UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of January, 2024

Commission File Number: 001-15276

Itaú Unibanco Holding S.A.

(Exact name of registrant as specified in its charter)

Itaú Unibanco Holding S.A.

(Translation of Registrant’s Name into English)

Praça

Alfredo Egydio de Souza Aranha, 100-Torre Conceicao

CEP

04344-902 São Paulo, SP, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F

or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82–

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: January 16, 2024.

|

|

|

| Itaú Unibanco Holding S.A. |

|

|

| By: |

|

/s/ Renato Lulia Jacob |

| Name: |

|

Renato Lulia Jacob |

| Title: |

|

Group Head of Investor Relations and Market Intelligence |

|

|

| By: |

|

/s/ Alexsandro Broedel |

| Name: |

|

Alexsandro Broedel |

| Title: |

|

Chief Financial Officer |

Corporativo | Interno ENVIRONMENTAL, SOCIAL AND CLIMATE RESPONSIBILITY

POLICY (GLOBAL) Publication Date: 16.01.2024 1. PURPOSE The “Environmental, Social and Climate Responsibility Policy” (or

“PRSAC” in Portuguese) sets out the principles, strategies and guidelines of an environmental, social, and climate nature

to be observed in the performance of Itaú Unibanco’s business, activities and processes, as well as in its relationship

with stakeholders. 2. TARGET AUDIENCE This Policy is applicable to the activities of Itaú Unibanco and its controlled companies.

3. INTRODUCTION As the institution that represents the conglomerate before the Central Bank of Brazil, Itaú’s vision is

to be a leading institution in sustainable performance and customer satisfaction by creating value to be shared among all stakeholders,

clear performance to ensure business continuity and compliance with laws and regulations. As a financial institution, Itaú influences

decisions and guides financial flows through its products and services. Itaú’s commitment to sustainable development in

the countries where it operates is in the essence of its activity and is translated into its sustainability strategy, which guides the

integration of aspects of an environmental, social and climate nature into its business, and in the way it creates value for society

through Positive Impact Commitments (sustainability strategy with public targets on the institution’s website), which pervade the

entire organization and guide decision-making processes in its business, activities and processes. Adherence to this responsibility Policy

is mandatory and guides a set of efforts of the entire organization towards compliance with these principles. 4. PRINCIPLES AND GUIDELINES

This Policy establishes guidelines that, provided that the relevance and proportionality principles are observed, must guide the performance

of Itaú’s business, activities and processes, as well as its relationship with stakeholders, taking the following natures

into consideration: I. Regarding the social nature - Respect and protection of human rights by promoting diversity, equity and inclusion,

preventing moral and sexual harassment, discrimination of any kind and work in degrading conditions in disagreement with legislation

(child labor and forced or compulsory labor). - Promotion of equal opportunities for employees and value chain, as well as for the development

of corporate leaders on diversity and human rights aspects. - Encouragement for the transformation of society in crucial fields for social

development on topics such as education, employability, mobility, culture, health, sports, in conformity with the private social investment

strategy. - Contribution to the reduction of social inequalities through support for historically vulnerable groups in society due to

gender, race, age, sexual orientation, disability or regionality. - Support for entrepreneurship so as to increase social development

and contribute to the financial inclusion and prosperity of micro, small and middle-market entrepreneurs based on access to financial

products, tools and solutions that improve the management of businesses and expand their growth potential. - Ethical and transparent

posture, with the availability of whistleblowing channels that are accessible and suitable for stakeholders to receive and check reports

on suspected violations of integrity. - Respect for the regulatory environment and for competition conditions for a fair financial system

that promotes the best sustainability practices in the industry. Corporativo | Interno II. Regarding the environmental nature - Seek

to reduce any negative environmental impacts of direct operations, in addition to promote sustainable practices, by means of efficiency

in the consumption and use of natural resources, proper management and disposal of waste and effluents generated in the bank’s

activities and efficiency in energy use. - Management and minimization of negative environmental impacts arising from activities and

value chain through continuous improvement processes, taking into consideration good environmental management practices and legal requirements.

- Adoption of environmental and social risk and opportunity management that contributes to the conservation and sustainable use of resources

and protection of Brazilian biodiversity. - Attention to compliance with applicable environmental legislation in processes. - Support

for clients in the reduction of their environmental impacts by means of the products and services offered. - Investments in sustainable

development projects in the most diverse economic sectors and, in particular, in the agribusiness industry. III. Regarding the climate

nature - Incorporation of climate variables into the management of risks, as defined in the Environmental, Social and Climate Risks Policy

(Global), in accordance with Resolution No. 4,557/17 of the National Monetary Council (CMN), as amended by CMN Resolution No. 4,943/21.

