0001618563false00016185632023-12-292023-12-290001618563us-gaap:CommonClassAMember2023-12-292023-12-290001618563us-gaap:SeriesAPreferredStockMember2023-12-292023-12-290001618563us-gaap:SeriesBPreferredStockMember2023-12-292023-12-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

—————————

FORM 8-K

—————————

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 29, 2023

National Storage Affiliates Trust

(Exact name of registrant as specified in its charter) | | | | | | | | | | | |

Maryland | 001-37351 | 46-5053858 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

8400 East Prentice Avenue, 9th Floor

Greenwood Village, Colorado 80111

(Address of principal executive offices)

(720) 630-2600

(Registrant's telephone number, including area code)

—————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Common Shares of Beneficial Interest, $0.01 par value per share | NSA | New York Stock Exchange |

| Series A Cumulative Redeemable Preferred Shares of Beneficial Interest, par value $0.01 per share | NSA Pr A | New York Stock Exchange |

| Series B Cumulative Redeemable Preferred Shares of Beneficial Interest, par value $0.01 per share | NSA Pr B | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

—————————

ITEM 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 29, 2023, National Storage Affiliates Trust (the “Company”) amended and restated the LTIP Unit Award Agreements for the Company’s executive officers with respect to awards granted pursuant to agreements dated (i) February 26, 2021 (the “2021 Agreements”), (ii) March 15, 2022 and August 26, 2022 (the “2022 Agreements”), and (iii) February 27, 2023 and June 5, 2023 (the “2023 Agreements,” and together with the 2021 Agreements and the 2022 Agreements, the “Executive Award Agreements”). The Executive Award Agreements contain, among other things, performance-based vesting for a portion of the awards under which vesting is based in part on the Company’s three-year total shareholder return (“TSR”), relative to the TSRs of its four stock exchange-listed company self storage peers (such group, the “Peer Group” and such performance-based component, the “Peer TSR Component”).

As a result of a merger between two members of the Peer Group in July 2023 (the “Merger”) , one member of the Peer Group was eliminated as a standalone company and therefore, since the closing of the Merger the Peer Group includes only three other stock exchange-listed self storage companies. Accordingly, as the measurement period of the Peer TSR Component is over a three-year period, and each Peer Group member must be part of the Peer Group for the entirety of the measurement period, the Company’s Compensation, Nominating and Corporate Governance Committee (the “CNCG Committee”) determined that it would be appropriate to amend certain aspects of the Executive Award Agreements in which the Company’s performance was compared to the Peer Group for purposes of determining the portions of the awards that vest.

With respect to the amendment and restatement of the 2021 Agreements, the CNCG Committee revised these agreements to, among other things: (i) reduce the size of the Peer Group from four to three as a result of the Merger; and (ii) modify the Peer TSR Component to provide for no vesting of the relevant portion of the award if the Company was ranked fourth.

With respect to the amendment and restatement of the 2022 Agreements and the 2023 Agreements (the “Amended and Restated 2022 and 2023 Agreements”), the CNCG Committee revised these agreements to, among other things: (i) account for one less member in the Peer Group as with the amendment and restatement of the 2021 Agreements; (ii) modify the potential award under each of the 2022 Agreements and 2023 Agreements to now compare the Company’s TSR to the cumulative three-year weighted average of the Peer Group’s TSR (“Peer Group Weighted Average TSR”) plus or minus a certain number of basis points (previously the Company’s three-year relative TSR was compared to the three-year relative TSR of the Peer Group, with payout determined by achieving either fourth place for the minimum award, 110% of the Peer Group’s average TSR for the target award, or first place for the maximum award); and (iii) modify the allocation of performance-based long term incentive performance units (“LTIPs”) such that 30% (previously 50%) of the potential award is based on the Peer TSR Component and 70% (previously 50%) of the potential award vests based on a comparison of the Company’s three-year TSR relative to the MSCI US REIT Index, which allocation percentages would be subject to a 10% decrease (in the case of the Peer TSR Component) and a 10% increase (in the case of the component based on the MSCI US REIT Index) if another peer is removed from the SS Peer Group. As a result of these modifications, the fair value of the awards (on an accounting basis) in the Executive Award Agreements as of the accounting modification date of such agreements has decreased as compared to the fair value of the awards prior to modification.

