false000091007300009100732024-10-312024-10-310000910073us-gaap:CommonStockMember2024-10-312024-10-310000910073nycb:BifurcatedOptionNotesUnitSecuritiesMember2024-10-312024-10-310000910073nycb:FixedToFloatingRateSeriesANoncumulativePerpetualPreferredStockMember2024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2024

FLAGSTAR FINANCIAL, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-31565 | | 06-1377322 |

(State or Other Jurisdiction

of Incorporation) | | Commission File Number | | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 102 Duffy Avenue, | Hicksville, | New York | 11801 |

| (Address of principal executive offices) |

(516) 683-4100

(Registrant's telephone number, including area code)

New York Community Bancorp, Inc.

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | | FLG | | New York Stock Exchange |

Bifurcated Option Note Unit SecuritiESSM | | FLG PRU | | New York Stock Exchange |

| Depositary Shares each representing a 1/40th interest in a share of Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock | | FLG PRA | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

CURRENT REPORT ON FORM 8-K

| | | | | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On October 31, 2024, Flagstar Bank, National Association (“Flagstar”), the wholly owned subsidiary of Flagstar Financial, Inc. (f/k/a New York Community Bancorp, Inc.) (the “Company”), completed its previously announced sale of certain assets, including mortgage servicing rights, subservicing contracts, and third-party origination assets (the “Transaction”), to Nationstar Mortgage LLC, a Delaware limited liability company and operating subsidiary of Mr. Cooper Group Inc. (“Nationstar”), for an aggregate purchase price of approximately $1.3 billion in cash. The Transaction was effected pursuant to the terms of (1) the Agreement for the Bulk Purchase and Sale of Mortgage Servicing Rights, dated as of July 24, 2024, by and between Flagstar and Nationstar (the “MSR Purchase Agreement”) and (2) the related Asset Purchase Agreement, dated as of July 24, 2024, by and between Flagstar and Nationstar (the “Asset Purchase Agreement”).

The foregoing description of the MSR Purchase Agreement and the Asset Purchase Agreement does not purport to be complete, and is subject to, and qualified in its entirety by, the terms of the MSR Purchase Agreement and the Asset Purchase Agreement, which were filed as Exhibit 2.1 and Exhibit 2.2, respectively, to the Company’s Current Report on Form 8-K filed on July 29, 2024 and are incorporated herein by reference.

On November 1, 2024, the Company issued a press release announcing the completion of the Transaction. The full text of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(b) Pro forma financial information

The following unaudited pro forma consolidated financial statements of the Company and its subsidiaries reflecting the disposition of the assets in the Transaction are filed as Exhibit 99.2 to this Current Report on Form 8-K and are incorporated herein by reference:

•Unaudited Pro Forma Consolidated Statement of Condition as of June 30, 2024;

•Unaudited Pro Forma Consolidated Statements of (Loss) Income for the six months ended June 30, 2024 and year ended December 31, 2023; and

•Notes to the Unaudited Pro Forma Consolidated Financial Statements.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Exhibit |

| 2.1 | | |

| 2.2 | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K may include forward‐looking statements by the Company and our authorized officers pertaining to such matters as our goals, beliefs, intentions, and expectations regarding (a) revenues, earnings, loan production, asset quality, liquidity position, capital levels, risk analysis, divestitures, acquisitions, and other material transactions, among other matters; (b) the future costs and benefits of the actions we may take; (c) our assessments of credit risk and probable losses on loans and associated allowances and reserves; (d) our assessments of interest rate and other market risks; (e) our ability to execute on our strategic plan, including the sufficiency of our internal resources, procedures and systems; (f) our ability to attract, incentivize, and retain key personnel and the roles of key personnel; (g) our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction, and our ability to fully and timely implement the risk management programs institutions greater than $100 billion in assets must maintain; (h) the effect on our capital ratios of the approval of certain proposals approved by our shareholders during our 2024 annual meeting of shareholders; (i) the conversion or exchange of shares of the Company’s preferred stock; (j) the payment of dividends on shares of the Company’s capital stock, including adjustments to the amount of dividends payable on shares of the Company’s preferred stock; (k) the availability of equity and dilution of existing equity holders associated with amendments to the 2020 Omnibus Incentive Plan; (l) the effects of the reverse stock split; and (m) transactions relating to the sale of our mortgage business and mortgage warehouse business.

Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” "confident," and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward‐looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward‐looking statements. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results.

Our forward‐looking statements are subject to, among others, the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities, credit and financial markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios, including associated allowances and reserves; changes in future allowance for credit losses, including changes required under relevant accounting and regulatory requirements; the ability to pay future dividends; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; recent turnover in our Board of Directors and our executive management team; changes in our strategic plan, including changes in our internal resources, procedures and systems, and our ability to successfully implement such plan; changes in competitive pressures among financial institutions or from non‐financial institutions; changes in legislation, regulations, and policies; the imposition of restrictions on our operations by bank regulators; the outcome of pending or threatened litigation, or of investigations or any other matters before regulatory agencies, whether currently existing or commencing in the future; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; our ability to recognize anticipated expense reductions and enhanced efficiencies with respect to our recently announced strategic workforce reduction; the impact of failures or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction: the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations).

More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10‐K/A for the year ended December 31, 2023, Quarterly Report on Forms 10-Q for the quarters ended March 31, 2024 and June 30, 2024 and in other SEC reports we file. Our forward‐looking statements may also be subject to other risks and uncertainties, including those we may discuss in this news release, on our conference call, during investor presentations, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Date: | November 6, 2024 | | FLAGSTAR FINANCIAL, INC. |

| | |

| | | /s/ Salvatore DiMartino |

| | | Salvatore DiMartino |

| | | Executive Vice President and Director of Investor Relations |

‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐

Unaudited Proforma Consolidated Financial Statements

On July 24, 2024, Flagstar Bank, National Association (“Flagstar”), the wholly owned subsidiary of Flagstar Financial, Inc. (the “Company”), entered into (1) an Agreement for the Bulk Purchase and Sale of Mortgage Servicing Rights (the “MSR Purchase Agreement”) with Nationstar Mortgage LLC, a Delaware limited liability company and operating subsidiary of Mr. Cooper Group Inc. (“Nationstar”), and (2) a related Asset Purchase Agreement (the “Asset Purchase Agreement”) with Nationstar. Pursuant to the terms of the MSR Purchase Agreement and the Asset Purchase Agreement, Flagstar agreed to sell certain assets, including mortgage servicing rights, subservicing contracts, and third-party origination assets, to Nationstar (the “Transaction”). The Transaction was completed on October 31, 2024.

The accompanying pro forma consolidated financial statements are presented to show the effects of the Transaction on the Company’s consolidated financial statements and reflect transaction accounting adjustments as further described below. The unaudited pro forma consolidated financial statements and the notes thereto should be read together with: the Company’s consolidated financial statements and the notes thereto as of and for the year ended December 31, 2023; the Management’s Discussion and Analysis included in the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2023; and the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

Unaudited Pro Forma Consolidated Statement of Condition

| | | | | | | | | | | | | | | | | | | | |

| As of June 30, 2024 (a) | | Proforma Adjustments | | | Pro Forma |

| (in millions, except per share data) | (unaudited) | | | | | |

| ASSETS: | | | | | | |

| Cash and cash equivalents | $ | 18,990 | | | $ | 1,273 | | (c) | | $ | 20,263 | |

| Securities: | | | | | | — |

| Debt Securities available-for-sale ($9,402 pledged at June 30, 2024) | 10,535 | | — | | | 10,535 |

| Equity investments with readily determinable fair values, at fair value | 14 | | — | | | 14 |

| Total securities net of allowance for credit losses | 10,549 | | — | | | 10,549 |

| Loans held for sale ($1,451 measured at fair value, respectively) | 7,845 | | — | | | 7,845 |

| Loans and leases held for investment, net of deferred loan fees and costs ($68 measured at fair value at June 30, 2024) | 74,552 | | (374) | (d) | | 74,178 |

