As filed with the U.S. Securities and Exchange Commission on June 12, 2023

Securities Act File No. 333-261173

Investment Company Act File No. 811-09475

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

(CHECK APPROPRIATE BOX OR BOXES)

| ☒ |

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| ☐ |

Pre-Effective Amendment No. |

| ☒ |

Post-Effective Amendment No. 3 |

| ☒ |

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

Nuveen AMT-Free Municipal Credit Income Fund

333 West Wacker Drive, Chicago, Illinois 60606

(Address of Principal Executive Offices)

(Number, Street, City, State, Zip Code)

(800) 257-8787

(Registrant’s Telephone Number, including Area Code)

Mark L. Winget

Vice

President and Secretary

333 West Wacker Drive

Chicago, Illinois 60606

Name and Address (Number, Street, City, State, Zip Code) of Agent for Service

Copies to:

|

|

|

|

|

| Thomas S. Harman

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue NW

Washington, DC 20004 |

|

Eric F. Fess

Chapman and Cutler LLP

111 W. Monroe Street

Chicago, IL 60603 |

|

Jonathan B. Miller

Kenny S. Terrero Sidley

Austin LLP 787 Seventh Avenue

New York, NY 10019 |

Approximate Date of Proposed Public Offering: From time to time after the effective date of the Registration Statement.

☐ Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest

reinvestment plans.

☒ Check box if any securities being registered on this Form will be offered on a delayed or

continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”) other than securities offered in connection with a dividend reinvestment plan.

☐ Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment

thereto.

☐ Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective

amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act.

☐ Check box if this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act.

It is proposed that this filing will become effective (check appropriate box):

☐ when declared effective pursuant to Section 8(c) of the Securities Act.

If appropriate, check the following box:

☐ This post-effective amendment designates a new effective date for a previously filed post-effective amendment.

☐ This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and

the Securities Act registration statement number of the earlier effective registration statement for the same offering is: .

☐ This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act

registration statement number of the earlier effective registration statement for the same offering is: .

☒ This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act

registration statement number of the earlier effective registration statement for the same offering is: 333-261173.

Check each box that appropriately characterizes the Registrant:

☒ Registered Closed-End Fund (closed-end

company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)).

☐ Business

Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act).

☐ Interval Fund (Registered Closed-End Fund or a Business Development Company that

makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

☒ A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

☒ Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

☐ Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act

of 1934 (“Exchange Act”).

☐ If an Emerging Growth Company, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

☐ New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this

filing).

EXPLANATORY NOTE

This Post-Effective Amendment No. 3 to the Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475) of Nuveen AMT-Free Municipal Credit Income Fund (the

“Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of filing exhibits to the Registration Statement. Accordingly, this

Post-Effective Amendment No. 3 consists only of a facing page, this explanatory note, and Part C of the Registration Statement on Form N-2 setting forth the exhibits to the Registration Statement.

This Post-Effective Amendment No. 3 does not modify any other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 3 shall become effective immediately upon filing with the

Securities and Exchange Commission. The contents of the Registration Statement are hereby incorporated by reference.

PART C—OTHER INFORMATION

Item 25: Financial Statements and Exhibits.

| |

Financial Highlights for Nuveen AMT-Free Municipal Credit Income Fund

(the “Fund” or the “Registrant”) for fiscal years ended October 31, 2011, October 31, 2012, October 31, 2013, October 31, 2014, October 31, 2015, October 31, 2016, October 31, 2017,

October 31, 2018, October 31, 2019 and October 31, 2020 and the six months ended April 30, 2021 are filed in Part A of this Registration Statement under the caption “Financial Highlights.” |

| |

Registrant’s Financial Statements are incorporated in Part A by reference to Registrant’s

October 31, 2020 Annual Report (audited) on Form N-CSR as filed with the U.S. Securities and Exchange Commission

(the “SEC” or the “Commission”) on January 7, 2021 and Registrant’s April 30, 2021 Semi-Annual Report (unaudited) on Form N-CSR as filed with the SEC on July 7, 2021. |

| |

Registrant’s Financial Statements are incorporated in Part B by reference to Registrant’s

October 31, 2020 Annual Report (audited) on Form N-CSR as filed with the SEC on January 7, 2021 and

Registrant’s April 30, 2021 Semi-Annual Report (unaudited) on Form N-CSR as filed with the SEC on July 7,

2021. |

|

|

|

| a.1 |

|

Registrant’s Declaration of Trust dated July

12, 1999 (the “Declaration of Trust”) is incorporated herein by reference to Exhibit a.1 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-160630 and 811-09475), as filed with the SEC on July 17, 2009. |

|

|

| a.2 |

|

Certificate of Amendment dated October

6, 2009 to the Declaration of Trust is incorporated herein by reference to Exhibit a.3 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-160630 and 811-09475), as filed with the SEC on October 9, 2009. |

|

|

| a.3 |

|

Certificate of Name Change Amendment dated December

9, 2011 to the Declaration of Trust is incorporated herein by reference to Exhibit (1)(b) to the Registrant’s Registration Statement on Form N-14 (File No.

