SECURITIES

AND EXCHANGE COMMISSION

Washington

DC 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

OF

THE

SECURITIES EXCHANGE ACT OF 1934

For 05

May 2023

InterContinental Hotels Group PLC

(Registrant's

name)

Broadwater

Park, Denham, Buckinghamshire, UB9 5HJ, United Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F

Form 40-F

Indicate

by check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes

No

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): Not

applicable

EXHIBIT

INDEX

|

99.1

|

2023

First Quarter Trading Update dated 05 May 2023

|

Exhibit No: 99.1

5 May

2023

InterContinental Hotels Group PLC

2023

First Quarter Trading Update

|

●

|

Q1

group RevPARa +33% vs 2022, with

Americas +18%, EMEAA +64% and Greater China +75%

|

|

●

|

Q1

group RevPAR +6.8% vs 2019, with Americas +11.1%, EMEAA +9.7% and

Greater China (9.1)%

|

|

●

|

Average

daily rate +11% vs 2022, +10% vs 2019; occupancy +10%pts vs 2022,

(2)%pts vs 2019

|

|

●

|

Gross

system size growth +5.8% YOY, +0.9% YTD; opened 8.4k rooms (45

hotels) in Q1, ahead of 2022

|

|

●

|

Net

system size growth +4.2% YOY on an adjustedb basis, +0.4%

YTD

|

|

●

|

Global

system of 915k rooms (6,179 hotels); 66% across midscale segments,

34% across upscale and luxury

|

|

●

|

Signed

16.5k rooms (108 hotels) in Q1, in-line with 2022; global pipeline

of 287k rooms (1,906 hotels), +3.3% YOY

|

|

Keith

Barr, Chief Executive Officer, IHG Hotels & Resorts,

said:

|

“We’ve

seen a good start to the year, with continued strong trading in

both the Americas and EMEAA, and an excellent rebound in demand in

Greater China since the lifting of travel restrictions. Leisure

demand has remained buoyant, and there has been further return of

business and group travel as expected.

The

guest appeal of our brands has continued to support pricing, with

rate up 10% versus 2019 and occupancy now almost back to pre-Covid

levels. For owners, the strength of our enterprise platform and

investments we’ve made to enhance our portfolio and widen our

offer continues to attract demand and drive growth. We signed over

16 thousand rooms across 108 hotels into our development pipeline

in the quarter, in line with our performance in 2022. A third of

all signings were across our six Luxury & Lifestyle brands, as

we accelerate our growth in the segment.

We

opened eight thousand rooms across 45 hotels in the quarter, and

while financing challenges for the wider commercial real estate

industry are holding back new hotel development and opening

activity fully returning to normal, we anticipate improving levels

as the year progresses. Meanwhile, conversions increased to be over

a third of both openings and signings in the period.

Whilst

comparatives to 2022 get tougher from the second quarter onwards

and there are ongoing economic uncertainties, IHG has continued to

prove the resiliency of its business model and we remain confident

about the strong tailwinds for attractive long-term, sustainable

growth and value creation. We look forward to making additional

progress over the course of 2023 in further evolving our brand

portfolio, increasing RevPAR and expanding our system

size.”

Americas

Q1

RevPAR was up +18% vs 2022 (up +11% vs 2019), with US RevPAR up

+15% (up +10% vs 2019). Occupancy was 64%, up +5%pts on last year

(and up 0.5%pts vs 2019), whilst rate was up +9%. Driven by another

strong Spring Break vacation period, leisure rooms revenue for the

total estate was 11% higher than last year, and up 22% on 2019

levels.

Gross

system size growth was +4.0% YOY, with 1.9k rooms (15 hotels)

opened in the quarter.

Net system size growth was +2.7% YOY. A further

5.4k rooms (54 hotels) were added to the pipeline. Signings

included the first Regent property for the region and 10 further

Luxury & Lifestyle properties; there were 21 hotels signed

across the Holiday Inn Brand Family and a further 18 across our

extended stay brands.

EMEAA

Q1

RevPAR was up +64% vs 2022 (up +10% vs 2019). Occupancy was 65%, up

+17%pts, whilst rate was up +20%. By major geographic markets

within the region, the dispersion of RevPAR performance has

narrowed as borders have opened and international travel has

increasingly returned. Q1 RevPAR vs 2019 therefore ranged from up

+21% in the Middle East, +12% in the UK, +11% in Australia and up

+7% in Continental Europe, to down just (9)% in Japan.

Gross

system size growth was +8.0% YOY, with 5.4k rooms (24 hotels)

opened in the quarter. Net system size growth was +6.0% YOY on an

adjusted basis. There were 5.2k rooms (26 hotels) added to the

pipeline; conversions were half of all signings in the region, and

Luxury & Lifestyle brands represented almost

two-thirds.

Greater China

Q1

RevPAR was up +75% vs 2022 (down (9)% vs 2019). Occupancy was 52%,

up +17%pts, whilst rate was up +17%. Tier 1 cities saw RevPAR up

+53%, reflecting the slower return of international travel and the

boost in Q1 2022 from the Beijing Winter Olympics; the performance

was stronger across Tier 2-4 cities which were up

+80%.