| Less: Allowance for credit losses on loans and leases | (1,268) | | — | | | (1,268) |

| Total loans and leases held for investment, net | 73,284 | | (374) | | | 72,910 |

| Federal Home Loan Bank stock and Federal Reserve Bank stock, at cost | 1,565 | | — | | | 1,565 |

| Premises and equipment, net | 691 | | — | | | 691 |

| Core deposit and other intangibles | 557 | | — | | | 557 |

| Mortgage servicing rights | 1,122 | | (1,089) | (d) | | 33 |

| Bank-owned life insurance | 1,586 | | — | | | 1,586 |

| Other assets | 2,866 | | (13) | (d) | | 2,853 |

| Total assets | $ | 119,055 | | | $ | (203) | | | | $ | 118,852 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY: | | | | | | — |

| Deposits: | | | | | | — |

| Interest-bearing checking and money market accounts | $ | 21,740 | | | $ | — | | | | $ | 21,740 | |

| Savings accounts | 10,638 | | — | | | 10,638 |

| Certificates of deposit | 28,780 | | — | | | 28,780 |

| Non-interest-bearing accounts | 17,874 | | — | | | 17,874 |

| Total deposits | 79,032 | | — | | | 79,032 |

| Borrowed funds: | | | | | | — |

| Federal Home Loan Bank and Federal Reserve Bank advances | 27,750 | | — | | | 27,750 |

| Repurchase agreements | 121 | | — | | | 121 |

| Total wholesale borrowings | 27,871 | | — | | | 27,871 |

| Junior subordinated debentures | 580 | | — | | | 580 |

| Subordinated notes | 441 | | — | | | 441 |

| Total borrowed funds | 28,892 | | — | | | 28,892 |

| Other liabilities | 2,476 | | (333) | (d) | | 2,143 |

| Total liabilities | 110,400 | | (333) | | | 110,067 |

| Mezzanine equity: | | | | | | — |

| Preferred stock - Series B | 258 | | — | | | 258 |

| Stockholders' equity: | | | | | | |

Preferred stock - Series A | 503 | | — | | | 503 |

Common stock at par 0.01 (666,666,666 shares authorized; 358,864,464

shares issued; and 351,304,364 shares outstanding) | 4 | | — | | | 4 |

| Paid-in capital in excess of par | 8,997 | | — | | | 8,997 |

| (Accumulated deficit)/Retained earnings | (270) | | 130 | (e) | | (140) |

| Treasury stock, at cost (7,560,100 shares) | (223) | | — | | | (223) |

| Accumulated other comprehensive loss, net of tax: | | | | | | |

| Net unrealized loss on securities available for sale, net of tax of $256 | (674) | | — | | | (674) |

| Net unrealized loss on pension and post-retirement obligations, net of tax of $11 | (28) | | — | | | (28) |

| Net unrealized gain on cash flow hedges, net of tax of $(32) | 88 | | — | | | 88 |

| Total accumulated other comprehensive loss, net of tax | (614) | | — | | | (614) |

| Total stockholders’ equity | 8,397 | | 130 | | | 8,527 |

| Total liabilities, Mezzanine and Stockholders’ Equity | $ | 119,055 | | | $ | (203) | | | | $ | 118,852 | |

Unaudited Pro Forma Consolidated Statements of (Loss) Income

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | | Six Months Ended June 30, 2024 (a) | | Proforma Adjustments (f) | | | Pro forma |

| INTEREST INCOME: | | | | | | | |

| Loans and leases | | $ | 2,360 | | | $ | — | | | | $ | 2,360 | |

| Securities and money market investments | | 701 | | | — | | | | 701 | |

| Total interest income | | 3,061 | | | — | | | | 3,061 | |

| INTEREST EXPENSE: | | | | | | | |

| Interest-bearing checking and money market accounts | | 446 | | | 78 | | (g) | | 524 | |