The foregoing description of the Amended and Restated 2022 and 2023 Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the form of Amended and Restated 2022 and 2023 LTIP Unit Award Agreement, a copy of which is filed as Exhibit 10.1 to this Form 8-K and is incorporated by reference herein.

ITEM 9.01. Financial Statements and Exhibits.

The following exhibits are furnished with this report:

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 101 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| NATIONAL STORAGE AFFILIATES TRUST | | |

| | | |

| By: | /s/ David G. Cramer | | |

| David G. Cramer | | |

| President and Chief Executive Officer | | |

Date: January 4, 2024

NATIONAL STORAGE AFFILIATES TRUST

AMENDED AND RESTATED FORM OF 20[●] LTIP UNIT AWARD AGREEMENT

THE SECURITIES WHICH ARE THE SUBJECT OF THIS AGREEMENT HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH SALE OR DISPOSITION MAY BE EFFECTED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933.

This Amended and Restated 20[●] LTIP Unit Award Agreement (this "Agreement") is made as of [●] (the "Amendment Date") by and between National Storage Affiliates Trust (the "Company" or "NSA"), in its sole capacity as general partner of NSA OP, LP (the "Partnership") and [●] (the "Grantee"). The Company and Grantee are parties to a 20[●] LTIP Unit Award Agreement (the "Prior Agreement"), made as of [●] (the "Date of Grant"). The parties acknowledge that the purpose of this Agreement, which is an amendment and restatement of the Prior Agreement, is to modify the vesting provisions of the Prior Agreement, provided that nothing contained in this Agreement shall (a) constitute a new grant of LTIP Units or (b) otherwise affect the Date of Grant or the Vesting Period (as defined below).

1. Grant of LTIP Units. The Company, in its sole capacity as general partner of the Partnership, awarded the Grantee [●] LTIP Units (the "LTIP Units") in the Partnership on the Date of Grant. The LTIP Units are subject to the terms and conditions of this Agreement and subject to the provisions of the Company's 2015 Equity Incentive Plan (the "Plan") and the Third Amended and Restated Limited Partnership Agreement of the Partnership, dated as of April 28, 2015 (as amended, the "Partnership Agreement"). The Plan is hereby incorporated herein by reference as though set forth herein in its entirety. Definitions not included herein shall have the meaning set forth in the Plan and Partnership Agreement, as applicable.

2. Restrictions and Conditions. The LTIP Units are subject to the following restrictions and conditions, in addition to any requirements or restrictions set forth with respect to LTIP Units in the Plan and the Partnership Agreement:

(a) [●] LTIP Units shall vest as specified in Annex A attached hereto (the "Time Vested LTIP Units") and [●] LTIP Units, representing the maximum number of LTIP Units that can vest based on performance, shall vest as specified in Annex B attached hereto (the "Performance Vested LTIP Units"). Subject to paragraph 5(b) below, during the period prior to the full vesting of any LTIP Unit (the "Vesting Period"), the Grantee shall not be permitted voluntarily or involuntarily to sell, transfer, pledge, hypothecate, alienate, encumber or assign such LTIP Unit (or have such LTIP Unit attached or garnished).

(b) Except as provided in the foregoing paragraph (a), below in this paragraph (b) or in the Plan, the Grantee shall have, in respect of the LTIP Units, all of the rights of a holder of LTIP Units as set forth in the Partnership Agreement. Distributions and allocations with respect to the LTIP Units shall be made to the Grantee in accordance with the terms of the Partnership Agreement, except that the Grantee, during the Vesting Period, shall be entitled to receive distributions (1) with respect to each Time Vested LTIP Unit, equal to and concurrently with each distribution paid to a holder of a Class A OP Unit as distributions on Class A OP Units are made and (2) with respect to each Performance Vested LTIP Unit at the "Maximum Level" (as set forth on Annex B), equal to ten percent (10%) of the distributions payable with respect to each distribution paid to a holder of a Class A OP Unit as distributions on Class A OP

