Herbalife Ltd. (NYSE: HLF) today reported third quarter record

net sales of $1.0 billion, a 14 percent increase, driven by a 17

percent increase in volume points compared to the prior year

period. The company reported net income of $117.8 million, or $1.04

per diluted share, compared to the third quarter 2011 net income of

$108.0 million, or $0.87 per diluted share, reflecting an increase

of 9 percent and 20 percent, respectively.

“Our business momentum has continued through the third quarter

with double digit volume growth from all six of our geographical

regions,” said Michael O. Johnson, the company’s chairman and CEO.

“Our 2013 guidance for double-digit volume and EPS growth

illustrates our belief in continued growth driven by the ongoing

global expansion of daily consumption and our city by city approach

to deepen our penetration in existing markets.”

For the quarter ended September 30, 2012, the company generated

cash flow from operations of $142.4 million, paid dividends of

$32.4 million, and invested $20.0 million in capital expenditures.

Also in the third quarter, the company repurchased $181.9 million

in common shares outstanding, completing the $427.9 million

repurchase agreement announced on May 3, 2012.

Third Quarter Regional Key

Metrics1,2

Regional Volume Point and Average Active Sales Leader

Metric

Volume Points

(Mil) Average Active Sales Leaders Region

3Q'12

Yr/Yr % Chg

3Q'12

Yr/Yr % Chg

North America 287.4 14 % 67,826 15 % Asia Pacific 305.6 17 % 66,433

29 % EMEA 145.5 10 % 44,861 14 % Mexico 211.2 17 % 60,123 21 %

South & Central America 186.0 24 % 46,466 29 % China 57.1 42 %

12,692 33 %

Worldwide Total 1,192.8 17

% 288,397 22 %

1 Supplemental tables that include additional business metrics

can be found at http://www.ir.herbalife.com.

2 Worldwide Average Active Sales Leaders may not equal the sum

of the Average Active Sales Leaders in each region due to the

calculation being an average of Sales Leaders active in a period,

not a summation, and the fact that some sales leaders are active in

more than one region but are counted only once in the worldwide

amount.

Updated 2012 Guidance

Guidance for fully diluted 2012 EPS is based on the average

daily exchange rates of the first two weeks of October 2012.

Based on current business trends the company’s fourth quarter

fiscal 2012 and fiscal 2012 guidance is provided below.

Three Months Ending Twelve Months Ending

December 31, 2012

December 31, 2012

Low High Low

High Volume Point Growth vs 2011 13.0% 15.0% 18.0%

20.0% Net Sales Growth vs 2011 17.0% 19.0% 16.0% 18.0% Diluted EPS

$0.97 $1.01 $3.99 $4.03 Cap Ex ($ millions) $50.0 $60.0 $110.0

$120.0 Effective Tax Rate 26.0% 28.0% 26.0% 28.0%

2013 Guidance

Guidance for 2013 assumes a Venezuelan FX rate of 10:1 compared

to prior utilization of a 5.3 bolivars to 1 USD on all ongoing

operations but excludes any potential one-time impact from a

devaluation or the repatriation of existing cash balances.

Twelve Months Ending

December 31, 2013

Low

High

Volume Point Growth vs 2012

8.5

%

10.5

%

Net Sales Growth vs 2012

10.0

%

12.0

%

Diluted EPS

$

4.40

$

4.55

Cap Ex ($ millions)

$

165.0

$

185.0

Effective Tax Rate

26.5

%

28.5

%

Announces Quarterly Dividend

The company reported today that its board of directors has

approved a dividend of $0.30 per share to shareholders of record on

November 14, 2012, payable on November 28, 2012.

Third Quarter Earnings Conference Call

Herbalife senior management will host an investor conference

call to discuss its recent financial results and provide an update

on current business trends on Tuesday, October 30, 2012 at 8 a.m.

PST (11 a.m. EST).

The dial-in number for this conference call for domestic callers

is (877) 317-1296 and (706) 634-5671 for international callers

(conference ID 33885084). Live audio of the conference call will be

simultaneously webcast in the investor relations section of the

company's website at http://ir.herbalife.com.