333-206627), as filed with the SEC on August 27, 2015. |

|

|

| a.4 |

|

Certificate of Name Change Amendment dated April

1, 2016 to the Declaration of Trust is incorporated herein by reference to Exhibit (1)(c) to the Registrant’s Registration Statement on Form N-14 (File No.

333-206627), as filed with the SEC on May 19, 2016. |

|

|

| a.5 |

|

Certificate of Name Change Amendment dated December

12, 2016 to the Declaration of Trust is incorporated herein by reference to Exhibit a.10 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-226136 and 811-09475), as filed with the SEC on July 12, 2018. |

|

|

| a.6 |

|

Reserved. |

|

|

| a.7 |

|

Amended and Restated Statement Establishing and Fixing the Rights and Preferences of Series 1 Variable Rate Demand Preferred Shares dated

June 18, 2019 is incorporated herein by reference to Exhibit a.7 to the Registrant’s Registration Statement on Form N-2 (File

Nos. 333-261173 and 811-09475), as filed with the SEC on November 18, 2021. |

|

|

| a.8 |

|

Notice of Subsequent Rate Period Designating the Subsequent Rate Period Succeeding the Initial Rate Period as a Minimum Rate Period for Series

1 Variable Rate Demand Preferred Shares dated June 20, 2019 is incorporated herein by reference to Exhibit a.8 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on November 18, 2021. |

|

|

| a.9 |

|

Statement Establishing and Fixing the Rights and Preferences of Series 2 Variable Rate Demand Preferred Shares dated April

7, 2016 is incorporated herein by reference to Exhibit a.6 to the Registrant’s Registration Statement of Form N-2 (File Nos.

333-226136 and 811-09475), as filed with the SEC on July 12, 2018. |

C-1

|

|

|

|

|

| a.10 |

|

Statement Establishing and Fixing the Rights and Preferences of Series 4 Variable Rate Demand Preferred Shares dated June

15, 2016 and Amendment No. 1 thereto dated June 18, 2018 are incorporated herein by reference to Exhibit a.7 to the Registrant’s Registration Statement of Form

N-2 (File Nos. 333-226136 and 811-09475), as filed with the SEC on July 12, 2018. |

|

|

| a.11 |

|

Notice of Subsequent Rate Period Designating the Subsequent Rate Period Succeeding the Initial Rate Period as a Minimum Rate Period for

Series 4 Variable Rate Demand Preferred Shares dated June 21, 2018 is incorporated herein by reference to Exhibit a.12 to the Registrant’s Registration Statement on

Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on

November 18, 2021. |

|

|

| a.12 |

|

Amendment No.

2 to Statement Establishing and Fixing the Rights and Preferences of Series 4 Variable Rate Demand Preferred Shares dated June

19, 2019 is incorporated herein by reference to Exhibit a.13 to the Registrant’s Registration Statement on Form N-2 (File Nos.

333-261173 and 811-09475), as filed with the SEC on November 18, 2021. |

|

|

| a.13 |

|

Statement Establishing and Fixing the Rights and Preferences of Series 5 Variable Rate Demand Preferred Shares dated November

9, 2016 is incorporated herein by reference to Exhibit a.8 to the Registrant’s Registration Statement of Form N-2 (File Nos.

333-226136 and 811-09475), as filed with the SEC on July 12, 2018. |

|

|

| a.14 |

|

Statement Establishing and Fixing the Rights and Preferences of Series 6 Variable Rate Demand Preferred Shares dated November 9,

2016 is incorporated herein by reference to Exhibit a.9 to the Registrant’s Registration Statement of Form N-2 (File

Nos. 333-226136 and 811-09475), as filed with the SEC on July 12, 2018. |

|

|

| a.15 |

|

Statement Establishing and Fixing the Rights and Preferences of Series A MuniFund Preferred Shares dated January

25, 2018 and related Supplement Initially Designating the Variable Rate Mode is incorporated herein by reference to Exhibit a.11 to the Registrant’s Registration Statement of Form N-2 (File Nos. 333-226136 and 811-09475), as filed with the SEC on July 12, 2018. |

|

|

| a.16 |

|

Amendment No.

1 to Supplement to the Statement Establishing and Fixing the Rights and Preferences of Series A MuniFund Preferred Shares (Initially Designating the Variable Rate Mode for the Series A MuniFund Preferred Shares) dated September

28, 2018 is incorporated herein by reference to Exhibit a.17 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on November 18, 2021. |

|

|

| a.17 |

|

Amendment No.

2 to Supplement to the Statement Establishing and Fixing the Rights and Preferences of Series A MuniFund Preferred Shares Initially Designating the Variable Rate Mode for the Series A MuniFund Preferred Shares dated November

13, 2020 is incorporated herein by reference to Exhibit a.18 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on November 18, 2021. |

|

|

| a.18 |

|

Statement Establishing and Fixing the Rights and Preferences of Series B MuniFund Preferred Shares dated March

5, 2019 is incorporated herein by reference to Exhibit d.3 to the Registrant’s Registration Statement on Form N-2 (File Nos.