Units are made (the "Interim Distributions"). Upon the completion of the Vesting Period, Grantee shall be entitled to receive an amount equal to (1) the distributions payable during the Vesting Period with respect to a number of Class A OP Units of the Partnership that is identical to the actual number of Performance Vested LTIP Units earned pursuant to Annex B, less (2) the amount of the Interim Distributions (such amount, the "Performance Distribution"). After the completion of the Vesting Period, Grantee shall be entitled to receive distributions on each vested LTIP Unit equal to distributions paid to a holder of a Class A OP Unit as distributions on Class A OP Units are made.

(c) Subject to paragraphs (e) and (f) below, if the Grantee has a Termination of Service prior to the completion of the Vesting Period (i) by reason of the Grantee's death or (ii) on account of the Grantee's Disability (as defined in Grantee's employment agreement with the Company dated [●] (the "Employment Agreement")), then (1) upon the completion of the Vesting Period, the portion of the Performance Vested LTIP Units that become vested and nonforfeitable, if any, shall be determined at such time in accordance with Annex B, as if Grantee had not had a Termination of Service prior to the completion of the Vesting Period, (2) upon the completion of the Vesting Period, the Grantee shall receive the amount of the Performance Distribution that would have been paid upon the completion of the Vesting Period if Grantee had not had a Termination of Service prior to the completion of the Vesting Period, and (3) a prorated portion of such Time Vested LTIP Units shall immediately vest calculated by multiplying the total number of Time Vested LTIP Units otherwise eligible to vest on the next vesting date by a fraction, the numerator of which is (y) the number of days of employment or service, as applicable, since the immediately prior January 1st until the date of the Grantee's death or Disability, as applicable, and the denominator of which is (z) 365.

(d) Subject to paragraphs (e) and (f) below, if the Grantee has a Termination of Service prior to the completion of the Vesting Period (i) without Cause (as defined in the Employment Agreement) or (ii) for Good Reason (as defined in the Employment Agreement) prior to the completion of the Vesting Period, then all outstanding LTIP Units shall immediately vest and become free of restrictions.

(e) Upon the completion of the Vesting Period, or, if earlier, the Grantee's Termination of Service for any reason other than as specified above in paragraphs (c) and (d), all LTIP Units granted hereunder that have not vested will be forfeited without payment of any consideration, and neither the Grantee nor his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in such LTIP Units.

(f) If the Grantee commences or continues service as a director or consultant of the Company upon termination of employment, such continued service shall be treated as continued employment hereunder (and for purposes of the Plan), and the subsequent termination of service shall be treated as the applicable Termination of Service for purposes of this Agreement.

(g) For purposes of this Agreement, a Termination of Service shall occur when the employee-employer relationship or trusteeship, or other service relationship, between the Grantee and the Company is terminated for any reason, including, but not limited to, any termination by resignation, discharge, death or retirement under the Employment Agreement. The Compensation Committee, in its absolute discretion, shall determine the effects of all matters and questions relating to termination of service. For this purpose, the service relationship shall be treated as continuing intact while the Grantee is on sick leave or other bona fide leave of absence (to be determined in the discretion of the Compensation Committee).

(h) Notwithstanding anything in this Agreement to the contrary, Unvested LTIP Units shall be forfeited without consideration by the Grantee upon the Grantee's breach of any of the restrictive covenants contained in the Employment Agreement.

