File No. [●]

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

In the Matter of the Application of:

NEUBERGER BERMAN BDC LLC,

NEUBERGER BERMAN NEXT GENERATION CONNECTIVITY

FUND INC.,

NB PRIVATE MARKETS FUND II (MASTER) LLC,

NB PRIVATE MARKETS FUND III (MASTER) LLC,

NB CROSSROADS PRIVATE MARKETS FUND IV HOLDINGS LLC,

NB CROSSROADS PRIVATE MARKETS FUND V HOLDINGS LP,

NB CROSSROADS PRIVATE MARKETS FUND VI HOLDINGS LP,

NB CROSSROADS PRIVATE MARKETS FUND VII HOLDINGS LP,

NB CROSSROADS PRIVATE MARKETS ACCESS FUND LLC,

NB ALTERNATIVES ADVISERS LLC,

NEUBERGER BERMAN INVESTMENT ADVISERS LLC,

COLUMBIA NB CROSSROADS FUND II LP,

GOLDEN ROAD CAPITAL POOLING L.P.,

MEP OPPORTUNITIES FUND HOLDINGS LP,

NB - IOWA’S PUBLIC UNIVERSITIES LP,

NB 1 PE INVESTMENT HOLDINGS LP; NB 1911 LP,

NB AGI PE PORTFOLIO II FUND LP,

NB ASGA FUND HOLDINGS LP,

NB AYAME HOLDINGS LP,

NB BLUE ENSIGN FUND LP,

NB CASPIAN HOLDINGS LP,

NB CPEG FUND HOLDINGS LP,

NB CREDIT OPPORTUNITIES CO-INVEST AFFORDABLE CARE I LP,

NB CREDIT OPPORTUNITIES CO-INVEST I LP,

NB CREDIT OPPORTUNITIES FUND II LP,

NB CREDIT OPPORTUNITIES II CAYMAN LP,

NB CREDIT OPPORTUNITIES II CO-INVESTMENT FUND (CAYMAN) LP,

NB CREDIT OPPORTUNITIES II CO-INVESTMENT (WHISTLER) LP,

NB CROSSROADS 23 LC HOLDINGS LP,

NB CROSSROADS 23 MC HOLDINGS LP,

NB CROSSROADS 23 SS HOLDINGS LP,

NB CROSSROADS 23 VC HOLDINGS LP,

NB CROSSROADS 24 LC HOLDINGS LP,

NB CROSSROADS 24 MC HOLDINGS LP,

NB CROSSROADS 24 SS HOLDINGS LP,

NB CROSSROADS 24 VC HOLDINGS LP,

NB CROSSROADS XXII – MC HOLDINGS LP,

NB CROSSROADS XXII – VC HOLDINGS LP,

NB CRYSTAL PE HOLDINGS LP,

NB DIRECT ACCESS FUND II LP,

NB ENHANCED INCOME HOLDINGS LP,

NB ENHANCED INCOME HOLDINGS II LP,

NB ENSTAR PE OPPORTUNITIES FUND, LP,

NB EURO CROSSROADS 2018 HOLDINGS SCSP,

NB EURO CROSSROADS 2021 HOLDINGS SCSP,

NB FLAMINGO PRIVATE DEBT LP,

NB FLAT CORNER PE HOLDINGS LP,

NB GEMINI FUND LP,

NB GRANITE PRIVATE DEBT LP,

NB GREENCASTLE LP,

NB INITIUM INFRASTRUCTURE (EUR) HOLDINGS LP,

NB INITIUM INFRASTRUCTURE (USD) HOLDINGS LP,

NB INITIUM PE (EUR) HOLDINGS LP,

NB INITIUM PE (USD) HOLDINGS LP,

NB INITIUM PE II (USD) HOLDINGS LP,

NB K-P LOAN PARTNERS LP,

NB OAK LP; NB PA CO-INVESTMENT FUND LP,

NB PD III HOLDINGS (LO) LP,

NB PD III HOLDINGS (LS) LP,

NB PD III HOLDINGS (UO) LP,

NB PD III HOLDINGS (US) LP,

NB PD IV EQUITY LP,

NB PD IV HOLDINGS (LO-A) LP,

NB PD IV HOLDINGS (LO-MS) LP,

NB PD IV HOLDINGS (LS-A) LP,

NB PD IV HOLDINGS (US-A) (LEVERED) LP,

NB PD IV HOLDINGS (US-B) (UNLEVERED) LP,

NB PD IV HOLDINGS (UO-A) LP,

NB PEP HOLDINGS LIMITED,

NB PINNACOL ASSURANCE FUND LP,

NB PRIVATE DEBT FUND LP,

NB PRIVATE DEBT II HOLDINGS LP,

NB PRIVATE EQUITY CREDIT OPPORTUNITIES HOLDINGS LP,

NB PRIVATE PACKAGE LP,

NB REMBRANDT HOLDINGS 2018 LP,

NB REMBRANDT HOLDINGS 2020 LP,

NB REMBRANDT HOLDINGS 2022 LP,

NB RENAISSANCE PARTNERS HOLDINGS S.A R.L.,

NB RESOF HOLDINGS LP,

NB RESOF II CAYMAN HOLDINGS LP,

NB RESOF II HOLDINGS LP,

NB RESOF SP1 LP,

NB RIVER CITY FUND LP,

NB RP CO-INVESTMENT & SECONDARY FUND

LLC,

NB RPPE PARTNERS LP,

NB SBS US 3 FUND LP,

NB SELECT OPPS III MHF LP,

NB SELECT OPPS IV MHF LP,

NB SELECT OPPS V MHF LP,

NB SHP FUND HOLDINGS LP,

NB SI-APOLLO SENGAI FUND HOLDINGS LP,

NB SOF III HOLDINGS LP,

NB SOF IV CAYMAN HOLDINGS LP,

NB SOF IV HOLDINGS LP,

NB SOF V CAYMAN HOLDINGS LP,

NB SOF V HOLDINGS LP,

NB SONORAN FUND LIMITED PARTNERSHIP,

NB STAR BUYOUT STRATEGY 2020 HOLDINGS LTD,

NB STAR BUYOUT STRATEGY 2021 HOLDINGS LTD,

NB STAR BUYOUT STRATEGY 2022 HOLDINGS LTD,

NB STRATEGIC CAPITAL LP,

NB STRATEGIC CO-INVESTMENT PARTNERS IV HOLDINGS

LP,

NB STRATEGIC PARTNERSHIP FUND CO-INVESTMENTS

LP,

NB SWAN PRIVATE DEBT SCSP,

NB TCC STRATEGIC HOLDINGS LP,

NB TPSF EM PE FUND LP,

NB WESSEX HOLDINGS LP,

NB WILDCATS FUND LP; NB ZCF LP,

NBAL HOLDINGS LP,

NBFOF IMPACT - HOLDINGS LP,

NBPD AT HOLDINGS (LO-A) LP,

NBPD CENTENNIAL HOLDINGS (LO-A) LP,

NBPD III EQUITY CO-INVEST HOLDINGS A LP,

NB-SOMPO RA HOLDINGS LP,

NEUB HOLDINGS LP,

NEUB INFRASTRUCTURE HOLDINGS LP,

