Revenue Up by 25% and Net Margin Improvement

by 10ppt YoY for Full Year 2021

OneConnect Financial Technology Co., Ltd. (“OneConnect” or the

“Company”) (NYSE: OCFT), a leading technology-as-a-service provider

for financial institutions in China, today announced its unaudited

financial results for the fourth quarter and full year ended

December 31, 2021.

Fourth Quarter 2021 Financial Highlights

- Revenue increased 19% year-over-year to RMB1,280 million from

RMB1,076 million.

- Gross margin expanded year-over-year to 35% from 34%; non-IFRS

gross margin1 was 41%, as compared to 43% same period of the prior

year.

- Operating loss narrowed year-over-year to RMB380 million from

RMB414 million.

- Net loss attributable to shareholders narrowed year-over-year

to RMB358 million from RMB365 million.

- Net loss per ADS, basic and diluted, narrowed year-over-year to

RMB0.97 from RMB0.99.

Full Year 2021 Financial Highlights

- Revenue increased 25% year-over-year to RMB4,132 million from

RMB3,312 million.

- Gross margin was 35%, as compared to 38% in the prior year;

non-IFRS gross margin1 was 42%, as compared to 47% in the prior

year.

- Operating loss narrowed year-over-year to RMB1,405 million from

RMB1,470 million.

- Net loss attributable to shareholders narrowed year-over-year

to RMB1,282 million from RMB1,354 million.

- Net loss per ADS, basic and diluted, narrowed year-over-year to

RMB3.47 from RMB3.81.

In RMB’000, except percentages and per ADS

amounts

Three Months Ended December

31

Full Year Ended December

31

2021

2020

YoY

2021

2020

YoY

Revenue

Revenue from Ping An Group

715,416

615,966

16.1%

2,316,714

1,726,807

34.2%

Revenue from Lufax

150,871

76,595

97.0%

428,071

343,252

24.7%

Revenue from third-party

customers2

413,978

383,165

8.0%

1,387,572

1,242,231

11.7%

Total

1,280,265

1,075,726

19.0%

4,132,357

3,312,290

24.8%

Gross profit

450,135

368,370

22.2%

1,436,651

1,243,456

15.5%

Gross margin

35.2%

34.2%

34.8%

37.5%

Non-IFRS gross margin1

40.8%

42.8%

42.1%

46.7%

Operating loss

-380,173

-413,837

-1,404,740

-1,470,326

Operating margin

-29.7%

-38.5%

-34.0%

-44.4%

Net loss to shareholders

-358,359

-364,922

-1,281,699

-1,353,608

Net loss ratio

-28.0%

-33.9%

-31.0%

-40.9%

Net loss per ADS3, basic and diluted

-0.97

-0.99

-3.47

-3.81

1 For more details on this non-IFRS

financial measure, please see the section entitled “Use of

Unaudited Non-IFRS Financial Measures” and the table captioned

“Reconciliations of IFRS and Non-IFRS Results (Unaudited)” set

forth at the end of this press release.

2 Third-party customers refer to each

customer with revenue contribution of less than 5% of our total

revenue in the relevant period. These customers are a key focus of

the Company’s diversification strategy.

3 Each ADS represents three ordinary

shares

Chairman,CEO and CFO Comments

“I am delighted to announce that, in spite of the difficult year

just gone, our revenue increased 25% year-over-year, and the strong

momentum of the growth of our premium4 and premium plus5 customers

base demonstrated customer acknowledgement and market recognition

of our products.” said Mr. Ye Wangchun, Chairman of the Board. “In

2021, we entered into our 2nd Stage strategy, focusing on

strengthening products integration, deepening customer engagements,

and empowering other participants within our ecosystem. We firmly

believe it will fuel the long term growth of our company.”

Mr. Shen Chongfeng, Chief Executive Officer, commented

“Efficient implementation of second stage strategy is critical to

our success as we face a world with changing dynamics. OneConnect

has established a strong foothold in the market, where the

potential from digital transformation is immense. We will continue

to reinforce our products integration and customer upgrade in 2022,

to further solidify our position and fulfill our mission of

supporting financial institutions to grow efficiently.”