3. Certain Terms of LTIP Units.

(a) The Company may, but is not obligated to, issue to the Grantee (or its assignee or transferee, as applicable) a certificate in respect of the LTIP Units or may indicate such Grantee's ownership of LTIP Units on the Company's books and records. Such certificate, if any, shall be registered in the name of the Grantee (or such assignee or transferee). The certificates for LTIP Units issued hereunder may include any legend which the Compensation Committee deems appropriate to reflect any restrictions on transfer hereunder, or pursuant to any assignment or transfer by the Grantee, or as the Compensation Committee may otherwise deem appropriate, and, without limiting the generality of the foregoing, shall bear a legend referring to the terms, conditions, and restrictions applicable to such LTIP Units, substantially in the following form:

THE TRANSFERABILITY OF THIS CERTIFICATE AND THE LTIP UNITS REPRESENTED HEREBY ARE SUBJECT TO THE TERMS AND CONDITIONS OF THE NATIONAL STORAGE AFFILIATES TRUST 2015 EQUITY INCENTIVE PLAN, THE PARTNERSHIP AGREEMENT AND AN AWARD AGREEMENT APPLICABLE TO THE GRANT OF THE LTIP UNITS REPRESENTED BY THIS CERTIFICATE. COPIES OF SUCH PLAN, PARTNERSHIP AGREEMENT AND AWARD ARE ON FILE IN THE OFFICES OF NSA OP, LP.

(b) Certificates, if any, evidencing the LTIP Units granted hereby shall be held in custody by the Company until the restrictions have lapsed. If and when such restrictions so lapse, the certificates shall be delivered by the Company to the Grantee.

(c) So long as the Grantee holds any LTIP Units, the Grantee shall disclose to the Company in writing such information as may be reasonably requested with respect to ownership of LTIP Units and any conditions applicable thereto, as the Company, as applicable, may deem reasonably necessary, including in order to ascertain and establish compliance with provisions of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to the Company or to comply with requirements of any other appropriate taxing or other regulatory authority.

4. Compliance with Securities laws. The Grantee acknowledges that the LTIP Units have not been registered under the Securities Act or under any state securities or “blue sky” law or regulation (collectively, "Securities Laws") and hereby makes the following representations and covenants as a condition to the grant of LTIP Units:

(a) The Grantee has not taken, and covenants that it will not take, himself or herself or through any agent acting on his behalf, any action that would subject the issuance or sale of the LTIP Units to the registration provisions of the Securities Act or to the registration, qualification or other similar provisions of any Securities Laws, or breach any of the provisions of any Securities Laws, but, rather, that the Grantee shall at all times act with regard to the LTIP Units in full compliance with all Securities Laws;

(b) The Grantee has acquired and, to the extent applicable, is acquiring the LTIP Units for his or her own account for investment and with no present intention of distributing the LTIP Units or any part thereof;

(c) The Grantee is and shall be an "accredited investor" as defined in Section 2(15) and Rule 501(a) of Regulation D of the Securities Act;

(d) The Grantee is capable of evaluating the merits and risks of the acquisition and ownership of the LTIP Units and has obtained all information regarding the Company (and its applicable affiliates) and the LTIP Units as the Grantee deems appropriate, and has relied solely upon such information, and the Grantee's own knowledge, experience and investigation, and those of his advisors, and not upon any representations of the Company, in connection with his investment decision in acquiring the LTIP Units; and

(e) The Grantee and his or her professional advisors have had an opportunity to conduct, and have so conducted if so desired, a due diligence investigation of the Company in connection with the decision to acquire the LTIP Units and in such regard have done all things as the Grantee and they have deemed appropriate and have had an opportunity to ask questions of and receive answers from the Company, and have done so, as they have deemed appropriate.

5. Miscellaneous.

(a) THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE, WITHOUT REGARD TO ANY PRINCIPLES OF CONFLICTS OF LAW WHICH COULD CAUSE THE APPLICATION OF THE LAWS OF ANY JURISDICTION OTHER THAN THE STATE OF DELAWARE.

(b) Except as set forth in the Partnership Agreement, the Grantee shall not have the right to transfer all or any portion of the LTIP Units without the prior written consent of the General Partner (in its sole discretion); provided, however, that the Grantee may transfer all or any portion of the Grantee's vested LTIP Units for bona fide estate planning purposes to an immediate family member or the legal representative, estate, trustee or other successor in interest, as applicable, of the Grantee. Any transfer in violation of this Agreement or the Partnership Agreement, or which does not otherwise comply with the conditions of transfer imposed by the General Partner shall be void.

