UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

RULE 13e-3 TRANSACTION STATEMENT UNDER SECTION

13(E)

OF THE SECURITIES EXCHANGE ACT OF 1934

Navios

Maritime Holdings Inc.

(Name of the Issuer)

Navios

Maritime Holdings Inc.

N Logistics Holdings Corporation

Navigation Merger Sub Inc.

N Shipmanagement Acquisition Corp.

Angeliki Frangou

(Names

of Persons Filing Statement)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

Y62197119

(CUSIP Number

of Class of Securities)

|

|

|

| Navios Maritime Holdings Inc.

Strathvale House, 90 N Church Street

P.O. Box 309, Grand Cayman

KY1-1104 Cayman Islands

Attn: Vasiliki Papaefthymiou, Esq.

Telephone: +1 345 232 3067 |

|

N Logistics Holdings Corporation

Navigation Merger Sub Inc.

N Shipmanagement Acquisition Corp.

Angeliki Frangou 85 Akti

Miaouli Street Piraeus, Greece 185 38

Attn: Vasiliki Papaefthymiou, Esq.

Telephone: +302104595000 |

(Name, Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of

the Persons Filing Statement)

With copies to

|

|

|

|

|

| Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza New

York, NY 10004 Attn: Philip Richter

(212) 859-8000 |

|

Latham & Watkins LLP

811 Main Street, Suite 3700

Houston, TX 77002 Attn:

Ryan J. Maierson; Nick S. Dhesi (713) 546-5400 |

|

Thompson Hine LLP

300 Madison Avenue, 27th Floor

New York, NY 10017 Attn:

Todd E. Mason (212) 344-5680 |

This statement is filed in connection with (check the appropriate box):

|

|

|

|

|

| a. |

|

☐ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

|

|

|

| b. |

|

☐ |

|

The filing of a registration statement under the Securities Act of 1933. |

|

|

|

| c. |

|

☐ |

|

A tender offer. |

|

|

|

| d. |

|

☒ |

|

None of the above. |

Check the following box if the soliciting

materials or information statement referred to in checking box (a) are preliminary copies: ☐

Check the following

box if the filing is a final amendment reporting the results of the transaction: ☐

NEITHER THE SECURITIES AND

EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS TRANSACTION STATEMENT

ON SCHEDULE 13E-3. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

INTRODUCTION

This Rule 13e-3 transaction statement on Schedule 13E-3,

together with the exhibits hereto (this “Transaction Statement”), is being filed with the SEC pursuant to Section 13(e) of the Exchange Act jointly by the following persons (each, a “Filing Person,” and collectively, the

“Filing Persons”): (a) Navios Maritime Holdings Inc., a corporation organized under the laws of the Republic of the Marshall Islands corporation (the “Company”), the issuer of common stock, par value $0.0001 per share (the

“Company Common Stock”), (b) N Logistics Holdings Corporation, a corporation organized under the laws of the Republic of the Marshall Islands (“NLHC”) and controlled by Ms. Angeliki Frangou, (c) Navigation Merger Sub

Inc., a corporation organized under the laws of the Republic of the Marshall Islands and a wholly owned subsidiary of NLHC (“Merger Sub”), (d) N Shipmanagement Acquisition Corp., a corporation organized under the laws of the Republic of

the Marshall Islands (“NSC”) and controlled by Ms. Angeliki Frangou, and (e) Ms. Angeliki Frangou.

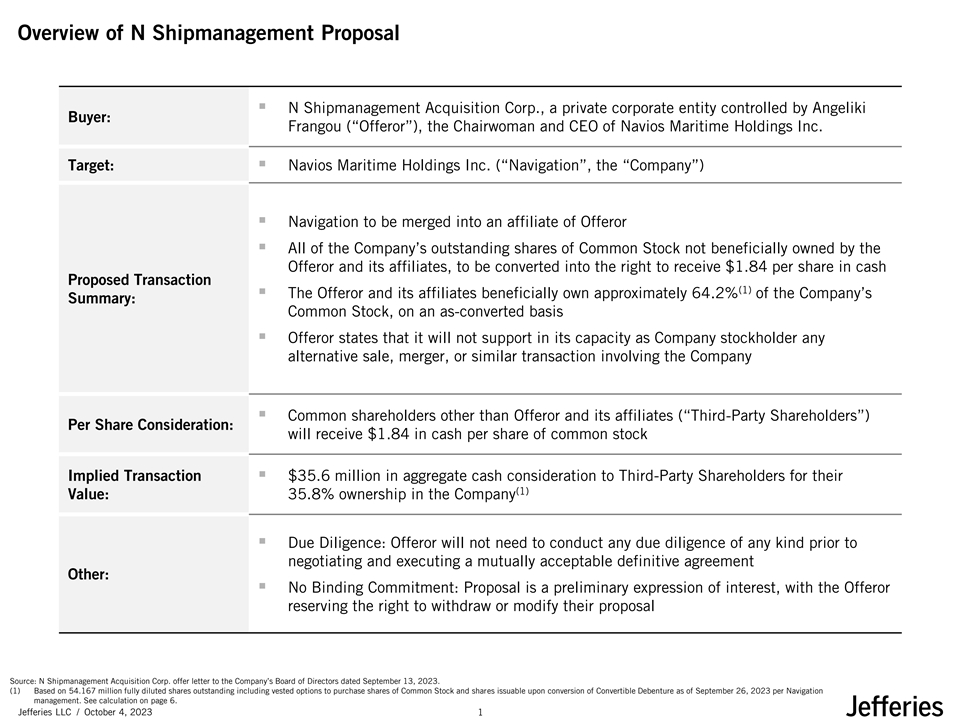

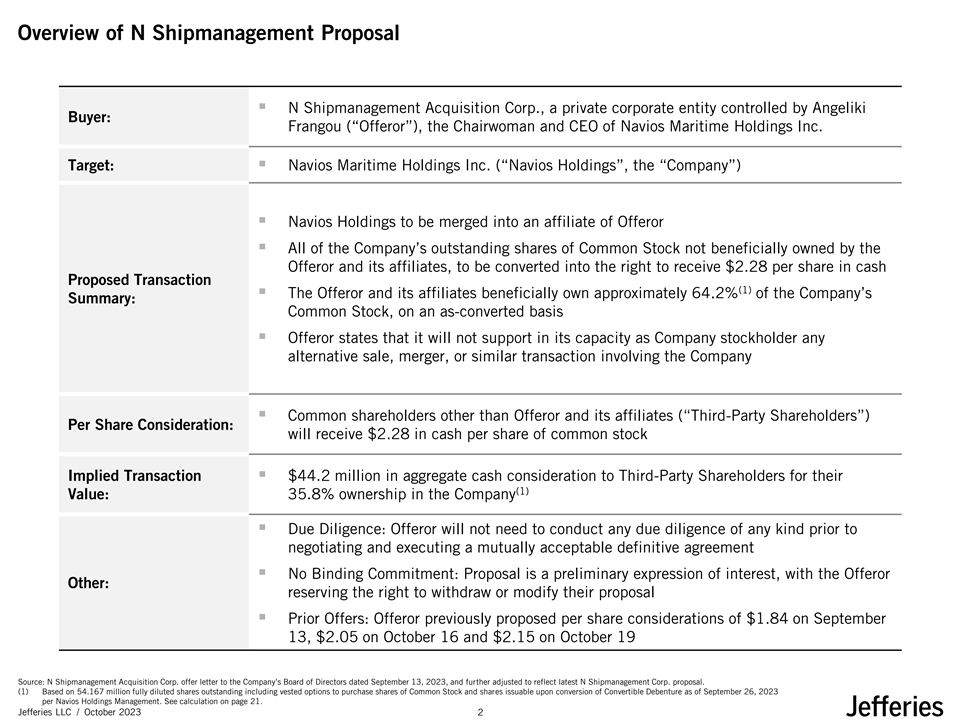

On

September 13, 2023, the Board of Directors of the Company (the “Company Board”) received a non-binding Proposal Letter (the “Proposal Letter”) from NSC to acquire the outstanding

shares of Company Common Stock not held by NSC and its affiliates (the “Potential Transaction”) and indicating that NSC would not proceed with the Potential Transaction unless approved by a special committee of independent and

disinterested directors of the Company.

After receiving the Proposal Letter, the Company Board formed a special committee (the

“Special Committee”) consisting solely of independent and disinterested directors of the Company to evaluate and negotiate the Potential Transaction.

On October 22, 2023, acting on the unanimous recommendation of the Special Committee, the Company Board approved, by unanimous vote of

the directors not affiliated with NLHC or its affiliates, and the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among the Company, NLHC, Merger Sub and, for limited purposes, NSC. Pursuant to the

Merger Agreement, Merger Sub will merge with and into the Company, with the Company continuing as the surviving corporation (the “Surviving Corporation”) in the merger and a subsidiary of NLHC (the “Merger”).

Pursuant to the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each share of Company Common Stock

that is issued and outstanding immediately prior to the Effective Time (other than shares of Company Common Stock held by (i) the Company or any of its subsidiaries or (ii) NLHC or Merger Sub) will be automatically converted into the right

to receive the merger consideration of $2.28 per share of Company Common Stock in cash (the “Per Share Merger Consideration”), without interest and less any required withholding taxes.

The Company’s outstanding shares of (i) 8.75% Series G Cumulative Redeemable Perpetual Preferred Stock (and the related American

Depositary Shares), (ii) 8.625% Series H Cumulative Redeemable Perpetual Preferred Stock (and the related American Depositary Shares), and (iii) Series I Non-Economic Preferred Stock (the

“Series I Preferred Stock”) will be unaffected by the Merger and remain outstanding as identical securities of the Surviving Corporation.