Mr. Luo Yongtao, Chief Financial Officer, commented, “Our

customer upgrades continued to bear fruit, evidenced by both the

number of our premium and premium plus customers and their revenue

expansion,” commented CFO Luo Yongtao. “Our number of premium

customers grew from 594 to 796, almost doubled the growth of that

of the prior year, and the number of premium plus customers, where

is our key focus, grew from 168 to 212. Benefitting from our 2nd

stage strategy on deepening customer engagements, the Net Expansion

Rate for premium customers also improved to 96% from 84%. Our

revenue increased 25% year-over-year. Our net loss ratio of 2021

further narrowed, from 41% to 31% year over year. This achievement

reflects solid revenue increase performance as well as disciplined

cost management, marking another milestone in the path to

profitability. We are ready to go further this year.”

Revenue Breakdown

In RMB’000, except percentages

Three Months Ended December

31

Full Year Ended December

31

2021

2020

YoY

2021

2020

YoY

Implementation revenue

216,622

279,421

-22.5%

733,648

851,856

-13.9%

Transaction-based and support

revenue

Business origination services

99,685

148,326

-32.8%

450,597

605,733

-25.6%

Risk management services

216,509

112,854

91.8%

534,071

362,530

47.3%

Operation support services

330,807

294,898

12.2%

1,097,719

1,061,445

3.4%

Cloud services platform

304,683

190,519

59.9%

1,050,179

314,338

234.1%

Post-implementation support services

15,818

20,606

-23.2%

49,447

55,678

-11.2%

Others

96,141

29,102

230.3%

216,696

60,710

256.9%

Total

1,063,643

796,305

33.6%

3,398,709

2,460,434

38.1%

Total

1,280,265

1,075,726

19.0%

4,132,357

3,312,290

24.8%

Revenue in 2021 rose 25% to RMB4,132 million from RMB3,312

million in 2020. Risk management and cloud services platform were

the key drivers. Revenue from cloud services platform surged by

234% year-over-year. Risk management increased 47% year-over-year

due to the increase in demand for an end-to-end risk management

solutions. Others, which included revenue from insurer ecosystem

participants, increased 257%, benefitting from our ecosystem

expansion as part of our 2nd stage strategy.

4 Premium customers refer to our customers

that have contributed revenue of at least RMB100,000 since the

beginning of the applicable fiscal year, excluding Ping An Group

and its subsidiaries, although this category includes certain

customers that we have direct contracts with, and provide direct

services to, where payments for these services have been made

through contractual arrangements that we have with others,

including Ping An Group

5 Premium plus customers refer to our

premium customers that have contributed revenue of at least RMB1

million since the beginning of the applicable fiscal year.

Full Year 2021 Financial

Results

Revenue Revenue increased by 25% to

RMB4,132 million from RMB3,312 million in the prior year, primarily

driven by more demand for solutions in risk management and cloud

services platform. Revenue generated from business origination and

implementation declined since we phased out certain products.

Cost of Revenue Cost of revenue was

RMB2,696 million, compared with RMB2,069 million in the prior year,

primarily driven by higher technology service fees and employee

benefit expenses caused by expansion of operation and changes in

product solution mix.

Gross Profit Gross profit increased

by 16% to RMB1,437 million from RMB1,243 million in the prior year.

Gross margin was 34.8%, compared with 37.5% in the prior year,

primarily due to changes in product solution mix. Non-IFRS gross

margin was 42.1%, compared with 46.7% in the prior year. For a

reconciliation of the Company’s IFRS and non-IFRS gross margin,

please refer to “Reconciliation of IFRS and Non-IFRS Results

(Unaudited).”

Operating Loss and Expenses Total

operating expenses for the full year of 2021 amounted to RMB2,855

million, compared with RMB2,772 million in the prior year. As a

percentage of revenue, total operating expenses decreased to 69%

from 84%.

- Research and Development expenses for the full year of 2021

rose to RMB1,353 million from RMB1,173 million, reflecting

investment put into enhancing existing solutions and innovations.

As a percentage of revenue, R&D expenses amounted to 33%,

compared with 35% in the prior year.

- Sales and Marketing expenses for the full year of 2021 totaled

RMB588 million, compared with RMB629 million in the prior year,

mainly due to a decrease in marketing and telecommunication

expenses. As a percentage of revenue, sales and marketing expenses

decreased to 14% from 19%.

- General and Administrative expenses for the full year of 2021

amounted to RMB842 million, compared with RMB835 million in the

prior year. As a percentage of revenue, general and administrative

expenses decreased to 20% from 25%.