NEUBERGER BERMAN / NEW JERSEY CUSTOM INVESTMENT FUND III LP,

NYC-NORTHBOUND EMERGING MANAGERS PROGRAM LP,

NYSCRF NB CO-INVESTMENT FUND LLC,

NYSCRF NB CO-INVESTMENT FUND II LLC,

OLIVE CAYMAN HOLDINGS LTD,

PECO-PD III BORROWER LP,

SJFED PRIVATE EQUITY STRATEGIC PARTNERSHIP, L.P.,

SJPF PRIVATE EQUITY STRATEGIC PARTNERSHIP, L.P.,

SOLEIL 2020 CAYMAN HOLDINGS LTD,

SOLEIL 2022 EUR CAYMAN HOLDINGS LTD,

SOLEIL B 2022 EUR CAYMAN HOLDINGS LTD,

SOLEIL B 2022 USD CAYMAN HOLDINGS LTD,

SUNBERG PE OPPORTUNITIES FUND LLC,

SUNBERN ALTERNATIVE OPPORTUNITIES FUND LLC,

TORANOMON PRIVATE EQUITY 1, L.P.

1290 Avenue of the Americas

New York, NY 10104

APPLICATION FOR AN ORDER TO AMEND A PRIOR ORDER

UNDER SECTIONS 17(d) AND 57(i) OF

THE INVESTMENT COMPANY ACT OF 1940 AND RULE 17d-1 UNDER THE INVESTMENT COMPANY ACT

OF 1940

PERMITTING CERTAIN JOINT TRANSACTIONS OTHERWISE PROHIBITED BY SECTIONS 17(d) AND 57(a)(4)

OF THE INVESTMENT COMPANY ACT OF 1940 AND RULE 17d-1 UNDER THE INVESTMENT COMPANY ACT OF 1940

All Communications, Notices and Orders to:

Corey Issing

Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, NY 10104

(212) 476-9000

Copies to:

Nicole M. Runyan

William J. Tuttle

Kirkland & Ellis LLP

601 Lexington Ave

New York, NY 10022

Nicole.Runyan@kirkland.com

August 5, 2022

On January 13, 2022, the Securities and Exchange Commission (the

“Commission”) issued an order under Sections 17(d) and 57(i) of the Investment Company Act of 1940, as amended (the

“1940 Act”),1 and Rule 17d-1 thereunder, permitting certain joint transactions otherwise prohibited by Sections

17(d) and 57(a)(4) of the 1940 Act and Rule 17d-1 thereunder, as described more fully therein (the “Prior Order”).2

The Prior Order permits certain business development companies and closed-end management investment companies to co-invest in portfolio

companies with each other and with affiliated investment entities.

The Applicants (defined below) hereby seek an amended order (the “Amended

Order”) from the Commission under Section 57(i) of the 1940 Act, and Rule 17d-1 thereunder, to amend the term “Follow-On

Investment” to mean (i) with respect to a Regulated Fund, an additional investment in the same issuer in which the Regulated

Fund is currently invested; or (ii) with respect to an Affiliated Fund, (X) an additional investment in the same issuer in which

the Affiliated Fund and at least one Regulated Fund are currently invested; or (Y) an investment in an issuer in which at least one

Regulated Fund is currently invested but in which the Affiliated Fund does not currently have an investment.

| • | Neuberger Berman BDC LLC, an externally managed, closed-end, non-diversified management investment company that intends to elect to

be regulated as a business development company under the 1940 Act (“NBBDC”); |

| • | Neuberger Berman Next Generation Connectivity Fund Inc., a closed-end management investment company registered under the 1940 Act

(“NBXG”); |

| • | NB Private Markets Fund II (Master) LLC, a closed-end management investment company registered under the 1940 Act (“NB Private

Markets II”); |

| • | NB Private Markets Fund III (Master) LLC, a closed-end management investment company registered under the 1940 Act (“NB Private

Markets III”); |

| • | NB Crossroads Private Markets Fund IV Holdings LLC, a closed-end management investment company registered under the 1940 Act (“NB

Private Markets IV”); |

| • | NB Crossroads Private Markets Fund V Holdings LP, a closed-end management investment company registered under the 1940 Act (“NB

Private Markets V”); |

| • | NB Crossroads Private Markets Fund VI Holdings LP, a closed-end management investment company registered under the 1940 Act (“NB

Private Markets VI”); |

| • | NB Crossroads Private Markets Fund VII Holdings LP, a closed-end management investment company registered under the 1940 Act (“NB

Private Markets VII”); |

| 1 | Unless otherwise indicated, all section and rule references

herein are to the 1940 Act and rules promulgated thereunder. |

| 2 | See Neuberger Berman BDC LLC, et al. (File No. 812-15124)