The Merger Agreement and the terms of the transactions contemplated thereby, including the Merger, were negotiated on behalf of the Company by

the Special Committee, with the assistance of the Special Committee’s financial advisor and legal advisor. The Special Committee unanimously (i) determined that the Merger Agreement and the transactions contemplated thereby, including the

Merger, are fair to and in the best interests of the Company and the holders of Company Common Stock (other than NLHC and its affiliates); (ii) approved the Merger Agreement and the consummation of the transactions contemplated thereby, including

the Merger; (iii) recommended to the Company Board that it approve the Merger Agreement and the consummation of the transactions contemplated thereby, including the Merger; and (iv) recommended, subject to the Company Board approving the

Merger Agreement and the transactions contemplated thereby, including the Merger, and submitting the Merger Agreement to the stockholders, that the stockholders approve the adoption of the Merger Agreement and the Merger. The Company Board, acting

upon the unanimous recommendation of the Special Committee, by unanimous vote of the directors not affiliated with NLHC or its affiliates, (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger,

are fair to and in the best interests of the Company and its stockholders; (ii) approved and declared advisable the Merger Agreement and the transactions contemplated thereby, including the Merger; (iii) directed that the Merger Agreement

be submitted to the stockholders for approval at the Company Stockholders’ Meeting (as defined below) and recommended that the stockholders approve and adopt the Merger Agreement and approve the Merger.

1

The Company will hold a special meeting of its stockholders (the “Company

Stockholders’ Meeting”) to vote on the Merger Agreement and the Merger. In order for the Merger to be completed, the Merger Agreement and the transactions contemplated thereby, including the Merger, must be authorized and approved by the

affirmative vote of the holders of outstanding shares of Company Common Stock and Series I Preferred Stock representing a majority of the total votes entitled to be cast on the Merger by the holders of all outstanding shares of Company Common Stock

and Series I Preferred Stock, voting together as a single class.

Under the terms of the Merger Agreement, unless the Special Committee

withdraws its recommendation in favor of the Merger, NSC, the holder of all of the issued and outstanding shares of Series I Preferred Stock, is required to vote all of the shares of Series I Preferred Stock in favor of the Merger and the

Merger Agreement at the Company Stockholders’ Meeting. Since the votes entitled to be cast by NSC in respect of the shares of Series I Preferred Stock represent a majority of the total votes entitled to be cast on the Merger by the holders of

all outstanding shares of Company Common Stock and Series I Preferred Stock, the voting by NSC of the shares of Series I Preferred Stock in favor of the approval and authorization of the Merger Agreement will provide sufficient votes to assure that

the Merger Agreement will be approved.

The Company is making available to its stockholders a proxy statement (the “Proxy

Statement,” a copy of which is attached as Exhibit (a)-(1) to this Transaction Statement), relating to the Company Stockholders’ Meeting. A copy of the Merger Agreement is attached to the Proxy Statement as Annex A and is

incorporated herein by reference.

Pursuant to General Instruction F to Schedule 13E-3, the

information contained in the Proxy Statement, including all annexes thereto, is incorporated in its entirety herein by this reference, and the responses to each item in this Schedule 13E-3 are qualified in

their entirety by the information contained in the Proxy Statement and the annexes thereto.

All information contained in this Transaction

Statement concerning each Filing Person has been supplied by such Filing Person, and no other Filing Person takes responsibility for the accuracy of such information as it relates to any other Filing Person.

ITEM 1 SUMMARY TERM SHEET

Regulation M-A Item 1001

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

ITEM 2 SUBJECT COMPANY INFORMATION

Regulation M-A Item 1002

(a) Name and Address. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

| |

• |

|

“Summary Term Sheet–The Parties to the Merger Agreement” |

(b) Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“The Special Meeting–Record Date and Quorum” |

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

2

(c) Trading Market and Price. The information set forth in the Proxy Statement under

the following caption is incorporated herein by reference:

| |

• |

|

“Additional Information Regarding the Company–Market Price of the Shares of Company Common Stock and

Dividends” |

(d) Dividends.

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

| |

• |

|

“Additional Information Regarding the Company–Market Price of the Shares of Company Common Stock and

Dividends” |

(e) Prior Public Offerings. The information set forth in the Proxy Statement under the following

caption is incorporated herein by reference:

| |

• |

|

“Additional Information Regarding the Company–Prior Public Offerings” |

(f) Prior Stock Purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

| |

• |

|

“Additional Information Regarding the Company–Transactions in Common Stock” |

| |

• |

|

“Additional Information Regarding the Company–Arrangements of the Buyer Group Involving the

Company’s Securities” |

ITEM 3 IDENTITY AND BACKGROUND OF FILING PERSON

Regulation M-A Item 1003(a)-(c)

(a) Name and Address. Navios Maritime Holdings Inc. is the subject company. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference:

| |

• |

|

“Summary Term Sheet–The Parties to the Merger Agreement” |

| |

• |

|

“Additional Information Regarding the Company” |

| |

• |

|

“Additional Information Regarding the Buyer Group” |

(b) Business and Background of Entities. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

| |

• |

|

“Summary Term Sheet–The Parties to the Merger Agreement” |

| |

• |

|

“Additional Information Regarding the Company” |

| |

• |

|

“Additional Information Regarding the Buyer Group” |

(c) Business and Background of Natural Persons. The information set forth in the Proxy Statement under the following captions is

incorporated herein by reference:

| |

• |

|

“Additional Information Regarding the Company–Information Regarding the Company’s Directors and

Executive Officers” |

| |

• |

|

“Additional Information Regarding the Buyer Group” |

ITEM 4 TERMS OF THE TRANSACTION

Regulation M-A Item 1004(a), (c)-(f)

(a) Material Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

3

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

(c) Different Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“The Special Meeting–Required Vote” |

| |

• |

|

“Provisions for Public Stockholders” |

| |

• |

|

“Additional Information Regarding the Company–Arrangements of the Buyer Group Involving the

Company’s Securities” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

(d) Dissenters’ Rights. The information set forth in the Proxy Statement under the following captions is

incorporated herein by reference:

| |

• |

|

“Summary Term Sheet–No Appraisal Rights” |

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

| |

• |

|

“Special Factors–No Appraisal Rights” |

(e) Provisions for Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following caption is

incorporated herein by reference:

| |

• |

|

“Provisions for Public Stockholders” |

(f) Eligibility of Listing or Trading. Not applicable.

ITEM 5 PAST CONTRACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS

Regulation M-A Item 1005(a)-(c), (e)

(a) Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

| |

• |

|

“Additional Information Regarding the Company–Transactions in Common Stock” |

(b) Significant Corporate Events. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

4

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

| |

• |

|

“Additional Information Regarding the Company–Transactions in Common Stock” |

| |

• |

|

“Additional Information Regarding the Company–Arrangements of the Buyer Group Involving the

Company’s Securities” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

(c) Negotiations or Contacts. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Certain Effects of the Merger” |

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“Additional Information Regarding the Company–Arrangements of the Buyer Group Involving the

Company’s Securities” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

(e) Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Certain Effects of the Merger” |

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

| |

• |

|

“Additional Information Regarding the Company–Transactions in Common Stock” |

| |

• |

|

“Additional Information Regarding the Company–Arrangements of the Buyer Group Involving the

Company’s Securities” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

ITEM 6 PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS

Regulation M-A Item 1006(b), (c)(1)-(8)

(b) Use of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

5

| |

• |

|

“Special Factors–Certain Effects of the Merger” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

(c) (1)-(8) Plans. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Certain Effects of the Merger” |

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

| |

• |

|

“Additional Information Regarding the Company–Arrangements of the Buyer Group Involving the

Company’s Securities” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

ITEM 7 PURPOSES, ALTERNATIVES, REASONS AND EFFECTS

Regulation M-A Item 1013

(a) Purpose. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders;” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

(b) Alternatives. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Plans for the Company if the Merger is Not Completed” |

(c) Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

6

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Certain Effects of the Merger” |

| |

• |

|

“Special Factors–Opinion of the Financial Advisor to the Special Committee” |

| |

• |

|

“Additional Information Regarding the Company–Market Price of the Shares of Company Common Stock and

Dividends” |

(d) Effects. The information set forth in the Proxy Statement under the following captions is

incorporated herein by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Certain Effects of the Merger” |

| |

• |

|

“Special Factors–Plans for the Company if the Merger is Not Completed” |

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“Special Factors–Material Tax Considerations” |

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

ITEM 8 FAIRNESS OF THE TRANSACTION

Regulation M-A Item 1014

(a) - (b) Fairness; Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Recommendation of the Special Committee” |

| |

• |

|

“Special Factors–Recommendation of the Company Board” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Opinion of the Financial Advisor to the Special Committee” |

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

7

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

| |

• |

|

“Annex B – Opinion of Jefferies LLC” |

(c) Approval of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

| |

• |

|

“The Special Meeting–Required Vote” |

(d) Unaffiliated Representative. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Recommendation of the Special Committee” |

| |

• |

|

“Special Factors–Recommendation of the Company Board” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“Special Factors–Opinion of the Financial Advisor to the Special Committee” |

(e) Approval of Directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Recommendation of the Special Committee” |

| |

• |

|

“Special Factors–Recommendation of the Company Board” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

