the Code, to accrue at a rate which

exceeds $25,000 of the Fair Market Value of such stock (determined at the time such option is granted) for each calendar year in which

the option is outstanding at any time. The Committee may further limit the amount of Common Stock which may be purchased by any employee

during an offering period in accordance with Section 423(b)(5) of the Code. |

| (a) | No option, right or benefit under the Plan (including any derivative security within the meaning of paragraph (a)(2) of SEC Rule 16b-3)

may be transferred by a participating employee, whether by will, the laws of descent and distribution, or otherwise, and all options,

rights and benefits under the Plan may be exercised during the participating employee’s lifetime only by such employee. |

| (b) | Book entry accounts and certificates for shares of Common Stock purchased under the Plan may be maintained or registered, as the case

may be, only in the name of the participating employee or, if such employee so indicates on his or her payroll deduction authorization

form, in his or her name jointly with a member of his or her family, with right of survivorship. An employee who is a resident of a jurisdiction

which does not recognize such a joint tenancy may have book entry accounts maintained and certificates registered in the employee’s

name as tenant in common with a member of the employee’s family, without right of survivorship. |

| 10. | Effective Date and Duration of Plan |

The Plan (including any restatements thereof)

shall become effective when adopted by the Board, provided that the stockholders of the Company approve it within 12 months thereafter

at a duly held stockholders’ meeting. If not so approved by shareholders, the Plan shall be null, void and of no force or effect.

If so approved, the Plan shall remain in effect until all shares authorized to be issued or transferred hereunder have been exhausted

or until the Plan is sooner terminated by the Board of Directors, and may continue in effect thereafter with respect to any options outstanding

at the time of such termination if the Board of Directors so provides.

| 11. | Amendment and Termination of the Plan |

The Plan may be amended by the Board of Directors,

without shareholder approval, at any time and in any respect, unless shareholder approval of the amendment in question is required under

Oklahoma law, the Code (including without limitation Code Section 423 and Treasury Regulation Section 1.423-2(c)(4) thereunder), any exemption

from Section 16 of the Exchange Act (including without limitation SEC Rule 16b-3) for which the Company intends Section 16 Persons to

qualify, any national securities exchange or system on which the Stock is then listed or reported, by any regulatory body having jurisdiction

with respect to the Plan, or under any other applicable laws, rules or regulations. The Plan provisions that determine the amount, price

and timing of option grants to Section 16 Persons may not be amended more than once every six months, other than to comport with changes

in the Internal Revenue Code, the Employee Retirement Income Security Act of 1974, or the rules thereunder, unless the General Counsel

determines that such restriction on amendments is not necessary to secure or maintain any exemption from Section 16 of the Exchange Act

for which the Company intends Section 16 Persons to qualify. The Plan may also be terminated at any time by the Board of Directors.

| (a) | Nothing contained in this Plan shall be deemed to confer upon any person any right to continue as an employee of or to be associated

in any other way with the Company for any period of time or at any particular rate of compensation. |

| (b) | No person shall have any rights as a stockholder of the Company with respect to any shares optioned under the Plan until such shares

are issued or transferred to him or her. |

| (c) | All expenses of adopting and administering the Plan shall be borne by the Company, and none of such expenses shall be charged to any

participant. |

| (d) | The Plan shall be governed by and construed under the laws of the State of Oklahoma, without giving effect to the principles of conflicts

of laws of that State. |

| (e) | The Plan and each offering under the Plan is intended to qualify as an employee stock purchase plan within the meaning of Section

423 of the Code. Transactions under the Plan by or with respect to Section 16 Persons are also intended to qualify for exemption under

SEC Rule 16b-3, unless the Committee specifically determines otherwise. Every provision of the Plan shall be administered, interpreted

and construed to carry out those intentions, and any provision that cannot be so administered, interpreted and construed shall to that

extent be disregarded. |

8

Exhibit 107.1

Calculation of Filing Fee Table

Form S-8

(Form Type)

ONEOK, Inc.

(Exact name of registrant as specified in its charter)

Table 1 - Newly Registered Securities

| Security Type | |

Security Class Title | |

Fee Calculation Rule | |

Amount Registered

(1) | | |

Proposed Maximum Offering Price Per Unit | | |

Maximum Aggregate Offering Price (3) | | |

Fee Rate | | |

Amount of Registration Fee | |

| Equity | |

Common Stock, par value $0.01 per share | |

Rule 457 (c) and Rule 457 (h) | |

| 1,500,000 | (2) | |

$ | 65.40

| (3) | |

$ | 98,100,000.00 | | |

$ | 0.00014760 | | |

$ | 14,479.56 | |

| Total Offering Amounts | |

| |

| | | |

| | | |

$ | 98,100,000.00 | | |

| | | |

$ | 14,479.56 | |

| Total Fee Previously Paid |

| | | |

| | | |

| | | |

| | | |

$ | 0 | |

| Total Offsets | |

| | | |

| | | |

| | | |

| | | |

$ | 0 | |

| Net Fee Due | |

| | | |

| | | |

| | | |

| | | |

$ | 14,479.56 | |

| (1) | Pursuant to Rule 416 (a) under the Securities Act of 1933

(the “Securities Act”), this Registration Statement on Form S-8 (the “Registration Statement”) also

covers an indeterminate number of additional shares of common stock, par value $0.01 per share (“Common Stock”), of

ONEOK, Inc. (the “Registrant”) that may be offered and issued under the ONEOK, Inc. Employee Stock Purchase Plan (the

“Plan”) to prevent dilution resulting from stock splits, stock distributions or similar transactions. |

| (2) | Represents shares of Common Stock of the Registrant issuable

pursuant to the Plan. |

| (3) | Estimated solely for the purpose of calculating the registration

fee pursuant to Rule 457(c) and Rule 457(h) of the Securities Act, based upon the average of the high and low prices of the common stock

of the Registrant on the New York Stock Exchange on November 2, 2023. |

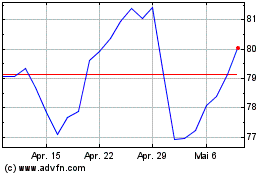

ONEOK (NYSE:OKE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

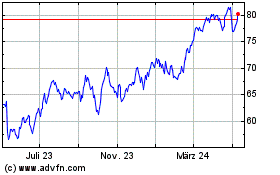

ONEOK (NYSE:OKE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024