Investment Company Act Rel. Nos. 34443 (December 16, 2021) (notice) and 34469 (January 13, 2022) (order). |

| • | NB Crossroads Private Markets Access Fund LLC, a closed-end management investment company registered under the 1940 Act (“NB

Private Markets Access” and, collectively with NBXG, NB Private Markets II, NB Private Markets III, NB Private Markets IV, NB Private

Markets V, NB Private Markets VI and NB Private Markets VII, the “Existing Regulated Funds”); |

| • | NB Alternatives Advisers LLC (“NBAA”), which (i) is investment adviser to the Existing Affiliated Funds (as defined

below), (ii) will serve as investment adviser to NBBDC at the time NBBDC relies on the order requested herein, and (iii) is

sub-investment adviser to the Existing Regulated Funds, on behalf of itself and its successors;3

and Neuberger Berman Investment Advisers LLC (“NBIA”), investment adviser to the Existing Regulated Funds and which may serve

as investment adviser to Future Regulated Funds (as defined in the Prior Application (as defined below)), on behalf of itself and its

successors. NBAA and NBIA, with respect to the Affiliated Funds and Regulated Funds they advise, are referred to as the “NB Advisers.”

Each of the NB Advisers is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. NBAA, and its direct

and indirect wholly-owned subsidiaries, from time to time may hold various financial assets in a principal capacity (together, in such

capacity, the “Existing NB Proprietary Accounts” and, together with any Future NB Proprietary Account (as defined in the Prior

Application), the “NB Proprietary Accounts”); and |

| • | the investment vehicles identified in Appendix A, each of which is a separate and distinct legal entity and each of which would be

an investment company but for Section 3(c)(1) or 3(c)(7) (the “Existing Affiliated Funds” and, together with

NBBDC, the Existing Regulated Funds and the NB Advisers, the “Applicants”). |

All Applicants are eligible to rely on the Prior Order.4

Except as stated herein, defined terms used in this application (the

“Application”) have the same meanings provided in the application for the Prior Order, as amended and restated (the “Prior

Application”).5

“Follow-On Investment” means (i) with respect to a

Regulated Fund, an additional investment in the same issuer in which the Regulated Fund is currently invested; or (ii) with respect

to an Affiliated Fund, (X) an additional investment in the same issuer in which the Affiliated Fund and at least one Regulated Fund

are currently invested; or (Y) an investment in an issuer in which at least one Regulated Fund is currently invested but in which

the Affiliated Fund does not currently have an investment. An investment in an issuer includes, but is not limited to, the exercise of

warrants, conversion privileges or other rights to purchase securities of the issuer.

| 3 | For purposes of the requested Amended Order, a “successor”

means an entity or entities that result from a reorganization into another jurisdiction or a change in the type of business organization. |

| 4 | All existing entities that currently rely on the Prior Order

and intend to rely on the Amended Order have been named as applicants and any existing or future entities that may rely on the Amended

Order in the future will comply with the terms and conditions of the Amended Order as set forth in or incorporated into this Application. |

| 5 | See Neuberger Berman BDC LLC, et al. (File No. 812-15124)

(November 18, 2021) (application). |

The Amended Order, if granted, would expand the relief provided in

the Prior Order to permit Affiliated Funds to participate in Follow-On Investments in issuers in which at least one Regulated Fund is

invested, but such Affiliated Funds are not invested. This relief would not permit Follow-On Investments by Regulated Funds that are not

invested in the issuer. The requested relief is based on the temporary relief granted by the Commission on April 8, 2020.6

| III. | STATEMENT IN SUPPORT OF RELIEF REQUESTED |

Except as stated herein, the disclosure in Section IV, “Statement

in Support of Relief Requested,” of the Prior Application is equally applicable to this Application.

Except as stated herein, the Conditions of the Prior Order, as stated

in Section V of the Prior Application, will remain in effect. Any language in the Conditions of the Prior Order stating that an Affiliated

Fund is required to have an existing investment in an issuer and/or needs to have previously participated in a Co-Investment Transaction

with respect to such issuer in order to participate in a Follow-On Investment shall be deemed removed if the Amended Order is granted.

Applicants file this Application in accordance with Rule 0-2 under

the 1940 Act. Pursuant to Rule 0-2(f) under the 1940 Act, Applicants state that their address is indicated on the cover page of

this Application. Applicants further request that all communications concerning this Application should be directed and copied to the

persons listed on the cover page of the Application.

In accordance with Rule 0-2(c) under the 1940 Act, Applicants

state that all actions necessary to authorize the execution and filing of this Application have been taken, and the persons signing and

filing this document are authorized to do so on behalf of Applicants pursuant to their corporate organizational documents, and in the

case of the Trust, the attached resolutions. Applicants also have attached the verifications required by Rule 0-2(d) under the

1940 Act.

In accordance with Rule 0-5 under the 1940 Act, Applicants request

that the Commission issue the requested Amended Order without holding a hearing.

All requirements for the execution and filing of this Application in

the name and on behalf of each Applicant by the undersigned have been complied with and the undersigned is fully authorized to do so and

has duly executed this Application as of this 5th day of August, 2022.

| |

By: |

/s/ Christian Neira |

| |

|

Name: |

Christian Neira |

| |

|

Title: |

Authorized Signatory |

| 6 | BDC Temporary Exemptive Order, Investment Company Act

Rel. Nos. 33837 (April 8, 2020) (order) (extension granted on January 5, 2021 and further extension granted on April 22, 2021). |

| |

NEUBERGER BERMAN NEXT GENERATION CONNECTIVITY FUND INC. |

| |

By: |

/s/ Brian Kerrane |

| |

|

Name: |

Brian Kerrane |

| |

|

Title: |

Chief Operating Officer |

| |

NB PRIVATE MARKETS FUND II (MASTER) LLC |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB PRIVATE MARKETS FUND III (MASTER) LLC |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS FUND IV HOLDINGS LLC |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS FUND V HOLDINGS LP |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS FUND VI HOLDINGS LP |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS FUND VII HOLDINGS LP |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS ACCESS FUND LLC |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB ALTERNATIVES ADVISERS LLC |

| |

By: |

/s/ Christian Neira |

| |

|

Name: |

Christian Neira |

| |

|

Title: |

Authorized Signatory |

| |

NEUBERGER BERMAN INVESTMENT ADVISERS LLC |

| |

By: |

/s/ Brian Kerrane |

| |

|

Name: |

Brian Kerrane |

| |

|

Title: |

Authorized Signatory |

| |

COLUMBIA NB CROSSROADS FUND II LP

GOLDEN ROAD CAPITAL POOLING L.P.

