SECURITIES

AND EXCHANGE COMMISSION

Washington

DC 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

OF

THE

SECURITIES EXCHANGE ACT OF 1934

For 08

March 2024

InterContinental Hotels Group PLC

(Registrant's

name)

1

Windsor Dials, Arthur Road, Windsor, SL4 1RS, United

Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F

Form 40-F

EXHIBIT

INDEX

|

99.1

|

Director/PDMR

Shareholding dated 23 February 2024

|

|

99.2

|

Transaction

in Own Shares dated 26 February 2024

|

|

99.3

|

Transaction

in Own Shares dated 27 February 2024

|

|

|

Transaction

in Own Shares dated 28 February 2024

|

|

99.5

|

Director/PDMR

Shareholding dated 29 February 2024

|

|

99.6

|

Transaction

in Own Shares dated 29 February 2024

|

|

99.7

|

Transaction

in Own Shares dated 01 March 2024

|

|

99.8

|

Director/PDMR

Shareholding dated 01 March 2024

|

|

99.9

|

Transaction

in Own Shares dated 04 March 2024

|

|

99.10

|

Transaction

in Own Shares dated 07 March 2024

|

|

99.11

|

Transaction

in Own Shares dated 08 March 2024

|

Exhibit

No: 99.1

InterContinental Hotels Group PLC

Person Discharging Managerial Responsibility ("PDMR")

Shareholding

InterContinental Hotels Group PLC (the "Company") has been notified

that on 21 February 2024 the following shares were allocated,

pursuant to the vesting of shares under the Company's 2021/23 Long

Term Incentive Plan, following adjustments for tax and social

security withholdings, to the following PDMRs:

|

Name of PDMR

|

Number of shares

|

|

Elie Maalouf

|

10,197

|

|

Michael Glover

|

2,368

|

|

Heather Balsley

|

3,548*

|

|

Jolyon Bulley

|

5,039*

|

|

Yasmin Diamond

|

3,690*

|

|

Nicolette Henfrey

|

4,010

|

|

Wayne Hoare

|

5,374

|

|

Kenneth Macpherson

|

5,232*

|

|

George Turner

|

5,179

|

*A number of shares were subsequently sold upon vesting as also

notified below.

This notice is given in fulfilment of the obligation under Article

19 of the Market Abuse Regulation.

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Elie Maalouf

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Executive Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

10,197

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

10,197

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Michael Glover

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Financial Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

2,368

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

2,368

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Heather Balsley

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Global Chief Customer Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary

Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

3,548

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

3,548

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Jolyon Bulley

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Executive Officer, Americas and Group Transformation Lead,

Luxury & Lifestyle

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

5,039

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

5,039

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Yasmin Diamond

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Executive Vice President, Global Corporate Affairs

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

3,690

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

3,690

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Nicolette Henfrey

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Executive Vice President, General Counsel & Company

Secretary

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

4,010

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

4,010

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Wayne Hoare

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Human Resources Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

5,374

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

5,374

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Kenneth Macpherson

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Executive Officer, Europe, Middle East, Asia and

Africa

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

5,232

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

5,232

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

George Turner

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Commercial & Technology Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Shares allocated pursuant to the vesting of shares under the

Company's 2021/23 Long Term Incentive Plan, following adjustments

for tax and social security withholdings

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

Nil

consideration

|

5,179

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

5,179

Nil consideration

Nil consideration

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

The Company has been notified that on 21 February 2024, the

following number of shares were sold upon vesting of the Company's

2021/23 Long Term Incentive Plan, following adjustments for tax and

social security withholdings, by the following PDMRs:

|

Name of PDMR

|

Number of shares sold

|

|

Heather Balsley

|

1,993

|

|

Jolyon Bulley

|

5,039

|

|

Yasmin Diamond

|

3,050

|

|

Kenneth Macpherson

|

5,232

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Heather Balsley

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Global Chief Customer Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Disposal

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

£83.521309

|

1,993

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

1,993

£83.521309

£166,457.97

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

XLON

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Jolyon Bulley

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Executive Officer, Americas and Group Transformation Lead,

Luxury & Lifestyle

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Disposal

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

£83.521309

|

5,039

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

5,039

£83.521309

£420,863.88

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

XLON

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Yasmin Diamond

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Executive Vice President, Global Corporate Affairs