- Net impairment losses on financial and contract assets for the

full year of 2021 totaled RMB72 million, compared with RMB135

million for the same period in the prior year, reflecting better

management efforts in trade receivables and contract assets. As a

percentage of revenue, net impairment losses were 2%, versus 4% in

the prior year.

Loss from operations for the full year of 2021 amounted to

RMB1,405 million, compared with RMB1,470 million in the prior year.

Operating loss margin decreased to 34% from 44% in the prior

year.

Net Loss Net loss attributable to

OneConnect’s shareholders totaled RMB1,282 million in 2021, versus

RMB1,354 million in the prior year. Net loss attributable to

OneConnect’s shareholders per basic and diluted ADS amounted to

RMB3.47, versus RMB3.81 in the prior year. Weighted average number

of ADSs for the full year was 369,430,420.

Cash Flow For the full year of

2021, net cash used in operating activities was RMB404 million. Net

cash generated from in investing activities was RMB388 million, as

scale of onshore borrowing using offshore pledges reduced and as a

result restricted cash balance decreased. Net cash generated from

financing activities was RMB1,612 million.

Conference Call Information

Date/Time

Thursday, February 24, 2021 at 8:00 p.m.,

U.S. Eastern Time Friday, February 25, 2021 at 9:00 a.m., Beijing

Time

Online registration

https://www.incommglobalevents.com/registration/q4inc/10120/oneconnect-financial-technology-co-ltd-fy2021-earnings-release/

An archived recording and the transcript of the conference call

will be available at OneConnect’s investor relations website at

ir.ocft.com.

About OneConnect OneConnect Financial Technology Co. Ltd.

is a technology-as-a-service provider for financial institutions.

The Company integrates extensive financial services industry

expertise with market-leading technology to provide technology

applications and technology-enabled business services to financial

institutions. The integrated solutions and platform the Company

provides include digital retail banking solution, digital

commercial banking solution, digital insurance solution and Gamma

Platform, which is a technology infrastructural platform for

financial institutions. The Company’s solutions enable its

customers’ digital transformations, which help them improve

efficiency, enhance service quality, and reduce costs and

risks.

The Company has established long-term cooperation relationships

with financial institutions to address their needs of digital

transformation. The Company has also expanded its services to other

participants in the value chain to support the digital

transformation of financial services eco-system. In addition, the

Company has successfully exported its technology solutions to

overseas financial institutions.

For more information, please visit ir.ocft.com.

Safe Harbor Statement This announcement contains

forward-looking statements. These statements constitute

“forward-looking” statements within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended, and as defined in

the U.S. Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “confident” and similar statements. Such

statements are based upon management’s current expectations and

current market and operating conditions and relate to events that

involve known or unknown risks, uncertainties and other factors,

all of which are difficult to predict and many of which are beyond

the Company’s control. Forward-looking statements involve inherent

risks and uncertainties. A number of factors could cause actual

results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: the Company’s limited operating history in the

technology-as-a-service for financial institutions industry; its

ability to achieve or sustain profitability; the tightening of

laws, regulations or standards in the financial services industry;

the Company’s ability to comply with the evolving regulatory

requirements in the PRC and other jurisdictions where it operates;

its ability to maintain and enlarge the customer base or strengthen

customer engagement; its ability to maintain its relationship with

Ping An Group, which is its strategic partner, most important

customer and largest supplier; its ability to compete effectively

to serve China’s financial institutions; the effectiveness of its

technologies, its ability to maintain and improve technology

infrastructure and security measures; its ability to protect its

intellectual property and proprietary rights; risks of defaults by

borrowers under the loans for which the Company provided credit

enhancement under its legacy credit management business; its

ability to maintain or expand relationship with its business

partners and the failure of its partners to perform in accordance

with expectations; its ability to protect or promote its brand and

reputation; its ability to timely implement and deploy its

solutions; its ability to obtain additional capital when desired;

disruptions in the financial markets and business and economic

conditions; the Company’s ability to pursue and achieve optimal

results from acquisition or expansion opportunities; the duration

of the COVID-19 outbreak and its potential impact on the Company’s

business and financial performance; and assumptions underlying or

related to any of the foregoing. Further information regarding

these and other risks is included in the Company’s filings with the

SEC. All information provided in this press release and in the

attachments is as of the date of this press release, and the

Company undertakes no obligation to update any forward-looking

statement, except as required under applicable law.

Use of Unaudited Non-IFRS Financial Measures The

unaudited consolidated financial information is prepared in

accordance with International Financial Reporting Standards (IFRS).