MEP OPPORTUNITIES FUND HOLDINGS LP

NB - IOWA’S PUBLIC UNIVERSITIES LP

NB 1 PE INVESTMENT HOLDINGS LP

NB 1911 LP

NB AGI PE PORTFOLIO II FUND LP

NB ASGA FUND HOLDINGS LP

NB AYAME HOLDINGS LP

NB BLUE ENSIGN FUND LP

NB CASPIAN HOLDINGS LP

NB CPEG FUND HOLDINGS LP

NB CREDIT OPPORTUNITIES CO-INVEST AFFORDABLE CARE I LP

NB CREDIT OPPORTUNITIES CO-INVEST I LP

NB CREDIT OPPORTUNITIES FUND II LP

NB CREDIT OPPORTUNITIES II CAYMAN LP

NB CREDIT OPPORTUNITIES II CO-INVESTMENT FUND (CAYMAN) LP

NB CREDIT OPPORTUNITIES II CO-INVESTMENT (WHISTLER) LP

NB CROSSROADS 23 LC HOLDINGS LP

NB CROSSROADS 23 MC HOLDINGS LP

NB CROSSROADS 23 SS HOLDINGS LP

NB CROSSROADS 23 VC HOLDINGS LP

NB CROSSROADS 24 LC HOLDINGS LP

NB CROSSROADS 24 MC HOLDINGS LP

NB CROSSROADS 24 SS HOLDINGS LP

NB CROSSROADS 24 VC HOLDINGS LP

NB CROSSROADS XXII – MC HOLDINGS LP

NB CROSSROADS XXII – VC HOLDINGS LP

NB CRYSTAL PE HOLDINGS LP |

| |

NB DIRECT ACCESS FUND II LP

NB ENHANCED INCOME HOLDINGS LP |

| |

NB ENHANCED INCOME HOLDINGS II LP

NB ENSTAR PE OPPORTUNITIES FUND, LP

NB EURO CROSSROADS 2018 HOLDINGS SCSP

NB EURO CROSSROADS 2021 HOLDINGS SCSP

NB FLAMINGO PRIVATE DEBT LP

NB FLAT CORNER PE HOLDINGS LP

NB GEMINI FUND LP

NB GRANITE PRIVATE DEBT LP

NB GREENCASTLE LP

NB INITIUM INFRASTRUCTURE (EUR) HOLDINGS LP

NB INITIUM INFRASTRUCTURE (USD) HOLDINGS LP

NB INITIUM PE (EUR) HOLDINGS LP

NB INITIUM PE (USD) HOLDINGS LP |

| |

NB INITIUM PE II (USD) HOLDINGS LP

NB K-P LOAN PARTNERS LP

NB OAK LP

NB PA CO-INVESTMENT FUND LP

NB PD III HOLDINGS (LO) LP

NB PD III HOLDINGS (LS) LP

NB PD III HOLDINGS (UO) LP

NB PD III HOLDINGS (US) LP

NB PD IV EQUITY LP

NB PD IV HOLDINGS (LO-A) LP |

| |

NB PD IV HOLDINGS (LO-MS) LP

NB PD IV HOLDINGS (LS-A) LP

NB PD IV HOLDINGS (US-A) (LEVERED) LP

NB PD IV HOLDINGS (US-B) (UNLEVERED) LP

NB PD IV HOLDINGS (UO-A) LP

NB PEP HOLDINGS LIMITED

NB PINNACOL ASSURANCE FUND LP

NB PRIVATE DEBT FUND LP

NB PRIVATE DEBT II HOLDINGS LP

NB PRIVATE EQUITY CREDIT OPPORTUNITIES HOLDINGS LP

NB PRIVATE PACKAGE LP

NB REMBRANDT HOLDINGS 2018 LP

NB REMBRANDT HOLDINGS 2020 LP

NB REMBRANDT HOLDINGS 2022 LP

NB RENAISSANCE PARTNERS HOLDINGS S.A R.L.

