As filed with the Securities and Exchange Commission

on August 9, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Orion S.A.

(Exact Name of Registrant as Specified in its Charter)

| Grand Duchy of Luxembourg |

|

Not Applicable |

|

(State or other jurisdiction of

Incorporation or organization) |

|

(I.R.S. employer

identification no.) |

1700 City Plaza Drive, Suite 300

Spring, Texas 77389

(Address of principal executive offices, including

zip code)

Orion Engineered Carbons S.A. 2023 Omnibus

Incentive Compensation Plan

Orion Engineered Carbons S.A. 2023 Non-Employee

Director Plan

(Full title of the plans)

Corning F. Painter

Chief Executive Officer

Orion S.A.

1700 City Plaza Drive, Suite 300

Spring, Texas 77389

(281) 318-2959

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent For Service)

With copies to:

David S. Huntington

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, NY 10019

(212) 373-3000

Indicate by check mark whether the registrant is a large accelerated

filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated

filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule

12b-2 of the Exchange Act. Check one:

| Large accelerated filer |

x |

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

Emerging growth company |

¨ |

If an emerging growth company, indicate by check mark whether the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

PART I

Information required by Part I of Form S-8 to be contained in the

Section 10(a) prospectuses is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act, and the Note

to Part I of Form S-8. The documents containing the information specified in Part I will be delivered to the participants in the plans

covered by this Registration Statement as required by Rule 428(b). Such documents are not being filed with the SEC as part of this Registration

Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

| Item 2. | Registrant Information and Employee Plan Annual Information |

The written statement required by Item 2 of Part I is included in

documents delivered to participants in the plans covered by this Registration Statement pursuant to Rule 428(b) of the Securities Act.

PART II

| Item 3. | Incorporation of Documents by Reference |

The following documents filed by Orion S.A., a société

anonyme (Public Limited Company) incorporated and existing under the laws of the Grand Duchy of Luxembourg, having its registered office

at 6, route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, registered with the Luxembourg Trade and Companies Register

under registration number B 160558 (the “Registrant”) are incorporated herein by reference:

(a) The Registrant’s Annual Report on Form

10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “Commission”) on February

24, 2023;

(b) The Registrant’s Quarterly Report on Form

10-Q for the quarter ended March 31, 2023, filed with the Commission on May 4, 2023;

(c) The Registrant’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2023, filed with the Commission on August 9, 2023;

(d) The Registrant’s Current Reports on Form 8-K, filed with

the Commission on February 16,

2023, March 9, 2023,

March 9, 2023, April

25, 2023, May 1, 2023,

May 5, 2023, June

7, 2023, June 7, 2023

and June 8, 2023;

(e) The description of the Registrant’s common shares, no

par value (the “Common Shares”) contained in the Registrant’s Registration Statement on Form

F-1, filed with the Commission on July 14, 2014, File No. 333-196593, together with any amendment or report filed with the SEC updating

such description.

All documents subsequently filed by the Registrant pursuant to Sections

13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), prior to the filing of a post-effective

amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold,

shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing of such documents; provided, however,

that documents or information deemed to have been furnished and not filed in accordance with the SEC rules shall not be deemed incorporated

by reference into this Registration Statement.

| Item 4. | Description of Securities |

Not applicable.

| Item 5. | Interests of Named Experts and Counsel |

Not applicable.

| Item 6. | Indemnification of Directors and Officers |

The Registrant is a Luxembourg joint stock corporation (société

anonyme or S.A.). The Registrant’s Articles of Association provide that its directors and officers will be indemnified to the

fullest extent permitted by Luxembourg law from and against any liabilities arising out of or in connection with their services. The right

to indemnification does not exist inter alios in the case of willful misconduct, gross negligence, reckless disregard of the duties

involved in the conduct of a manager’s office, fraud, or bad faith.

The Registrant maintains liability insurance for its directors and

officers. Such insurance is available to its directors and officers in accordance with its terms.

| Item 7. | Exemption from Registration Claimed |

Not applicable.

The exhibits filed herewith or incorporated by reference herein are

set forth in the Exhibit Index filed as part of this Registration Statement hereof.

The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being

made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the

Securities Act;

(ii) To reflect in the prospectus any facts or events arising after

the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set forth in this Registration Statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which

was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus

filed with the Commission pursuant to Rule 424(b) under the Securities Act if, in the aggregate, the changes in volume and price represent

no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee”

table in the Registration Statement; and

(iii) To include any material information with respect to the plan

of distribution not previously disclosed in this Registration Statement or any material changes to such information in this Registration

Statement; provided, however, paragraphs (1)(i) and (1)(ii) above do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(2) That, for the purpose of determining any liability under the

Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment

any of the securities being registered which remain unsold at the termination of the offering.

