0000061986false00000619862024-06-122024-06-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): June 12, 2024 |

The Manitowoc Company, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Wisconsin |

1-11978 |

39-0448110 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

11270 West Park Place Suite 1000 |

|

Milwaukee, Wisconsin |

|

53224 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 414 760-4600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.01 Par Value |

|

MTW |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

The Manitowoc Company, Inc. will be presenting at the IDEAS Conference on Thursday, June 13, 2024, beginning at 9:15 AM, ET. A copy of the investor presentation is attached hereto as Exhibit 99 and shall be deemed furnished and not filed.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

THE MANITOWOC COMPANY, INC.

(Registrant) |

|

|

|

|

Date: |

June 12, 2024 |

By: |

/s/ Brian P. Regan |

|

|

|

Brian P. Regan

Executive Vice President and Chief Financial Officer |

The Manitowoc Company, Inc. IDEAS Conference June 13, 2024 New York, NY

Forward-Looking Statements Safe Harbor Statement Any statements contained in this presentation that are not historical facts are “forward-looking statements.” These statements are based on the current expectations of the management of the Company, and are subject to uncertainty and changes in circumstances.��The Company undertakes no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. As a general matter, forward-looking statements are those focused upon anticipated events or trends, expectations and beliefs relating to matters that are not historical in nature. Forward-looking statements include, without limitation, statements typically containing words such as “intends,” “expects,” “anticipates,” “targets,” “estimates,” and words of similar import. By their nature, forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. By their nature, forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. For a list of factors that could cause actual results to differ materially from those discussed or implied, please see the Company’s periodic filings with the SEC, particularly those disclosed in “Risk Factors” in the Company’s Annual Reports on Form 10-K. Any “forward-looking statements” in this presentation are intended to qualify for the safe harbor from liability under the Private Securities Litigation Reform Act of 1995. Non-GAAP Measures Adjusted net income, adjusted diluted net income per share (“Adjusted DEPS”), EBITDA, adjusted EBITDA, adjusted return on invested capital, and free cash flows are financial measures that are not in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). For a reconciliation to the comparable GAAP numbers please see “Appendix – GAAP to Non-GAAP Reconciliation.” Manitowoc believes these non-GAAP financial measures provide important supplemental information to both management and investors regarding financial and business trends used in assessing its results of operations. Manitowoc believes excluding specified items provides a more meaningful comparison to the corresponding reporting periods and internal budgets and forecasts, assists investors in performing analysis that is consistent with financial models developed by investors and research analysts, provides management with a more relevant measure of operating performance, and is more useful in assessing management performance.

Company Overview _____________________ Source: Company filings Please refer to Appendix for Non-GAAP reconciliations Calculated as total debt less cash and cash equivalents divided by Adjusted EBITDA For the year-ended December 31, 2023 2023 Revenue: $2.2B 2023 Adjusted EBITDA(1): $175M (7.9% of sales) 2023 Adjusted ROIC(1): 11.2% 2023 Net Leverage Ratio(2): 1.9x Global footprint Strong brand loyalty Large installed base and growth of accretive aftermarket business Sales by Geography(3) Market leading provider of lifting solutions

A Crane Renaissance in the Making… Total Revenue ($M) 2010 - 2013 Avg Revenue: ~$2,200 2017 - 2019 Avg Revenue: ~$1,700 2004 - 2008 Avg Revenue: ~$2,400 2020 – 2023 Avg Revenue: ~$1,850 Demand has been relatively flat for the last 10 years, adjusting for Inflation Higher Commodity Prices Saudi Vision 2030 Aging Crane Fleets Need Refresh U.S. Infrastructure Bill & CHIPS Investments European Housing Market Demand Global Investments in Energy Generation and Distribution

Manitowoc’s Evolution Since 2016 2016 Became a standalone crane Company 2023 Opened Denver, Kansas City, MO, Aiken, SC, and Lima, Peru distribution and service branch locations 2019 Refinanced debt 2020 COVID-19 pandemic – good stress test 2022 Acquired Honnen Equipment’s crane assets; opened Spain service location 2021 Acquired Aspen Equipment & H&E crane business Introduced Four Breakthrough Initiatives FN bottom Capitalize on aftermarket created by our installed base

Growing Aftermarket Business Parts & Service Rent-to-Own (RPO) Rentals Used sales Crane remanufacturing Training services Digital solutions Targeting aftermarket mid-single digit cagr

Driving Shareholder Value _____________________ (1) Please refer to Appendix Growing aftermarket increases margins and reduces cyclicality

Building Momentum on Breakthrough Initiatives Grow EU Tower Crane �Rental & Aftermarket Grow our Belt & Road Presence (Middle East focus) Leverage All-Terrain Crane NPD to Grow Aftermarket Megatrends Infrastructure Investments Electrification Strong Commodity Prices Fleet Renewal Aspirational Targets $3.0B Revenue $1.0B Non-new machine sales 12% Adjusted EBITDA 15% Adjusted ROIC(1) Expand Aftermarket in North America THE MANITOWOC WAY _____________________ (1) Adjusted ROIC is defined as adjusted net operating profit after taxes divided by total assets less cash, non-interest-bearing debt, and income taxes Positioning the company to capture greater aftermarket