333-226136 and 811-09475), as filed with the SEC on March 7, 2019. |

|

|

| a.19 |

|

Supplement to the Statement Establishing and Fixing the Rights and Preferences of Series B MuniFund Preferred Shares dated March 5,

2019 is incorporated herein by reference to Exhibit d.3 to the Registrant’s Registration Statement on Form N-2 (File

Nos. 333-226136 and 811-09475), as filed with the SEC on March 7, 2019. |

|

|

| a.20 |

|

Statement Establishing and Fixing the Rights and Preferences of Adjustable Rate MuniFund Preferred Shares, Series 2028 dated November 18,

2019 is incorporated herein by reference to Exhibit a.21 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on November 18, 2021. |

C-2

|

|

|

|

|

| a.21 |

|

Amendment No.

1 to Statement Establishing and Fixing the Rights and Preferences of Series 5 Variable Rate Demand Preferred Shares dated December 1, 2021 is incorporated herein by reference to Exhibit a.22 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on December 3, 2021. |

|

|

| a.22 |

|

Amendment No.

1 to Statement Establishing and Fixing the Rights and Preferences of Series 6 Variable Rate Demand Preferred Shares dated December

1, 2021 is incorporated herein by reference to Exhibit a.23 to the Registrant’s Registration Statement on Form N-2 (File Nos.

333-261173 and 811-09475), as filed with the SEC on December 3, 2021. |

|

|

| b. |

|

Registrant’s By-Laws (Amended and Restated as of October

5, 2020) are incorporated herein by reference to Exhibit 3.1 to Registrant’s Form 8-K (File No. 811-09475),

as filed with the SEC on October 6, 2020. |

|

|

| c. |

|

Not applicable. |

|

|

| d.1 |

|

Reserved. |

|

|

| d.2 |

|

Form of Share Certificate for Series C MuniFund Preferred Shares is incorporated herein by reference to Exhibit d.2 to the Registrant’s

Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as

filed with the SEC on December 3, 2021. |

|

|

| d.3 |

|

Statement Establishing and Fixing the Rights and Preferences of Series C MuniFund Preferred Shares dated December

1, 2021 is incorporated herein by reference to Exhibit d.3 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on December 3, 2021. |

|

|

| d.4 |

|

Supplement to the Statement Establishing and Fixing the Rights and Preferences of Series C MuniFund Preferred Shares Designating the Variable

Rate Remarketed Mode dated December 1, 2021 is incorporated herein by reference to Exhibit d.4 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on December 3, 2021. |

|

|

| d.5 |

|

Form of Supplement to the Statement Establishing and Fixing the Rights and Preferences of MuniFund Preferred Shares Designating the Variable

Rate Mode is incorporated herein by reference to Exhibit d.5 to the Registrant’s Registration Statement on Form N-2 (File

Nos. 333-261173 and 811-09475), as filed with the SEC on November 18, 2021. |

|

|

| d.6 |

|

Form of Supplement to the Statement Establishing and Fixing the Rights and Preferences of MuniFund Preferred Shares Designating the Variable

Rate Mode (Adjustable Rate) incorporated herein by reference to Exhibit d.6 to the Registrant’s Registration Statement on Form N-2 (File

Nos. 333-261173 and 811-09475), as filed with the SEC on November 18, 2021. |

|

|

| e. |

|

Terms and Conditions of the Dividend Reinvestment Plan is incorporated herein by reference to Exhibit e. to Nuveen Municipal Income Fund, Inc.’s

Registration Statement on Form N-2 (File

Nos. 333-211435 and 811-05488), as filed with the SEC on May 18, 2016. |

|

|

| f. |

|

Not applicable. |

|

|

| g.1 |

|

Investment Management Agreement dated April

11, 2016 between the Registrant and Nuveen Fund Advisors, LLC (the “Investment Management Agreement”) is incorporated herein by reference to Exhibit (6)(a) to the Registrant’s Registration Statement on Form N-14 (File No. 333-206627), as filed with the SEC on May 19, 2016. |

|

|

| g.2 |

|

Amendment dated August

1, 2019 to the Investment Management Agreement is incorporated herein by reference to an Exhibit to the Registrant’s Annual Report on Form N-CEN (File No.

811-09475), as filed on January 14, 2020. |

|

|

| g.3 |

|

Continuance of Management Agreements dated July

29, 2022 between the Registrant and Nuveen Fund Advisors, LLC is incorporated herein by reference to Exhibit (g)(2) to Nuveen Select Tax-Free Income Portfolio’s Registration Statement on Form N-2 (File Nos. 333-271575 and 811-06548), as filed on May 2, 2023.

|

C-3

|

|

|

|

|

| g.4 |

|

Investment Sub-Advisory Agreement dated April

11, 2016 between Nuveen Fund Advisors, LLC and Nuveen Asset Management, LLC is incorporated herein by reference to Exhibit (6)(b) to the Registrant’s Registration Statement on Form N-14 (File No. 333-206627), as filed with the SEC on May 19, 2016. |

|

|

| g.5 |

|

Notice of Continuance of Investment Sub-Advisory Agreements dated July

29, 2022 between Nuveen Fund Advisors, LLC and Nuveen Asset Management, LLC is incorporated herein by reference to Exhibit (g)(4) to Nuveen Select Tax-Free Income Portfolio’s Registration Statement on Form

N-2 (File Nos. 333-271575 and 811-06548), as filed on May 2, 2023. |

|

|

| h.1 |

|

Underwriting Agreement with respect to MFP Shares dated December

1, 2021 is incorporated herein by reference to Exhibit h.1 to the Registrant’s Registration Statement on Form N-2 (File Nos.