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Disposal

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

£83.521309

|

3,050

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

3,050

£83.521309

£254,739.99

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

XLON

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Kenneth Macpherson

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Executive Officer, Europe, Middle East, Asia and

Africa

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Disposal

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

£83.521309

|

5,232

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

5,232

£83.521309

£436,983.49

|

|

e)

|

Date of the transaction

|

2024-02-21

|

|

f)

|

Place of the transaction

|

XLON

|

Exhibit

No: 99.2

26 February 2024

InterContinental Hotels Group PLC (the Company)

Purchase of own shares

The Company announces that on 23 February 2024 it purchased the

following number of its ordinary shares of 20340/399pence

each through Goldman Sachs International ("GSI") on the London Stock Exchange in accordance with

the authority granted by shareholders at the Company's Annual

General Meeting on 5 May 2023 (the "Purchase"). The Purchase was effected pursuant to

instructions issued by the Company on 20 February 2024, as

announced on 20 February 2024.

|

Date of purchase:

|

23 February 2024

|

|

|

|

|

Aggregate number of ordinary shares purchased:

|

6,962

|

|

|

|

|

Lowest price paid per share:

|

£ 86.0000

|

|

|

|

|

Highest price paid per share:

|

£ 86.3400

|

|

|

|

|

Average price paid per share:

|

£ 86.1717

|

The Company intends to cancel the purchased shares.

Following the above transaction, the Company has 165,243,022

ordinary shares in issue (excluding 7,006,782 held in

treasury).

A full breakdown of the individual purchases by GSI is included

below.

http://www.rns-pdf.londonstockexchange.com/rns/3458E_1-2024-2-23.pdf

Enquiries to:

InterContinental Hotels Group PLC:

Investor Relations: Stuart Ford (+44 (0)7823 828 739); Aleksandar

Milenkovic (+44 (0)7469 905 720);

Joe Simpson (+44 (0)7976 862 072)

Media Relations: Mike Ward (+44 (0)7795 257 407)

Schedule of Purchases

Shares purchased: 6,962 (ISIN: GB00BHJYC057)

Date of purchases: 23 February 2024

Investment firm: GSI

Aggregated information:

|

|

London Stock Exchange

|

Cboe BXE

|

Cboe CXE

|

Turquoise

|

|

Number of ordinary shares purchased

|

5,861

|

|

1,101

|

|

|

Highest price paid (per ordinary share)

|

£ 86.3400

|

|

£ 86.2800

|

|

|

Lowest price paid (per ordinary share)

|

£ 86.0000

|

|

£ 86.0000

|

|

|

Volume weighted average price paid(per ordinary share)

|

£ 86.1689

|

|

£ 86.1868

|

|

Exhibit

No: 99.3

27 February 2024

InterContinental Hotels Group PLC (the Company)

Purchase of own shares

The Company announces that on 26 February 2024 it purchased the

following number of its ordinary shares of 20340/399pence

each through Goldman Sachs International ("GSI") on the London Stock Exchange in accordance with

the authority granted by shareholders at the Company's Annual

General Meeting on 5 May 2023 (the "Purchase"). The Purchase was effected pursuant to

instructions issued by the Company on 20 February 2024, as

announced on 20 February 2024.

|

Date of purchase:

|

26 February 2024

|

|

|

|

|

Aggregate number of ordinary shares purchased:

|

148,932

|

|

|

|

|

Lowest price paid per share:

|

£ 86.4600

|

|

|

|

|

Highest price paid per share:

|

£ 87.9000

|

|

|

|

|

Average price paid per share:

|

£ 86.9827

|

The Company intends to cancel the purchased shares.

Following the above transaction, the Company has 165,094,090

ordinary shares in issue (excluding 7,006,782 held in

treasury).