(f) Other Offers. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

8

ITEM 9 REPORTS, OPINIONS, APPRAISALS AND NEGOTIATIONS

Regulation M-A Item 1015

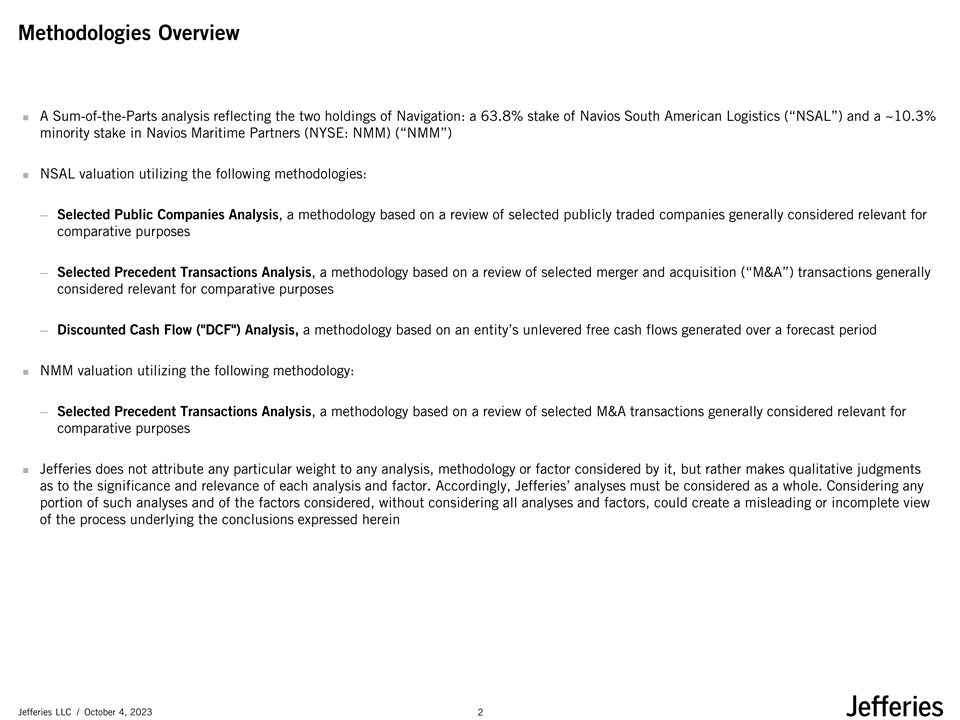

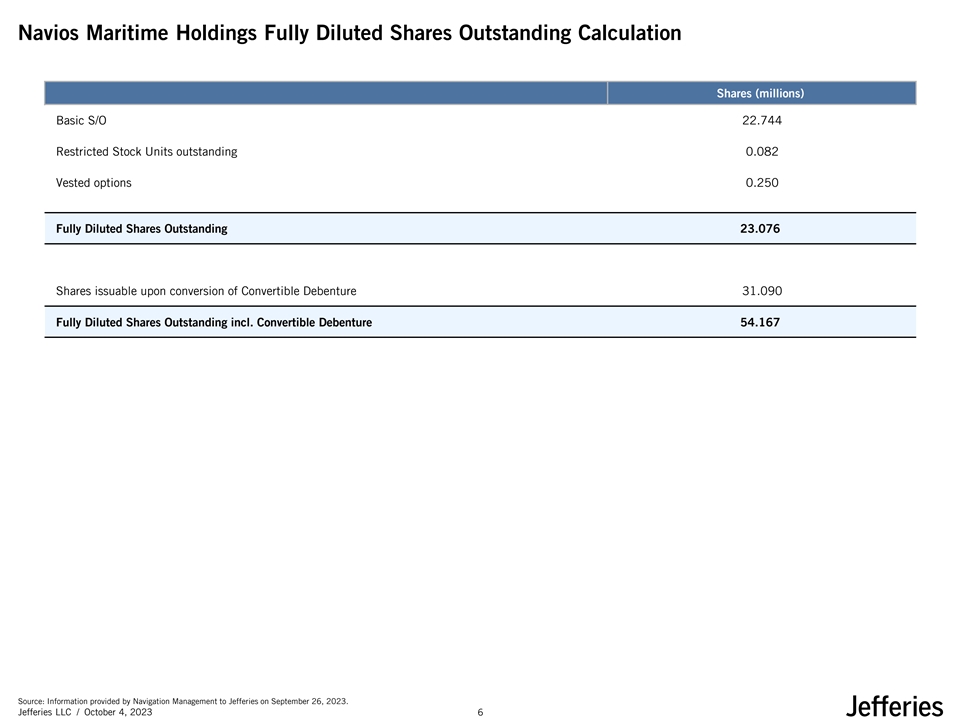

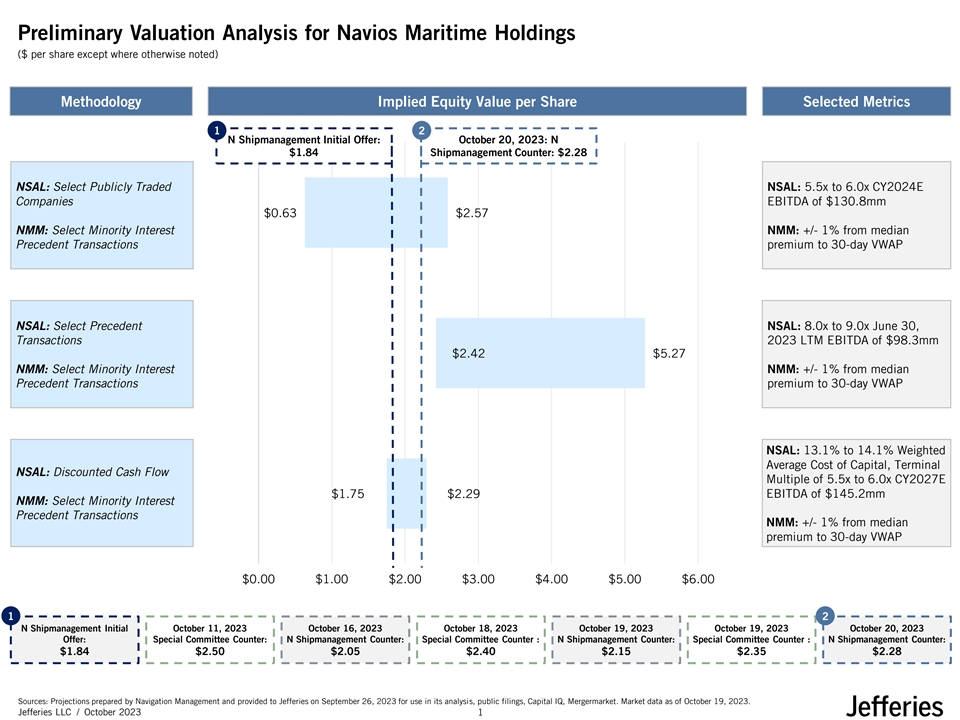

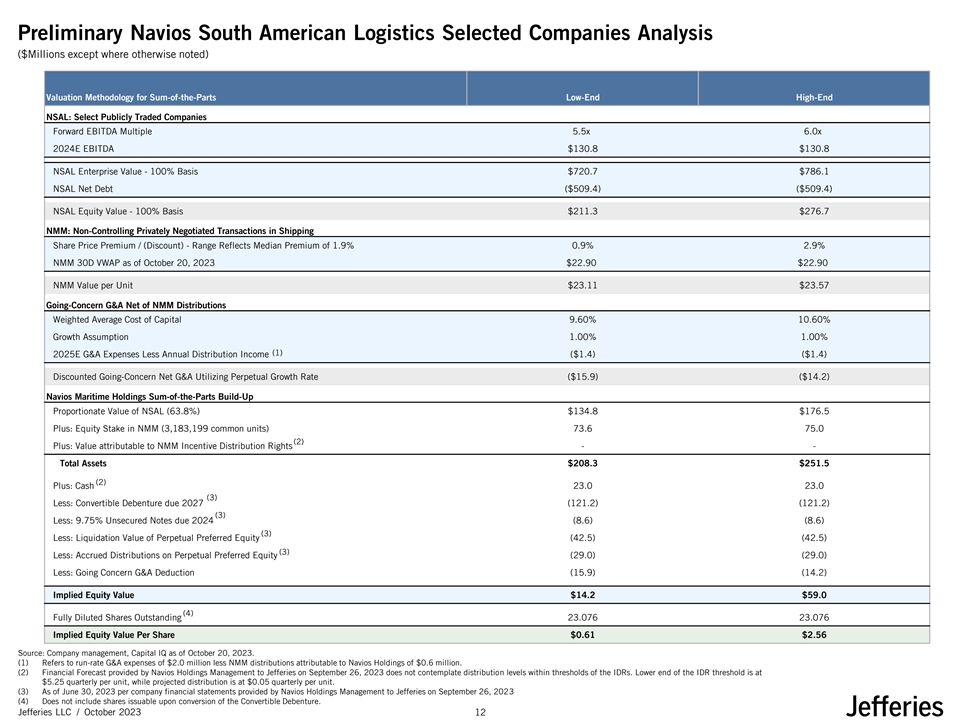

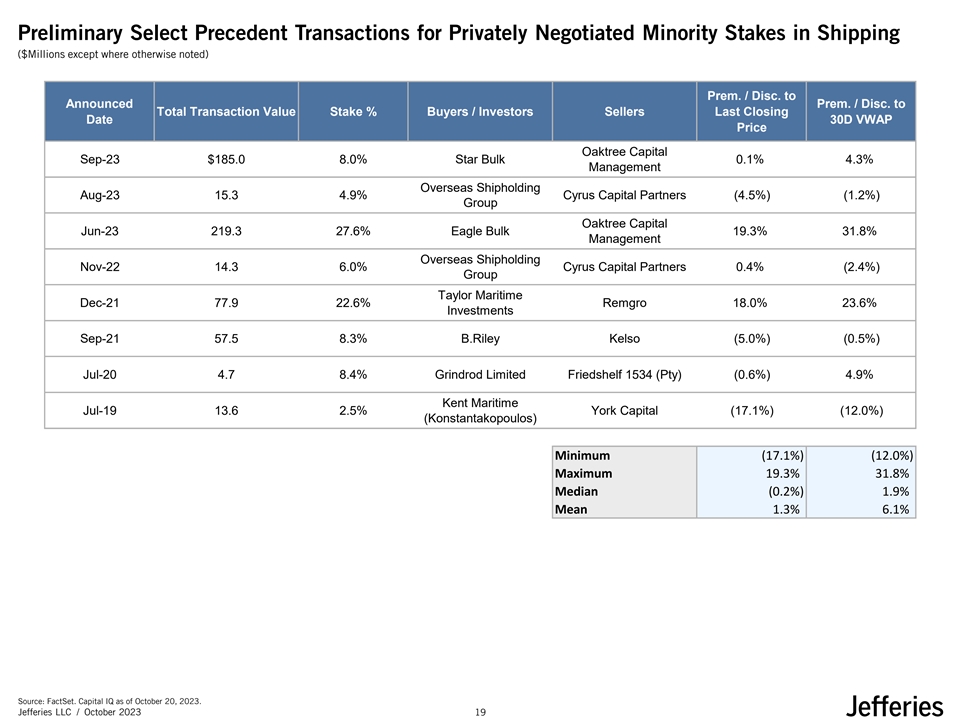

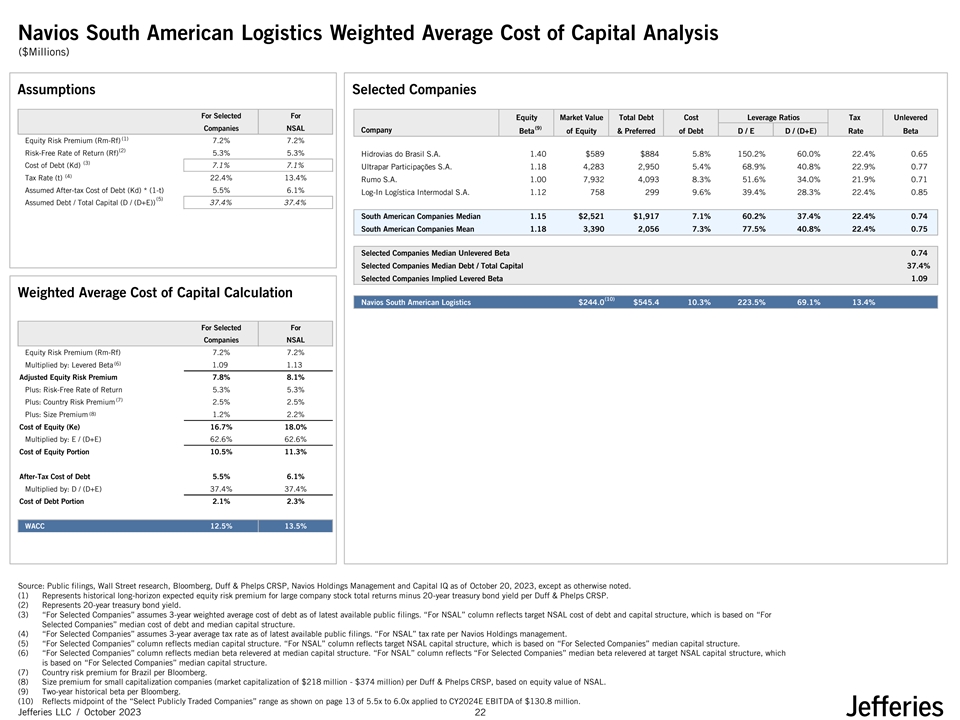

(a) - (b) Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal. The presentation materials prepared by

Jefferies LLC and provided to the Special Committee, dated October 4, 2023, October 11, 2023, October 20, 2023 and October 22, 2023 are set forth as Exhibits (c)(2) - (c)(5),

respectively, hereto and are incorporated herein by reference. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Summary Term Sheet–Opinion of the Financial Advisor to the Special Committee”

|

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Opinion of the Financial Advisor to the Special Committee” |

| |

• |

|

“Special Factors–Financial Projections Prepared by the Company” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

| |

• |

|

“Annex B–Opinion of Jefferies LLC” |

The written opinion of Jefferies LLC is attached to the Proxy Statement as Annex B and is incorporated herein by reference.

(c) Availability of Documents. The information set forth in the Proxy Statement under the following caption is incorporated herein by

reference:

| |

• |

|

“Where You Can Find More Information” |

| |

• |

|

“Letter to the Stockholders of Navios Maritime Holdings Inc. from the Chairman of the Special

Committee” |

| |

• |

|

“Notice of Special Meeting of Stockholders of Navios Maritime Holdings Inc.” |

The reports, opinions or appraisals referenced in this Item 9 will be made available for inspection and copying at the principal executive

offices of the Company during its regular business hours by any interested holder of the Company Common Stock or his, her or its representative who has been so designated in writing.

ITEM 10 SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

Regulation M-A Item 1007

(a) Source of Funds. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Special Factors–Source of Funds” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

(b) Conditions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

| |

• |

|

“Summary Term Sheet–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Summary Term Sheet–The Merger Agreement” |

| |

• |

|

“Special Factors–Source of Funds” |

(c) Expenses. The information set forth in the Proxy Stgatement under the following caption is incorporated herein by reference:

| |

• |

|

“Special Factors–Estimated Fees and Expenses of the Merger” |

(d) Borrowed Funds. Not applicable.

9

ITEM 11 INTEREST IN SECURITIES OF THE SUBJECT COMPANY

Regulation M-A Item 1008

(a) Securities Ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

(b) Securities Transactions. The information set forth in the Proxy Statement under the following

caption is incorporated herein by reference:

| |

• |

|

“Additional Information Regarding the Company–Transactions in Common Stock” |

| |

• |

|

“Additional Information Regarding the Company–Arrangements of the Buyer Group Involving the

Company’s Securities” |

ITEM 12 THE SOLICITATION OR RECOMMENDATION

Regulation M-A Item 1012(d)-(e)

(d) Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“The Special Meeting–Required Vote” |

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

| |

• |

|

“Annex A–Agreement and Plan of Merger” |

(e) Recommendations of Others. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders;” |

| |

• |

|

“Special Factors–Recommendation of the Special Committee” |

| |

• |

|

“Special Factors–Recommendation of the Company Board” |

| |

• |

|

“Special Factors–Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to

the Fairness of the Merger to Public Stockholders” |

ITEM 13 FINANCIAL STATEMENTS

Regulation M-A Item 1010(a)-(b)

(a) Financial Information. The audited financial statements of the Company for the two years ended December 31, 2022 and 2021 are

incorporated herein by reference to the Company’s Form 20-F for the year ended December 31, 2022, filed on March 28, 2023 (see page F-1 and following

pages). The unaudited consolidated financial statements of the Company for the six-month periods ended June 30, 2023 and 2022 are incorporated herein by reference to the Company’s report on Form 6-K filed on September 7, 2023.

The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference:

| |

• |

|

“Special Factors–Financial Projections Prepared by the Company” |

| |

• |

|

“Additional Information Regarding the Company–Summary Historical Consolidated Financial Data”

|

10

| |

• |

|

“Where You Can Find More Information” |

(b) Pro Forma Information. Not applicable.

ITEM 14 PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED

Regulation M-A Item 1009

(a) Solicitation or Recommendations. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

| |

• |

|

“Questions and Answers about the Special Meeting and the Merger Agreement Proposal”

|

| |

• |

|

“Special Factors–Background of the Merger” |

| |

• |

|

“Special Factors–Reasons for the Merger; The Special Committee’s Position as to the Fairness of

the Merger to Public Stockholders” |

| |

• |

|

“Special Factors–Opinion of the Financial Advisor to the Special Committee” |

(b) Employees and Corporate Assets. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

| |

• |

|

“Special Factors–Interests of Certain Persons in the Merger” |

| |

• |

|

“The Parties to the Merger” |

| |

• |

|

“Additional Information Regarding the Company–Security Ownership of Management and Certain Beneficial

Owners” |

| |

• |

|

“Additional Information Regarding the Company–Information Regarding the Company’s Directors and

Executive Officers” |

ITEM 15 ADDITIONAL INFORMATION

Regulation M-A Item 1011(b)-(c)

(c) Other Material Information. The information contained in the Proxy Statement, including all annexes thereto, is incorporated herein

by reference.

ITEM 16 EXHIBITS

Regulation M-A Item 1016(a)-(d), (f)-(g)

|

|

|

| (a)-(1) |

|

Proxy Statement of the Company (the “Proxy Statement”), dated November 13, 2023 |

|

|

| (a)-(2) |

|

Letter to the Stockholders of Navios Maritime Holdings Inc. from the Chairman of the Special Committee, incorporated herein by reference to the Proxy Statement |

|

|

| (a)-(3) |

|

Notice of Special Meeting of Stockholders of Navios Maritime Holdings Inc., incorporated herein by reference to the Proxy Statement |

|

|

| (a)-(4) |

|

Form of Proxy Card |

|

|

| (c)-(1) |

|

Opinion of Jefferies LLC, dated October 22, 2023, incorporated herein by reference to Annex B to the Proxy Statement |

|

|

| (c)-(2) |

|

Presentation materials prepared by Jefferies LLC, dated October 4, 2023, for the Special Committee |

11

|

|

|

| (c)-(3) |

|

Presentation materials prepared by Jefferies LLC, dated October 11, 2023, for the Special Committee |

|

|

| (c)-(4) |

|

Presentation materials prepared by Jefferies LLC, dated October 20, 2023, for the Special Committee |

|

|

| (c)-(5) |

|

Presentation materials prepared by Jefferies LLC, dated October 22, 2023, for the Special Committee |

|

|

| (d)-(1) |

|

Agreement and Plan of Merger, dated October

22, 2023, by and among Navios Maritime Holdings Inc., N Logistics Holdings Corporation, Navigation Merger Sub Inc., and, for limited purposes, N Shipmanagement Acquisition Corp., incorporated herein by reference to Annex A to the Proxy Statement

|

|

|

| (d)-(2) |

|

Amendment No. 1, dated October 22, 2023, to the Convertible Debenture, dated January 3, 2022, between Navios Maritime Holdings Inc. and N Shipmanagement

Acquisition Corp. (as transferee of Navios Shipmanagement Holdings Corporation) (incorporated by reference to Exhibit 4.1 of the Form 6-K filed by Navios Maritime Holdings Inc. on October 24, 2023). |

|

|

| (d)-(3) |

|

Convertible Debenture, dated January 3, 2022, between Navios Maritime Holdings Inc. and Navios Shipmanagement Holdings Corporation (incorporated

by reference to Exhibit 99.1 of Amendment No. 13 to the Schedule 13D filed by Angeliki Frangou and the other filing persons on January 10, 2022). |

|

|

| 107 |

|

Calculation of Filing Fee Tables |

12

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

Date: November 13, 2023

|

|

|

| NAVIOS MARITIME HOLDINGS INC. |

|

|

| By: |

|

/s/ Vasiliki Papaefthymiou |

| Name: |

|

Vasiliki Papaefthymiou |

| Title: |

|

Secretary |

|

| N LOGISTICS HOLDINGS CORPORATION |

|

|

| By: |

|

/s/ Sofia Tavla |

| Name: |

|

Sofia Tavla |

| Title: |

|

Secretary |

|

| N SHIPMANAGEMENT ACQUISITION CORP. |

|

|

| By: |

|

/s/ Brigido Navarro |

| Name: |

|

Brigido Navarro |

| Title: |

|

President |

|

| NAVIGATION MERGER SUB INC |

|

|

| By: |

|

/s/ Sofia Tavla |

| Name: |

|

Sofia Tavla |

| Title: |

|

Secretary |

|

|

|

|

/s/ Angeliki Frangou |

|

|

Angeliki Frangou |

13

Exhibit (a)-(1)

November 13, 2023

LETTER TO THE STOCKHOLDERS OF NAVIOS MARITIME HOLDINGS INC. FROM THE CHAIRMAN OF THE SPECIAL COMMITTEE:

Dear Stockholders of Navios Maritime Holdings Inc.:

You are

cordially invited to attend a special meeting (including any adjournments or postponements thereof, the “Special Meeting”) of the stockholders of Navios Maritime Holdings Inc. (the “Company”) to be held at the offices of the

Company located at Strathvale House, 90 N Church Street, Grand Cayman, KY1-1104 Cayman Islands, on Wednesday, December 13, 2023, at 9:00 a.m., local time. The Notice of Special Meeting, the accompanying

proxy statement and related materials can also be found at https://www.cstproxy.com/naviosmaritimeholdings/2023.