333-261173 and 811-09475), as filed with the SEC on December 3, 2021. |

|

|

| h.2 |

|

Distribution Agreement Relating to At-the-Market offerings

dated December 15, 2021 between the Registrant and Nuveen Securities, LLC (the “Distribution Agreement”) is incorporated herein by reference to Exhibit h.2 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on December 17, 2021. |

|

|

| h.3 |

|

Amendment, dated June 9, 2023, to Distribution Agreement is filed herewith. |

|

|

| h.4 |

|

Dealer Agreement Relating to At-the-Market offerings dated

December 17, 2021 between Nuveen Securities, LLC and Virtu Americas LLC (the “Dealer Agreement”) is incorporated herein by reference to Exhibit h.3 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on December 17, 2021. |

|

|

| h.5 |

|

Amendment, dated June 9, 2023, to Dealer Agreement is filed herewith. |

|

|

| i. |

|

Nuveen Fund Board Voluntary Deferred Compensation Plan for Independent Directors and Trustees, effective as of November 1, 2021, as Exhibit

(f) to Nuveen Global Net Zero Transition ETF’s Registration Statement on Form N-1A (File Nos. 333-212032 and 811-23161) and incorporated herein by reference. |

|

|

| j.1 |

|

Amended and Restated Master Custodian Agreement between the Registrant and State Street Bank and Trust Company dated July

15, 2015 (the “Custodian Agreement”) is incorporated herein by reference to Exhibit 9(a) to the Registrant’s Registration Statement on Form N-14

(File No. 333-206627), as filed with the SEC on October 2, 2015. |

|

|

| j.2 |

|

Amendment and revised Appendix A, effective September

8, 2022, to the Amended and Restated Master Custodian Agreement dated July

15, 2015 between the Registrant and State Street Bank and Trust Company is incorporated herein by reference by Exhibit (g)(3) to Post-Effective Amendment No. 81 to Nuveen Investment Trust V’s Registration Statement on Form N-1A (File Nos. 333-138592 and 811-21979), as filed on December 29, 2022. |

|

|

| k.1 |

|

Transfer Agency and Service Agreement dated June

15, 2017 between the Registrant and Computer Share Inc. and Computershare Trust Company, N.A. (the “Transfer Agency Agreement”) is incorporated herein by reference to Exhibit k.1 to Nuveen California

AMT-Free Quality Municipal Income Fund’s Registration Statement on Form N-2 (File Nos. 333-184971 and

811-21212), as filed with the SEC on November 16, 2017. |

|

|

| k.2 |

|

First Amendment, dated September 7, 2017, to the Transfer Agency and Service Agreement dated June

15, 2017 between the Registrant and ComputerShare Inc. and ComputerShare Trust Company, N.A. is incorporated herein by reference by Exhibit k.2 to Nuveen Municipal Credit Opportunities Fund’s Registration Statement on Form N-2 (File Nos. 333-254678 and 811-23440), as filed on March 25,

2021. |

C-4

|

|

|

|

|

| k.3 |

|

Second Amendment, dated February 26, 2018, to the Transfer Agency and Service Agreement dated June

15, 2017 between the Registrant and ComputerShare Inc. and ComputerShare Trust Company, N.A. is incorporated herein by reference by Exhibit k.3 to Nuveen Municipal Credit Opportunities Fund’s Registration Statement on Form N-2 (File Nos. 333-254678 and 811-23440), as filed on March 25, 2021. |

|

|

| k.4 |

|

Third Amendment, effective May 11, 2020, to the Transfer Agency and Service Agreement dated June

15, 2017 between the Registrant and ComputerShare Inc. and ComputerShare Trust Company, N.A. is incorporated herein by reference by Exhibit k.4 to Nuveen Municipal Credit Opportunities Fund’s Registration Statement on Form N-2 (File Nos. 333-254678 and 811-23440), as filed on March 25, 2021. |

|

|

| k.5 |

|

Amended and Restated Schedule A, effective March

28, 2023, to the Transfer Agency and Service Agreement dated June 15, 2017 between the Registrant and ComputerShare Inc. and ComputerShare Trust Company, N.A. is incorporated herein by reference by Exhibit (k)(5) to Nuveen Select Tax-Free Income Portfolio’s Registration Statement on Form N-2 (File Nos. 333-271575 and 811-06548),

as filed on May 2, 2023. |

|

|

| k.6 |

|

Rule 12d1-4 Investment Agreement between RiverNorth Funds as Acquiring Funds and Nuveen CEFs as Acquired

Funds, dated January 19, 2022 is incorporated herein by reference by Exhibit (k)(6) to Nuveen Select Tax-Free Income Portfolio’s Registration Statement on Form