NB RESOF HOLDINGS LP

NB RESOF II CAYMAN HOLDINGS LP

NB RESOF II HOLDINGS LP

NB RESOF SP1 LP |

| |

NB RIVER CITY FUND LP

NB RP CO-INVESTMENT & SECONDARY FUND LLC

NB RPPE PARTNERS LP

NB SBS US 3 FUND LP |

| |

NB SELECT OPPS III MHF LP

NB SELECT OPPS IV MHF LP

NB SELECT OPPS V MHF LP

NB SHP FUND HOLDINGS LP

NB SI-APOLLO SENGAI FUND HOLDINGS LP

NB SOF III HOLDINGS LP

NB SOF IV CAYMAN HOLDINGS LP

NB SOF IV HOLDINGS LP

NB SOF V CAYMAN HOLDINGS LP

NB SOF V HOLDINGS LP

NB SONORAN FUND LIMITED PARTNERSHIP

NB STAR BUYOUT STRATEGY 2020 HOLDINGS LTD

NB STAR BUYOUT STRATEGY 2021 HOLDINGS LTD |

| |

NB STAR BUYOUT STRATEGY 2022 HOLDINGS LTD

NB STRATEGIC CAPITAL LP

NB STRATEGIC CO-INVESTMENT PARTNERS IV HOLDINGS LP |

| |

NB STRATEGIC PARTNERSHIP FUND CO-INVESTMENTS LP |

| |

NB SWAN PRIVATE DEBT SCSP

NB TCC STRATEGIC HOLDINGS LP |

| |

NB TPSF EM PE FUND LP |

| |

NB WESSEX HOLDINGS LP

NB WILDCATS FUND LP

NB ZCF LP

NBAL HOLDINGS LP

NBFOF IMPACT – HOLDINGS LP |

| |

NBPD AT HOLDINGS (LO-A) LP |

| |

NBPD CENTENNIAL HOLDINGS (LO-A) LP

NBPD III EQUITY CO-INVEST HOLDINGS A LP

NB-SOMPO RA HOLDINGS LP

NEUB HOLDINGS LP

NEUB INFRASTRUCTURE HOLDINGS LP

NEUBERGER BERMAN / NEW JERSEY CUSTOM INVESTMENT FUND III LP

NYC-NORTHBOUND EMERGING MANAGERS PROGRAM LP

NYSCRF NB CO-INVESTMENT FUND LLC

NYSCRF NB CO-INVESTMENT FUND II LLC

OLIVE CAYMAN HOLDINGS LTD

PECO-PD III BORROWER LP

SJFED PRIVATE EQUITY STRATEGIC PARTNERSHIP, L.P.

SJPF PRIVATE EQUITY STRATEGIC PARTNERSHIP, L.P.

SOLEIL 2020 CAYMAN HOLDINGS LTD |

| |

SOLEIL 2022 EUR CAYMAN HOLDINGS LTD |

| |

SOLEIL B 2022 EUR CAYMAN HOLDINGS LTD |

| |

SOLEIL B 2022 USD CAYMAN HOLDINGS LTD

SUNBERG PE OPPORTUNITIES FUND LLC

SUNBERN ALTERNATIVE OPPORTUNITIES FUND LLC

TORANOMON PRIVATE EQUITY 1, L.P. |

| |

By: |

/s/ Christian Neira |

| |

|

Name: |

Christian Neira |

| |

|

Title: |

Authorized Signatory |

The undersigned states that he or she has duly executed the attached

Application for an Order under Sections 17(d) and 57(i) of the Investment Company Act of 1940, as amended, and Rule 17d-1

thereunder, dated August 5, 2022, for and on behalf of the Applicants, as the case may be, that he or she holds the office with such

entity as indicated below and that all actions by the stockholders, directors, and other bodies necessary to authorize the undersigned

to execute and file such Application have been taken. The undersigned further says that he or she is familiar with the instrument and

the contents thereof, and that the facts set forth therein are true to the best of his or her knowledge, information, and belief.

| |

By: |

/s/ Christian Neira |

| |

|

Name: |

Christian Neira |

| |

|

Title: |

Authorized Signatory |

| |

NEUBERGER BERMAN NEXT GENERATION CONNECTIVITY FUND INC. |

| |

By: |

/s/ Brian Kerrane |

| |

|

Name: |

Brian Kerrane |

| |

|

Title: |

Chief Operating Officer |

| |

NB PRIVATE MARKETS FUND II (MASTER) LLC |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB PRIVATE MARKETS FUND III (MASTER) LLC |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS FUND IV HOLDINGS LLC |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS FUND V HOLDINGS LP |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS FUND VI HOLDINGS LP |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS FUND VII HOLDINGS LP |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB CROSSROADS PRIVATE MARKETS ACCESS FUND LLC |

| |

By: |

/s/ James Bowden |

| |

|

Name: |

James Bowden |

| |

|

Title: |

Chief Executive Officer and President |

| |

NB ALTERNATIVES ADVISERS LLC |

| |

By: |

/s/ Christian Neira |

| |

|

Name: |

Christian Neira |

| |

|

Title: |

Authorized Signatory |

| |

NEUBERGER BERMAN INVESTMENT ADVISERS LLC |

| |

By: |

/s/ Brian Kerrane |

| |

|

Name: |

Brian Kerrane |

| |

|

Title: |

Authorized Signatory |

| |

COLUMBIA NB CROSSROADS FUND II LP

GOLDEN ROAD CAPITAL POOLING L.P.

