Current Report Filing (8-k)

03 November 2022 - 11:46AM

Edgar (US Regulatory)

0000873860

false

0000873860

2022-11-03

2022-11-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 3, 2022

OCWEN

FINANCIAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Florida |

|

1-13219 |

|

65-0039856 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

1661

Worthington Road, Suite 100

West

Palm Beach, Florida 33409

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (561) 682-8000

Not

applicable.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.01 Par

Value |

|

OCN |

|

New York Stock Exchange

(NYSE) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

November 3, 2022, Ocwen Financial Corporation (together with its consolidated subsidiaries including PHH Mortgage Corporation, “Ocwen”

or the “Company”) issued a press release announcing results for the third quarter ended September 30, 2022 and providing

a business update, including the information described under Item 8.01, Other Events, below. A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Item 2.02 and the information in the related exhibit attached hereto shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On

November 2, 2022, Ocwen and OCW MAV Holdings, LLC (“OMH”), a special purpose entity managed by Oaktree Capital Management

L.P., entered into an agreement modifying certain terms relating to the capitalization, management and operations of their mortgage servicing

rights joint venture, MAV Canopy HoldCo I, LLC (“Canopy”), a Delaware limited liability

company, and its wholly-owned operating subsidiary, MSR Asset Vehicle LLC, a California limited liability company. OMH and Ocwen own

85% and 15%, respectively, of the limited liability company interests in Canopy.

Under

the terms of the agreement, Ocwen and OMH agreed to increase the aggregate capital contributions to Canopy by up to an additional $250

million during an investment period ending May 2, 2024, subject to two annual extensions upon mutual agreement. Ocwen may elect to contribute

up to its pro rata share of the additional capital commitment. To the extent Ocwen does not contribute its pro rata share

of the additional capital commitment, the ownership percentages held by Ocwen and OMH will be adjusted based on the parties’ current

percentage interests, capital contributions, and book value. In connection with the increased investment, Ocwen and OMH agreed to reduce

Ocwen’s incentive fee, which the parties refer to as the “promote distribution.”

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned, hereunto duly authorized.

| |

OCWEN FINANCIAL CORPORATION |

| |

(Registrant) |

| |

|

|

| Date: November 3, 2022 |

By: |

/s/

Sean B. O’Neil |

| |

|

Sean B. O’Neil |

| |

|

Chief Financial Officer |

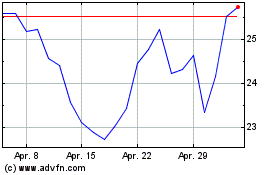

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

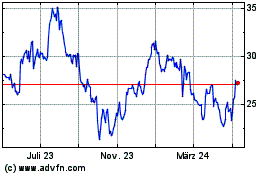

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024