Gross

system size growth was +8.2% YOY, with 1.1k rooms (6 hotels) opened

in the quarter. Net system size growth was +6.1% YOY. A further

5.9k rooms (28 hotels) were added to the pipeline. This is expected

to support the gradual improvement in system growth in coming years

following the period of development and openings being held back by

the prior Covid-related restrictions.

At the

time of reporting our 2022 full year results on 21 February 2023,

IHG announced a $750m share buyback programme to return surplus

capital to shareholders. The programme commenced on the date of

that announcement and will end no later than 29 December 2023. The

programme is currently 32% complete with $240.5m (£193.7m)

having been cumulatively spent to date, repurchasing 3,540,836

shares at an average price of £54.71 per share. The programme

to date has therefore reduced the total number of voting rights in

the Company by 2.02% to 171,852,482 as at market close on Thursday

4 May 2023. Earnings per share is calculated using the weighted

average number of shares in issue for the year which will reduce

accordingly to take account of the timing of shares

repurchased.

For further information, please contact:

Investor

Relations:

Stuart Ford (+44

(0)7823 828 739); Aleksandar Milenkovic (+44 (0)7469 905

720);

Joe Simpson (+44

(0)7976 862 072)

Media

Relations:

Amy Shields (+44

(0)7881 035 550); Alex O’Neil (+44 (0)7407 798

576)

Conference call for analysts and institutional

shareholders:

Keith

Barr, Chief Executive Officer, and Michael Glover, Chief Financial

Officer, will host a call commencing at 9:00am (London time) on 5

May. The live listen-only audio webcast can be accessed directly at

https://www.investis-live.com/ihg/64229f47ccbbd112001140ef/htdr

or via www.ihgplc.com/en/investors/results-and-presentations.

Analysts

and institutional shareholders wishing to ask questions should use

the following dial-in details for a Q&A facility:

|

UK

local:

|

0203

936 2999

|

|

US

local:

|

646 664

1960

|

|

All

other locations:

|

+44 203

936 2999

|

|

Passcode:

|

55 38

39

|

An

audio replay will also be available for 7 days using the following

details:

|

UK

local:

|

0203

936 3001

|

|

US

local:

|

845 709

8569

|

|

All

other locations:

|

+44 203

936 3001

|

|

Passcode:

|

31 28

26

|

Website:

The

full release and supplementary data will be available on our

website from 7:00am (London time) on 5 May. The web address is

www.ihgplc.com/en/investors/results-and-presentations.

About IHG Hotels & Resorts:

IHG Hotels & Resorts [LON:IHG, NYSE:IHG (ADRs)] is a

global hospitality company, with a purpose to provide True

Hospitality for Good.

With a

family of 18 hotel brands and IHG One

Rewards, one of the world’s largest hotel loyalty

programmes, IHG has over 6,000 open hotels in more than 100

countries, and more than 1,900 in the development

pipeline.

●

Luxury & Lifestyle: Six Senses Hotels

Resorts Spas, Regent Hotels &

Resorts, InterContinental

Hotels & Resorts, Vignette

Collection, Kimpton Hotels &

Restaurants, Hotel

Indigo

●

Premium: voco

hotels,

HUALUXE

Hotels & Resorts, Crowne

Plaza Hotels

& Resorts,

EVEN

Hotels

●

Essentials: Holiday Inn Hotels

& Resorts, Holiday Inn

Express, avid

hotels

●

Suites: Atwell Suites,

Staybridge

Suites, Holiday Inn Club

Vacations, Candlewood

Suites

●

Exclusive Partners: Iberostar Beachfront

Resorts

InterContinental

Hotels Group PLC is the Group’s holding company and is

incorporated and registered in England and Wales. Approximately

345,000 people work across IHG’s hotels and corporate offices

globally.

Visit

us online for more about our hotels and

reservations and IHG One

Rewards. To download the new IHG One Rewards app, visit the

Apple

App or

Google

Play stores.

For our

latest news, visit our Newsroom and

follow us on LinkedIn,

Facebook and

Twitter.

Cautionary note regarding forward-looking statements:

This

announcement contains certain forward-looking statements as defined

under United States law (Section 21E of the Securities Exchange Act

of 1934) and otherwise. These forward-looking statements can be

identified by the fact that they do not relate only to historical

or current facts. Forward-looking statements often use words such

as ‘anticipate’, ‘target’,

‘expect’, ‘estimate’, ‘intend’,

‘plan’, ‘goal’, ‘believe’ or

other words of similar meaning. These statements are based on

assumptions and assessments made by InterContinental Hotels Group

PLC’s management in light of their experience and their

perception of historical trends, current conditions, expected

future developments and other factors they believe to be

appropriate. By their nature, forward-looking statements are

inherently predictive, speculative and involve risk and

uncertainty. There are a number of factors that could cause actual

results and developments to differ materially from those expressed

in or implied by, such forward-looking statements. The main factors

that could affect the business and the financial results are

described in the ‘Risk Factors’ section in the current

InterContinental Hotels Group PLC’s Annual report and Form

20-F filed with the United States Securities and Exchange

Commission.