The undersigned Registrant hereby undertakes that, for purposes

of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or

15(d) of the Exchange Act that is incorporated by reference in this Registration Statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities

Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise,

the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy

as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant

certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this

Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Spring, State of Texas,

United States of America, on August 9, 2023.

| |

Orion S.A. |

|

| |

|

|

|

| |

By: |

/s/ Corning

F. Painter |

|

| |

Name: |

Corning F. Painter |

|

| |

Title: |

Chief Executive Officer |

|

POWER OF ATTORNEY

The undersigned officers and directors do hereby constitute and

appoint Corning F. Painter, Jeffrey Glajch and Christian Eggert, or any of them, with full power of substitution, our true and lawful

attorneys-in-fact and agents to do any and all acts and things in our name and behalf in our capacities as directors and officers, and

to execute any and all instruments for us and in our names in the capacities indicated below, that such person may deem necessary or advisable

to enable the Registrant to comply with the Securities Act and any rules, regulations and requirements of the Securities and Exchange

Commission in connection with this Registration Statement, including specifically, but not limited to, power and authority to sign for

us, or any of us, in the capacities indicated below, any and all amendments hereto (including pre-effective and post-effective amendments

or any other registration statement filed pursuant to the provisions of Rule 462(b) under the Securities Act); and we do hereby ratify

and confirm all that said attorney-in-fact and agent, or his or her substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration

Statement has been signed by the following persons in the capacities indicated on August 9, 2023.

| Signature |

|

Title |

| |

|

|

| /s/

Corning F. Painter |

|

|

| Corning F. Painter |

|

Chief Executive Officer |

| |

|

|

| /s/

Jeffrey Glajch |

|

|

| Jeffrey Glajch |

|

Chief Financial Officer |

| |

|

|

| /s/

Robert Hrivnak |

|

|

| Robert Hrivnak |

|

Chief Accounting Officer |

| |

|

|

| /s/

Dan F. Smith |

|

|

| Dan F. Smith |

|

Chairman |

| |

|

|

| /s/

Anthony L. Davis |

|

|

| Anthony L. Davis |

|

Director |

| |

|

|

| /s/

Kerry A. Galvin |

|

|

| Kerry A. Galvin |

|

Director |

| |

|

|

| /s/

Paul Huck |

|

|

| Paul Huck |

|

Director |

| |

|

|

| /s/

Mary Lindsey |

|

|

| Mary Lindsey |

|

Director |

| |

|

|

| /s/

Didier Miraton |

|

|

| Didier Miraton |

|

Director |

| |

|

|

| /s/

Yi Hyon Paik |

|

|

| Yi Hyon Paik |

|

Director |

| |

|

|

| /s/

Hans-Dietrich Winkhaus |

|

|

| Hans-Dietrich Winkhaus |

|

Director |

| |

|

|

| /s/

Michel Wurth |

|

|

| Michel Wurth |

|

Director |

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements

to Section 6(a) of the Securities Act of 1933, as amended, the undersigned has signed this Registration Statement solely in the capacity

of the duly authorized representative of the Registrant in the United States on August 9, 2023.

| |

Orion Engineered Carbons LLC |

|

| |

|

|

|

| |

By: |

/s/ Corning

F. Painter |

|

| |

Name: |

Corning F. Painter |

|

| |

Title: |

Authorized Signatory |

|

INDEX TO EXHIBITS

EXHIBIT 5.1

| |

To the Board of Directors

of Orion S.A.

6, Route de Trèves

2633 Senningerberg

Grand Duchy of Luxembourg

R.C.S. Luxembourg B160558 |

| |

|

| |

|

| |

Luxembourg, 9 August 2023 |

| |

|

| |

Your ref. : / |

| |

Our ref. : 57224/ 38856034 |

| |

carsten.opitz@arendt.com |

| |

Tel. : (352) 40 78 78-691 |

| |

Fax : (352) 40 78 04-749 |

ORION S.A.