(c) The captions of this Agreement are not part of the provisions hereof and shall have no force or effect. This Agreement may not be amended or modified except by a written agreement executed by the parties hereto or their respective successors and legal representatives. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement.

(d) The Compensation Committee may make such rules and regulations and establish such procedures for the administration of this Agreement as it deems appropriate. Without limiting the generality of the foregoing, the Compensation Committee may interpret the Plan and this Agreement, with such interpretations to be conclusive and binding on all persons and otherwise accorded the maximum deference permitted by law. In the event of any dispute or disagreement as to interpretation of the Plan or this Agreement or of any rule, regulation or procedure, or as to any question, right or obligation arising from or related to the Plan or this Agreement, the decision of the Compensation Committee shall be final and binding upon all persons.

(e) All notices hereunder shall be in writing, and if to the Company or the Compensation Committee, shall be delivered to the Company or mailed to its principal office, addressed to the attention of the Compensation Committee; and if to the Grantee, shall be delivered personally, sent by facsimile transmission or mailed to the Grantee at the address appearing in the records of the Company. Such addresses may be changed at any time by written notice to the other party given in accordance with this paragraph 5(e).

(f) The failure of the Grantee or the Company to insist upon strict compliance with any provision of this Agreement or the Plan, or to assert any right the Grantee or the Company, respectively, may have under this Agreement or the Plan, shall not be deemed to be a waiver of such provision or right or any other provision or right of this Agreement or the Plan.

(g) Nothing in this Agreement shall confer on the Grantee any right to continue in the employ or other service of the Company or interfere in any way with the right of the Company or its affiliates to terminate the Grantee's employment or other service at any time.

(h) The terms of this Agreement shall be binding upon the Grantee and upon the Grantee's heirs, executors, administrators, personal representatives, transferees, assignees and successors in interest and upon the Company and its successors and assignees, subject to the terms of the Plan.

(i) Notwithstanding anything to the contrary contained in this Agreement, to the extent that the board of trustees of the Company (the "Board") determines that an LTIP Unit or the Plan is subject to

Section 409A of the Code and fails to comply with the requirements of Section 409A of the Code, the Compensation Committee reserves the right (without any obligation to do so or to indemnify the Grantee for failure to do so), without the consent of the Grantee, to amend or terminate this Agreement and the Plan and/or amend, restructure, terminate or replace the LTIP Unit in order to cause the LTIP Unit to either not be subject to Section 409A of the Code or to comply with the applicable provisions of such section.

(j) If, in the opinion of the independent trustees of the Board, the Company's financial results are restated due in whole or in part to intentional fraud or misconduct by one or more of the Company's executive officers, the Company's independent trustees may, based upon the facts and circumstances surrounding the restatement, direct that the Company recover all or a portion of, or cancel, the awards granted under this Agreement.

(k) This Agreement, together with the Plan and Partnership Agreement, contain the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements, written or oral, with respect thereto.

IN WITNESS WHEREOF, the Company and the Grantee have executed this Agreement on the date first written above.

NATIONAL STORAGE AFFILIATES TRUST

By: __________________________________

Name:

Title:

GRANTEE

By: __________________________________

Name:

Title:

ANNEX A

Time Vested LTIP Units

Subject to Section 2 of this Agreement, the [●] Time Vested LTIP Units shall otherwise vest on the following dates:

| | | | | | | | | | | |

| Percentage (Amount) of Time Vested LTIP Units Awarded Hereunder | | Vesting Date | |

| [●]% ([●]) | | January 1, 20[●] | |

| [●]% ([●]) | | January 1, 20[●] | |

| [●]% ([●]) | | January 1, 20[●] | |

ANNEX B

PERFORMANCE VESTED LTIP UNITS

Subject to Section 2 of this Agreement, the [●] Performance Vested LTIP Units shall be subject to the following vesting rules during the period between January 1, 20[●] and December 31, 20[●] (the "Performance Period") and shall vest on January 1, 20[●], subject to the achievement of the performance criteria set forth below:

1. Subject to the next two sentences in this paragraph, 70% of the Performance Vested LTIP Units shall vest in accordance with Section 2 of this Annex B and 30% of the Performance Vested LTIP Units shall vest in accordance with Section 3 of this Annex B. If a Peer Group member ceases to exist or ceases to be listed on a national securities exchange during the Performance Period, such Peer Group member shall automatically be removed from the Peer Group. The percentage of Performance Vested LTIP Units that shall vest in accordance with Section 2 shall thereby increase by 10% for each Peer Group member removed, and the percentage of Performance Vested LTIP Units that shall vest in accordance with Section 3 shall correspondingly decrease by 10% for each Peer Group member removed.

2. As of the date of this Agreement, 70% of the Performance Vested LTIP Units shall vest as follows (the "Maximum MSCI Allocation"):

| | | | | | | | | | | |

| NSA 3-Year TSR vs. MSCI US REIT Index (RMS) | Vesting Percentage | Number of Units |

| "Minimum Level" | 35th Percentile | 25% | [●] |

| "Target Level" | 55th Percentile | 50% | [●] |

| "Maximum Level" | 75th Percentile | 100% | [●] |

In the event NSA's 3-Year TSR vs. MSCI US REIT Index falls between the 35th and 55th percentile, the Vesting Percentage shall be determined using a straight-line linear interpolation between 25% and 50% and in the event that NSA's 3-Year TSR vs. MSCI US REIT Index falls between the 55th and 75th percentile, the Vesting Percentage shall be determined using a straight-line linear interpolation between 50% and 100%. In the event NSA's 3-Year TSR vs. MSCI US REIT Index is below the 35th percentile, the Vesting Percentage and number of Performance Vested LTIP Units vesting shall equal 0%. In the event NSA's 3-Year TSR vs. MSCI US REIT Index exceeds the 75th percentile, the Vesting Percentage shall not exceed 100%. Once the applicable Vesting Percentage is determined, it shall be multiplied against the Maximum MSCI Allocation Performance Vested LTIP Units to determine the total number of Performance Vested LTIP Units vesting.

3. As of the date of this Agreement, 30% of the Performance Vested LTIP Units shall vest as follows (the "Maximum Peer Group Allocation"):

| | | | | | | | | | | |

| NSA 3-Year TSR vs 3-Year Peer Group Weighted Average TSR | Vesting Percentage | Number of Units |

| "Minimum Level" | 3-Year Peer Group Weighted Average TSR less 750 basis points | 25% | [●] |

| "Target Level" | 3-Year Peer Group Weighted Average TSR plus 100 basis points | 50% | [●] |

| "Maximum Level" | 3-Year Peer Group Weighted Average TSR plus 750 basis points | 100% | [●] |

In the event NSA's 3-Year TSR vs. the 3-Year Peer Group Weighted Average TSR falls between the "Minimum Level" and the "Target Level," the Vesting Percentage shall be determined using a straight-line linear interpolation between 25% and 50% and in the event that NSA's 3-Year TSR vs. the 3-Year Peer Group Weighted Average TSR falls between the "Target Level" and the "Maximum Level," the Vesting Percentage shall be determined using a straight-line linear interpolation between 50% and 100%. In the event NSA's 3-Year TSR vs. the 3-Year Peer Group Weighted Average TSR is below the "Minimum Level," the Vesting Percentage and number of Performance Vested LTIP Units vesting shall equal 0%. In the event NSA's 3-Year TSR vs. the 3-Year Peer Group Weighted Average TSR exceeds the "Maximum Level," the Vesting Percentage shall not exceed 100%. Once the applicable Vesting Percentage is determined, it shall be multiplied against the Maximum Peer Group Allocation Performance Vested LTIP Units to determine the total number of Performance Vested LTIP Units vesting.