N-2 (Files Nos. 333-271575 and 811-06548), as filed on May 2, 2023. |

|

|

| l.1 |

|

Opinion of Morgan, Lewis & Bockius LLP dated December

3, 2021 is incorporated herein by reference to Exhibit l.1 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on December 3, 2021. |

|

|

| l.2 |

|

Opinion of Sidley Austin LLP dated December

3, 2021 is incorporated herein by reference to Exhibit l.2 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on December 3, 2021. |

|

|

| m. |

|

Not applicable. |

|

|

| n. |

|

Not applicable. |

|

|

| o. |

|

Not applicable. |

|

|

| p. |

|

Not applicable. |

|

|

| q. |

|

Not applicable. |

|

|

| r.1 |

|

Code of Ethics and Reporting Requirements of Nuveen dated February

15, 2023 is incorporated herein by reference by Exhibit (r)(1) to Nuveen Select-Tax Free Income Portfolio’s Registration Statement on Form N-2 (File No. 333-271575 and 811-06548), as filed on May 2, 2023. |

|

|

| r.2 |

|

Code of Ethics of the Independent Trustees of the Nuveen Funds as last amended May

23, 2019 is incorporated herein by reference to Exhibit r.2 to Nuveen Taxable Municipal Income Fund’s Registration Statement on Form N-2 (File Nos. 333-248493 and 811-22391), as filed with the SEC on August 31, 2020. |

|

|

| s.1 |

|

Powers of Attorney dated April 21, 2022 is incorporated herein by reference by Exhibit (s) to Nuveen Select Tax-Free Income Portfolio’s Registration Statement on Form N-2 (File Nos. 333-271575 and 811-06548),

as filed on May 2, 2023. |

|

|

| s.2 |

|

Remarketing Agreement dated as of December

3, 2021 with respect to the Series C MuniFund Preferred Shares is incorporated herein by reference to Exhibit s.2 to the Registrant’s Registration Statement on Form N-2 (File Nos. 333-261173 and 811-09475), as filed with the SEC on December 3, 2021. |

C-5

Item 26: Marketing Arrangements.

Reference is made to the Underwriting Agreement, Distribution Agreement and Dealer Agreement for the Registrant’s Common Shares and

Preferred Shares, filed as exhibits to the Registration Statement, and the Underwriting Agreement, Distribution Agreements and Dealer Agreements (or forms thereof) which relate to the specific issuances of Common Shares and Preferred Shares under

the Registration Statement and filed as exhibits to the Registration Statement. Reference also is made to the information under the headings “Plan of Distribution” in the Registrant’s prospectus and under the heading

“Underwriting,” or other similar such captions, in the Registrant’s prospectus supplement relating to specific issuances of Common Shares and Preferred Shares filed with the Securities and Exchange Commission from time to time.

Item 27: Other Expenses of Issuance and Distribution.

|

|

|

|

|

| Printing and Engraving Fees |

|

$ |

5,500 |

|

| Legal Fees |

|

$ |

20,000 |

|

| Accounting Fees |

|

$ |

5,500 |

|

| Financial Industry Regulatory Authority Fees |

|

$ |

15,000 |

|

| Stock Exchange Listing Fees |

|

$ |

20,000 |

|

| Miscellaneous Fees |

|

$ |

4,000 |

|

|

|

|

|

|

| Total |

|

$ |

70,000 |

|

|

|

|

|

|

Item 28: Persons Controlled by or Under Common Control.

None.

Item 29: Number of Holders of

Securities.

April 30, 2023:

|

|

|

|

|

| Title of Class |

|

Number of Record Holders |

|

| Common Shares, $0.01 par value |

|

|

71,430 |

|

| Preferred Shares |

|

|

22 |

|

Item 30: Indemnification.

Section 4 of Article XII of the Registrant’s Declaration of Trust provides as follows:

Subject to the exceptions and limitations contained in this Section 4, every person who is, or has been, a Trustee, officer, employee or

agent of the Trust, including persons who serve at the request of the Trust as directors, trustees, officers, employees or agents of another organization in which the Trust has an interest as a shareholder, creditor or otherwise (hereinafter

referred to as a “Covered Person”), shall be indemnified by the Trust to the fullest extent permitted by law against liability and against all expenses reasonably incurred or paid by him in connection with any claim, action, suit or

proceeding in which he becomes involved as a party or otherwise by virtue of his being or having been such a Trustee, director, officer, employee or agent and against amounts paid or incurred by him in settlement thereof.

No indemnification shall be provided hereunder to a Covered Person:

| |

(a) |

against any liability to the Trust or its Shareholders by reason of a final adjudication by the court or other

body before which the proceeding was brought that he engaged in willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office; |

| |

(b) |

with respect to any matter as to which he shall have been finally adjudicated not to have acted in good faith

in the reasonable belief that his action was in the best interests of the Trust; or |

| |

(c) |

in the event of a settlement or other disposition not involving a final adjudication (as provided in paragraph

(a) or (b)) and resulting in a payment by a Covered Person, unless there has been either a determination that such Covered Person did not engage in willful misfeasance, bad faith, gross negligence or reckless disregard

|

C-6

| |

of the duties involved in the conduct of his office by the court or other body approving the settlement or other disposition or a reasonable determination, based on a review of readily available

facts (as opposed to a full trial-type inquiry), that he did not engage in such conduct: |

(i) by a vote of a majority of

the Disinterested Trustees acting on the matter (provided that a majority of the Disinterested Trustees then in office act on the matter); or

(ii) by written opinion of independent legal counsel.