On October 22, 2023, the Company

entered into an Agreement and Plan of Merger (the “Merger Agreement”) with N Logistics Holdings Corporation (“NLHC”), a company affiliated with the Company’s Chairwoman and Chief Executive Officer, Angeliki Frangou,

Navigation Merger Sub Inc., a wholly owned subsidiary of NLHC (“Merger Sub”), and, for limited purposes, N Shipmanagement Acquisition Corp. (“NSC”), another company affiliated with Ms. Frangou. Pursuant to the Merger

Agreement, Merger Sub will be merged with and into the Company, with the Company continuing as the surviving corporation (the “Merger”), with the Company becoming a subsidiary of NLHC upon consummation of the Merger.

At the effective time of the Merger (the “Effective Time”), each share of common stock, par value $0.0001 per share, of the Company (such shares,

the “Company Common Stock”) outstanding immediately prior to the Effective Time (other than shares of Company Common Stock held by (i) the Company or any of its subsidiaries or (ii) NLHC or Merger Sub) will be converted into the

right to receive $2.28 per share in cash (the “Per Share Merger Consideration”), without interest and less any required withholding taxes.

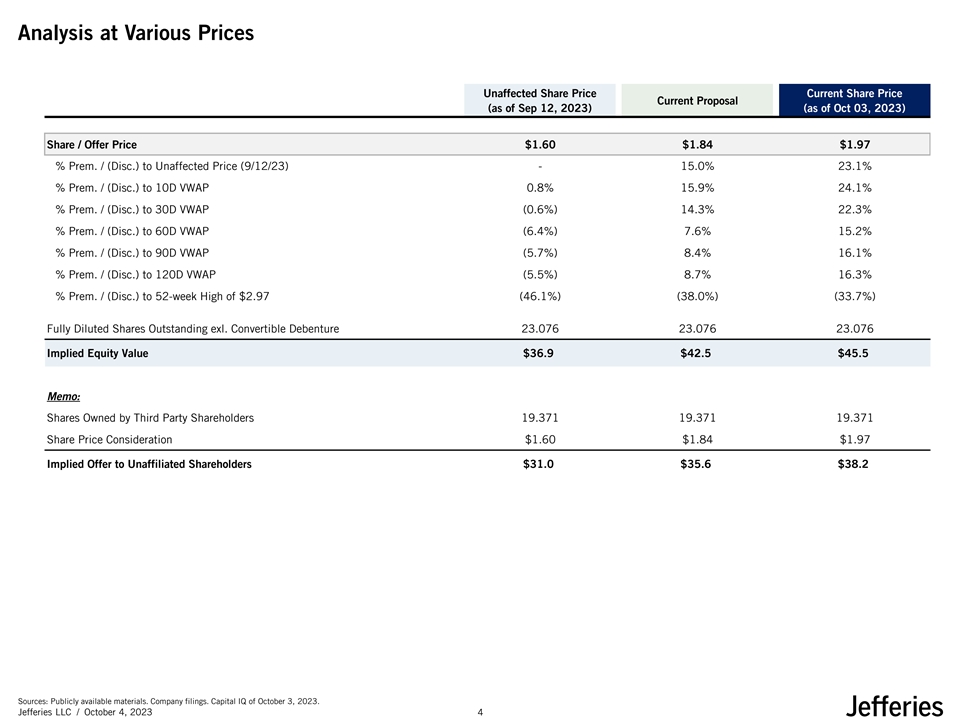

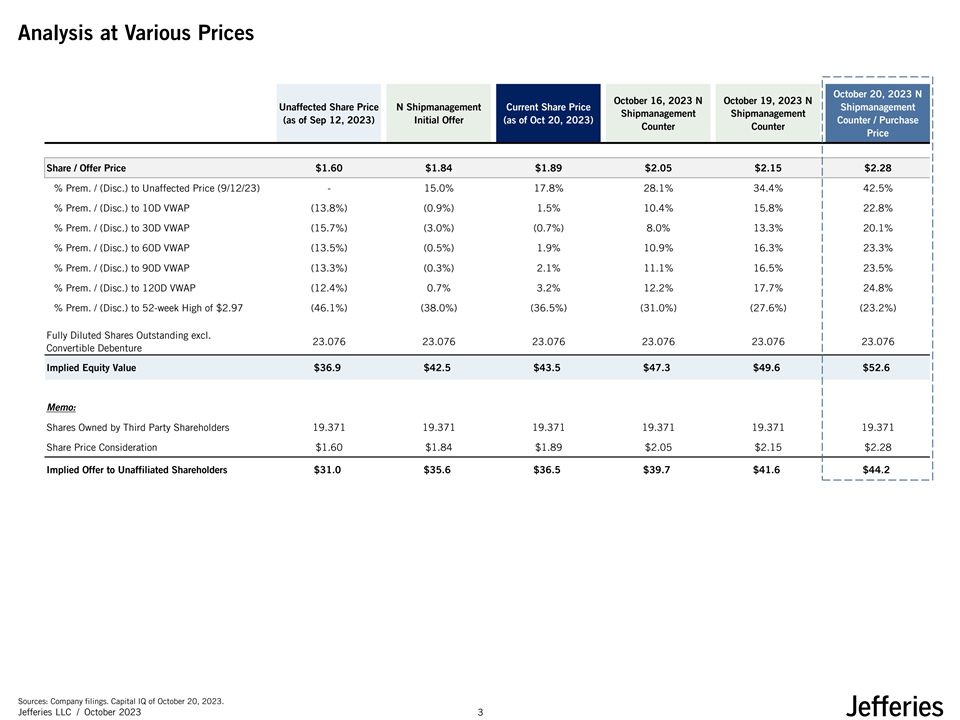

The

Per Share Merger Consideration of $2.28 in cash, represents a premium of approximately 43% to the $1.60 closing price of the shares of Company Common Stock on September 12, 2023, the last trading day before the Company’s announcement

of an offer made by an affiliate of Ms. Frangou on September 13, 2023 to acquire all of the shares of Company Common Stock not already owned by NLHC for $1.84 per share, and a premium of approximately 21% to the $1.89 closing price of the

shares of Company Common Stock on October 20, 2023, the last trading day before the Company’s announcement of the Merger Agreement.

The Merger

Agreement was negotiated and unanimously approved by a special committee of the board of directors of the Company consisting solely of independent and disinterested directors (the “Special Committee”). The Merger Agreement was also

approved by the Company’s board of directors (the “Company Board”) by unanimous vote of the directors not affiliated with NLHC or its affiliates.

The proposed Merger is a “going private” transaction under the rules of the U.S. Securities and Exchange Commission (the “SEC”). If the

Merger is completed, all of the shares of Company Common Stock will cease to be publicly traded and will be owned by NLHC.

The Special Committee

unanimously (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are fair to and in the best interests of the Company and the holders of Company Common Stock (other than NLHC and its

affiliates); (ii) approved the Merger Agreement and the consummation of the transactions contemplated thereby, including the Merger; (iii) recommended to the Company Board that it approve the Merger Agreement and the consummation of the

transactions contemplated thereby, including the Merger; and (iv) recommended, subject to the Company Board approving the Merger Agreement and the transactions contemplated thereby, including the Merger, and submitting the Merger Agreement to

the Company’s stockholders, that the stockholders approve the adoption of the Merger Agreement and the Merger.

The Company Board, acting upon the unanimous recommendation of the Special Committee, by unanimous vote of

the directors not affiliated with NLHC or its affiliates, (i) determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are fair to and in the best interests of the Company and its stockholders;

(ii) approved and declared advisable the Merger Agreement and the transactions contemplated thereby, including the Merger; (iii) directed that the Merger Agreement be submitted to the Company’s stockholders for approval at the Special

Meeting and recommended that the stockholders approve and adopt the Merger Agreement and approve the Merger.

At the Special Meeting, the Company will ask

you to vote on a proposal to approve and adopt the Merger Agreement and approve the Merger (the “Merger Agreement Proposal”). The Merger Agreement and the Merger have been unanimously approved and recommended by the Special Committee.

Based on the unanimous recommendation of the Special Committee, the Company Board, by unanimous vote of the directors not affiliated with NLHC or its affiliates, recommends that stockholders vote “FOR” the Merger Agreement Proposal.

In order for the Merger to be completed, the Merger Agreement and the transactions contemplated thereby, including the Merger, must be authorized and

approved by the affirmative vote of the holders of outstanding shares of Company Common Stock and Series I Preferred Stock representing a majority of the total votes entitled to be cast on the Merger by the holders of all outstanding shares of

Company Common Stock and Series I Preferred Stock, voting together as a single class. Under the terms of the Merger Agreement, unless the Special Committee withdraws its recommendation in favor of the Merger, NSC, the holder of shares of the Company

representing a majority of the total votes entitled to be cast on the Merger by the holders of all outstanding shares of the Company will be required to vote or cause to be voted the shares of the Company beneficially owned by it and its affiliates

in favor of the Merger Agreement Proposal.

In the materials accompanying this letter, you will find a Notice of Special Meeting of stockholders, a proxy

statement relating to the actions to be taken by holders of Company Common Stock and Series I Preferred Stock at the Special Meeting or any adjournment or postponement thereof and a proxy card. The proxy statement includes other important

information about the Merger Agreement and the transactions contemplated thereby, including the Merger. The Company encourages you to read the entire proxy statement, including the annexes and the documents referred to or incorporated by reference

in the proxy statement, carefully. A copy of the Merger Agreement is attached as Annex A to the accompanying proxy statement. You may also obtain additional information about the Company from documents the Company has filed with the SEC.

