Earlier this week I read an article that suggested the moon's

effect on tides may have led to the disastrous sinking of the

Titanic. The theory is that the unusually close proximity of the

moon to the Earth at the time probably caused higher than expected

tides, which dislodged extraordinarily large icebergs. What struck

me about the article is that it mentioned that the captain of the

Titanic was assigned to this maiden voyage

precisely because

he was a highly experienced, knowledgeable and careful seaman of

the North Atlantic. I hadn't known that he was so credentialed.

What we all do know is that those unusually large icebergs made

their way much further South than expected, into the shipping

lanes.

So here is a situation where an experienced professional was

extremely comfortable operating in a certain environment and in a

certain manner. Yet the environment had changed beyond his

expectations and, because he was operating the ship the way he

would given past conditions, the captain was headed for disaster.

And we all know what happened as a result of his complacency.

What We Can Learn from Titanic

The lesson of the Titanic's captain could have similar

implications for your stock portfolio. Perhaps you're a seasoned

investor and have been selecting stocks the same way for 10, 20, or

even more years. If so, how do you truly know if your stock-picking

strategy still works? Have you been keeping perfect records to know

with confidence that your strategy outperforms, or are you simply

"remembering" that your stock picks have been profitable? (Numerous

behavioral studies have shown that people tend to remember their

successes and ignore their failures. We condition ourselves to

"believe" we're better at performing a task than we actually are.

Humans are an optimistic species. It's a trait that served us well

during our evolution, but it may not serve us so well in our

modern, complex world of investing.)

On the other hand, if you're new to stock investing, what kind

of ideas do you have that will lead to higher returns? Would you

like a way to test those ideas?

How To Look Deeper

Furthermore, how would you like to have access to numerous data

items like analyst ratings, target prices and corporate financial

statements for thousands of companies? After all, the more informed

you are; the better decision maker you'll be. Does the appeal to

test your ideas over many historical time periods, including up and

down markets and economic cycles, appeal to you? Would you like to

get a sense of the riskiness or volatility of your strategy? In

other words, wouldn't it be good to know the frequency and size of

the "icebergs" inherent in your strategy? Wouldn't you like to know

if momentum, value, or growth strategies (or combinations thereof)

perform better over time?

Zacks offers a tool that allows you to find answers to these

questions. You can use the Research Wizard to navigate all the

different data available, discover strategies that lead to higher

returns and test it all for confident trading. It truly is a

one-of-a-kind product, available to the individual investor. With

the Research Wizard, you're only limited by your imagination.

Let's look at an example. Sticking with the non-complacency

theme, I decided to not only look at stocks with the best Zacks

Rank, but those that most recently appeared as Zacks Rank #1s

(Strong Buys). So I'm avoiding complacency here by selecting the

freshest and best Zacks Ranks.

Testing a strategy of the stocks that just became a #1 within

the last week yielded a 10.8% annual average return--compared to a

0% annual average return for the S&P 500 from 2000-2011. So

$10,000 invested in this strategy at the end of 1999 would have

returned $34,062 at the end of 2011, versus $10,049 for the S&P

500. The strategy was, however, slightly more risky with the

largest losing period returning -32.5% compared to -27.5% for the

S&P 500. The number of stocks in the portfolio averaged just

above 30 over this 11-year timeframe, and portfolios with a smaller

number of stocks tend to be more volatile.

Here's how to find the stocks that just became Zacks Rank

#1s:

- First, start with only US common stocks

- Next, create a liquid, investible set of the stocks with the

largest 3000 market values and average daily trading volume

greater than or equal to to 100,000 shares (if there's not

enough liquidity, it'll be hard for you to trade)

- Select only those stocks with a current Zacks Rank equal to

1. (You want current high-ranking stocks.)

- Finally, select only those stocks with a Zacks Rank [1 week

ago] not equal to 1. (You want the previous week's Zacks Rank

to NOT be a 1.)

Here are five stocks using the above methodology (3/16/12):

KR – The Kroger Company

Kroger, a Cincinnati-based company, operates as a retailer in

the US, and manufactures and processes food for sale in its

supermarkets. This company has become a new Zacks #1 Rank of a

"Strong Buy". The improvement in the Zacks Rank is due to several

quarters of earnings surprises and recent upward revisions in both

quarterly and fiscal earnings estimates.

ICE – IntercontinentalExchange, Inc.

IntercontinentalExchange, an Atlanta-based company, operates

regulated exchanges, clearing houses, and over-the-counter (OTC)

markets for agricultural, credit, currency, emissions, energy and

equity index contracts. This new Zacks #1 Rank has a solid history

of earnings surprises and just had four estimate revisions in the

last seven days, and five in the last 30 days for both its current

fiscal quarter and annual earnings.

HLF – Herbalife Ltd.

Over the last year, this company has had super strong earnings

surprises of at least 15%. Couple those surprises with at least

eight revisions for both the current quarterly and annual earnings

estimates over the last 30 days, and you have what adds up to a

Zacks #1 Rank. Herbalife, a network marketing company, sells weight

management, nutritional supplement, energy, sports and fitness, and

personal care products worldwide.

WLK – Westlake Chemical Corp.

Westlake manufactures and markets basic chemicals, vinyls,

polymers and fabricated products. This company has delivered a

positive earnings surprise six out of the last seven quarters and

had at least two quarterly and annual estimate revisions within the

last 30 days. Earnings surprises and upward earnings revisions lead

to a good Zacks Rank.

CPRT – Copart, Inc.

Copart provides online auctions and vehicle remarketing services

in the United States, Canada and the United Kingdom. This Zacks #1

Rank's latest earnings report beat expectations by over 20%, which

has caused upward estimate revisions within the last week and month

for both quarterly and annual earnings.

Do Your Own Research

Because I'm a strong proponent of self-improvement, I encourage

you to verify your strategies and try to improve upon them with the

Zacks Research Wizard. Starting today, you are invited to do

this free of charge. You'll have 14 days to create, tweak and

backtest your strategies. At the same time, you can see the latest

picks from pre-loaded winning strategies that average gains of up

to +67.4% per year.

Don't be complacent with your current strategy. Avoid unseen

disasters in your portfolio by becoming a better stock picker

today.

Learn more about your Research Wizard free trial

>>

Good Investing,

Kip

Kip Robbins is a Quantitative Analyst with Zacks.com. He

analyzes screens and strategies for Zacks customers and for use in

Zacks Research Wizard, which empowers individual investors to use

market-beating screens, build their own, and back test their

results.

COPART INC (CPRT): Free Stock Analysis Report

HERBALIFE LTD (HLF): Free Stock Analysis Report

INTERCONTINENTL (ICE): Free Stock Analysis Report

KROGER CO (KR): Free Stock Analysis Report

WESTLAKE CHEM (WLK): Free Stock Analysis Report

To read this article on Zacks.com click here.

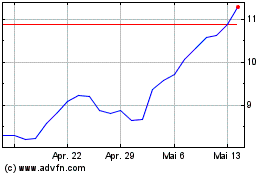

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024