The rights of indemnification herein provided may be insured against by policies maintained by the Trust, shall be severable, shall not affect

any other rights to which any Covered Person may now or hereafter be entitled, shall continue as to a person who has ceased to be such a Covered Person and shall inure to the benefit of the heirs, executors and administrators of such a person.

Nothing contained herein shall affect any rights to indemnification to which Trust personnel other than Covered Persons may be entitled by contract or otherwise under law.

Expenses of preparation and presentation of a defense to any claim, action, suit or proceeding subject to a claim for indemnification under

this Section 4 shall be advanced by the Trust prior to final disposition thereof upon receipt of an undertaking by or on behalf of the recipient to repay such amount if it is ultimately determined that he is not entitled to indemnification

under this Section 4, provided that either:

(a) such undertaking is secured by a surety bond or some other appropriate security or

the Trust shall be insured against losses arising out of any such advances; or

(b) a majority of the Disinterested Trustees acting on the

matter (provided that a majority of the Disinterested Trustees then in office act on the matter) or independent legal counsel in a written opinion shall determine, based upon a review of the readily available facts (as opposed to a full trial-type

inquiry), that there is reason to believe that the recipient ultimately will be found entitled to indemnification.

As used in this

Section 4, a “Disinterested Trustee” is one (x) who is not an Interested Person of the Trust (including anyone, as such Disinterested Trustee, who has been exempted from being an Interested Person by any rule, regulation or order

of the Commission), and (y) against whom none of such actions, suits or other proceedings or another action, suit or other proceeding on the same or similar grounds is then or has been pending.

As used in this Section 4, the words “claim,” “action,” “suit” or “proceeding” shall apply to all

claims, actions, suits, proceedings (civil, criminal, administrative or other, including appeals), actual or threatened; and the words “liability” and “expenses” shall include without limitation, attorneys’ fees, costs,

judgments, amounts paid in settlement, fines, penalties and other liabilities.

The trustees and officers of the Registrant are covered by

joint errors and omissions insurance policies against liability and expenses of claims of wrongful acts arising out of their position with the Registrant and other Nuveen funds, subject to such policies’ coverage limits, exclusions and

retention.

Section 8 of the Distribution Agreement Relating to

At-the-Market offerings, filed as Exhibit h.2 to this Registration Statement, provides for each of the parties thereto, including the Registrant and the underwriters, to

indemnify the others, their trustees, directors, certain of their officers, trustees, directors and persons who control them against certain liabilities in connection with the offering described herein, including liabilities under the federal

securities laws.

Insofar as indemnification for liability arising under the Securities Act of 1933, as amended (the “Securities

Act”), may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that, in the opinion of the SEC, such indemnification is against public

policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or

controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be

governed by the final adjudication of such issue.

C-7

Item 31: Business and Other Connections of Investment Adviser and

Sub-Adviser.

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”) manages the

Registrant and serves as investment adviser or manager to other open-end and closed-end management investment companies and to separately managed accounts. The principal

business address for all of these investment companies and the persons named below is 333 West Wacker Drive, Chicago, Illinois 60606.

A

description of any other business, profession, vocation or employment of a substantial nature in which the directors and officers of Nuveen Fund Advisors or Nuveen Asset Management, LLC (“Nuveen Asset Management”) who serve as officers or

Trustees of the Registrant have engaged during the last two years for his or her own account or in the capacity of director, officer, employee, partner or trustee appears under “Management” in the Statement of Additional Information. Such

information for the remaining senior officers of Nuveen Fund Advisors appears below:

|

|

|

| Name and Position with Nuveen Fund Advisors |

|

Other Business, Profession, Vocation or

Employment During Past Two Years |

| Oluseun Salami, Executive Vice President and Chief Financial Officer |

|

Senior Vice President (since 2020) NIS/R&T, Inc.; Senior Vice President and Chief Financial Officer, Nuveen Alternative Advisors LLC

(since 2020), Teachers Advisors, LLC (since 2020), TIAA-CREF Asset Management LLC (since 2020) and TIAA-CREF Investment Management, LLC (since 2020); Executive Vice President (since 2022), formerly, Senior Vice President (2020-2022), and Chief

Financial Officer (since 2020), Nuveen, LLC; Executive Vice President and Chief Financial Officer (since 2021), Nuveen Investments, Inc.; Executive Vice President (since 2021), formerly, Senior Vice President, Chief Financial Officer (2018-2021),

formerly, Business Finance and Planning (2020) Chief Accounting Officer (2019-2020), Corporate Controller (2018-2020), Teachers Insurance and Annuity Association of America; Senior Vice President, Corporate Controller, College Retirement