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH DOES NOT

REQUIRE POSTAGE IF MAILED IN THE UNITED STATES. YOU CAN ALSO VOTE BY INTERNET BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD. THE VOTE OF EVERY SHAREHOLDER IS IMPORTANT AND YOUR COOPERATION IN RETURNING YOUR EXECUTED PROXY CARD PROMPTLY WILL BE

APPRECIATED. ANY SIGNED PROXY CARD RETURNED AND NOT COMPLETED WILL BE VOTED BY MANAGEMENT “FOR” THE MERGER AGREEMENT PROPOSAL. IN ADDITION, IF YOUR SHARES ARE HELD IN THE NAME OF YOUR BROKER, BANK OR OTHER NOMINEE, THE FAILURE TO

INSTRUCT YOUR BROKER, BANK OR OTHER NOMINEE TO VOTE YOUR SHARES “FOR” APPROVAL OF THE MERGER AGREEMENT PROPOSAL WILL HAVE THE SAME EFFECT AS A VOTE “AGAINST” APPROVAL OF THE MERGER AGREEMENT PROPOSAL.

|

| Very truly yours, |

|

| /s/ George Malanga |

| George Malanga |

| Chairman of the Special Committee of Navios Maritime Holdings Inc. |

Neither the United States Securities and Exchange Commission nor any state securities regulatory agency

has approved or disapproved the Merger, passed upon the merits or fairness of the Merger or passed upon the adequacy or accuracy of the disclosure in the accompanying proxy statement. Any representation to the contrary is a criminal offense.

The accompanying proxy statement is dated November 13, 2023, and together with the enclosed form of proxy card, is first being mailed to

holders of Company Common Stock and Series I Preferred Stock on or about November 13, 2023.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

Notice is hereby given that a special meeting of the stockholders (including any adjournments or postponements thereof, the “Special Meeting”) of

Navios Maritime Holdings Inc. (the “Company”) will be held at the offices of Navios Maritime Holdings Inc., located at Strathvale House, 90 N Church Street, Grand Cayman, KY1-1104 Cayman Islands, on

Wednesday, December 13, 2023, at 9:00 a.m., local time, to:

| |

• |

|

Consider and vote upon a proposal to approve and adopt the Agreement and Plan of Merger, dated as of

October 22, 2023 (as may be amended from time to time, the “Merger Agreement”), by and among the Company, N Logistics Holdings Corporation (“NLHC”), Navigation Merger Sub Inc. (“Merger Sub”), and, for limited

purposes, N Shipmanagement Acquisition Corp., a copy of which is attached as Annex A to the accompanying proxy statement, and the transactions contemplated thereby, including the merger of Merger Sub with and into the Company (the

“Merger”), with the Company continuing as the surviving corporation in the Merger and a subsidiary of NLHC (such proposal, “Merger Agreement Proposal”). |

The record date for the Special Meeting is November 3, 2023 (the “Record Date”). Only holders of record of shares of Company Common Stock and

Series I Preferred Stock at the close of business on the Record Date are entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof.

Whether or not you plan to attend the Special Meeting, please read the enclosed proxy statement and complete, sign, date, and return the enclosed proxy card

as soon as possible to ensure your representation at the Special Meeting. We have provided a postage-paid envelope for your convenience. You can also vote by Internet by following the instructions on your proxy card. If you plan to attend the

Special Meeting and prefer to vote in person, you may still do so even if you have already returned your proxy card. Your vote is very important, regardless of the number of shares of Company Common Stock or Series I Preferred Stock that you own.

Accordingly, please submit your proxy whether or not you plan to attend the Special Meeting in person. Proxies must be received by 11:59 p.m., New York time, on December 12, 2023, the day before the Special Meeting. If you hold shares of

Company Common Stock through an account with a bank, broker, trust or other nominee, please follow the instructions you receive from your bank, broker, trust or other nominee to vote your shares.

ANY SIGNED PROXY CARD RETURNED AND NOT COMPLETED WILL BE VOTED BY MANAGEMENT “FOR” THE MERGER AGREEMENT PROPOSAL. IN ADDITION, IF YOUR SHARES

ARE HELD IN THE NAME OF YOUR BROKER, BANK OR OTHER NOMINEE, THE FAILURE TO INSTRUCT YOUR BROKER, BANK OR OTHER NOMINEE TO VOTE YOUR SHARES “FOR” APPROVAL OF THE MERGER AGREEMENT PROPOSAL WILL HAVE THE SAME EFFECT AS A VOTE

“AGAINST” APPROVAL OF THE MERGER AGREEMENT PROPOSAL.

The proxy statement that accompanies this notice provides extensive information

about the Special Meeting, the Merger Agreement and the transactions contemplated thereby, including the Merger. We encourage you to read the entire proxy statement and its annexes, including the Merger Agreement and the documents referred to or

incorporated by reference in the proxy statement, carefully and in their entirety. A copy of the Merger Agreement is included in the proxy statement as Annex A. You may also obtain additional information about the Company from other documents

we have filed with the U.S. Securities and Exchange Commission (the “SEC”).

If you have questions about the Merger or the Special Meeting, need

additional copies of the proxy statement or need to obtain proxy cards or other information related to the proxy solicitation, you may contact Navios Maritime Holdings Inc. by writing to Vasiliki (Villy) Papaefthymiou, Secretary, Navios Maritime

Holdings Inc., Strathvale House, 90 N Church Street, Grand Cayman, KY1-1104 Cayman Islands, or by telephone at +1 345 232 3066.

|

| By Order of the Board of Directors, |

|

| /s/ Vasiliki Papaefthymiou |

| Vasiliki Papaefthymiou |

| Secretary |

November 13, 2023

Grand Cayman, Cayman Islands

PROXY STATEMENT

Dated November 13, 2023

SUMMARY VOTING INSTRUCTIONS

PLEASE SIGN, DATE AND MAIL THE ENCLOSED PROXY CARD TODAY!

Record Holders

Whether you plan to attend the

Special Meeting or not, we urge you to vote by proxy. Voting by proxy will not affect your right to attend the Special Meeting. If you hold book-entry shares of Company Common Stock that are registered directly in your name on the books and records

of our stock transfer agent, Continental Stock Transfer & Trust Company, or you have stock certificates representing shares of Company Common Stock, you may vote:

| |

• |

|

By mail. Complete and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your

proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by the Company Board. |

| |

• |

|

Via the Internet. This proxy statement is accompanied by a proxy card with instructions for how to

submit your vote. You may vote via the Internet by accessing the Internet address as specified on the enclosed proxy card by the deadlines set forth on the card. Your shares will be voted as you direct in the same manner as if you had completed,

signed, dated and returned your proxy card. |

| |

• |

|

In person at the meeting. If you attend the Special Meeting, you may deliver your completed proxy card in

person or you may vote by completing a ballot, which will be available at the meeting. |

“Street Name” Holders

If your shares of Company Common Stock are held in “street name” (held in the name of a bank, broker or other nominee), you must provide

the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

| |

• |

|

By mail. You will receive instructions from your broker or other nominee explaining how to vote your

shares. |

| |

• |

|

In person at the meeting. Contact the broker or other nominee who holds your shares to obtain a

broker’s proxy card and bring it with you to the meeting. You will not be able to vote at the meeting unless you have a proxy card from your bank, broker or other nominee. |

“Street name” holders may vote by telephone or Internet if their bank, broker or other nominee makes those methods available, in which case the

bank, broker or other nominee will enclose the instructions with the proxy materials. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to vote their shares, and to confirm

that their instructions have been recorded properly.

If you have questions about the Merger or the Special Meeting, need additional copies of this

proxy statement or need to obtain proxy cards or other information related to the proxy solicitation, please contact Navios Maritime Holdings Inc. at:

Navios Maritime Holdings Inc.

Attn: Vasiliki (Villy) Papaefthymiou, Secretary

Strathvale House

90 N Church

Street, Grand Cayman, KY1-1104

Cayman Islands

Telephone: +1 345 232 3066

Email:

legal_corp@navios.com

If a bank, broker or other nominee holds your shares of Company Common Stock, then you should also contact your bank, broker or

other nominee for additional information.

|

|

|

|

|

| SUMMARY TERM SHEET |

|

|

1 |

|

|

|

| The Parties to the Merger Agreement |

|

|

1 |

|

|

|

| Certain Effects of the Merger |

|

|

2 |

|

|

|

| Reasons for the Merger; The Special Committee’s Position as to the Fairness of the Merger to Public

Stockholders; Recommendations of the Special Committee; Recommendations of the Company Board |

|

|

2 |

|

|

|

| Opinion of the Financial Advisor to the Special Committee |

|

|

4 |

|

|

|

| Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to the Fairness of the Merger to

Public Stockholders |

|

|

5 |

|

|

|

| The Special Meeting |

|

|

5 |

|

|

|

| Record Date and Quorum |

|

|

5 |

|

|

|

| Required Stockholder Vote for the Merger |

|

|

6 |

|

|

|

| Interests of Certain Persons in the Merger |

|

|

6 |

|

|

|

| Material U.S. Federal Income Tax Consequences of the Merger |

|

|

7 |

|

|

|

| The Merger Agreement |

|

|

7 |

|

|

|

| Source of Funds |

|

|

9 |

|

|

|

| No Appraisal Rights |

|

|

9 |

|

|

|

| QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE MERGER AGREEMENT PROPOSAL |

|

|

10 |

|

|

|

| SPECIAL FACTORS |

|

|

16 |

|

|

|

| Background of the Merger |

|

|

16 |

|

|

|

| Reasons for the Merger; The Special Committee’s Position as to the Fairness of the Merger to Public

Stockholders |

|

|

20 |

|

|

|

| Recommendation of the Special Committee |

|

|

24 |

|

|

|

| Recommendation of the Company Board |

|

|

25 |

|

|

|

| Financial Projections Prepared by the Company |

|

|

25 |

|

|

|

| Opinion of the Financial Advisor to the Special Committee |

|

|

27 |

|

|

|

| Buyer Group’s Purposes and Reasons for the Merger; Position of Buyer Group as to the Fairness of the Merger to