4. For purposes of this Annex B, TSR performance will be calculated as the growth rate, expressed as a percentage (rounded to the nearest tenth of a percent (0.1%)), in the value per share of common stock during the Performance Period due to the appreciation in the price per share of common stock and dividends paid during the Performance Period, assuming dividends are reinvested. The TSR performance is calculated as follows:

•"Cumulative TSR" = ((1*(1 + TSR Year 1)*(1 + TSR Year 2)*(1 + TSR Year 3)) -1)

•For purposes of the Cumulative TSR calculation, "TSR" for a given year shall be calculated as follows:

Where "D" is the amount of dividends paid to a shareholder of record with respect to one share of common stock during the Performance Period, and assuming such dividend is reinvested. For purposes of the calculation above, the "Ending Share Price" for the last year (third year) of performance shall be based on a 20 day trailing average closing stock price.

5. The Cumulative TSR of NSA will be compared with the Cumulative TSR of each company in the MSCI US REIT Index, determined at the beginning of the Performance Period. The relative performance of NSA versus the other companies in the MSCI US REIT Index will be expressed in terms of relative percentile ranking, which shall be applied as set forth in the table in Section 2 above.

6. The Cumulative TSR of NSA will be compared with the 3-Year Peer Group Weighted Average TSR as set forth in Section 3 above. The "3-Year Peer Group Weighted Average TSR" means the sum of all Peer Group Individual Weighted Average TSRs. The "Peer Group Individual Weighted Average TSR" with respect to any Peer Group member is calculated as follows

•"Enterprise Value" means the sum, determined as of the first day of the Performance Period by the Compensation Committee, of a Peer Group member’s: (x) Common Equity Capitalization, (y) preferred equity capitalization and (z) debt capitalization, without duplication, based on the most recent publicly available information disclosed in a filing with the Securities and Exchange Commission prior to the date on which the determination is made.

•"Common Equity Capitalization" means a Peer Group member's common equity capitalization on a fully diluted basis, assuming the conversion of all convertible securities and prior exchange on a one-for-one basis of all outstanding units in such self-storage company's operating partnership for common shares or other securities.

7. For purposes of this Annex B, the current members of the "Peer Group" are:

•CubeSmart

•Extra Space Storage Inc.

•Public Storage

In order for a Peer Group member to be included in the calculation for ascertaining the level of relative TSR performance under Section 3 of this Annex B, the Peer Group member must be present for the entire Performance Period. If a Peer Group member is removed from the Peer Group (for example, as a result of being acquired during the Performance Period), such Peer Group member shall be entirely omitted from the calculation.

v3.23.4

Document and Entity Information Document

|

Dec. 29, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 29, 2023

|

| Entity Registrant Name |

National Storage Affiliates Trust

|

| Entity Central Index Key |

0001618563

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-37351

|

| Entity Tax Identification Number |

46-5053858

|

| Entity Address, Address Line One |

8400 East Prentice Avenue, 9th Floor

|

| Entity Address, City or Town |

Greenwood Village

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80111

|

| City Area Code |

720

|

| Local Phone Number |

630-2600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Shares of Beneficial Interest, $0.01 par value per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Shares of Beneficial Interest, $0.01 par value per share

|

| Trading Symbol |

NSA

|

| Security Exchange Name |

NYSE

|

| Series A Cumulative Redeemable Preferred Shares of Beneficial Interest, par value $0.01 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series A Cumulative Redeemable Preferred Shares of Beneficial Interest, par value $0.01 per share

|

| Trading Symbol |

NSA Pr A

|

| Security Exchange Name |

NYSE

|

| Series B Cumulative Redeemable Preferred Shares of Beneficial Interest, par value $0.01 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series B Cumulative Redeemable Preferred Shares of Beneficial Interest, par value $0.01 per share

|

| Trading Symbol |

NSA Pr B

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

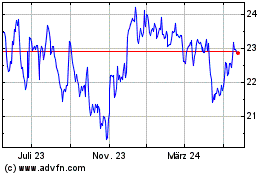

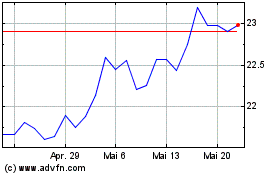

National Storage Affilia... (NYSE:NSA-A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

National Storage Affilia... (NYSE:NSA-A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024