Non-IFRS measures are used in gross profit and gross margin,

adjusted to exclude non-cash items, which consist of amortization

of intangible assets recognized in cost of revenue, depreciation of

property and equipment recognized in cost of revenue, and

share-based compensation expenses recognized in cost of revenue.

OneConnect’s management regularly review non-IFRS gross profit and

non-IFRS gross margin to assess the performance of our business. By

excluding non-cash items, these financial metrics allow

OneConnect’s management to evaluate the cash conversion of one

dollar revenue on gross profit. OneConnect uses these non-IFRS

financial to evaluate our ongoing operations and for internal

planning and forecasting purposes. OneConnect believes that

non-IFRS financial information, when taken collectively, is helpful

to investors because it provides consistency and comparability with

past financial performance, facilitates period-to-period

comparisons of results of operations, and assists in comparisons

with other companies, many of which use similar financial

information. OneConnect also believes that presentation of the

non-IFRS financial measures provides useful information to its

investors regarding its results of operations because it allows

investors greater transparency to the information used by

OneConnect’s management in its financial and operational decision

making so that investors can see through the eyes of the

OneConnect’s management regarding important financial metrics that

the management uses to run the business as well as allowing

investors to better understand OneConnect’s performance. However,

non-IFRS financial information is presented for supplemental

informational purposes only, and should not be considered a

substitute for financial information presented in accordance with

IFRS, and may be different from similarly-titled non-IFRS measures

used by other companies. In light of the foregoing limitations, you

should not consider non-IFRS financial measure in isolation from or

as an alternative to the financial measure prepared in accordance

with IFRS. Whenever OneConnect uses a non-IFRS financial measure, a

reconciliation is provided to the most closely applicable financial

measure stated in accordance with IFRS. You are encouraged to

review the related IFRS financial measures and the reconciliation

of these non-IFRS financial measures to their most directly

comparable IFRS financial measures. For more information on

non-IFRS financial measures, please see the table captioned

“Reconciliations of IFRS and non-IFRS results (Unaudited)” set

forth at the end of this press release.

ONECONNECT CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

Three Months Ended December

31

Full Year Ended December

31

2021

2020

2021

2020

RMB'000

RMB'000

RMB'000

RMB'000

Revenue

1,280,265

1,075,726

4,132,357

3,312,290

Cost of revenue

-830,130

-707,356

-2,695,706

-2,068,834

Gross profit

450,135

368,370

1,436,651

1,243,456

Research and development

expenses

-389,720

-349,223

-1,353,018

-1,173,290

Selling and marketing

expenses

-164,999

-154,407

-588,380

-629,488

General and administrative

expenses

-280,281

-247,650

-841,685

-834,917

Net impairment losses on

financial and contract assets

-8,955

-63,121

-72,229

-134,519

Other income, gains or

loss-net

13,647

32,194

13,921

58,432

Operating loss

-380,173

-413,837

-1,404,740

-1,470,326

Finance income

2,899

17,270

28,823

77,237

Finance costs

-14,634

-32,612

-76,637

-150,363

Finance costs – net

-11,735

-15,342

-47,814

-73,126

Share of losses of associate and

joint venture

-886

-1,322

9,946

-7,802

Loss before income tax

-392,794

-430,501

-1,442,608

-1,551,254

Income tax benefit

29,625

43,616

112,095

137,131

Loss for the period

-363,169

-386,885

-1,330,513

-1,414,123

Loss attributable to:

- Owners of the Company

-358,359

-364,922

-1,281,699

-1,353,608

- Non-controlling interests

-4,810

-21,963

-48,814

-60,515

Other comprehensive income, net

of tax

Items that may be subsequently

reclassified to profit or loss

- Foreign currency translation

differences

-104,778

-395,532

-152,542

-608,427

- Changes in the fair value of

debt instruments at fair value through other comprehensive

income

-17

-3

-16

-39

Items that will not be

subsequently reclassified to profit or loss

- Changes in the fair value of

equity investments at fair value through other comprehensive

income

-1,796

-1,796

Total comprehensive loss for

the period

-469,760

-782,420

-1,484,867

-2,022,589

Total comprehensive loss

attributable to:

- Owners of the Company

-464,950

-760,457

-1,436,053

-1,962,074

- Non-controlling interests

-4,810

-21,963

-48,814

-60,515

Loss per ADS attributable to

owners of the Company

(expressed in RMB per

share)