Equities Fund, TIAA Board of Overseers, TIAA Separate Account VA-1, TIAA-CREF Funds, TIAA-CREF Life Funds (2018-2020). |

|

|

| Megan Sendlak, Managing Director and Controller |

|

Managing Director and Controller (since 2020) of Nuveen Alternatives Advisors LLC, Nuveen Asset Management, LLC, Nuveen Investments, Inc.,

Teachers Advisors, LLC and TIAA-CREF Investment Management, LLC; Managing Director and Controller (since 2020), formerly Assistant Controller (2019-2020) of Nuveen Securities, LLC; Managing Director and Controller (since 2020), formerly, Vice

President and Corporate Accounting Director (2018-2020) of Nuveen, LLC; Managing Director and Controller (since 2021) of NIS/R&T, INC.; formerly, Vice President and Controller of NWQ Investment Management Company, LLC and Santa Barbara Asset

Management, LLC (2020-2021); Vice President and Controller of Winslow Capital Management, LLC (since 2020). |

|

|

| Michael A. Perry, President |

|

Chief Executive Officer (since 2023), formerly, Co-Chief Executive Officer (2019-2023), Executive Vice President (2017-2019) and Managing Director (2015-2017) of Nuveen Securities, LLC; and

Executive Vice President (since 2017) of Nuveen Alternative Investments, LLC. |

C-8

|

|

|

| Name and Position with Nuveen Fund Advisors |

|

Other Business, Profession, Vocation or

Employment During Past Two Years |

| Erik Mogavero, Managing Director and Chief Compliance Officer |

|

Formerly employed by Deutsche Bank (2013- 2017) as Managing Director, Head of Asset Management and Wealth Management Compliance for the

Americas region and Chief Compliance Officer of Deutsche Investment Management Americas. |

Nuveen Asset Management serves as investment sub-adviser to the

Registrant and also serves as investment sub-adviser to other open-end and closed-end funds and investment adviser to separately

managed accounts. The following is a list of the remaining senior officers of Nuveen Asset Management. The principal business address for each person is 333 West Wacker Drive, Chicago, Illinois 60606.

|

|

|

| Name and Position with Nuveen Asset Management |

|

Other Business, Profession, Vocation or

Employment During Past Two Years |

| William T. Huffman, President |

|

Executive Vice President (since 2020) of Nuveen Securities, LLC and Nuveen, LLC; President, Nuveen Investments, Inc. (since 2020), Teachers Advisors, LLC and TIAA-CREF Investment Management, LLC (since 2019); Senior Managing

Director (since 2019) of Nuveen Alternative Advisors LLC; Senior Managing Director (since 2022) and Chairman (since 2019) of Churchill Asset Management LLC. |

|

|

| Stuart J. Cohen, Managing Director, Head of Legal and Assistant Secretary |

|

Managing Director and Assistant Secretary (since 2002) of Nuveen Securities, LLC; Managing Director (since 2007) and Assistant Secretary

(since 2003) of Nuveen Fund Advisors, LLC; Managing Director, Associate General Counsel and Assistant Secretary (since 2019) of Teachers Advisors, LLC; Managing Director, General Counsel and Assistant Secretary (since 2019) of TIAA-CREF Investment

Management, LLC; Vice President and Assistant Secretary (since 2008) of Winslow Capital Management, LLC; formerly, Vice President (2007-2021) and Assistant Secretary (2003-2021) of NWQ Investment Management Company, LLC; formerly Vice President

(2007-2021) and Assistant Secretary (2006-2021) of Santa Barbara Asset Management, LLC. |

|

|

| Travis M. Pauley, Managing Director and Chief Compliance Officer |

|

Regional Head of Compliance and Regulatory Legal (2013-2020) of AXA Investment Managers. |

|

|

| Megan Sendlak, Managing Director and Controller |

|

Managing Director and Controller (since 2020) of Nuveen Alternatives Advisors LLC, Nuveen Investments, Inc., Nuveen Fund Advisors, LLC,

Teachers Advisors, LLC and TIAA-CREF Investment Management, LLC; Managing Director and Controller (since 2020), formerly Assistant Controller (2019-2020) of Nuveen Securities, LLC; Managing Director and Controller (since 2020), formerly, Vice

President and Corporate Accounting Director (2018-2020) of Nuveen, LLC; Managing Director and Controller (since 2021) of NIS/R&T, INC., formerly, Vice President and Controller of NWQ Investment Management Company, LLC and Santa Barbara Asset

Management, LLC (2020-2021);Vice President and Controller of Winslow Capital Management, LLC (since 2020). |

C-9

Item 32: Location of Accounts and Records.

Nuveen Fund Advisors, LLC, 333 West Wacker Drive, Chicago, Illinois 60606, maintains the Fund’s Declaration of Trust, By-Laws, minutes of trustee and shareholder meetings, and contracts of the Registrant and all advisory material of the investment adviser. Nuveen Asset Management, LLC, in its capacity as sub-adviser, may also hold certain accounts and records of the Fund.