- Measurement of scopes 1 and 2 greenhouse gas emissions and offset of own emissions. - Definition of financed emissions management strategy

(scope 3) and implementation of a decarbonization plan to support the transition of businesses to a carbon-neutral economy. 5. GUIDELINES

FOR RELATIONSHIPS WITH STAKEHOLDERS I) CLIENTS - Contribute to increase the access to financial products and services and offer tools

and content that support healthier financial decisions. - By means of products and services, partnerships and investments, foster the

development of people and companies through access to financial resources, tools and solutions that improve the management of businesses

and increase their growth potential. - Encourage clients to develop environmental, social and climate responsibility practices. - Promote

practices for the continuous improvement of accessibility, social inclusion, respect for human rights and diversity of clients. - Have

suitability as an assumption in the sale of products and provision of services aimed at an increasingly sustainable economy. - Influence

the sustainable development of people and companies by means of the business, whether through credit granting in industries with a positive

impact on society, structuring ESG operations or products that support the economic climate transition, and have offers of responsible

investment products that are always open for funding. II) EMPLOYEES - Offer to employees a healthy, accessible, inclusive and thriving

workplace that generates well-being by adopting good development, training, health and safety practices. - Have Ombudsman’s Office

procedures available to both guide and advise employees and address suspicions, complaints and claims of ethical misconduct and practices

that are contrary to institutional Policies, such as moral or sexual harassment, discrimination, disrespect and interpersonal conflicts

and conflicts of interest in the workplace. - Adopt clear and transparent compensation processes aimed at complying with the applicable

regulation and the best national and international practices, as well as ensure consistency with this Policy. - Promote practices for

the appreciation of diversity, equity and inclusion in the workplace. III) SUPPLIERS - Monitor the environmental, social and climate

aspects for engaging and retaining suppliers in accordance with the principles of this Policy, as well as compliance by suppliers with

applicable legislation. Corporativo | Interno - Engage suppliers to encourage the adoption of the best environmental, social and climate

responsibility practices. IV) INVESTORS AND STOCKHOLDERS - Disclose financial and non-financial information in a simple and objective

manner that allows investors and stockholders to assess the organization’s work and strategy, enabling them to make proper investment

decisions. - Report, in an integrated, continuous and consistent way, significant environmental, social, climate and governance aspects.

6. MANAGEMENT OF PRINCIPLES AND GUIDELINES The impacted departments shall include in their respective internal procedures the means for

the implementation of the guidelines established in this Policy, when applicable. We point out the processes required for the effective

compliance with guidelines: - Establish governance processes for the proper management of the environmental, social and climate aspects

with regular reporting in the proper forums, and monitor the application of the guidelines and actions aimed at the effectiveness of

this Policy. - Establish the basic guidelines of the Environmental Management System, or any other system that may replace it, used in

the certified administrative buildings to ensure compliance with the NBR ISO 14.001:2015 Standard, and adopt the best environmental management

practices in such uncertified administrative buildings, branch network and technological centers. - Incorporate sustainability and environmental,

social and climate responsibility criteria into the management of and decision on companies over which Itaú Unibanco holds partner

rights and effective operational or corporate control. - Integrate sustainability and environmental, social and climate responsibility

issues into the management of third-party resources and exercise the responsibility, as a supervisor, through the engagement of companies

and participation in the meetings of investees. - Promote awareness among and education of employees on environmental, social and climate

topics and the proper application of this Policy. - Disseminate good practices, strategy and environmental, social and climate content

to our stakeholders; - Manage the environmental, social and climate risk as one of the many types of risk to which Itaú is exposed

in operations, products and services. - Disclose this Policy on the institution’s website, as well as any implemented actions aimed

at the effectiveness of PRSAC, the list of sensitive sectors and sectors subject to restrictions, the list of products and services offered

that contribute positively to aspects of an Environmental, Social or Climate nature, and the list of pacts, agreements or voluntary commitments

assumed, as set out in items II and III of Article 10 of CMN Resolution No. 4,945/21. 7. MAIN ROLES AND RESPONSIBILITIES The governance

of the environmental, social and climate responsibility at Itaú Unibanco has forums and departments indicated below with the following

roles and responsibilities, as follows: ▪ Board of Directors: It approves and reviews the Environmental, Social and Climate Responsibility

Policy and ensures the adherence by the institution to the Policy and the actions aimed at its effectiveness and due corrections, as

well as the compatibility with the other Policies established, and ensures that the compensation structure adopted by the institution

does not encourage behavior incompatible with PRSAC, with support from the responsible department. ▪ Environmental, Social and

Climate Responsibility Committee: It coordinates the activities with the Risk and Capital Management Committee (CGRC) and acts on the

recommendations to the Board of Directors for the establishment and review of this Policy and, when required, it proposes recommendations

for improvement of the actions implemented aimed at ensuring the effectiveness of PRSAC. ▪ Superior ESG Council: It ensures compliance

with Itaú Unibanco’s Corporate Sustainability (ESG) Strategy in accordance with PRSAC, monitors the progress and evolution

of main indicators, projects and processes of the Corporate Sustainability (ESG) agenda, both in the retail and wholesale segments, monitoring

the bank’s work in view of the main ESG demands from the market, regulators and civil society, approving projects and resources

Corporativo | Interno necessary for addressing any gaps that may compromise the effectiveness of the Environmental, Social and Climate

Responsibility Policy and, when required, it submits proposals for improvement to the Environmental, Social and Climate Responsibility

