Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

27 Februar 2024 - 1:30PM

Edgar (US Regulatory)

Free Wrinting Prospectus

Filed Pursuant to Rule 433

Registration No. 333- 272573

TERM SHEET

Dated

February 26, 2024

KeyCorp

Senior Medium-Term Notes, Series S

$1,000,000,000

6.401% Fixed-to-Floating Senior Notes due 2035

|

|

|

| Issuer: |

|

KeyCorp |

|

|

| Security Type: |

|

Senior Notes |

|

|

| Aggregate Principal Amount Offered: |

|

$1,000,000,000 |

|

|

| Settlement Date: |

|

February 28, 2024 (T+2) |

|

|

| Maturity Date: |

|

March 6, 2035 |

|

|

| Issue Price: |

|

99.998% of principal amount |

|

|

| Fixed Rate Reference Benchmark: |

|

4.000% UST due February 15, 2034 |

|

|

| Fixed Rate Benchmark Treasury Strike: |

|

97-18+; 4.301% |

|

|

| Fixed Rate Spread to Benchmark: |

|

+210 basis points (2.100%) |

|

|

| Fixed Rate Yield to Maturity: |

|

6.401% |

|

|

| Redemption Provisions: |

|

The notes are redeemable by KeyCorp, solely at its option, (i) on or after August 26, 2024 (180 days following the issue date), and, prior to March 6, 2034 (one year prior to the Maturity Date), in whole or in part,

at any time and from time to time, at a make-whole redemption price based on the treasury rate plus 30 basis points, plus accrued interest thereon to, but excluding, the redemption date, and (ii) on March 6, 2034, in whole but not in part,

or on or after December 6, 2034 (three months prior to the Maturity Date), in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of Notes being redeemed, in each case, plus accrued

interest thereon to, but excluding, the redemption date, in each case in accordance with the redemption provisions described under “Supplemental Information Concerning Description of Notes—Optional Redemption” in the applicable

Preliminary Pricing Supplement. KeyCorp will give notice to the holders of the notes at least 5 days and not more than 60 days prior to the date fixed for redemption in the manner described under “Description of Notes—Optional Redemption,

Repayment and Repurchase”. |

|

|

|

|

|

| Fixed Rate Period: |

|

From and including February 28, 2024 to, but excluding, March 6, 2034 |

|

|

| Floating Rate Period: |

|

From and including March 6, 2034 to, but excluding, the Maturity Date |

|

|

| Fixed Rate Interest Rate: |

|

6.401%, payable semi-annually in arrears during the Fixed Rate Period |

|

|

| Floating Rate Interest Rate: |

|

An annual floating rate equal to the Base Rate plus a spread of 2.420% per annum, payable quarterly in arrears during the Floating Rate Period |

|

|

| Base Rate: |

|

Compounded SOFR determined for each quarterly interest period during the floating rate period calculated based on the Compounded Index Rate in accordance with the specific formula described under “Description of

Notes—Calculation of Interest—SOFR Notes—Compounded SOFR Index Notes”. |

|

|

| Minimum Floating Interest Rate: |

|

During the Floating Rate Period, zero |

|

|

| Interest Period: |

|

During the Fixed Rate Period, the period commencing on any Fixed Rate Interest Payment Date (and with respect to the initial fixed interest

period only, commencing on the issue date of the Fixed-to-Floating Rate Notes) to, but excluding, the next succeeding Fixed Rate Interest Payment Date. In the case of

the last fixed interest period, from and including the Fixed Rate Interest Payment Date immediately preceding the last Fixed Rate Interest Payment Date before the commencement of the first floating rate interest period on March 6, 2034 to, but

excluding, such last Fixed Rate Interest Payment Date. During the Floating Rate

Period, the period commencing on any Floating Rate Interest Payment Date (or, with respect to the initial floating interest period only, commencing on March 6, 2034) to, but excluding, the next succeeding Floating Rate Interest Payment Date. In

the case of the interest payment at maturity, from and including the Floating Rate Interest Payment Date immediately preceding the Maturity Date to, but excluding, such Maturity Date. |

- 2 -

|

|

|

|

|

|

|

Each of a Fixed Rate Interest Payment Date and a Floating Rate Interest Payment Date is an “Interest Payment Date.”