MEP OPPORTUNITIES FUND HOLDINGS LP

NB - IOWA’S PUBLIC UNIVERSITIES LP

NB 1 PE INVESTMENT HOLDINGS LP

NB 1911 LP

NB AGI PE PORTFOLIO II FUND LP

NB ASGA FUND HOLDINGS LP |

| |

NB AYAME HOLDINGS LP

NB BLUE ENSIGN FUND LP

NB CASPIAN HOLDINGS LP

NB CPEG FUND HOLDINGS LP

NB CREDIT OPPORTUNITIES CO-INVEST AFFORDABLE CARE I LP

NB CREDIT OPPORTUNITIES CO-INVEST I LP

NB CREDIT OPPORTUNITIES FUND II LP

NB CREDIT OPPORTUNITIES II CAYMAN LP

NB CREDIT OPPORTUNITIES II CO-INVESTMENT FUND (CAYMAN) LP

NB CREDIT OPPORTUNITIES II CO-INVESTMENT (WHISTLER) LP

NB CROSSROADS 23 LC HOLDINGS LP

NB CROSSROADS 23 MC HOLDINGS LP

NB CROSSROADS 23 SS HOLDINGS LP

NB CROSSROADS 23 VC HOLDINGS LP

NB CROSSROADS 24 LC HOLDINGS LP

NB CROSSROADS 24 MC HOLDINGS LP

NB CROSSROADS 24 SS HOLDINGS LP

NB CROSSROADS 24 VC HOLDINGS LP

NB CROSSROADS XXII – MC HOLDINGS LP

NB CROSSROADS XXII – VC HOLDINGS LP

NB CRYSTAL PE HOLDINGS LP |

| |

NB DIRECT ACCESS FUND II LP

NB ENHANCED INCOME HOLDINGS LP |

| |

NB ENHANCED INCOME HOLDINGS II LP

NB ENSTAR PE OPPORTUNITIES FUND, LP

NB EURO CROSSROADS 2018 HOLDINGS SCSP

NB EURO CROSSROADS 2021 HOLDINGS SCSP

NB FLAMINGO PRIVATE DEBT LP

NB FLAT CORNER PE HOLDINGS LP

NB GEMINI FUND LP

NB GRANITE PRIVATE DEBT LP

NB GREENCASTLE LP

NB INITIUM INFRASTRUCTURE (EUR) HOLDINGS LP

NB INITIUM INFRASTRUCTURE (USD) HOLDINGS LP

NB INITIUM PE (EUR) HOLDINGS LP

NB INITIUM PE (USD) HOLDINGS LP |

| |

NB INITIUM PE II (USD) HOLDINGS LP

NB K-P LOAN PARTNERS LP

NB OAK LP

NB PA CO-INVESTMENT FUND LP

NB PD III HOLDINGS (LO) LP

NB PD III HOLDINGS (LS) LP

NB PD III HOLDINGS (UO) LP

NB PD III HOLDINGS (US) LP

NB PD IV EQUITY LP

NB PD IV HOLDINGS (LO-A) LP |

| |

NB PD IV HOLDINGS (LO-MS) LP

NB PD IV HOLDINGS (LS-A) LP

NB PD IV HOLDINGS (US-A) (LEVERED) LP

NB PD IV HOLDINGS (US-B) (UNLEVERED) LP

NB PD IV HOLDINGS (UO-A) LP

NB PEP HOLDINGS LIMITED

NB PINNACOL ASSURANCE FUND LP

NB PRIVATE DEBT FUND LP

NB PRIVATE DEBT II HOLDINGS LP

NB PRIVATE EQUITY CREDIT OPPORTUNITIES HOLDINGS LP

NB PRIVATE PACKAGE LP

NB REMBRANDT HOLDINGS 2018 LP

NB REMBRANDT HOLDINGS 2020 LP

NB REMBRANDT HOLDINGS 2022 LP

NB RENAISSANCE PARTNERS HOLDINGS S.A R.L.

NB RESOF HOLDINGS LP

NB RESOF II CAYMAN HOLDINGS LP

NB RESOF II HOLDINGS LP

NB RESOF SP1 LP |

| |

NB RIVER CITY FUND LP

NB RP CO-INVESTMENT & SECONDARY FUND LLC

NB RPPE PARTNERS LP

NB SBS US 3 FUND LP

NB SELECT OPPS III MHF LP

NB SELECT OPPS IV MHF LP

NB SELECT OPPS V MHF LP

NB SHP FUND HOLDINGS LP

NB SI-APOLLO SENGAI FUND HOLDINGS LP

NB SOF III HOLDINGS LP

NB SOF IV CAYMAN HOLDINGS LP

NB SOF IV HOLDINGS LP

NB SOF V CAYMAN HOLDINGS LP

NB SOF V HOLDINGS LP

NB SONORAN FUND LIMITED PARTNERSHIP

NB STAR BUYOUT STRATEGY 2020 HOLDINGS LTD

NB STAR BUYOUT STRATEGY 2021 HOLDINGS LTD |

| |

NB STAR BUYOUT STRATEGY 2022 HOLDINGS LTD

NB STRATEGIC CAPITAL LP

NB STRATEGIC CO-INVESTMENT PARTNERS IV HOLDINGS LP |

| |

NB STRATEGIC PARTNERSHIP FUND CO-INVESTMENTS LP |

| |

NB SWAN PRIVATE DEBT SCSP

NB TCC STRATEGIC HOLDINGS LP |

| |

NB TPSF EM PE FUND LP |

| |

NB WESSEX HOLDINGS LP

NB WILDCATS FUND LP

NB ZCF LP

NBAL HOLDINGS LP

NBFOF IMPACT – HOLDINGS LP |

| |

NBPD AT HOLDINGS (LO-A) LP |

| |

NBPD CENTENNIAL HOLDINGS (LO-A) LP

NBPD III EQUITY CO-INVEST HOLDINGS A LP

NB-SOMPO RA HOLDINGS LP

NEUB HOLDINGS LP

NEUB INFRASTRUCTURE HOLDINGS LP

NEUBERGER BERMAN / NEW JERSEY CUSTOM INVESTMENT FUND III LP

NYC-NORTHBOUND EMERGING MANAGERS PROGRAM LP

NYSCRF NB CO-INVESTMENT FUND LLC

NYSCRF NB CO-INVESTMENT FUND II LLC

OLIVE CAYMAN HOLDINGS LTD

PECO-PD III BORROWER LP

SJFED PRIVATE EQUITY STRATEGIC PARTNERSHIP, L.P.

SJPF PRIVATE EQUITY STRATEGIC PARTNERSHIP, L.P.

SOLEIL 2020 CAYMAN HOLDINGS LTD |

| |

SOLEIL 2022 EUR CAYMAN HOLDINGS LTD |

| |

SOLEIL B 2022 EUR CAYMAN HOLDINGS LTD |

| |

SOLEIL B 2022 USD CAYMAN HOLDINGS LTD

SUNBERG PE OPPORTUNITIES FUND LLC

SUNBERN ALTERNATIVE OPPORTUNITIES FUND LLC

TORANOMON PRIVATE EQUITY 1, L.P. |

| |

By: |

/s/ Christian Neira |

| |

|

Name: |

Christian Neira |

| |

|

Title: |

Authorized Signatory |

APPENDIX A

Below is a listing of the Existing Affiliated Funds other than the

NB Proprietary Accounts. All such Existing Affiliated Funds are advised by NBAA:

| 1. | Columbia NB Crossroads Fund II LP |

| 2. | Golden Road Capital Pooling L.P. |

| 3. | MEP Opportunities Fund Holdings LP |

| 4. | NB - Iowa’s Public Universities LP |

| 5. | NB 1 PE Investment Holdings LP |

| 6. | NB 1911 LP |

| 7. | NB AGI PE Portfolio II Fund LP |

| 8. | NB ASGA Fund Holdings LP |

| 9. | NB Ayame Holdings LP |

| 10. | NB Blue Ensign Fund LP |

| 11. | NB Caspian Holdings LP |

| 12. | NB CPEG Fund Holdings LP |

| 13. | NB Credit Opportunities Co-Invest Affordable Care I LP |

| 14. | NB Credit Opportunities Co-Invest I LP |

| 15. | NB Credit Opportunities Fund II LP |

| 16. | NB Credit Opportunities II Cayman LP |

| 17. | NB Credit Opportunities II Co-Investment Fund (Cayman) LP |

| 18. | NB Credit Opportunities II Co-Investment (Whistler) LP |

| 19. | NB Crossroads 23 LC Holdings LP |

| 20. | NB Crossroads 23 MC Holdings LP |

| 21. | NB Crossroads 23 SS Holdings LP |

| 22. | NB Crossroads 23 VC Holdings LP |

| 23. | NB Crossroads 24 LC Holdings LP |

| 24. | NB Crossroads 24 MC Holdings LP |

| 25. | NB Crossroads 24 SS Holdings LP |

| 26. | NB Crossroads 24 VC Holdings LP |

| 27. | NB Crossroads XXII – MC Holdings LP |

| 28. | NB Crossroads XXII – VC Holdings LP |

| 29. | NB Crystal PE Holdings LP |

| 30. | NB Direct Access Fund II LP |

| 31. | NB Enhanced Income Holdings LP |

| 32. | NB Enhanced Income Holdings II LP |

| 33. | NB Enstar PE Opportunities Fund, LP |

| 34. | NB Euro Crossroads 2018 Holdings SCSp |

| 35. | NB Euro Crossroads 2021 Holdings SCSp |

| 36. | NB Flamingo Private Debt LP |

| 37. | NB Flat Corner PE Holdings LP |

| 38. | NB Gemini Fund LP |

| 39. | NB Granite Private Debt LP |

| 40. | NB Greencastle LP |

| 41. | NB Initium Infrastructure (EUR) Holdings LP |

| 42. | NB Initium Infrastructure (USD) Holdings LP |

| 43. | NB Initium PE (EUR) Holdings LP |

| 44. | NB Initium PE (USD) Holdings LP |

| 45. | NB Initium PE II (USD) Holdings LP |

| 46. | NB K-P Loan Partners LP |

| 47. | NB Oak LP |

| 48. | NB PA Co-Investment Fund LP |

| 49. | NB PD III Holdings (LO) LP |

| 50. | NB PD III Holdings (LS) LP |

| 51. | NB PD III Holdings (UO) LP |

| 52. | NB PD III Holdings (US) LP |

| 53. | NB PD IV Equity LP |

| 54. | NB PD IV Holdings (LO-A) LP |

| 55. | NB PD IV Holdings (LO-MS) LP |

| 56. | NB PD IV Holdings (LS-A) LP |

| 57. | NB PD IV Holdings (US-A) (Levered) LP |

| 58. | NB PD IV Holdings (US-B) (Unlevered) LP |

| 59. | NB PD IV Holdings (UO-A) LP |

| 60. | NB PEP Holdings Limited |

| 61. | NB Pinnacol Assurance Fund LP |

| 62. | NB Private Debt Fund LP |

| 63. | NB Private Debt II Holdings LP |

| 64. | NB Private Equity Credit Opportunities Holdings LP |

| 65. | NB Private package lp |

| 66. | NB Rembrandt Holdings 2018 LP |

| 67. | NB Rembrandt Holdings 2020 LP |

| 68. | NB Rembrandt Holdings 2022 LP |

| 69. | NB Renaissance Partners Holdings S.a r.l. |

| 70. | NB RESOF Holdings LP |

| 71. | NB RESOF II Cayman Holdings LP |

| 72. | NB RESOF II Holdings LP |

| 73. | NB RESOF SP1 LP |

| 74. | NB River City Fund LP |

| 75. | NB RP Co-Investment & Secondary Fund LLC |

| 76. | NB RPPE Partners LP |

| 77. | NB SBS US 3 Fund LP |

| 78. | NB Select Opps III MHF LP |

| 79. | NB Select Opps IV MHF LP |

| 80. | NB Select Opps V MHF LP |

| 81. | NB SHP Fund Holdings LP |

| 82. | NB SI-Apollo Sengai Fund Holdings LP |

| 83. | NB SOF III Holdings LP |

| 84. | NB SOF IV Cayman Holdings LP |

| 85. | NB SOF IV Holdings LP |

| 86. | NB SOF V Cayman Holdings LP |

| 87. | NB SOF V Holdings LP |

| 88. | NB Sonoran Fund Limited Partnership |

| 89. | NB STAR Buyout Strategy 2020 Holdings Ltd |

| 90. | NB STAR Buyout Strategy 2021 Holdings Ltd |

| 91. | NB STAR Buyout Strategy 2022 Holdings Ltd |

| 92. | NB Strategic Capital LP |

| 93. | NB Strategic Co-Investment Partners IV Holdings LP |

| 94. | NB Strategic Partnership Fund Co-Investments LP |

| 95. | NB Swan Private Debt SCSp |

| 96. | NB TCC Strategic Holdings LP |

| 97. | NB TPSF EM PE Fund LP |

| 98. | NB Wessex Holdings LP |

| 99. | NB Wildcats Fund LP |

| 100. | NB ZCF LP |

| 101. | NBAL Holdings LP |

| 102. | NBFOF Impact – Holdings LP |

| 103. | NBPD AT Holdings (LO-A) LP, |

| 104. | NBPD Centennial Holdings (LO-A) LP, |

| 105. | NBPD III Equity Co-Invest Holdings A LP |

| 106. |

NB-Sompo RA Holdings LP |

| 107. |

NEUB Holdings LP |

| 108. |

NEUB Infrastructure Holdings LP |

| 109. |

Neuberger Berman / New Jersey Custom Investment Fund III LP |

| 110. |

NYC-NorthBound Emerging Managers Program LP |

| 111. |

NYSCRF NB Co-Investment Fund LLC |

| 112. |

NYSCRF NB Co-Investment Fund II LLC |

| 113. |

Olive Cayman Holdings Ltd |

| 114. |

PECO-PD III BORROWER LP |

| 115. |

SJFED Private Equity Strategic Partnership, L.P. |

| 116. |

SJPF Private Equity Strategic Partnership, L.P. |

| 117. |

Soleil 2020 Cayman Holdings Ltd |

| 118. |

Soleil 2022 EUR Cayman Holdings Ltd |

| 119. |

Soleil B 2022 EUR Cayman Holdings Ltd |

| 120. |

Soleil B 2022 USD Cayman Holdings Ltd |

| 121. |

SunBerg PE Opportunities Fund LLC |

| 122. |

SunBern Alternative Opportunities Fund LLC |