A full breakdown of the individual purchases by GSI is included

below.

http://www.rns-pdf.londonstockexchange.com/rns/5202E_1-2024-2-26.pdf

Enquiries to:

InterContinental Hotels Group PLC:

Investor Relations: Stuart Ford (+44 (0)7823 828 739); Aleksandar

Milenkovic (+44 (0)7469 905 720);

Joe Simpson (+44 (0)7976 862 072)

Media Relations: Mike Ward (+44 (0)7795 257 407)

Schedule of Purchases

Shares purchased: 148,932 (ISIN: GB00BHJYC057)

Date of purchases: 26 February 2024

Investment firm: GSI

Aggregated information:

|

|

London Stock Exchange

|

Cboe BXE

|

Cboe CXE

|

Turquoise

|

|

Number of ordinary shares purchased

|

70,584

|

43,726

|

26,840

|

7,782

|

|

Highest price paid (per ordinary share)

|

£ 87.8800

|

£ 87.8600

|

£ 87.9000

|

£ 87.8600

|

|

Lowest price paid (per ordinary share)

|

£ 86.4600

|

£ 86.4600

|

£ 86.4600

|

£ 86.4800

|

|

Volume weighted average price paid(per ordinary share)

|

£ 87.0191

|

£ 86.8803

|

£ 87.0339

|

£ 87.0518

|

Exhibit

No: 99.4

28 February 2024

InterContinental Hotels Group PLC (the Company)

Purchase of own shares

The Company announces that on 27 February 2024 it purchased the

following number of its ordinary shares of 20340/399pence

each through Goldman Sachs International ("GSI") on the London Stock Exchange in accordance with

the authority granted by shareholders at the Company's Annual

General Meeting on 5 May 2023 (the "Purchase"). The Purchase was effected pursuant to

instructions issued by the Company on 20 February 2024, as

announced on 20 February 2024.

|

Date of purchase:

|

27 February 2024

|

|

|

|

|

Aggregate number of ordinary shares purchased:

|

129,295

|

|

|

|

|

Lowest price paid per share:

|

£ 86.2000

|

|

|

|

|

Highest price paid per share:

|

£ 86.8800

|

|

|

|

|

Average price paid per share:

|

£ 86.6596

|

The Company intends to cancel the purchased shares.

Following the above transaction, the Company has 164,964,795

ordinary shares in issue (excluding 7,006,782 held in

treasury).

A full breakdown of the individual purchases by GSI is included

below.

http://www.rns-pdf.londonstockexchange.com/rns/6919E_1-2024-2-27.pdf

Enquiries to:

InterContinental Hotels Group PLC:

Investor Relations: Stuart Ford (+44 (0)7823 828 739); Aleksandar

Milenkovic (+44 (0)7469 905 720);

Joe Simpson (+44 (0)7976 862 072)

Media Relations: Mike Ward (+44 (0)7795 257 407)

Schedule of Purchases

Shares purchased: 129,295 (ISIN: GB00BHJYC057)

Date of purchases: 27 February 2024

Investment firm: GSI

Aggregated information:

|

|

London Stock Exchange

|

Cboe BXE

|

Cboe CXE

|

Turquoise

|

|

Number of ordinary shares purchased

|

67,124

|

35,304

|

21,649

|

5,218

|

|

Highest price paid (per ordinary share)

|

£ 86.8800

|

£ 86.8800

|

£ 86.8600

|

£ 86.8600

|

|

Lowest price paid (per ordinary share)

|

£ 86.2000

|

£ 86.2000

|

£ 86.2600

|

£ 86.3200

|

|

Volume weighted average price paid(per ordinary share)

|

£ 86.6669

|

£ 86.6099

|

£ 86.7012

|

£ 86.7308

|

Exhibit

No: 99.5

InterContinental Hotels Group PLC

Person Discharging Managerial Responsibility ("PDMR")

Shareholding

InterContinental Hotels Group PLC (the "Company") notifies that on

28 February 2024 the following shares were granted, under the

Company's 2023 Annual Performance Plan, to the following

PDMRs:

|

Name of PDMR

|

Number of shares granted

|

|

Elie Maalouf

|

8,088

|

|

Michael Glover

|

4,817

|

|

Heather Balsley

|

1,492

|

|

Jolyon Bulley

|

5,011

|

|

Yasmin Diamond

|

3,417

|

|

Nicolette Henfrey

|

4,078

|

|

Wayne Hoare

|

4,394

|

|

Kenneth Macpherson

|

4,285

|

|

George Turner

|

4,467

|

This notice is given in fulfilment of the obligation under Article

19 of the Market Abuse Regulation.