| Savings accounts | | 111 | | | — | | | | 111 | |

| Certificates of deposit | | 628 | | | — | | | | 628 | |

| Borrowed funds | | 695 | | | — | | | | 695 | |

| Total interest expense | | 1,880 | | | 78 | | | | 1,958 | |

| Net interest income | | 1,181 | | | (78) | | | | 1,103 | |

| Provision for credit losses | | 705 | | | — | | | | 705 | |

| Net interest income after provision for credit loan losses | | 476 | | | (78) | | | | 398 | |

| NON-INTEREST INCOME: | | | | | | | |

| Fee income | | 75 | | | (34) | | | | 41 | |

| Bank-owned life insurance | | 22 | | | — | | | | 22 | |

| Net return on mortgage servicing rights | | 40 | | | (40) | | | | — | |

| Net gain on loan sales and securitizations | | 38 | | | (27) | | | | 11 | |

| Net loan administration (loss) income | | 11 | | | (6) | | (g) | | 5 | |

| Bargain purchase gain | | (121) | | | — | | | | (121) | |

| Other | | 58 | | | — | | | | 58 | |

| Total non-interest income | | 123 | | | (107) | | | | 16 | |

| NON-INTEREST EXPENSE: | | | | | | | |

| Operating expenses: | | | | | | | |

| Compensation and benefits | | 645 | | | (37) | | | | 608 | |

| FDIC insurance | | 141 | | | — | | | | 141 | |

| Occupancy and equipment | | 104 | | | (2) | | | | 102 | |

| General and administrative | | 369 | | | (49) | | | | 320 | |

| Total operating expense | | 1,259 | | | (88) | | | | 1,171 | |

| Intangible asset amortization | | 68 | | | — | | | | 68 | |

| Merger-related and restructuring expenses | | 77 | | | — | | | | 77 | |

| Total non-interest expense | | 1,404 | | | (88) | | | | 1,316 | |

| (Loss) income before income taxes | | (805) | | | (97) | | | | (902) | |

| Income tax (benefit) expense | | (155) | | | (25) | | | | (180) | |

| Net (loss) income | | $ | (650) | | | $ | (72) | | | | $ | (722) | |

| Preferred stock dividends | | 18 | | — | | | 18 |

| Net (loss) income available to common stockholders | | $ | (668) | | | $ | (72) | | | | $ | (740) | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Basic (loss) earnings per common share | | $ | (2.47) | | | | | | $ | (2.74) | |

| Diluted (loss) earnings per common share | | $ | (2.47) | | | | | | $ | (2.74) | |

| | | | | | | |

| Shares used in computing earnings per common share: | | | | | | | |

| Basic | | 269,902,354 | | | | | | 269,902,354 | |

| Diluted | | 269,902,354 | | | | | | 269,902,354 | |

Unaudited Pro Forma Consolidated Statements of (Loss) Income

| | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | Year Ended December 31, 2023 (b) | | Proforma Adjustments (f) | | | Proforma |

| INTEREST INCOME: | | | | | | |

| Loans and leases | $ | 4,509 | | | $ | — | | | | $ | 4,509 | |

| Securities and money market investments | 982 | | | — | | | | 982 | |

| Total interest income | 5,491 | | | — | | | | 5,491 | |

| INTEREST EXPENSE: | | | | | | |

| Interest-bearing checking and money market accounts | 943 | | | 168 | | (h) | | 1,111 | |

| Savings accounts | 169 | | | — | | | | 169 | |

| Certificates of deposit | 646 | | | — | | | | 646 | |

| Borrowed funds | 656 | | | — | | | | 656 | |

| Total interest expense | 2,414 | | | 168 | | | | 2,582 | |

| Net interest income | 3,077 | | | (168) | | | | 2,909 | |

| Provision for credit losses | 833 | | | — | | | | 833 | |

| Net interest income after provision for credit loan losses | 2,244 | | | (168) | | | | 2,076 | |