An audio replay will be available following the completion of

the conference call in MP3 format or by dialing (855) 859-2056 for

domestic callers or (404) 537-3406 for international callers

(conference ID 33885084. The webcast of the teleconference will be

archived and available on Herbalife's website.

About Herbalife Ltd.

Herbalife Ltd. (NYSE:HLF) is a global nutrition company that

sells weight-management, nutrition, and personal care products

intended to support a healthy lifestyle. Herbalife products are

sold in 85 countries to and through a network of independent

distributors. The company supports the Herbalife Family Foundation

and its Casa Herbalife program to help bring good nutrition to

children. Herbalife's website contains information about Herbalife,

including financial and other information for investors at

http://ir.Herbalife.com. The company encourages investors to visit

its website from time to time, as information is updated and new

information is posted.

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements other than statements of historical fact are

“forward-looking statements” for purposes of federal and state

securities laws, including any projections of earnings, revenue or

other financial items; any statements of the plans, strategies and

objectives of management for future operations; any statements

concerning proposed new services or developments; any statements

regarding future economic conditions or performance; any statements

of belief; and any statements of assumptions underlying any of the

foregoing. Forward-looking statements may include the words “may,”

“will,” “estimate,” “intend,” “continue,” “believe,” “expect” or

“anticipate” and any other similar words.

Although we believe that the expectations reflected in any of

our forward-looking statements are reasonable, actual results could

differ materially from those projected or assumed in any of our

forward-looking statements. Our future financial condition and

results of operations, as well as any forward-looking statements,

are subject to change and to inherent risks and uncertainties, such

as those disclosed or incorporated by reference in our filings with

the Securities and Exchange Commission. Important factors that

could cause our actual results, performance and achievements, or

industry results to differ materially from estimates or projections

contained in our forward-looking statements include, among others,

the following:

• any collateral impact resulting from the ongoing

worldwide financial “crisis,” including the availability of

liquidity to us, our customers and our suppliers or the willingness

of our customers to purchase products in a difficult economic

environment;

• our relationship with, and our ability to influence the

actions of, our distributors;

• improper action by our employees or distributors in violation

of applicable law;

• adverse publicity associated with our products or network

marketing organization;

• changing consumer preferences and demands;

• our reliance upon, or the loss or departure of any member of,

our senior management team which could negatively impact our

distributor relations and operating results;

• the competitive nature of our business;

• regulatory matters governing our products, including potential

governmental or regulatory actions concerning the safety or

efficacy of our products and network marketing program, including

the direct selling market in which we operate;

• legal challenges to our network marketing program;

• risks associated with operating internationally and the effect

of economic factors, including foreign exchange, inflation,

disruptions or conflicts with our third party importers, pricing

and currency devaluation risks, especially in countries such as

Venezuela;

• uncertainties relating to the application of transfer pricing,

duties, value added taxes, and other tax regulations, and changes

thereto;

• uncertainties relating to interpretation and enforcement of

legislation in China governing direct selling;

• our inability to obtain the necessary licenses to expand our

direct selling business in China;

• adverse changes in the Chinese economy, Chinese legal system

or Chinese governmental policies;

• our dependence on increased penetration of existing

markets;

• contractual limitations on our ability to expand our

business;

• our reliance on our information technology infrastructure and

outside manufacturers;

• the sufficiency of trademarks and other intellectual property

rights;

• product concentration;

• changes in tax laws, treaties or regulations, or their

interpretation;

• taxation relating to our distributors;

• product liability claims; and

• whether we will purchase any of our shares in the open markets

or otherwise.

We do not undertake any obligation to update or release any

revisions to any forward-looking statements or to report any events

or circumstances after the date hereof or to reflect the occurrence

of unanticipated events, except as required by law.