| 123. |

Toranomon Private Equity 1, L.P. |

APPENDIX B-1

Resolutions

of the Managing Member of Neuberger Berman BDC LLC (the “Company”)

WHEREAS,

the officers (the “Authorized Officers”) of NB Alternatives GP Holdings LLC, the managing member of the Company

deem it advisable and in the best interest of the Company to file with the Securities and Exchange Commission (the

“Commission”) an application to amend the Company’s current Order of Exemption pursuant to Sections 17(d) and

57(i) of the Investment Company Act, as amended (the “1940 Act”), and Rule 17d-1 promulgated thereunder (the

“Application”); now therefore be it

RESOLVED, that

the Authorized Officers be, and each of them hereby is, authorized and directed on behalf of the Company and in its name to prepare, execute,

and cause to be filed with the Commission the Application, and any further amendments thereto; and further

RESOLVED,

that the Authorized Officers be, and each of them hereby is, authorized and directed to take such further action and execute

such other documents as such Authorized Officer or Officers shall deem necessary or advisable in order to effectuate the intent of the

foregoing resolution.

Adopted July 21, 2022

APPENDIX B-2

Resolutions

of each of the Boards of Managers/Directors (each, a “Board”) of NB Private Markets II, NB Private Markets

III, NB Private Markets IV, NB Private Markets V, NB Private Markets VI, NB Private Markets VII and NB Private Markets Access (each,

a “Fund”)

WHEREAS, the Board deems it advisable

and in the best interest of the Fund to file with the Securities and Exchange Commission (the “Commission”) an application

to amend the Fund’s current Order of Exemption pursuant to Sections 17(d) and 57(i) of the Investment Company Act, as

amended (the “1940 Act”), and Rule 17d-1 promulgated thereunder (the “Application”); now therefore

be it

RESOLVED, that the officers of the Fund

be, and each of them hereby is, authorized and directed on behalf of the Fund and in its name to prepare, execute, and cause to be filed

with the Commission the Application, and any further amendments thereto; and further

RESOLVED, that the officers of the Fund be,

and each of them hereby is, authorized and directed to take such further action and execute such other documents as such officer or officers

shall deem necessary or advisable in order to effectuate the intent of the foregoing resolution.

Adopted July 21, 2022

APPENDIX B-3

Resolutions

of the Boards of Directors (the “Board”) of Neuberger Berman Next Generation Connectivity Fund Inc. (the

“Fund”)

RESOLVED, that the officers (the “Authorized

Officers”) of the Fund be, be, and each of them individually hereby is, authorized, empowered and directed, in the name and on behalf

of the Fund, to cause to be executed, delivered and filed with the U.S. Securities and Exchange Commission (the “SEC”) a Co-Investment

Exemptive Application (the “Exemptive Application”) for an order of the SEC pursuant to Sections 17(d) and 57(i) of

the Investment Company Act of 1940, as amended (the “1940 Act”), and Rule 17d-1 under the 1940 Act, to permit certain

joint transactions that otherwise may be prohibited by Section 17(d) and 57(a)(4) of the 1940 Act and Rule 17d-1 under

the 1940 Act; and

FURTHER RESOLVED, that the Authorized Officers

be, and each of them individually hereby is, authorized, empowered and directed, in the name and on behalf of the Fund, to cause to be

made, executed, delivered and filed with the SEC any amendments to the Exemptive Application and any additional applications for exemptive

relief or any amendments to an Order of Exemption as are determined necessary, advisable or appropriate by any such Authorized Officer

in order to effectuate the foregoing, such determination to be conclusively evidenced by the taking of any such action; and

FURTHER RESOLVED, that all acts and things

previously done by any Authorized Officer, on or prior to the date hereof, in the name and on behalf of the Fund in connection with the

foregoing are in all respects authorized, ratified, approved, confirmed and adopted as acts and deeds by and on behalf of the Fund; and

FURTHER RESOLVED, that the Authorized Officers

be, and each of them individually hereby is, authorized, empowered and directed, in the name and on behalf of the Fund, to certify and

deliver copies of these resolutions to such governmental bodies, agencies, persons, firms or corporations as any such officer may deem

necessary and to identify by such officer’s signature or certificate, or in such form as may be required, the documents and instruments

presented to and approved herein and to furnish evidence of the approval, by an officer authorized to give such approval, of any such

document, instrument or provision or any addition, deletion or change in any document, instrument or provision.

Adopted June 23, 2022

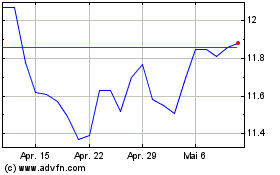

Neuberger Berman Next Ge... (NYSE:NBXG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Neuberger Berman Next Ge... (NYSE:NBXG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024