Public Stockholders |

|

|

36 |

|

|

|

| Certain Effects of the Merger |

|

|

41 |

|

|

|

| Interests of Certain Persons in the Merger |

|

|

42 |

|

|

|

| Plans for the Company if the Merger is Not Completed |

|

|

44 |

|

|

|

| Estimated Fees and Expenses of the Merger |

|

|

44 |

|

|

|

| Litigation Related to the Merger |

|

|

44 |

|

|

|

| Material Tax Considerations |

|

|

45 |

|

|

|

| Source of Funds |

|

|

49 |

|

|

|

| Anticipated Accounting Treatment of Transaction |

|

|

49 |

|

|

|

| No Appraisal Rights |

|

|

49 |

|

|

|

| CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION |

|

|

50 |

|

|

|

| THE PARTIES TO THE MERGER |

|

|

52 |

|

|

|

| N Logistics Holdings Corporation |

|

|

52 |

|

|

|

| Navigation Merger Sub Inc. |

|

|

52 |

|

|

|

|

|

|

|

|

| N Shipmanagement Acquisition Corp. |

|

|

52 |

|

|

|

| Navios Maritime Holdings Inc. |

|

|

52 |

|

|

|

| THE SPECIAL MEETING |

|

|

53 |

|

|

|

| Date, Time and Place |

|

|

53 |

|

|

|

| Record Date and Quorum |

|

|

53 |

|

|

|

| Required Vote |

|

|

54 |

|

|

|

| Voting; Proxies |

|

|

54 |

|

|

|

| Revocation of Proxies |

|

|

57 |

|

|

|

| Solicitation of Proxies; Payment of Solicitation Expenses |

|

|

57 |

|

|

|

| Adjournments |

|

|

57 |

|

|

|

| Other Information |

|

|

58 |

|

|

|

| THE MERGER AGREEMENT PROPOSAL |

|

|

59 |

|

|

|

| THE MERGER AGREEMENT |

|

|

60 |

|

|

|

| Explanatory Note Regarding the Merger Agreement |

|

|

60 |

|

|

|

| The Merger |

|

|

60 |

|

|

|

| Representations and Warranties |

|

|

63 |

|

|

|

| Conduct of Business Pending the Merger |

|

|

65 |

|

|

|

| Additional Agreements |

|

|

66 |

|

|

|

| Conditions to Completion of the Merger |

|

|

73 |

|

|

|

| Termination |

|

|

74 |

|

|

|

| Termination Fees |

|

|

76 |

|

|

|

| Effect of Termination |

|

|

76 |

|

|

|

| Expenses |

|

|

76 |

|

|

|

| Specific Performance |

|

|

77 |

|

|

|

| Amendments; Waivers |

|

|

77 |

|

|

|

| Governing Law |

|

|

77 |

|

|

|

| PROVISIONS FOR PUBLIC STOCKHOLDERS |

|

|

78 |

|

|

|

| ADDITIONAL INFORMATION REGARDING THE COMPANY |

|

|

79 |

|

|

|

| Company Background |

|

|

79 |

|

|

|

| Information Regarding the Company’s Directors and Executive Officers |

|

|

79 |

|

|

|

| Prior Public Offerings |

|

|

83 |

|

|

|

| Summary Historical Consolidated Financial Data |

|

|

83 |

|

|

|

| Market Price of the Shares of Company Common Stock and Dividends |

|

|

84 |

|

|

|

| Security Ownership of Management and Certain Beneficial Owners |

|

|

85 |

|

|

|

| Transactions in Common Stock |

|

|

86 |

|

|

|

| Arrangements of the Buyer Group Involving the Company’s Securities |

|

|

87 |

|

|

|

| ADDITIONAL INFORMATION REGARDING THE BUYER GROUP |

|

|

89 |

|

|

|

| Information Regarding the Buyer Group |

|

|

89 |

|

|

|

| Directors and Executive Officers |

|

|

89 |

|

|

|

| WHERE YOU CAN FIND MORE INFORMATION |

|

|

90 |

|

ANNEXES

Annex A - Agreement and Plan of Merger

Annex B - Opinion of

Jefferies LLC

GLOSSARY

Unless otherwise indicated or as the context otherwise indicates, when used in this proxy statement:

| |

• |

|

“book-entry shares” refers to non-certificated shares of

Company Common Stock represented by book-entry; |

| |

• |

|

“Buyer Group” refers to NLHC, NSC, Ms. Angeliki Frangou and Merger Sub, collectively;

|

| |

• |

|

“Closing Date” refers to date on which the Merger is completed; |

| |

• |

|

“Code” means the United States Internal Revenue Code of 1986, as amended; |

| |

• |

|

The “Company,” “Navios Holdings,” “we,” “us” and “our” refer to

Navios Maritime Holdings Inc., a corporation organized under the laws of the Republic of the Marshall Islands; |

| |

• |

|

“Company Board” refers to the board of directors of the Company; |

| |

• |

|

“Company Charter Documents” means the articles of incorporation (including the certificates of

designation applicable to the Preferred Stock) and bylaws of the Company; |

| |

• |

|

“Company Common Stock” refers to shares of common stock, $0.0001 par value, of the Company;

|

| |

• |

|

“Convertible Debenture” means the Convertible Debenture, dated January 3, 2022, by and between the

Company and NSC (as transferee of Navios Shipmanagement Holdings Corporation), as amended by the Convertible Debenture Amendment; |

| |

• |

|

“Convertible Debenture Amendment” means Amendment No. 1 to the Convertible Debenture, dated as of

October 22, 2023, by and between the Company and NSC (as transferee of Navios Shipmanagement Holdings Corporation); |

| |

• |

|

“Effective Time” refers to the effective time of the Merger; |

| |

• |

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| |

• |

|

“Merger” refers to the Merger of Merger Sub with and into the Company, with the Company continuing as

the surviving corporation and a subsidiary of NLHC, pursuant to the Merger Agreement; |

| |

• |

|

“Merger Agreement” refers to the Agreement and Plan of Merger, dated October 22, 2023, by and

among the Company, NLHC, Merger Sub and, for limited purposes, NSC, a copy of which is included as Annex A to this proxy statement; |

| |

• |

|

“IRS” refers to the U.S. Internal Revenue Service; |

| |

• |

|

“mark-to-market

election” means the election described in Section 1296 of the Code; |

| |

• |

|

“Merger Agreement Proposal” refers to the proposal for the stockholders of the Company to approve and

adopt the Merger Agreement and approve the Merger; |

| |

• |

|

“Merger Consideration” refers to $2.28 per share of Company Common Stock in cash, without interest and

less any required withholding taxes; |

| |

• |

|

“Merger Sub” refers to Navigation Merger Sub Inc., a corporation organized under the laws of the

Republic of the Marshall Islands and a wholly owned subsidiary of NLHC; |

| |

• |

|

“NLHC” means N Logistics Holdings Corporation, a corporation organized under the laws of the Republic

of the Marshall Islands; |

| |

• |

|

“Non-U.S. Holder” refers to a beneficial owner of shares of

Company common stock that is not a U.S. Holder and is not an entity or arrangement treated as a partnership or other type of pass-through entity for U.S. federal income tax purposes; |

| |

• |

|

“NSC” means N Shipmanagement Acquisition Corp., a corporation organized under the laws of the Republic

of the Marshall Islands; |

| |

• |

|

“NYSE” means the New York Stock Exchange; |

| |

• |

|

“PFIC” means a “passive foreign investment company,” as defined in Section 1297(a) of

the Code; |

| |

• |

|

“Preferred Stock” means shares of preferred stock, par value $0.0001 per share, of the Company;

|

| |

• |

|

“public stockholders” refers to holders of Company Common Stock who are not affiliates of any member of

the Buyer Group or the Company; |

| |

• |

|

“Record Date” refers to November 3, 2023; |

| |

• |

|

“SEC” refers to the United States Securities and Exchange Commission; |

| |

• |

|

“Series G Preferred Stock” means the shares of 8.75% Series G Cumulative Redeemable Perpetual Preferred

Stock, par value $0.0001 per share, of the Company; |

| |

• |

|

“Series H Preferred Stock” means the shares of 8.625% Series H Cumulative Redeemable Perpetual

Preferred Stock, par value $0.0001 per share, of the Company; |

| |

• |

|

“Series I Preferred Stock” means the shares of Series I

Non-Economic Preferred Stock, par value $0.0001 per share, of the Company; |

| |

• |

|

“Special Committee” refers to the special committee of the Company Board consisting solely of

independent and disinterested directors of the Company; |

| |

• |

|

“Special Meeting” refers to the meeting of the stockholders of the Company (including any adjournments

or postponements thereof) to be held to consider the authorization and approval of the Merger Agreement and the transactions contemplated thereby, including the Merger; and |

| |

• |

|

“U.S. Holder” refers to a beneficial owner of shares of Company common stock that is (i) an

individual who is a citizen or resident of the United States, (ii) a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created or organized under the laws of the United States or any state thereof,

(iii) an estate the income of which is subject to U.S. federal income taxation regardless of the source of that income or (iv) a trust if it (A) is subject to the primary supervision of a court within the United States and one or more

U.S. persons have the authority to control all substantial decisions of the trust or (B) has properly elected under applicable U.S. Treasury regulations to be treated as a U.S. person. |

SUMMARY TERM SHEET

This Summary Term Sheet discusses certain material information contained in this proxy statement, including with respect to the Merger Agreement. The Company

encourages you to read carefully the entirety of this proxy statement, which is first being mailed to stockholders of the Company on or about November 13, 2023, including its annexes and the documents referred to or incorporated by reference in

this proxy statement, as this Summary Term Sheet may not contain all of the information that may be important to you. In addition, this proxy statement incorporates by reference important business and financial information about the Company. You are

encouraged to read all of the documents incorporated by reference into this proxy statement and you may obtain such information without charge by following the instructions in “Where You Can Find More Information” beginning on

page 90.

The proposed Merger is a “going private” transaction under the rules of the SEC. If the Merger is completed, all of the

shares of Company Common Stock will cease to be publicly traded and will be owned by NLHC.

The Parties to the Merger Agreement

N Logistics Holdings Corporation

NLHC is a

corporation organized under the laws of the Republic of the Marshall Islands, and its principal business address is 85 Akti Miaouli Street, Piraeus, Greece 185 38 (telephone: +302104595000). The principal business of NLHC is acting as an investment

holding company. NLHC is controlled by Ms. Frangou. See “Additional Information Regarding Buyer Group–Information Regarding Buyer Group” beginning on page 89.

Navigation Merger Sub Inc.