- Registration Statement on Form S-8

Ladies and Gentlemen,

We are acting as Luxembourg counsel for Orion S.A.,

a société anonyme, having its registered office at 6, Route de Trèves, 2633 Senningerberg, Grand Duchy of

Luxembourg, registered with the Registre de Commerce et des Sociétés de Luxembourg under number B160558, (the “Company”)

in connection with the Registration Statement on Form S-8 including all amendments or supplements thereto (the “Registration

Statement”) filed with the U.S. Securities and Exchange Commission under the U.S. Securities Act of 1933, as amended, in relation

to common shares of the Company as may be issued pursuant to the 2023 Omnibus Incentive Compensation Plan (the “2023 Plan”)

and the 2023 Non-Employee Director Plan (the “2023 Director Plan” and together with the 2023 Plan, the “Plans”)

and have been asked by the Company to issue the current legal opinion in connection with the common shares of the Company which may be

issued pursuant to the Plans representing in total up to 5,000,000 common shares of the Company (the “Plan Shares”).

We have reviewed, and relied on, (i) the resolutions

adopted by the shareholders of the Company at an extraordinary general meeting held on 7 June 2023 (the “EGM”) approving

inter alia the renewal of an authorized share capital, (ii) the consolidated articles of association of the Company as at 7 June

2023 reflecting the changes approved by the EGM (the “Articles”), (iii) the resolutions of the Company’s Board

of Directors dated 5 April 2023 relating inter alia to the Plans (the “Board

Resolutions”), (iv) the Plans, (v) the Registration Statement and (vi) such corporate records that have been disclosed to us

and such certifications made to us, which we deemed necessary and appropriate as a basis for the opinions hereinafter expressed.

We have assumed for the purposes hereof (i) the genuineness

of all signatures, seals and stamps on all documents submitted to us, and the legal capacity of all individuals who have signed them;

(ii) the completeness and conformity to originals thereof of all documents submitted to us as certified, photostatic, faxed, scanned or

e-mailed copies, the authenticity of the originals of such documents and the conformity to the executed originals of all documents examined

by us in draft or execution form only; (iii) that the documents submitted to us for purposes of this opinion are in full force and effect

and have not been rescinded or amended in any way since the date thereof; (iv) that no proceedings have been instituted or injunction

granted against the Company to restrain it from performing any of its obligations under the Plans and/or issue the Plan Shares; (v) that

the resolutions of the EGM are in full force and effect and the conditions for the effectiveness of these resolutions have been fulfilled

in accordance with applicable law and especially we assume that the publication in the Recueil Electronique des Sociétés

et Associations of the notarial deed recording the EGM and its filing with the Luxembourg Trade and Companies Register will take place

within one month of the EGM; (vi) that the Company will at all times continue to have a sufficient authorised unissued share capital and

sufficient authorised unissued common shares with the relevant authorisation to waive any pre-emptive subscription rights in force; (vii)

that the Company will at all times have sufficient available reserves, to issue Plan Shares all or partially as the case may be by way

of incorporation of available reserves into the issued share capital; (viii) that the Board of Directors or its duly authorised delegates

will duly pass the relevant resolutions for the issue of the Plan Shares (including all or partially as the case may be by way of incorporation

of available reserves into the issued share capital) (the “Decisions”), in accordance with the Articles, the terms

of the Plans, the Board Resolutions, the EGM and applicable law; (ix) that upon issue of any Plan Shares, the Company will receive payment

in cash of an issue price at least equal to the accounting par value of EUR 1 per share or that the relevant Plan Shares will be issued

by way of incorporation of available reserves into the issued share capital and (x) that there will be no amendments to the authorised

share capital of the Company which would adversely affect the issue of the Plan Shares and the conclusions stated in this opinion.

We express no opinion as to any laws other than the

laws of the Grand Duchy of Luxembourg and this opinion is to be construed under Luxembourg law and is subject to the exclusive jurisdiction

of the courts of Luxembourg.

The opinions expressed herein are subject to all limitations

by reason of national or foreign bankruptcy, insolvency, moratorium, controlled management, suspension of payment, fraudulent conveyance,

general settlement of composition with creditors, general settlement with creditors, reorganisation or similar laws affecting the rights

of creditors generally.

Based on the foregoing, and having regard for such

legal considerations as we have deemed relevant, we are of the opinion that the Plan Shares, once duly subscribed to and fully paid and

issued in accordance with the Board Resolutions, the Decisions, the EGM, the Articles, the respective Plan and applicable law, will be

validly issued, fully paid and non-assessable.

In this opinion, Luxembourg legal concepts are

expressed in English terms and not in their original French terms. The concepts concerned may not be identical to the concepts

described by the same English terms as they exist in the laws of other jurisdictions. This opinion may, therefore, only be relied on

upon the express condition that any issues of interpretation or

liability arising thereunder will be governed by Luxembourg law and

be brought before a court in Luxembourg.