In the event of an optional redemption, the applicable interest period with respect to

the notes called for redemption will run to, but excluding, the redemption date. |

|

|

| Observation Period: |

|

During the Floating Rate Period, in respect of each interest period, the period from, and including, the date that is two U.S. Government Securities Business Days preceding the first date in such interest period to, but excluding,

the date two U.S. Government Securities Business Days preceding the Floating Rate Interest Payment Date for such interest period |

|

|

| Interest Payment Determination Date: |

|

During the Floating Rate Period, the date two U.S. Government Securities Business Days before the applicable Interest Payment Date |

|

|

| U.S. Government Securities Business Day: |

|

Any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in

U.S. government securities |

|

|

| Fixed Rate Interest Payment Dates: |

|

During the Fixed Rate Period, interest will be payable semi-annually in arrears on March 6 and September 6 in each year, commencing on September 6, 2024 and with the final fixed rate interest payment being made on

March 6, 2034 |

|

|

| Floating Rate Interest Payment Dates: |

|

During the Floating Rate Period, interest will be payable quarterly in arrears on June 6, September 6, December 6 and the Maturity Date, commencing on June 6, 2034 |

|

|

| Day Count: |

|

30 / 360 during the Fixed Rate Period, ACT / 360 during the Floating Rate Period |

|

|

| Day Count Convention: |

|

During the Fixed Rate Period, following business day, unadjusted. During the Floating Rate Period, modified following business day. |

|

|

| Gross Proceeds: |

|

$999,980,000 |

- 3 -

|

|

|

|

|

| Underwriting Discount: |

|

0.450% |

|

|

| Price to Issuer: |

|

99.548% of the principal amount |

|

|

| Net Proceeds After Underwriting Discount: |

|

$995,480,000 |

|

|

| CUSIP: |

|

49326EEP4 |

|

|

| Denomination: |

|

$2,000 and integral multiples of $1,000 in excess thereof |

|

|

| Record Date: |

|

15 calendar days prior to each Interest Payment Date |

|

|

| Joint Book-Running Managers: |

|

KeyBanc Capital Markets Inc. (21.5%) Citigroup

Global Markets Inc. (21.5%) Morgan Stanley & Co. LLC (21.5%)

RBC Capital Markets, LLC (21.5%) |

|

|

| Passive Bookrunners: |

|

BofA Securities, Inc. (4.0%) Goldman

Sachs & Co. LLC (4.0%) J.P. Morgan Securities LLC (4.0%) |

|

|

| Co-Managers: |

|

Academy Securities, Inc. (1.0%) CastleOak

Securities, L.P. (1.0%) |

|

|

| Expected Issue Ratings: |

|

Moody’s: Baa2 (Negative)

S&P: BBB (Stable) Fitch: BBB+ (Stable)

DBRS: A (Negative) |

We expect that delivery of the notes will be made to investors on or about February 28, 2024, which will be the second

business day following the date hereof (such settlement being referred to as “T+2”).

The issuer has filed a registration statement (including a

prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the supplements thereto and other

documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

Alternatively, a copy of the prospectus (including the supplements thereto) for the offering can be obtained by calling KeyBanc Capital Markets Inc. toll-free

at 1 (866) 227-6479, Citigroup Global Markets Inc. toll-free at 1 (800) 831-9146, Morgan Stanley & Co. LLC toll-free at 1 (866)

718-1649, or RBC Capital Markets, LLC toll-free at 1 (866) 375-6829.

- 4 -

Conflicts of Interest

Because KeyBanc Capital Markets Inc. is deemed to be an affiliate of KeyCorp, this offering is being conducted in compliance with FINRA Rule 5121. See

“Supplemental Information Concerning the Plan of Distribution (Conflicts of Interest)” in the pricing supplement relating to the notes.

Ratings

An explanation of the significance of ratings

may be obtained from the ratings agencies. Generally, ratings agencies base their ratings on such material and information, and such of their own investigations, studies and assumptions, as they deem appropriate. The security ratings above are not a

recommendation to buy, sell or hold the securities hereby. The ratings may be subject to revision or withdrawal at any time by Moody’s Investors Service, S&P Global Ratings, Fitch Ratings, Inc. and DBRS, Inc. Each of the security ratings

above should be evaluated independently of any other security rating.

Any disclaimers or other notices that may appear below are not applicable to

this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg or another email system.

- 5 -

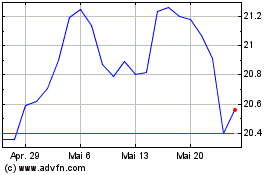

KeyCorp (NYSE:KEY-K)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

KeyCorp (NYSE:KEY-K)

Historical Stock Chart

Von Apr 2024 bis Apr 2025

Echtzeit-Nachrichten über KeyCorp (New York Börse): 0 Nachrichtenartikel

Weitere KeyCorp News-Artikel