| NON-INTEREST INCOME: | | | | | | |

| Fee income | 172 | | | (63) | | | | 109 | |

| Bank-owned life insurance | 43 | | | — | | | | 43 | |

| Net loss on securities | (1) | | | — | | | | (1) | |

| Net return on mortgage servicing rights | 103 | | | (103) | | | | — | |

| Net gain on loan sales and securitizations | 89 | | | (85) | | | | 4 | |

| Net loan administration income | 82 | | | 11 | | (h) | | 93 | |

| Bargain purchase gain | 2,131 | | | — | | | | 2,131 | |

| Other | 68 | | | — | | | | 68 | |

| Total non-interest income | 2,687 | | | (240) | | | | 2,447 | |

| NON-INTEREST EXPENSE: | | | | | | 0 |

| Operating expenses: | | | | | | 0 |

| Compensation and benefits | 1,149 | | | (72) | | | | 1,077 | |

| Occupancy and equipment | 200 | | | (2) | | | | 198 | |

| General and administrative | 750 | | | (109) | | | | 641 | |

| Total operating expense | 2,099 | | | (183) | | | | 1,916 | |

| Intangible asset amortization | 126 | | | — | | | | 126 | |

| Merger-related and restructuring expenses | 330 | | | — | | | | 330 | |

| Goodwill impairment | 2,426 | | | — | | | | 2,426 | |

| Total non-interest expense | 4,981 | | | (183) | | | | 4,798 | |

| (Loss) Income before income taxes | (50) | | | (225) | | | | (275) | |

| Income tax expense | 29 | | | (59) | | | | (30) | |

| Net (loss) income | $ | (79) | | | $ | (166) | | | | $ | (245) | |

| Preferred stock dividends | 33 | | — | | | 33 |

| Net (loss) income available to common stockholders | $ | (112) | | | $ | (166) | | | | $ | (278) | |

| | | | | | |

| Earnings per common share: | | | | | | |

| Basic (loss) earnings per common share | $ | (0.47) | | | | | | $ | (1.17) | |

| Diluted (loss) earnings per common share | $ | (0.47) | | | | | | $ | (1.17) | |

| | | | | | |

| Shares used in computing earnings per common share: | | | | | | |

| Basic | 237,881,183 | | | | | | 237,881,183 | |

| Diluted | 237,881,183 | | | | | | 237,881,183 | |

Notes to the Unaudited Pro Forma Consolidated Financial Statements

Note 1 - Basis of Presentation

The unaudited pro forma consolidated statement of condition of the Company as of June 30, 2024 is presented as if the Transaction, as described in the Company's Current Report on Form 8-K filed on July 29, 2024, had occurred at June 30, 2024. The unaudited pro forma consolidated statements of (loss) income for the year ended December 31, 2023 and for the six months ended June 30, 2024 are presented as if the disposition had occurred on January 1, 2023. The unaudited pro forma consolidated financial statements and related notes were prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma consolidated financial statements are based on the historical financial statements of the Company for each period presented and in the opinion of the Company’s management, all adjustments and disclosures necessary for a fair presentation of the pro forma data have been made. These adjustments do not reflect any expenses incurred outside of the mortgage servicing, subservicing and third-party origination platforms, including those related to interest expense or shared services.

The unaudited pro forma consolidated financial statements are presented for illustrative purposes only, are based on information currently available, do not reflect all actions that may be undertaken by the Company after completion of the sale, and are not necessarily indicative of the results of operations or financial condition that would have been achieved had the disposition been completed as of the dates indicated nor do they purport to project the future financial position or operating results to be expected in any future period.

Note 2 - Pro Forma Adjustments

The following pro forma adjustments have been reflected in the unaudited pro forma consolidated financial statements and are based on preliminary estimates, which may change as additional information is obtained.

a. Reflects the Company's historical unaudited consolidated statement of condition and historical unaudited consolidated statement of (loss) income as of and for the six months ended June 30, 2024, as presented in the Company’s Quarterly Report on Form 10-Q, as filed with the SEC on August 9, 2024.

b. Reflects the Company's historical consolidated statement of (loss) income for the year ended December 31, 2023, as presented in the Company’s Annual Report on Form 10-K/A, as filed with the SEC on March 15, 2024.