Committee and the Board of Directors. ▪ Officer in charge: Responsible for managing the Institutional Relations and Sustainability

Office, they provide support and engage in the decision-making process in connection with the establishment and review of PRSAC, assisting

the Board of Directors, implement actions aimed at the effectiveness of PRSAC, monitor and evaluate any implemented actions, improve

the implemented actions alongside the business and support areas whenever any deficiencies are identified, carry out a proper and reliable

disclosure of PRSAC-related information, and are responsible for notifying the Central Bank of Brazil in the case the officer assigned

to these responsibilities is replaced. ▪ Institutional Relations and Sustainability Office: It is responsible for implementing

and updating this Policy, as well as for developing and coordinating topics and processes related to environmental, social and climate

responsibility, in accordance with the responsibilities determined in specific internal rules and in line with the business and support

areas. ▪ Environmental and Social Legal Department: It provides support on specific legal topics and guidance on applicable legislation

and rules. ▪ Risk Department: It identifies, assesses, measures, controls, monitors and reports, as well as internalizes the Environmental,

Social and Climate Risks for Traditional Risks in the Policies and procedures. ▪ Operational Risk Office: Inserted in the second

line, with a Dedicated Operational Risk role, it ensures the independent performance and integrity of the Internal Control Systems, being

responsible for: i) supporting the first line in the management of operational risks; ii) developing and making available the methodologies,

tools, systems, infrastructure and governance required to support the integrated management of Operational Risk and Internal Controls;

iii) coordinating any Operational Risk and Internal Control activities alongside the Business and Support areas, being independent in

the exercise of their functions, and iv) communicating risk notes concerning moderate and high risks. ▪ Products and Services

Departments (Wholesale and Retail): They work on the development of opportunities with the potential to make a positive contribution

to society, nature, climate, environmental restoration and conservation, as well as on providing transparent information to the market.

▪ Procurement Department: It continuously monitors suppliers with respect to environmental and social criteria and it may, should

material facts be identified, suspend new contracts and ultimately terminate the existing ones at any time. ▪ Investor Relations

Department: It publishes information to investors in accordance with the guidelines of this Policy and provides the documents listed

by CMN Resolution No. 4,945/21 on the institution’s website. ▪ Compensation Department: It ensures that the compensation

structure adopted by the institution does not encourage behaviors incompatible with this Policy. ▪ Endomarketing Department: It

works on the dissemination of this Policy to employees and their engagement accordingly. ▪ Internal Audit: It checks, on an independent

and regular basis, the adequacy of processes and procedures for adherence to the Environmental, Social and Climate Responsibility Policy,

in accordance with the guidelines established in the Internal Audit Policy. ▪ Other departments of Itaú Unibanco: They

monitor the adherence to the principles and guidelines of this Policy in the activities under their responsibility and management. They

formalize, in their processes, Policies, procedures and/or manuals, the criteria that ensure adherence to the principles and guidelines

of this Policy. 8. COMMUNICATION CHANNELS Any questions and suggestions related to this Policy and its application must be forwarded

to email prsac@itau-unibanco.com.br. Public information on this Policy is available at the link https://www.itau.com.br/sustentabilidade/institucional/prsac/.

Corporativo | Interno 9. APPROVAL AND REVIEW OF THIS POLICY The review process will be carried out according to guidelines established

in the institution's internal procedure or upon the occurrence of events deemed material, through the approval from the Board of Directors

based on recommendations of the Environmental, Social and Climate Responsibility Committee. 10. RELATED RULES - CMN Resolution No. 4,945/21,

which provides for the Environmental, Social and Climate Responsibility Policy (PRSAC) and the actions aimed at its effectiveness. -

CMN Resolution No. 4,557/17, as amended by CMN Resolution No. 4,943/21, which provides for the risk management structure, capital management

structure and the information disclosure Policy. - SARB Regulation No. 014/2014 – Bank Self-Regulation (Brazilian Federation of

Banks - FEBRABAN) – Creation and implementation of the Environmental and Social Responsibility Policy. - NBR ISO 14.001:2015 of

the Brazilian Association of Technical Standards (ABNT) – Environmental Management System – Requirements for guidance and

use. - SUSEP Circular No. 666 of June 27, 2022 – Sustainability requirements to be fulfilled by insurance and capitalization companies.

11. BODIES RESPONSIBLE FOR PREPARING THE DOCUMENT Prepared by: ESG STRATEGY DEPARTMENT Approved by: BOARD OF DIRECTORS Office in charge:

INSTITUTIONAL RELATIONS AND SUSTAINABILITY OFFICE

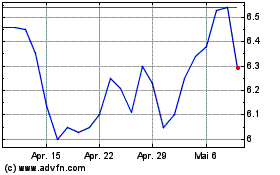

Itau Unibanco (NYSE:ITUB)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

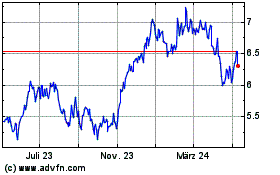

Itau Unibanco (NYSE:ITUB)

Historical Stock Chart

Von Mai 2023 bis Mai 2024