0000860748false00008607482024-02-072024-02-070000860748us-gaap:CommonStockMember2024-02-072024-02-070000860748kmpr:A5875FixedRateResetJuniorSubordinatedDebenturesDue2062Member2024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2024

Kemper Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-18298

| | | | | | | | |

| | |

| DE | | 95-4255452 |

(State or other jurisdiction

of incorporation) | | (IRS Employer

Identification No.) |

200 E. Randolph Street, Suite 3300, Chicago, IL 60601

(Address of principal executive offices, including zip code)

312-661-4600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2.below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | KMPR | NYSE |

| 5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062 | KMPB | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of

the Exchange Act. ¨

Section 2 – Financial Information

| | | | | |

| Item 2.02. | Results of Operations and Financial Conditions. |

On February 7, 2024, the Board of Directors (“Board”) of Kemper Corporation (“Company”) elected Suzet M. McKinney to the Board and appointed her to the Risk and Compensation Committees of the Board, in each case effective as of February 7, 2024.

Dr. McKinney will participate in the Company's non-employee director compensation program and is entitled to receive an indemnification agreement from the Company, the terms of which are described in the Director Compensation section of the Company's Proxy Statement for the 2023 Annual Meeting of Shareholders on file with the Securities and Exchange Commission (“SEC”).

There are no arrangements or understandings with Dr. McKinney pursuant to which she was selected as a director of the Company and there are no transactions involving Dr. McKinney or any of her immediate family members that are subject to disclosure by the Company under Item 404(a) of SEC Regulation S-K.

In addition, on February 7, 2024, Christopher B. Sarofim notified the Board that he will not stand for re-election at Kemper’s 2024 Annual Meeting of Shareholders. He will continue to serve as a director until the date of the Company’s Annual Meeting.

A copy of the press release announcing both Dr. McKinney’s election and Mr. Sarofim’s decision to not stand for re-election is attached as Exhibit 99.1.

Section 9 – Financial Statements and Exhibits

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

Exhibit Number | Exhibit Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | | Kemper Corporation |

| | |

| Date: | February 7, 2024 | | | /s/ C. Thomas Evans, Jr. |

| | | | C. Thomas Evans, Jr. |

| | | | Executive Vice President, Secretary and General Counsel |

| | | | | |

| Kemper Corporation 200 East Randolph Street Suite 3300 Chicago, IL 60601 kemper.com

|

|

|

|

| Press Release | |

Kemper Names Dr. Suzet McKinney of Sterling Bay to Board of Directors

Announces Retirement of Director Christopher Sarofim

CHICAGO, February 7, 2024 — Kemper Corporation (NYSE: KMPR) announced that its Board of Directors has elected Dr. Suzet M. McKinney as a Director, effective February 7. The Board also announced that Christopher B. Sarofim has informed the Board of his intention to retire as a director at the end of his current term, expiring May 1, 2024.

As Principal and Director of Life Sciences for Sterling Bay, the national real estate investment and development firm, McKinney oversees relationships with the scientific, academic, corporate, tech, and governmental sectors involved in the life sciences ecosystem. She also leads the strategy to expand Sterling Bay’s footprint in life sciences nationwide. Prior to Sterling Bay, she held a number of senior leadership roles in public health and policy administration. McKinney also serves on numerous boards and advisory committees, including the Board of Directors for Wintrust Financial Corporation. McKinney holds a Doctorate from the University of Illinois at Chicago School of Public Health, a Master of Public Health with certificates in Managed Care and Health Care Administration from Benedictine University, and a Bachelor of Arts in Biology from Brandeis University.

“We’re pleased to welcome Suzet to our board,” said Joseph P. Lacher, Jr., President, CEO and Chairman of Kemper’s Board of Directors. “Her leadership of large organizations, business experience, strategic execution, and deep familiarity with the Chicago business community make her an excellent addition to Kemper’s board, and we look forward to the benefits of her perspective and contributions.”

“It’s an exciting time for Kemper as they move forward and I’m pleased to join the board to help advance the strategic priorities of the company,” said McKinney. “I believe in Kemper’s commitment to serve the underserved and look forward to working with my fellow board members and the talented senior leadership team in support of that mission.”

Sarofim was elected to Kemper’s Board in May 2013, and has served on the Board’s Investment Committee. He currently serves as Chairman of Fayez, Sarofim & Co., a leader in the financial services and investment management industry. His community and charitable commitments include serving on the Board of Trustees for The Brown Foundation and Baylor College of Medicine, a member of the Advisory Committee for MD Anderson Cancer Center, and as the Chairman of the Board of Trustees of the Sarofim Foundation.

“Kemper has been very fortunate to have Chris’s leadership on our Board for nearly 11 years, and we thank him for his dedicated service and outstanding contributions,” said Lacher. “His investment management expertise has been of great value to the Board, and his financial market and investment banking experience has been beneficial to the Board. He’s been a highly effective director, and we extend our gratitude and best wishes to Chris and his family.”

“It’s been an honor serving on Kemper’s board over the last 11 years, and I couldn’t be prouder of what we’ve accomplished,” Sarofim said. “I leave with the utmost confidence in both the leadership team and the company’s prospects for the future, and know the outstanding Board and management will continue to successfully execute on Kemper’s strategic intent.”

About Kemper

The Kemper family of companies is one of the nation's leading specialized insurers. With approximately $13 billion in assets, Kemper is improving the world of insurance by providing affordable and easy-to-use personalized solutions to individuals, families and businesses through its Kemper Auto and Kemper Life brands. Kemper serves

over 4.9 million policies, is represented by 23,700 agents and brokers, and has 8,100 associates dedicated to meeting the ever-changing needs of its customers. Learn more about Kemper.

Contacts

News Media: Barbara Ciesemier, 312.661.4521, bciesemier@kemper.com

Investors: Karen Guerra, 312.661.4930, investors@kemper.com

v3.24.0.1

Document and Entity Information

|

Feb. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 07, 2024

|

| Entity Registrant Name |

Kemper Corporation

|

| Entity Central Index Key |

0000860748

|

| Amendment Flag |

false

|

| Entity File Number |

001-18298

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

95-4255452

|

| Entity Address, Address Line One |

200 E. Randolph Street

|

| Entity Address, Address Line Two |

Suite 3300

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60601

|

| City Area Code |

312

|

| Local Phone Number |

661-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| Trading Symbol |

KMPR

|

| Security Exchange Name |

NYSE

|

| Entity Listings [Line Items] |

|

| Trading Symbol |

KMPR

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| 5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062 |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062

|

| Trading Symbol |

KMPB

|

| Security Exchange Name |

NYSE

|

| Entity Listings [Line Items] |

|

| Trading Symbol |

KMPB

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kmpr_A5875FixedRateResetJuniorSubordinatedDebenturesDue2062Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

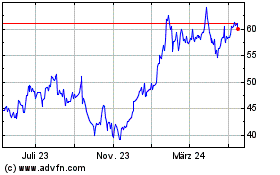

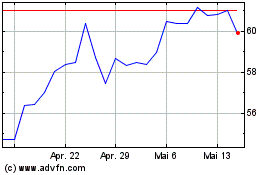

Kemper (NYSE:KMPR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Kemper (NYSE:KMPR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024