c. Reflects total cash and other consideration of $1,273 million from the Transaction, inclusive of the amount settled on October 31, 2024 and a customary five percent holdback related to mortgage servicing rights to be settled later in the fourth quarter 2024. The cash consideration from the purchaser consists of the net asset value of the assets purchased pursuant to the MSR Purchase Agreement and the Asset Purchase Agreement. The purchase price is subject to the settlement of customary post-closing adjustments based on the final determination of the net asset value of the assets purchased and liabilities assumed, which are not expected to be material.

d. Amounts represent the adjustments necessary to remove the assets and liabilities divested by the Company in accordance with the Transaction.

e. Reflects the estimated gain on sale, net of tax, of approximately $130 million. Subsequent to the transaction, the Company also expect to incur pre-tax costs, primarily the impairment of capitalized assets related to our mortgage servicing and third-party origination platform not included in the transaction and severance costs associated with the transaction totaling approximately $75 million.

f. Amounts represent the adjustments necessary to remove the historical revenues and expenses of the Company related to the assets and liabilities divested by the Company in accordance with the Transaction.

g. Charges on custodial deposits previously netted in loan administration income have been reclassified to interest expense related to this transaction. Although they remain with the bank at the time of the transaction, we expect approximately $4 billion of custodial deposits associated with our mortgage servicing activities and the related interest expense to transfer out of the Bank over the course of the five months following the October 31, 2024 close.

Loan administration income for the six months ended June 30, 2024 includes the elimination of $84 million of subservice fee income and a $78 million reclassification of charges on custodial deposits previously netted in loan administration income to interest expense, for a net decrease of $6 million

Notes to the Unaudited Pro Forma Consolidated Financial Statements

h. Charges on custodial deposits previously netted in loan administration income have been reclassified to interest expense related to this transaction. Although they remain with the bank at the time of the transaction, we expect approximately $4 billion of custodial deposits associated with our mortgage servicing activities and the related interest expense to transfer out of the Bank over the course of the five months following the October 31, 2024 close.

Loan administration income for the twelve months ended December 31, 2023 includes the elimination of $157 million of subservice fee income and a $168 million reclassification of charges on custodial deposits previously netted in loan administration income to interest expense, for a net increase of $11 million.

v3.24.3

Document and Entity Information

|

Oct. 31, 2024 |

| Document Information [Line Items] |

|

| Document Period End Date |

Oct. 31, 2024

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Entity Registrant Name |

FLAGSTAR FINANCIAL, INC.

|

| Entity Central Index Key |

0000910073

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

06-1377322

|

| Entity Address, City or Town |

Hicksville,

|

| Entity Address, Postal Zip Code |

11801

|

| City Area Code |

516

|

| Local Phone Number |

683-4100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

1-31565

|

| Entity Address, Address Line One |

102 Duffy Avenue,

|

| Entity Address, State or Province |

NY

|

| Entity Information, Former Legal or Registered Name |

New York Community Bancorp, Inc.

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

FLG

|

| Bifurcated Option Note Unit Securities [Member] |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Bifurcated Option Note Unit SecuritiESSM

|

| Trading Symbol |

FLG PRU

|

| Fixed To Floating Rate Series A Noncumulative Perpetual Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Depositary Shares each representing a 1/40th interest in a share of Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock

|

| Trading Symbol |

FLG PRA

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nycb_BifurcatedOptionNotesUnitSecuritiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nycb_FixedToFloatingRateSeriesANoncumulativePerpetualPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

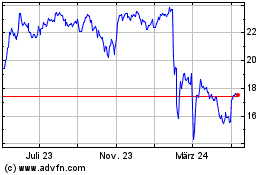

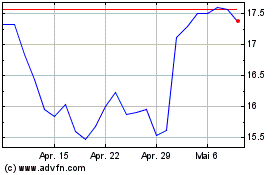

New York Community Bancorp (NYSE:NYCB-A)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

New York Community Bancorp (NYSE:NYCB-A)

Historical Stock Chart

Von Nov 2023 bis Nov 2024