false

0001171486

0001171486

2024-02-14

2024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 14, 2024

|

NATURAL RESOURCE PARTNERS LP

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware

|

001-31465

|

35-2164875

|

|

(State or other jurisdiction

of incorporation or organization)

|

(Commission File

Number)

|

(I.R.S. Employer

Identification No.)

|

| |

|

1415 Louisiana St., Suite 3325

Houston, Texas 77002

|

|

(Address of principal executive office) (Zip Code)

|

| |

|

(713) 751-7507

|

|

Registrant’s telephone number, including area code

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Units representing limited partner interests

|

|

NRP

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01. Entry Into a Material Definitive Agreement

The information under Item 2.03 below is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On February 1, 2024, NRP (Operating) LLC (“OpCo”) exercised its option under the Third Amended and Restated Credit Agreement, dated as of June 16, 2015 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Facility”), to increase the total aggregate commitment under the Credit Facility by $15.0 million from $185.0 million to $200.0 million. The increase in the total aggregate commitment is being made pursuant to an accordion feature of the Credit Facility. The Credit Facility otherwise continues to operate under its existing terms and conditions in all material respects.

In connection with this increase, Frost Bank increased its commitment by $15.0 million from $25.0 million to $40.0 million, pursuant to that certain Commitment Increase Agreement by and among OpCo, Zions Bancorporation, N.A. dba Amegy Bank, in its capacity as administrative agent under the Credit Facility, and Frost, Bank dated as of February 14, 2024 (the “Commitment Increase Agreement”). The Commitment Increase Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K. The summary of the Commitment Increase Agreement does not purport to be complete and is qualified in its entirety by reference to Exhibit 10.1.

Item 8.01. Other Events

On February 14, 2024 (the "exercise date"), holders of Natural Resource Partners L.P.'s (the "Partnership's") warrants to purchase common units ("warrants") exercised 500,000 warrants with a strike price of $34.00. The 15-day VWAP ending on the business day prior to the exercise date was $93.47. On February 16, 2024, the Partnership settled the warrants on a net basis with $29.7 million in cash. Of the originally issued 4.0 million warrants, 0.3 million warrants with a strike price of $34.00 remain outstanding.

Item 9.01. Financial Statements and Exhibits

|

(d)

|

Exhibits.

|

| |

|

| 10.1 |

Commitment Increase Agreement dated as of February 14, 2024, by and among NRP (Operating) LLC, Zions Bancorporation, N.A. dba Amegy Bank, and Frost Bank |

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NATURAL RESOURCE PARTNERS L.P.

(Registrant)

|

|

|

|

|

|

|

|

|

By:

|

NRP (GP) LP

|

|

|

|

|

its General Partner

|

|

|

|

|

|

|

| |

By: |

GP Natural Resource Partners LLC |

|

| |

|

its General Partner |

|

| |

|

|

|

| Date: February 20, 2024 |

|

/s/ Philip T. Warman |

|

| |

|

Philip T. Warman |

|

| |

|

General Counsel |

|

Exhibit 10.1

COMMITMENT INCREASE AGREEMENT

This Commitment Increase Agreement dated as of February 14, 2024 (this “Agreement”) is among (i) NRP (Operating) LLC (the “Borrower”), (ii) Zions Bancorporation, N.A. dba Amegy Bank, in its capacity as administrative agent (the “Administrative Agent”) under the Third Amended and Restated Credit Agreement dated as of June 16, 2015 (as amended by the First Amendment to Third Amended and Restated Credit Agreement dated as of June 3, 2016, the Second Amendment to Third Amended and Restated Credit Agreement dated as of March 2, 2017, the Third Amendment to Third Amended and Restated Credit Agreement dated as of January 18, 2019, the Fourth Amendment to Third Amended and Restated Credit Agreement dated as of April 3, 2019, the Master Assignment and Fifth Amendment to Third Amended and Restated Credit Agreement dated as of August 9, 2022, the Sixth Amendment to Third Amended and Restated Credit Agreement dated as of May 11, 2023, and as further amended, restated, supplemented, or otherwise modified from time to time, the “Credit Agreement”; capitalized terms that are defined in the Credit Agreement and not defined herein are used herein as therein defined) among the Borrower, the Administrative Agent and the Lenders party thereto, and (iii) Frost Bank (the “Increasing Lender”).

Preliminary Statements

(A) Pursuant to Section 2.18 of the Credit Agreement, the Borrower has the right, subject to the terms and conditions thereof, to effectuate from time to time an increase in the total Commitments under the Credit Agreement by agreeing with a Lender to increase that Lender’s Commitment.

(B) The Borrower has given notice to the Administrative Agent of its intention to increase the total Commitments pursuant to such Section 2.18 by increasing the Commitment of the Increasing Lender from $25,000,000 to $40,000,000, and the Administrative Agent is willing to consent thereto.