Merger Sub is a

corporation organized under the laws of the Republic of the Marshall Islands, and its principal business address is c/o N Logistics Holdings Corporation, 85 Akti Miaouli Street, Piraeus, Greece 185 38 (telephone: +302104595000). Merger Sub is a

wholly owned subsidiary of NLHC and was formed solely for the purpose of engaging in the Merger and other related transactions. Merger Sub has not engaged in any business other than in connection with the Merger and other related transactions. See

“Additional Information Regarding Buyer Group–Information Regarding Buyer Group” beginning on page 89.

N Shipmanagement

Acquisition Corp.

NSC is a corporation organized under the laws of the Republic of the Marshall Islands, and its principal business address is 85

Akti Miaouli Street, Piraeus, Greece 185 38 (telephone: +302104595000). The principal business of NSC is acting as an investment holding company. NSC is controlled by Ms. Frangou. See “Additional Information Regarding Buyer

Group–Information Regarding Buyer Group” beginning on page 89.

Navios Maritime Holdings Inc.

The Company is a corporation organized under the laws of the Republic of the Marshall Islands. The Company’s principal executive office and principal

place of business is located at Strathvale House, 90 N Church Street, P.O. Box 309, Grand Cayman, KY1-1104 Cayman Islands, and its telephone number is +1 345 232 3067.

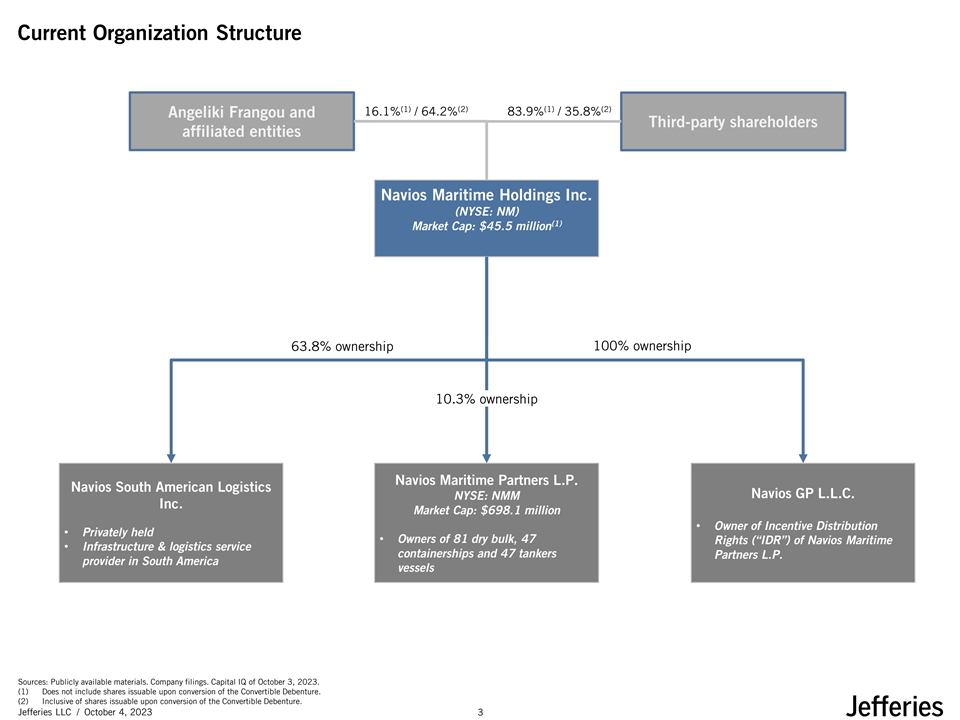

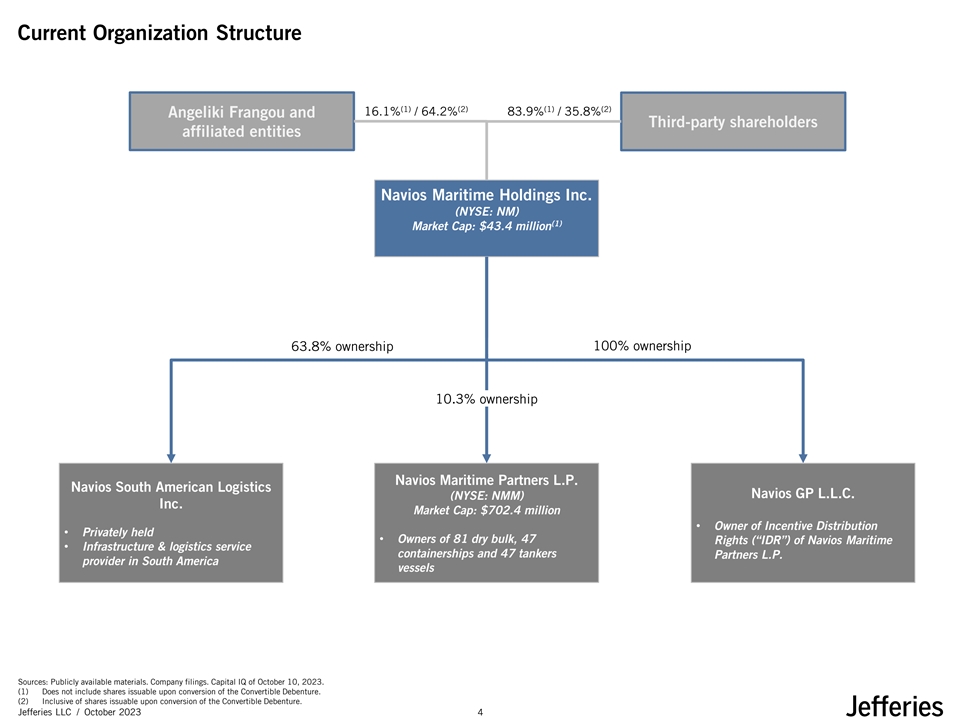

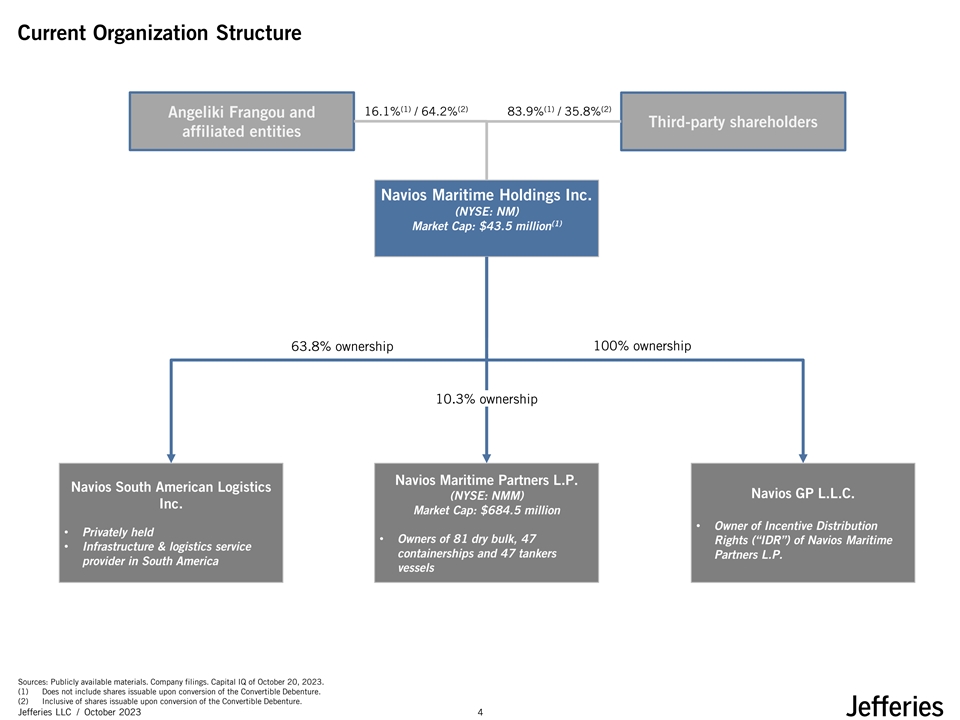

The Company owns a 63.8% controlling equity stake in Navios South American Logistics Inc. (“Navios Logistics”). Navios Logistics believes it is one

of the largest infrastructure and logistics companies in the Hidrovia region river system, the main navigable river system in the region (the “Hidrovia region”), and on the cabotage trades along the south-eastern coast of South America.

Navios Logistics serves its customers in the Hidrovia region through its three existing port storage and transfer facilities (the “Port Terminal Business”). The Port Terminal Business comprises its grain port terminal (the “Grain Port

Terminal”), which supports agricultural and forest-related exports; its iron-ore port terminal (the “Iron Ore Port Terminal”), which supports mineral-related exports; and its liquid

port terminal (the “Liquid Port Terminal”), with tank storage for refined petroleum products. The Grain Port Terminal and the Iron Ore Port Terminal are located in Nueva Palmira, Uruguay, and the Liquid Port Terminal is located in San

1

Antonio, Paraguay. Since October 2022, Navios Logistics has been providing bunkering services using floating storage capacity in the port of Nueva Palmira. Navios Logistics complements these

three port terminals with a diverse fleet of 271 barges and 30 pushboats that operate in its barge business, and six vessels, comprising five tankers and one river and estuary product tanker, all of which operate in its cabotage business. Navios

Logistics provides transportation for dry cargo (cereals, cotton pellets, soybeans, wheat, limestone (clinker), mineral iron, and rolling stones), liquid cargo (hydrocarbons such as crude oil, gas oil, naphtha, fuel oil and vegetable oils) and

liquefied cargo (liquefied petroleum gas). The Company also owns an interest in Navios Maritime Partners L.P., an international shipping company listed on the NYSE, which owns and operates dry cargo and tanker vessels. See “Additional

Information Regarding the Company” beginning on page 79. For a description of our history, development, business and organizational structure, see our Annual Report on Form 20-F for the year

ended December 31, 2022, which is incorporated herein by reference. See “Where You Can Find More Information” beginning on page 90 for a description of how to obtain a copy of our Annual Report.

Certain Effects of the Merger

Pursuant to the Merger

Agreement, upon completion of the Merger, each share of Company Common Stock that is issued and outstanding immediately prior to the Effective Time (other than shares of Company Common Stock held by (i) the Company (including as treasury stock)