RESULTS OF OPERATIONS:

Herbalife Ltd. Condensed Consolidated Statements of Income (In

thousands, except per share amounts) (Unaudited)

Three Months Ended Nine Months

Ended

9/30/2012

9/30/2011 9/30/2012

9/30/2011 North America $ 208,819 $ 180,735 $

644,191 $ 532,894 Mexico 127,473 112,979 364,031 330,738 South and

Central America 167,493 143,659 485,547 399,066 EMEA 147,490

147,670 463,117 463,624 Asia Pacific 288,205 255,169 844,701

691,575 China 77,407 55,006 211,423

152,071 Worldwide net sales 1,016,887 895,218 3,013,010 2,569,968

Cost of Sales 201,597 175,308 601,478

509,124 Gross Profit 815,290 719,910 2,411,532 2,060,844 Royalty

Overrides 330,247 290,842 982,975 844,451 SGA 324,200

277,721 926,903 788,472 Operating Income 160,843

151,347 501,654 427,921 Interest Expense - net 3,546

345 8,088 3,848 Income before income taxes 157,297

151,002 493,566 424,073 Income Taxes 39,518 42,980

134,257 116,852 Net Income 117,779

108,022 359,309 307,221 Basic Shares 108,816

116,975 113,838 118,059 Diluted Shares 113,646 124,275 119,376

125,889 Basic EPS $ 1.08 $ 0.92 $ 3.16 $ 2.60 Diluted EPS $

1.04 $ 0.87 $ 3.01 $ 2.44 Dividends declared per

share $ 0.30 $ 0.20 $ 0.90 $ 0.53 Herbalife Ltd. Condensed

Consolidated Balance Sheets (In thousands) (Unaudited) Sep

30, Dec 31,

2012 2011

ASSETS Current Assets: Cash & cash equivalents $ 321,722 $

258,775 Receivables, net 114,161 89,660 Inventories 313,581 247,696

Prepaid expenses and other current assets 124,095 117,073 Deferred

income taxes 51,628 55,615 Total

Current Assets 925,187 768,819 Property, plant and

equipment, net 198,562 193,703 Deferred compensation plan assets

23,977 20,511 Deferred financing cost, net 8,121 4,797 Other assets

45,477 41,125 Marketing related intangibles and other intangible

assets, net 311,283 311,764 Goodwill 105,490

105,490 Total Assets $ 1,618,097 $ 1,446,209

LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities: Accounts payable $ 80,119 $ 57,095 Royalty overrides

223,839 197,756 Accrued compensation 87,493 76,435 Accrued expenses

169,722 152,744 Current portion of long term debt 50,384 1,542

Advance sales deposits 38,890 31,702 Income taxes payable

13,501 31,415 Total Current Liabilities

663,948 548,689 Non-current liabilities Long-term debt, net

of current portion 450,053 202,079 Deferred compensation plan

liability 28,717 23,702 Deferred income taxes 62,808 72,348 Other

non-current liabilities 41,166 39,203

Total Liabilities 1,246,692 886,021 Commitments and

Contingencies Shareholders' equity: Common shares 108 116

Additional paid in capital 297,879 291,950 Accumulated other

comprehensive loss (36,625 ) (37,809 ) Retained earnings

110,043 305,931 Total Shareholders' Equity

371,405 560,188 Total

Liabilities and Shareholders' Equity $ 1,618,097 $ 1,446,209

Herbalife Ltd. Condensed Consolidated Statements of

Cash Flows (In thousands) (Unaudited)

Nine Months Ended

9/30/2012

9/30/2011 CASH FLOWS FROM OPERATING

ACTIVITIES Net income $ 359,309 $ 307,221 Adjustments to reconcile

net income to net cash provided by operating activities:

Depreciation and amortization 55,402 54,440 Excess tax benefits

from share-based payment arrangements (28,073 ) (24,030 ) Share

based compensation expenses 20,850 17,244 Amortization of discount

and deferred financing costs 1,135 721 Deferred income taxes (9,246

) (7,000 ) Unrealized foreign exchange transaction loss (gain)