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Elie Maalouf

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Executive Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 8,088 free

shares; the number of shares calculated by reference to a price of

GBP 86.27, being the MMQ of the Company's share price for the

three business days following the announcement of the Company's

results for the financial year ended 31 December

2023.

The award is conditional and may be forfeited if Elie Maalouf

ceases employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Michael Glover

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Financial Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 4,817 free

shares; the number of shares calculated by reference to a price of

GBP 86.27, being the MMQ of the Company's share price for the

three business days following the announcement of the Company's

results for the financial year ended 31 December

2023.

The award is conditional and may be forfeited if Michael Glover

ceases employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Heather Balsley

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Global Chief Customer Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 1,492 free shares; the number of shares

calculated by reference to a price of GBP 86.27, being the MMQ

of the Company's share price for the three business days following

the announcement of the Company's results for the financial year

ended 31 December 2023.

The award is conditional and may be forfeited if Heather Balsley

ceases employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Jolyon Bulley

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Executive Officer, Americas and Group Transformation Lead,

Luxury & Lifestyle

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 5,011 free shares; the number of shares

calculated by reference to a price of GBP 86.27, being the MMQ

of the Company's share price for the three business days following

the announcement of the Company's results for the financial year

ended 31 December 2023.

The award is conditional and may be forfeited if Jolyon Bulley

ceases employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Yasmin Diamond

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Executive Vice President, Global Corporate Affairs

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 3,417 free shares; the number of shares

calculated by reference to a price of GBP 86.27, being the MMQ

of the Company's share price for the three business days following

the announcement of the Company's results for the financial year

ended 31 December 2023.

The award is conditional and may be forfeited if Yasmin Diamond

ceases employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Nicolette Henfrey

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Executive Vice President, General Counsel and Company

Secretary

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 4,078 free shares; the number of shares

calculated by reference to a price of GBP 86.27, being the MMQ

of the Company's share price for the three business days following

the announcement of the Company's results for the financial year

ended 31 December 2023.

The award is conditional and may be forfeited if Nicolette Henfrey

ceases employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Wayne Hoare

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Human Resources Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 4,394 free shares; the number of shares

calculated by reference to a price of GBP 86.27, being the MMQ

of the Company's share price for the three business days following

the announcement of the Company's results for the financial year

ended 31 December 2023.

The award is conditional and may be forfeited if Wayne Hoare ceases

employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

Kenneth Macpherson

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Executive Officer, Europe, Middle East, Asia and

Africa

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 4,285 free shares; the number of shares

calculated by reference to a price of GBP 86.27, being the MMQ

of the Company's share price for the three business days following

the announcement of the Company's results for the financial year

ended 31 December 2023.

The award is conditional and may be forfeited if Kenneth Macpherson

ceases employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

George Turner

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Commercial & Technology Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Grant of deferred share awards under InterContinental Hotels Group

PLC 2023 Annual Performance Plan

|

|

c)

|

Price(s) and volume(s)

|

Rights over a total of 4,467 free shares; the number of shares

calculated by reference to a price of GBP 86.27, being the MMQ

of the Company's share price for the three business days following

the announcement of the Company's results for the financial year

ended 31 December 2023.

The award is conditional and may be forfeited if George Turner

ceases employment with the Group before 1 March 2027.

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

As noted in 4c above

As noted in 4c above

|

|

e)

|

Date of the transaction

|

2024-02-28

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

Exhibit

No: 99.6

29 February 2024

InterContinental Hotels Group PLC (the Company)

Purchase of own shares

The Company announces that on 28 February 2024 it purchased the

following number of its ordinary shares of 20340/399pence

each through Goldman Sachs International ("GSI") on the London Stock Exchange in accordance with

the authority granted by shareholders at the Company's Annual

General Meeting on 5 May 2023 (the "Purchase"). The Purchase was effected pursuant to

instructions issued by the Company on 20 February 2024, as

announced on 20 February 2024.

|

Date of purchase:

|

28 February 2024

|

|

|

|

|

Aggregate number of ordinary shares purchased:

|

158,091

|

|

|

|

|

Lowest price paid per share:

|

£ 85.6000

|

|

|

|

|

Highest price paid per share:

|

£ 86.9400

|

|

|

|

|

Average price paid per share:

|

£ 86.3456

|

The Company intends to cancel the purchased shares.