Appendix 1: RevPARa movement summary at

constant exchange rates (CER)

|

|

Q1 2023 vs 2022

|

Q1 2023 vs 2019

|

|

|

RevPAR

|

ADR

|

Occupancy

|

RevPAR

|

ADR

|

Occupancy

|

|

Group

|

33.0%

|

10.7%

|

10.4%pts

|

6.8%

|

9.5%

|

(1.6)%pts

|

|

Americas

|

18.1%

|

9.1%

|

4.9%pts

|

11.1%

|

10.2%

|

0.5%pts

|

|

EMEAA

|

63.6%

|

20.0%

|

17.2%pts

|

9.7%

|

17.6%

|

(4.7)%pts

|

|

G.

China

|

74.6%

|

16.9%

|

17.3%pts

|

(9.1)%

|

(6.2)%

|

(1.7)%pts

|

Appendix 2: RevPARa movement at CER vs

actual exchange rates (AER)

|

|

Q1 2023 vs 2022

|

Q1 2023 vs 2019

|

|

|

CER (as above)

|

AER

|

Difference

|

CER (as above)

|

AER

|

Difference

|

|

Group

|

33.0%

|

30.3%

|

(2.7)%pts

|

6.8%

|

4.0%

|

(2.8)%pts

|

|

Americas

|

18.1%

|

18.0%

|

(0.1)%pts

|

11.1%

|

10.5%

|

(0.6)%pts

|

|

EMEAA

|

63.6%

|

53.9%

|

(9.7)%pts

|

9.7%

|

1.8%

|

(7.9)%pts

|

|

G.

China

|

74.6%

|

62.4%

|

(12.2)%pts

|

(9.1)%

|

(10.1)%

|

(1.0)%pts

|

Appendix 3: Monthly RevPARa (CER)

|

2023 vs 2022

|

Jan

|

Feb

|

Mar

|

|

Group

|

40.8%

|

33.5%

|

27.2%

|

|

Americas

|

24.5%

|

18.3%

|

13.8%

|

|

EMEAA

|

84.0%

|

71.9%

|

44.5%

|

|

G.

China

|

53.3%

|

54.2%

|

125.2%

|

|

2023 vs 2019

|

Jan

|

Feb

|

Mar

|

|

Group

|

4.2%

|

6.7%

|

9.2%

|

|

Americas

|

8.8%

|

11.0%

|

13.1%

|

|

EMEAA

|

8.2%

|

7.7%

|

13.0%

|

|

G.

China

|

(16.6)%

|

(3.8)%

|

(6.6)%

|

Appendix 4: System and pipeline summary of Q1 2023 YTD and YOY

growths, and closing positions (rooms)

|

|

System

|

Pipeline

|

|

|

Openings

|

Removals

|

Net

|

Total

|

YTD%

|

YOY%

|

Adjusted YOY%b

|

Signings

|

Total

|

|

Group

|

8,365

|

(5,064)

|

3,301

|

914,928

|

+0.4%

|

+3.4%

|

+4.2%

|

16,496

|

286,539

|

|

Americas

|

1,886

|

(2,619)

|

(733)

|

514,763

|

(0.1)%

|

+2.7%

|

+2.7%

|

5,431

|

102,837

|

|

EMEAA

|

5,393

|

(1,479)

|

3,914

|

233,578

|

+1.7%

|

+3.0%

|

+6.0%

|

5,156

|

81,304

|

|

G.

China

|

1,086

|

(966)

|

120

|

166,587

|

+0.1%

|

+6.1%

|

+6.1%

|

5,909

|

102,398

|

a

RevPAR (revenue per available room), ADR (average

daily rate) and occupancy are on a comparable basis, based on

comparability as at 31 March 2023 and includes hotels that have

traded in all months in both current and the prior year. This same

group of hotels is also used to compare RevPAR performance for 2023

vs 2019. The principal exclusions in deriving these measures are

new openings, properties under major refurbishment and removals.

See ‘Use of key performance measures and non-GAAP

measures’ in IHG’s full year results announcement for

further information on definitions.

b

Adjusted for the removal of 6.5k

rooms (28 hotels) in Russia in Q2 2022, following IHG’s

announcements regarding ceasing all operations in that

country.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

InterContinental Hotels Group PLC

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ C. Lindsay

|

|

|

Name:

|

C.

LINDSAY

|

|

|

Title:

|

ASSISTANT

COMPANY SECRETARY

|

|

|

|

|

|

|

Date:

|

05 May 2023

|

|

|

|

|

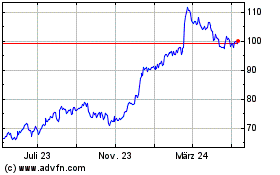

InterContinental Hotels (NYSE:IHG)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

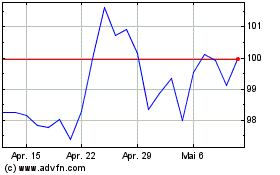

InterContinental Hotels (NYSE:IHG)

Historical Stock Chart

Von Jan 2024 bis Jan 2025