(3,529 ) 8,324 Write-off of deferred financing costs - 914 Other

172 1,383 Changes in operating assets and liabilities: Receivables

(26,444 ) (31,834 ) Inventories (58,705 ) (51,649 ) Prepaid

expenses and other current assets (7,977 ) (3,733 ) Other assets

(3,098 ) (4,742 ) Accounts payable 22,674 19,484 Royalty overrides

22,432 33,851 Accrued expenses and accrued compensation 20,028

7,579 Advance sales deposits 7,384 27,416 Income taxes 22,561

35,914 Deferred compensation plan liability 5,015

2,123 NET CASH PROVIDED BY OPERATING ACTIVITIES

399,890 393,626 CASH FLOWS FROM

INVESTING ACTIVITIES Purchases of property, plant and equipment

(59,229 ) (61,514 ) Proceeds from sale of property, plant and

equipment 243 213 Deferred compensation plan assets (3,466 )

(527 ) NET CASH USED IN INVESTING ACTIVITIES (62,452

) (61,828 ) CASH FLOWS FROM FINANCING ACTIVITIES Dividends

paid (102,687 ) (62,177 ) Borrowings from long-term debt 1,387,557

791,700 Principal payments on long-term debt (1,090,748 ) (747,896

) Deferred financing costs (4,460 ) (5,728 ) Share repurchases

(506,331 ) (268,795 ) Excess tax benefits from share-based payment

arrangements 28,073 24,030 Proceeds from exercise of stock options

and sale of stock under employee stock purchase plan 10,819

15,947 NET CASH USED IN FINANCING ACTIVITIES

(277,777 ) (252,919 ) EFFECT OF EXCHANGE RATE CHANGES

ON CASH 3,286 (7,908 ) NET CHANGE IN CASH AND

CASH EQUIVALENTS 62,947 70,971 CASH AND CASH EQUIVALENTS, BEGINNING

OF PERIOD 258,775 190,550 CASH AND CASH

EQUIVALENTS, END OF PERIOD 321,722 261,521

CASH PAID DURING THE YEAR Interest paid $ 10,263 $

6,457 Income taxes paid $ 123,063 $ 88,079

SUPPLEMENTAL INFORMATION

SCHEDULE A: RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

(unaudited), (Dollars in Thousand, Except Per Share

Data)

In addition to its reported results, the Company has included

in the tables below adjusted results that the Securities and

Exchange Commission defines as “non-GAAP financial measures.”

Management believes that such non-GAAP financial measures, when

read in conjunction with the Company’s reported results, can

provide useful supplemental information for investors in analyzing

period to period comparisons of the Company’s results. However,

non-GAAP financial measures should not be considered substitute

for, nor superior to, financial results and measures determined or

calculated in accordance with GAAP.

The following is a reconciliation of net income, presented and

reported in accordance with U.S. generally accepted

accounting principles, to net income adjusted for certain items:

Three Months Ended Nine Months Ended

9/30/2012 9/30/2011 9/30/2012 9/30/2011

Net income, as reported $ 117,779 $ 108,022 $ 359,309 $

307,221 Write-off of unamortized deferred financing cost from debt

refinancing (net of $214 tax benefit) - - -

700 Net income, as adjusted $ 117,779 $ 108,022 $ 359,309 $

307,921

The following is a reconciliation of diluted earnings

per share, presented and reported in accordance with U.S. generally

accepted accounting principles, to diluted earnings per share

adjusted for certain items:

Three Months Ended Nine

Months Ended 9/30/2012 9/30/2011

9/30/2012 9/30/2011 Diluted earnings per share, as

reported $ 1.04 $ 0.87 $ 3.01 $ 2.44 Write-off of unamortized

deferred financing cost from debt refinancing - -

- 0.01 Diluted earnings per share, as adjusted

$ 1.04 $ 0.87 $ 3.01 $ 2.45

The following is a reconciliation of total long-term debt to net

debt:

9/30/2012 12/31/2011 Total

long-term debt (current and long-term portion) $ 500,437 $ 203,621

Less: Cash and cash equivalents 321,722 258,775

Net debt $ 178,715 $ (55,154 )

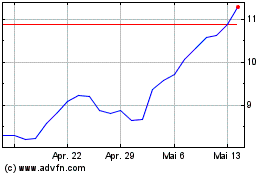

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024