Following the above transaction, the Company has 164,806,704

ordinary shares in issue (excluding 7,006,782 held in

treasury).

A full breakdown of the individual purchases by GSI is included

below.

http://www.rns-pdf.londonstockexchange.com/rns/8722E_1-2024-2-28.pdf

Enquiries to:

InterContinental Hotels Group PLC:

Investor Relations: Stuart Ford (+44 (0)7823 828 739); Aleksandar

Milenkovic (+44 (0)7469 905 720);

Joe Simpson (+44 (0)7976 862 072)

Media Relations: Mike Ward (+44 (0)7795 257 407)

Schedule of Purchases

Shares purchased: 158,091 (ISIN: GB00BHJYC057)

Date of purchases: 28 February 2024

Investment firm: GSI

Aggregated information:

|

|

London Stock Exchange

|

Cboe BXE

|

Cboe CXE

|

Turquoise

|

|

Number of ordinary shares purchased

|

73,000

|

49,400

|

27,491

|

8,200

|

|

Highest price paid (per ordinary share)

|

£ 86.9200

|

£ 86.9000

|

£ 86.9400

|

£ 86.7600

|

|

Lowest price paid (per ordinary share)

|

£ 85.6000

|

£ 85.7800

|

£ 85.6200

|

£ 85.6400

|

|

Volume weighted average price paid(per ordinary share)

|

£ 86.3353

|

£ 86.3629

|

£ 86.3418

|

£ 86.3456

|

Exhibit

No: 99.7

01 March 2024

InterContinental Hotels Group PLC (the Company)

Purchase of own shares

The Company announces that on 29 February 2024 it purchased the

following number of its ordinary shares of 20340/399pence

each through Goldman Sachs International ("GSI") on the London Stock Exchange in accordance with

the authority granted by shareholders at the Company's Annual

General Meeting on 5 May 2023 (the "Purchase"). The Purchase was effected pursuant to

instructions issued by the Company on 20 February 2024, as

announced on 20 February 2024.

|

Date of purchase:

|

29 February 2024

|

|

|

|

|

Aggregate number of ordinary shares purchased:

|

157,436

|

|

|

|

|

Lowest price paid per share:

|

£ 82.5800

|

|

|

|

|

Highest price paid per share:

|

£ 84.9400

|

|

|

|

|

Average price paid per share:

|

£ 83.6291

|

The Company intends to cancel the purchased shares.

Following the above transaction, the Company has 164,649,268

ordinary shares in issue (excluding 7,006,782 held in

treasury).

A full breakdown of the individual purchases by GSI is included

below.

http://www.rns-pdf.londonstockexchange.com/rns/0636F_1-2024-2-29.pdf

Enquiries to:

InterContinental Hotels Group PLC:

Investor Relations: Stuart Ford (+44 (0)7823 828 739); Aleksandar

Milenkovic (+44 (0)7469 905 720);

Joe Simpson (+44 (0)7976 862 072)

Media Relations: Mike Ward (+44 (0)7795 257 407)

Schedule of Purchases

Shares purchased: 157,436 (ISIN: GB00BHJYC057)

Date of purchases: 29 February 2024

Investment firm: GSI

Aggregated information:

|

|

London Stock Exchange

|

Cboe BXE

|

Cboe CXE

|

Turquoise

|

|

Number of ordinary shares purchased

|

73,000

|

49,000

|

27,264

|

8,172

|

|

Highest price paid (per ordinary share)

|

£ 84.9400

|

£ 84.9400

|

£ 84.9400

|

£ 84.8200

|

|

Lowest price paid (per ordinary share)

|

£ 82.6400

|

£ 82.5800

|

£ 82.6000

|

£ 82.6200

|

|

Volume weighted average price paid(per ordinary share)

|

£ 83.6619

|

£ 83.5925

|

£ 83.6151

|

£ 83.6019

|

Exhibit

No: 99.8

InterContinental Hotels Group PLC

Person Discharging Managerial Responsibility ("PDMR")

Shareholding

The following transaction notification is given in fulfilment of

the obligation under Article 19 of the Market Abuse

Regulation.

