KKR Acquires Portfolio of Four Industrial Warehouses Serving the Central Florida Market

21 Oktober 2024 - 10:15PM

Business Wire

KKR, a leading global investment firm, today announced that KKR

has acquired a portfolio of four Class A industrial warehouses

serving the greater Central Florida market, including Orlando and

Tampa.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241021128092/en/

(Photo: Business Wire)

The four industrial properties sit at the intersection of

Interstate 4 and U.S. Route 27, two vital transportation arteries

in southwest Orlando that facilitate access to key demand drivers

across Central Florida. The assets, totaling approximately 1.2

million square-feet (SF), are 100% leased to five high-quality

tenants, including investment grade public companies and regional

market leaders.

“We are pleased to grow our footprint in Central Florida with

the purchase of these strategically located, high-quality warehouse

assets,” said Ben Brudney, a Managing Director in the Real Estate

group at KKR who oversees the firm’s industrial investments in the

United States. “We believe that prime transit-adjacent distribution

locations in southwest Orlando continue to benefit from strong

demand drivers and limited new supply.”

KKR is acquiring the portfolio through its KKR Real Estate

Partners Americas III fund. The addition of this portfolio brings

KKR’s total warehouse acquisitions in the U.S. to nearly eight

million SF since the start of the year.

KKR’s global real estate business invests in high-quality,

thematic real estate through a full range of scaled equity and debt

strategies. Managing $75 billion in assets as of June 30, 2024,

KKR’s approximately 150 dedicated real estate investment and asset

management professionals across 16 offices apply the capabilities

and knowledge of KKR’s global platform to deliver outcomes for

clients and investors.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at

www.kkr.com. For additional information about Global

Atlantic Financial Group, please visit Global Atlantic Financial

Group’s website at www.globalatlantic.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021128092/en/

Media Miles Radcliffe-Trenner or Lauren McCranie

media@kkr.com

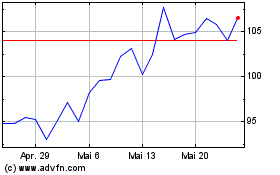

KKR (NYSE:KKR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

KKR (NYSE:KKR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025