This opinion speaks as of the date hereof and no obligation

is assumed to update this opinion occurring after the date hereof.

This opinion is issued solely for the purpose of the

filing of the Registration Statement and the issuance of the Plan Shares by the Company pursuant to the Plans and it is not to be relied

upon in respect of any other matter.

We hereby consent to the filing of this opinion as

an exhibit to the Registration Statement. In giving such consent we do not thereby admit that we are in the category of persons whose

consent is required under Section 7 of the U.S. Securities Act of 1933, as amended.

This opinion is issued by and signed on behalf of Arendt

& Medernach SA, admitted to practice in the Grand-Duchy of Luxembourg and registered on the list V of the Luxembourg Bar.

Very truly yours,

| /s/ Alexander Olliges |

By and on behalf of Arendt & Medernach SA

pp. Carsten Opitz, Partner |

EXHIBIT 23.1

Consent of Independent Registered Public

Accounting Firm

We consent to the incorporation by reference in the Registration Statement

(Form S-8) pertaining to Orion Engineered Carbons S.A.’s 2023 Omnibus Incentive Compensation Plan and 2023 Non-Employee Director

Plan of our reports dated February 23, 2023, with respect to the consolidated financial statements of Orion S.A. (formerly, Orion Engineered

Carbons S.A.) and the effectiveness of internal control over financial reporting of Orion S.A. (formerly, Orion Engineered Carbons S.A.)

included in its Annual Report (Form 10-K) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

Houston, TX

August 9, 2023

EXHIBIT 23.2

Consent of Independent Registered Public

Accounting Firm

We consent to the incorporation by reference in the Registration

Statement (Form S-8) pertaining to Orion Engineered Carbons S.A.’s 2023 Omnibus Incentive Compensation Plan and 2023 Non-Employee

Director Plan of our report dated February 18, 2021, with respect to the consolidated financial statements of Orion S.A. (formerly, Orion

Engineered Carbons S.A.) included in its Annual Report (Form 10-K) for the year ended December 31, 2022, filed with the Securities and

Exchange Commission.

/s/ Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft

Cologne, Germany

August 9, 2023

EXHIBIT 107

Calculation of Filing

Fee Tables

Registration Statement

on Form S-8

Orion S.A.

Table 1: Newly Registered

Securities

| Security Type |

Security

Class

Title |

Fee

Calculation

Rule |

Amount

Registered (1) |

Proposed

Maximum

Offering Price

Per Unit (2) |

Maximum

Aggregate

Offering Price |

Fee

Rate |

Amount of

Registration

Fee |

| Equity |

Common Shares, no par value per share |

Other (2) |

2,000,000 |

$21.31 |

$42,620,000.00 |

$110.20 per $1,000,000 |

$4,696.73 |

| Equity |

Common Shares, no par value per share |

Other (2) |

500,000 |

$21.31 |

$10,655,000.00 |

$110.20 per $1,000,000 |

$1,174.18 |

| Total Offering Amounts |

$53,275,000.00 |

|

$5,870.91 |

| Total Fee Offsets |

|

|

— |

| Net Fee Due |

|

|

$5,870.91 |

| (1) | This Registration Statement covers (A) common shares, no par value (the “Common Shares”) of Orion S.A. (the “Registrant”)

reserved for issuance under the Orion Engineered Carbons S.A. 2023 Omnibus Incentive Compensation Plan and the Orion Engineered Carbons

S.A. 2023 Non-Employee Director Plan (collectively, the “Plans”) and (B) pursuant to Rule 416 of the Securities Act of 1933,

as amended, this Registration Statement shall also cover any additional Common Shares which become issuable under the Plans pursuant to

this Registration Statement by reason of any stock dividend, stock split, recapitalization or any other similar transaction which results

in an increase in the number of the Registrant’s outstanding Common Shares. |

| (2) | Estimated in accordance with Rule 457(c) solely for purposes of calculating the registration fee. The maximum price per share of the

Common Shares and the maximum aggregate offering price are based on the average of the $21.44 (high) and $21.18 (low) sale price of the

Common Shares as reported on The New York Stock Exchange on August 2, 2023, which date is within five business days prior to filing this

registration statement. |

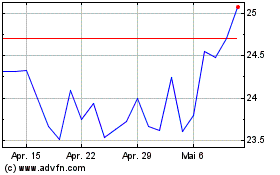

Orion (NYSE:OEC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Orion (NYSE:OEC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024