|

1

|

Details of the person discharging managerial responsibilities /

person closely associated

|

|

a)

|

Name

|

George Turner

|

|

2

|

Reason for the notification

|

|

a)

|

Position/status

|

Chief Commercial & Technology Officer

|

|

b)

|

Initial notification /Amendment

|

Initial

|

|

3

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

InterContinental Hotels Group PLC

|

|

b)

|

LEI

|

2138007ZFQYRUSLU3J98

|

|

4

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type of

instrument

Identification code

|

Ordinary Shares

GB00BHJYC057

|

|

b)

|

Nature of the transaction

|

Disposal

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

£84.544628

|

5,179

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

- Aggregated total

|

5,179

£84.544628

£437,856.63

|

|

e)

|

Date of the transaction

|

2024-02-29

|

|

f)

|

Place of the transaction

|

XLON

|

Exhibit

No: 99.9

04 March 2024

InterContinental Hotels Group PLC (the Company)

Purchase of own shares

The Company announces that on 01 March 2024 it purchased the

following number of its ordinary shares of 20340/399 pence

each through Goldman Sachs International ("GSI")

on the London Stock Exchange in accordance with the authority

granted by shareholders at the Company's Annual General Meeting on

5 May 2023 (the "Purchase").

The Purchase was effected pursuant to instructions issued by the

Company on 20 February 2024, as announced on 20 February

2024.

|

Date of purchase:

|

01 March 2024

|

|

|

|

|

Aggregate number of ordinary shares purchased:

|

115,612

|

|

|

|

|

Lowest price paid per share:

|

£ 83.3600

|

|

|

|

|

Highest price paid per share:

|

£ 84.7400

|

|

|

|

|

Average price paid per share:

|

£ 83.7924

|

The Company intends to cancel the purchased shares.

Following the above transaction, the Company has 164,533,656

ordinary shares in issue (excluding 7,006,782 held in

treasury).

A full breakdown of the individual purchases by GSI is included

below.

http://www.rns-pdf.londonstockexchange.com/rns/3540F_1-2024-3-1.pdf

Enquiries to:

InterContinental Hotels Group PLC:

Investor Relations: Stuart Ford (+44 (0)7823 828 739); Aleksandar

Milenkovic (+44 (0)7469 905 720);

Joe Simpson (+44 (0)7976 862 072)

Media Relations: Mike Ward (+44 (0)7795 257 407)

Schedule of Purchases

Shares purchased: 115,612 (ISIN: GB00BHJYC057)

Date of purchases: 01 March 2024

Investment firm: GSI

Aggregated information:

|

|

London Stock Exchange

|

Cboe BXE

|

Cboe CXE

|

Turquoise

|

|

Number of ordinary shares purchased

|

38,128

|

51,000

|

20,621

|

5,863

|

|

Highest price paid (per ordinary share)

|

£ 84.7200

|

£ 84.7400

|

£ 84.7200

|

£ 84.6000

|

|

Lowest price paid (per ordinary share)

|

£ 83.3600

|

£ 83.3600

|

£ 83.3800

|

£ 83.3600

|

|

Volume weighted average price paid(per ordinary share)

|

£ 83.7794

|

£ 83.8014

|

£ 83.8009

|

£ 83.7698

|

Exhibit

No: 99.10

07 March 2024

InterContinental Hotels Group PLC (the Company)

Purchase of own shares

The Company announces that on 06 March 2024 it purchased the

following number of its ordinary shares of 20340/399 pence

each through Goldman Sachs International ("GSI") on the London Stock Exchange in accordance with

the authority granted by shareholders at the Company's Annual

General Meeting on 5 May 2023 (the "Purchase"). The Purchase was effected pursuant to

instructions issued by the Company on 20 February 2024, as

announced on 20 February 2024.

|

Date of purchase:

|

06 March 2024

|

|

|

|

|

Aggregate number of ordinary shares purchased:

|

159,621

|

|

|

|

|

Lowest price paid per share:

|

£ 83.0200

|

|

|

|

|

Highest price paid per share:

|

£ 83.8400

|

|

|

|

|

Average price paid per share:

|

£ 83.4217

|

The Company intends to cancel the purchased shares.

Following the above transaction, the Company has 164,374,035

ordinary shares in issue (excluding 7,006,782 held in

treasury).