Expand Aftermarket in North America $180m investment in acquisitions Generating >$30m of adjusted ebitda Acquired H&E Crane business (MGX) and Aspen Equipment in 2021 Added 3 new branch locations Grew service technician headcount from 31 to 194 Launched QuickStart training program to accelerate development of revenue-producing service techs Full-Service Capabilities Parts Sales Rental Fleet Services Remanufacturing and Used Sales Retail Sales 2021 – 2023 Progress

Grow EU Tower Rental & Aftermarket $3 billion market I ~75% non-new machine sales 160 units in rental fleet Grew rental fleet OEC by $28 million Grew to 14 service locations and 107 service technicians 56 units sold out of rental fleet 202 used trade-ins sold Enhanced aftermarket offerings such as parts and whole goods accessories, on-site repairs, rebuilds, etc. Full-Service Capabilities Parts Sales Rental Fleet Services Remanufacturing and Used Sales Retail Sales 2021 – 2023 Progress

Capital Allocation Strategy <3x Target Net Leverage 2.4x Net Leverage(2) Strategic Rental Fleet Growth Increased OEC by $57M since 2020(1) Acquisitions $180M invested in 2021 Robust acquisition funnel Dividend Program None currently approved Share Repurchase(4) $28M/2.1M shares repurchased since 2019 $35M authorized $233M Total Liquidity(3) _____________________ Source: Company filings Excludes increase in OEC related to acquisition of the rental assets of the H&E crane business and Aspen Equipment Based on Adjusted EBITDA as of 3/31/2024 As of 3/31/2024 As of 3/31/2024. Average repurchase price of $13.16 per share since inception in 2019. On 10/31/2023, BOD approved new authorization of $35M replacing the prior repurchase authorization Prudent capital deployment supporting growth

In Conclusion MTW has undertaken significant “self-help” actions to achieve a reasonable ROIC. We have a proven track record with acquisitions and a good funnel. Positioning company in less cyclical, higher margin aftermarket segment. The Crane Cycle is poised for another boom period. Aging fleet Impending EU Tower rebound Global infrastructure spending A Methodical transformation is underway

Appendix

The Manitowoc Way: Sustainable Business Strategy FN bottom Updated Jan 24 Updated April 23 Updated Jan 24 Building communities for current and future generations

Aspirations _____________________ Dollars in millions

Appendix – GAAP to Non-GAAP Reconciliation _____________________ Dollars in millions Note: See full reconciliation of GAAP and Non-GAAP financial measures contained in our quarterly and full-year earnings releases

Appendix – GAAP to Non-GAAP Reconciliation _____________________ Dollars in millions Note: See full reconciliation of GAAP and Non-GAAP financial measures contained in our quarterly and full-year earnings releases

Appendix – Adjusted ROIC Calculation Year Ended December 31, 2023 Operating income $ 92.4 Amortization of intangible assets 3.2 Restructuring expense 1.3 Other non-recurring items – net 21.8 Adjusted operating income 118.7 Provision for income taxes (17.8) Adjusted NOPAT $ 100.9 5-Quarter Average Total assets $ 1,681.3 Total liabilities (1,112.1) Net total assets 569.3 Cash and cash equivalents (44.2) Short-term borrowings and current portion of long-term debt 12.9 Long-term debt 371.4 Income tax liabilities - net 0.3 Invested capital $ 909.6 Adjusted ROIC 11.1% _____________________ Dollars in millions Note: See full reconciliation of GAAP and Non-GAAP financial measures contained in our quarterly and full-year earnings releases

Crane Types Rough-terrain (RT) Tower Crane (TC) Crawler (CR) All-terrain (AT) Boom Truck (BT) Truck-mounted (TM)

Thank you for your interest Additional information: Ion Warner – SVP Marketing & Investor Relations O +1 414-760-4805 M +1 717-414-1813 ion.warner@manitowoc.com www.manitowoc.com

v3.24.1.1.u2

Document And Entity Information

|

Jun. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 12, 2024

|

| Entity Registrant Name |

The Manitowoc Company, Inc.

|

| Entity Central Index Key |

0000061986

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

1-11978

|

| Entity Incorporation, State or Country Code |

WI

|

| Entity Tax Identification Number |

39-0448110

|

| Entity Address, Address Line One |

11270 West Park Place

|

| Entity Address, Address Line Two |

Suite 1000

|

| Entity Address, City or Town |

Milwaukee

|

| Entity Address, State or Province |

WI

|

| Entity Address, Postal Zip Code |

53224

|

| City Area Code |

414

|

| Local Phone Number |

760-4600

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.01 Par Value

|

| Trading Symbol |

MTW

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

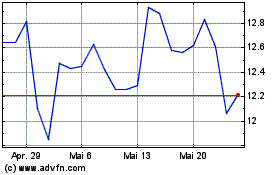

Manitowoc (NYSE:MTW)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Manitowoc (NYSE:MTW)

Historical Stock Chart

Von Dez 2023 bis Dez 2024