- Basic and diluted

-0.97

-0.99

-3.47

-3.81

ONECONNECT CONSOLIDATED

BALANCE SHEETS (Unaudited)

December 31

December 31

2021

2020

RMB'000

RMB'000

ASSETS

Non-current assets

Property and equipment

244,412

224,284

Intangible assets

687,194

917,063

Deferred tax assets

683,218

564,562

Financial assets measured at

amortized cost from banking operations

674

25,283

Investments accounted for using

the equity method

185,346

175,733

Financial assets at fair value

through other comprehensive income

640,501

21,828

Contract assets

868

16,788

Total non-current

assets

2,442,213

1,945,541

Current assets

Financial assets at amortized

cost

3,515

Trade receivables

891,174

838,690

Contract assets

227,895

257,830

Prepayments and other

receivables

749,152

443,328

Financial assets measured at

amortized cost from banking operations

12,711

576,305

Financial assets at fair value

through profit or loss

2,071,653

1,487,871

Financial assets at fair value

through other comprehensive income

482,497

Restricted cash

1,060,427

2,280,499

Cash and cash equivalents

1,399,370

3,055,194

Total current assets

6,898,394

8,939,717

Total assets

9,340,607

10,885,258

EQUITY AND LIABILITIES

Equity

Share capital

78

78

Shares held for share option

scheme

-80,102

-87,714

Other reserves

10,512,631

10,639,931

Accumulated losses

-6,638,625

-5,356,926

Equity attributable to equity

owners of the Company

3,793,982

5,195,369

Non-controlling interests

41,100

89,914

Total equity

3,835,082

5,285,283

LIABILITIES

Non-current

liabilities

Trade and other payables

313,834

395,514

Contract liabilities

19,418

17,683

Deferred tax liabilities

9,861

20,080

Total non-current

liabilities

343,113

433,277

Current liabilities

Trade and other payables

2,137,099

1,547,781

Payroll and welfare payables

515,067

625,330

Contract liabilities

153,844

138,547

Short-term borrowings

815,260

2,283,307

Customer deposits

1,350,171

405,853

Derivative financial

liabilities

190,971

165,880

Total current

liabilities

5,162,412

5,166,698

Total liabilities

5,505,525

5,599,975

Total equity and

liabilities

9,340,607

10,885,258

ONECONNECT CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

Three Months Ended December

31

Full Year Ended December

31

2021

2020

2021

2020

RMB'000

RMB'000

RMB'000

RMB'000

Net cash generated from /

(used in) operating activities

491,478

727,558

-404,334

-704,145

Net cash generated from /

(used in) investing activities

-581,152

601,176

388,435

1,315,725

Net cash generated from /

(used in) financing activities

-388,349

-225,140

-1,611,781

1,533,838

Net increase /(decrease) in

cash and cash equivalents

-478,023

1,103,594

-1,627,680

2,145,418

Cash and cash equivalents at the

beginning of the period

1,893,693

2,080,392

3,055,194

1,077,875

Effects of exchange rate changes

on cash and cash equivalents

-16,300

-128,792

-28,144

-168,099

Cash and cash equivalents at

the end of period

1,399,370

3,055,194

1,399,370

3,055,194

ONECONNECT RECONCILIATION OF

IFRS AND NON-IFRS RESULTS (Unaudited)

Three Months Ended December

31

Full Year Ended December

31

2021

2020

2021

2020

RMB'000

RMB'000

RMB'000

RMB'000

Gross profit

450,135

368,370

1,436,651

1,243,456

Gross margin

35.2%

34.2%

34.8%

37.5%

Non-IFRS adjustment

Amortization of intangible assets

recognized in cost of revenue

71,270

89,943

297,406

293,141

Depreciation of property and

equipment recognized in cost of revenue

884

305

3,633

2,978

Share-based compensation expenses

recognized in cost of revenue

598

1,569

935

6,904

Non-IFRS Gross profit

522,886

460,187

1,738,625

1,546,479

Non-IFRS Gross margin

40.8%

42.8%

42.1%

46.7%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220224005790/en/

Investor Relations: OCFT IR Team OCFT_IR@ocft.com

Media Relations: Amy Ding Dingjingmin787@ocft.com

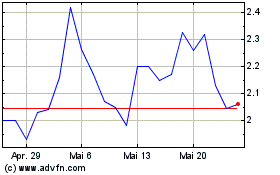

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025