Accordingly, the parties hereto agree as follows:

SECTION 1. Increase of Commitment. Pursuant to Section 2.18 of the Credit Agreement, the Commitment of the Increasing Lender is hereby increased from $25,000,000 to $40,000,000.

SECTION 2. Consent. The Administrative Agent hereby consents to the increase in the Commitment of the Increasing Lender effectuated hereby.

SECTION 3. Governing Law. This Agreement shall be governed by, and construed in accordance with, the Laws of the State of New York.

SECTION 4. Execution in Counterparts. This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement.

SECTION 5. Increasing Lender Credit Decision. The Increasing Lender acknowledges that it has, independently and without reliance upon the Administrative Agent or any other Lender and based on the financial statements referred to in Section 3.05 of the Credit Agreement or the most recent financial statements delivered pursuant to Section 5.01 thereof and such other documents and information as it has deemed appropriate, made its own credit analysis and decision to enter into this Agreement and to agree to the various matters set forth herein. The Increasing Lender also acknowledges that it will, independently and without reliance upon the Administrative Agent or any other Lender and based on such documents and information as it shall deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Credit Agreement.

SECTION 6. Representation and Warranties of the Borrower. The Borrower represents and warrants as follows:

(a) The execution, delivery and performance by the Borrower of this Agreement are within the Borrower’s corporate powers, have been duly authorized by all necessary limited liability company action and do not contravene (i) the Borrower’s certificate of incorporation or by-laws (or equivalent governing documents) or (ii) any indenture, loan agreement or other similar agreement or instrument binding on the Borrower.

(b) No authorization, consent or approval of any governmental body or agency is required for the valid execution, delivery and performance by the Borrower of this Agreement.

(c) This Agreement constitutes a valid and binding agreement of the Borrower enforceable against the Borrower in accordance with its terms, subject to applicable bankruptcy, insolvency or similar laws affecting creditors’ rights generally and equitable principles of general applicability.

(d) The aggregate amount of the Commitments under the Credit Agreement, including any increases pursuant to Section 2.18 thereof, does not exceed $200,000,000.

(e) As of the date hereof, no Default or Event of Default has occurred and is continuing.

(f) The Borrower is in compliance with the covenants set forth in Sections 6.16 and 6.17 of the Credit Agreement (assuming the Commitments, as hereby increased, are fully drawn).

SECTION 7. Expenses. The Borrower agrees to pay all reasonable costs and expenses of the Administrative Agent within ten Business Days after notice thereof in connection with the preparation, negotiation, execution and delivery of this Agreement, including, without limitation, the reasonable fees and out-of-pocket expenses of one counsel for the Administrative Agent with respect thereto.

SECTION 8. Effectiveness. When, and only when, the Administrative Agent shall have received (a) counterparts of, or telecopied signature pages of, this Agreement executed by the Borrower, the Administrative Agent and the Increasing Lender and (b) a certificate of a Financial Officer of the Borrower confirming the representation and warranty set forth in Section 6(f) hereof, this Agreement shall become effective as of the date first written above.

[Signatures appear on the following pages]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed by their respective officers thereunder duly authorized, as of the date first above written.

| |

BORROWER:

|

|

| |

|

|

| |

NRP (OPERATING) LLC,

|

|

| |

a Delaware limited liability company

|

|

| |

|

|

| |

By: /s/ Christopher J. Zolas

|

|

| |

Name: Christopher J. Zolas

|

|

| |

Title: Chief Financial Officer

|

|

[Signature Page to Commitment Increase Agreement]

| |

ADMINISTRATIVE AGENT:

|

|

| |

|

|

| |

ZIONS BANCORPORATION, N.A. dba AMEGY BANK,

|

|

| |

|

|

| |

By: /s/ John N. Moffitt

|

|

| |

John N. Moffitt

|

|

| |

Senior Vice President

|

|

[Signature Page to Commitment Increase Agreement]

| |

INCREASING LENDER:

|

|

| |

|

|

| |

Frost Bank |

|

| |

|

|

| |

By: /s/ Carly Bylund

|

|

| |

Name: Carly Bylund

|

|

| |

Title: Assistant Vice President

|

|

[Signature Page to Commitment Increase Agreement]

v3.24.0.1

Document And Entity Information

|

Feb. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NATURAL RESOURCE PARTNERS LP

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 14, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-31465

|

| Entity, Tax Identification Number |

35-2164875

|

| Entity, Address, Address Line One |

1415 Louisiana St., Suite 3325

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

751-7507

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Units representing limited partner interests

|

| Trading Symbol |

NRP

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001171486

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

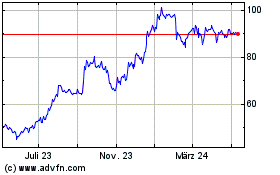

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

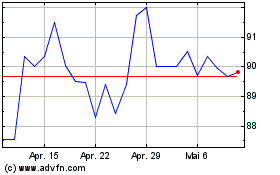

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024