State Street Bank and Trust

Company, One Congress Street, Suite 1, Boston, Massachusetts 02114-2016, maintains all general and subsidiary ledgers, journals, trial balances, records of all portfolio purchases and sales, and all other required records not maintained by Nuveen

Fund Advisors or Nuveen Asset Management.

Item 33: Management Services.

Not applicable.

Item 34: Undertakings.

1. Not applicable.

2. Not applicable.

3. The Registrant undertakes:

(a) to file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(1) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(2) to reflect in the prospectus any facts or events after the effective date of the Registration Statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement; and

(3) to include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any

material change to such information in the Registration Statement.

Provided, however, that paragraphs (a)(1), (a)(2), and (a)(3) of this

section do not apply if the registration statement is filed pursuant to General Instruction A.2 of Form N-2 and the information required to be included in a post-effective amendment by those paragraphs is

contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference into the registration statement, or is

contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(b) that, for the purpose of

determining any liability under the Securities Act, each post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be

the initial bona fide offering thereof;

(c) to remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering; and

(d) that, for the purpose of determining liability under the

Securities Act to any purchaser:

(1) if the Registrant is relying on Rule 430B:

(A) Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant

to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (x), or (xi) under the Securities Act for the purpose of providing the information

required by Section 10 (a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after

C-10

effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person

that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made

in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(2) Not Applicable.

(e) that for

the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this

registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a

seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

(1) any preliminary prospectus or

prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424 under the Securities Act;

(2)

free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(3) the portion of any other free writing prospectus or advertisement pursuant to Rule 482 under the Securities Act relating to the offering

containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(4) any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

4. Not Applicable.

5. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each

filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference into the registration statement shall be deemed to be a new registration statement relating to

the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

6. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and

controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the

Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

7. The Registrant undertakes to send by first class mail or other means designed to ensure equally prompt delivery, within two

business days of receipt of a written or oral request, any prospectus or Statement of Additional Information.

C-11

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933 and the Investment Company Act of 1940, the Registrant has duly caused this Registration Statement

to be signed on its behalf by the undersigned, thereunto duly authorized, in this City of Chicago, and State of Illinois, on the 12th day of June 2023.

|

| NUVEEN AMT-FREE MUNICIPAL CREDIT INCOME FUND |

|

| /S/ MARK L. WINGET |

| Mark L. Winget, |

| Vice President and Secretary |

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed below by the

following persons in the capacities and on the date indicated.

|

|

|

|

|

|

|

|

|

| Signature |

|

Title |

|

|

|

|

|

Date |

| /S/ E. SCOTT

WICKERHAM E. SCOTT WICKERHAM |

|

Vice President and Controller (Principal Financial and Accounting Officer) |

|

|

|

|

|

June 12, 2023 |

|

|

|

|

|

| /S/ DAVID J. LAMB

DAVID J. LAMB |

|

Chief Administrative Officer (principal executive officer) |

|

|

|

|

|

June 12, 2023 |

|

|

|

|

|

| TERENCE J. TOTH* |

|

Chairman of the Board and Trustee |

|

ü

ï ï

ï

ï

ï

ï

ï

ï

ï

ý

ï

ï

ï

ï

ï

ï

ï

ï

ï

ï

ï

þ |

|

By:* |

|

/S/ MARK L. WINGET

MARK L. WINGET,

Attorney-in-Fact

June 12, 2023 |

| JACK B. EVANS* |

|

Trustee |

| WILLIAM C. HUNTER* |

|

Trustee |

| ALBIN F. MOSCHNER* |

|

Trustee |

| AMY B. R. LANCELLOTTA* |

|

Trustee |

| JOANNE T. MEDERO* |

|

Trustee |

| JOHN K. NELSON* |

|

Trustee |

| MATTHEW THORNTON III* |

|

Trustee |

|

|

|

|

| MARGARET L. WOLFF* |

|

Trustee |

|

|

|

|

|

|

|

|

|

| ROBERT L. YOUNG* |

|

Trustee |

|

|

|

|

|

|

|

|

|

|

|

| BY*: |

|

/s/ MARK L. WINGET |

|

|

|

|

Mark L. Winget |

|

|

|

|

Attorney-in-Fact |

|

|

|

|

June 12, 2023 |

|

|

| * |

Original powers of attorney authorizing Mark L. Winget, among others, to execute this Registration Statement,

and Amendments thereto, for the trustees of the Registrant on whose behalf this Registration Statement is filed, have been executed and are filed herewith as Exhibit s.1 to this Registration Statement. |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Name |

|

|

| EX-99.H3 |

|

Amendment, dated June 9, 2023, to Distribution Agreement |

|

|

| EX-99.H5 |

|

Amendment, dated June 9, 2023, to Dealer Agreement |

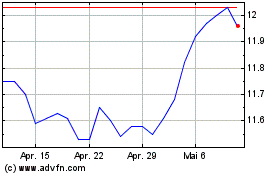

Nuveen AMT Free Municipa... (NYSE:NVG)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Nuveen AMT Free Municipa... (NYSE:NVG)

Historical Stock Chart

Von Mai 2023 bis Mai 2024