A full breakdown of the individual purchases by GSI is included

below.

http://www.rns-pdf.londonstockexchange.com/rns/9030F_1-2024-3-6.pdf

Enquiries to:

InterContinental Hotels Group PLC:

Investor Relations: Stuart Ford (+44 (0)7823 828 739); Aleksandar

Milenkovic (+44 (0)7469 905 720);

Joe Simpson (+44 (0)7976 862 072)

Media Relations: Mike Ward (+44 (0)7795 257 407)

Schedule of Purchases

Shares purchased: 159,621 (ISIN: GB00BHJYC057)

Date of purchases: 06 March 2024

Investment firm: GSI

Aggregated information:

|

|

London Stock Exchange

|

Cboe BXE

|

Cboe CXE

|

Turquoise

|

|

Number of ordinary shares purchased

|

92,000

|

26,275

|

30,640

|

10,706

|

|

Highest price paid (per ordinary share)

|

£ 83.8400

|

£ 83.8400

|

£ 83.7000

|

£ 83.8200

|

|

Lowest price paid (per ordinary share)

|

£ 83.0200

|

£ 83.0400

|

£ 83.0200

|

£ 83.0400

|

|

Volume weighted average price paid(per ordinary share)

|

£ 83.4260

|

£ 83.4112

|

£ 83.4196

|

£ 83.4160

|

Exhibit

No: 99.11

InterContinental Hotels Group PLC (the Company)

Purchase of own shares

The Company announces that on 07 March 2024 it purchased the

following number of its ordinary shares of 20340/399 pence

each through Goldman Sachs International ("GSI") on the London Stock Exchange in accordance with

the authority granted by shareholders at the Company's Annual

General Meeting on 5 May 2023 (the "Purchase"). The Purchase was effected pursuant to

instructions issued by the Company on 20 February 2024, as

announced on 20 February 2024.

|

Date of purchase:

|

07 March 2024

|

|

|

|

|

Aggregate number of ordinary shares purchased:

|

10,000

|

|

|

|

|

Lowest price paid per share:

|

£ 81.2600

|

|

|

|

|

Highest price paid per share:

|

£ 82.7000

|

|

|

|

|

Average price paid per share:

|

£ 81.8915

|

The Company intends to cancel the purchased shares.

Following the above transaction, the Company has 164,364,035

ordinary shares in issue (excluding 7,006,782 held in

treasury).

A full breakdown of the individual purchases by GSI is included

below.

http://www.rns-pdf.londonstockexchange.com/rns/0760G_1-2024-3-7.pdf

Enquiries to:

InterContinental Hotels Group PLC:

Investor Relations: Stuart Ford (+44 (0)7823 828 739); Aleksandar

Milenkovic (+44 (0)7469 905 720);

Joe Simpson (+44 (0)7976 862 072)

Media Relations: Mike Ward (+44 (0)7795 257 407)

Schedule of Purchases

Shares purchased: 10,000 (ISIN: GB00BHJYC057)

Date of purchases: 07 March 2024

Investment firm: GSI

Aggregated information:

|

|

London Stock Exchange

|

Cboe BXE

|

Cboe CXE

|

Turquoise

|

|

Number of ordinary shares purchased

|

10,000

|

|

|

|

|

Highest price paid (per ordinary share)

|

£ 82.7000

|

|

|

|

|

Lowest price paid (per ordinary share)

|

£ 81.2600

|

|

|

|

|

Volume weighted average price paid(per ordinary share)

|

£ 81.8915

|

|

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

InterContinental Hotels Group PLC

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ C.

Lindsay

|

|

|

Name:

|

C.

LINDSAY

|

|

|

Title:

|

SENIOR

ASSISTANT COMPANY SECRETARY

|

|

|

|

|

|

|

Date:

|

08 March 2024

|

|

|

|

|

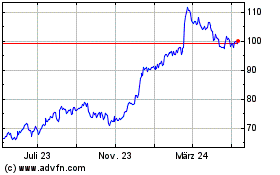

InterContinental Hotels (NYSE:IHG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

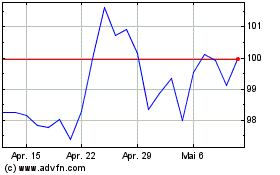

InterContinental Hotels (NYSE:IHG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024