Goldman Sachs Custody Solutions and NewEdge Capital Group Announce Strategic Collaboration to Provide Enhanced Services to RIAs

10 September 2024 - 3:00PM

Goldman Sachs Custody Solutions (“GSCS”), a modern

custodial provider for independent advisors, will now serve as

a select custodian for NewEdge Wealth and NewEdge Advisors,

subdivisions of NewEdge Capital Group. Both well known for

delivering differentiated solutions to seasoned advisors, GSCS

and NewEdge Capital Group are collaborating to deliver

industry-leading service and support to address the evolving needs

of sophisticated advisors and the clients they serve. This

relationship was solidified when two NewEdge teams, Fortis Wealth

Advisors and Lehigh Valley, recently selected GSCS as their primary

custodian.

“Goldman Sachs Custody Solutions is thrilled to continue our

collaboration with NewEdge Capital Group,” said Jeremy

Eisenstein, Managing Director at Goldman Sachs. “Their commitment

to providing a high level of service for clients with complex

needs aligns with our mission to empower advisors with

a digital-forward custodial solution and institutional

support. This relationship is a testament to our dedication in

elevating the advisor experience.”

The combination of GSCS’s institutional capabilities with

NewEdge Capital Group’s infrastructure aims to support

next-gen talent and create a unique environment for advisors who

are looking to take their services to the next level.

“At NewEdge, we take pride in being an open-architecture firm,

prioritizing products and solutions that best serve our

advisors and their clients—including custody services,” said Rob

Sechan, Co-Managing Partner of NewEdge Capital Group and CEO

of NewEdge Wealth. “We are thrilled to welcome GSCS as

a new custody partner for both NewEdge Wealth and NewEdge

Advisors.”

“NewEdge Capital Group’s long-standing relationship with GSCS

has been grounded in a shared vision for excellence in

advisory services,” said Alex Goss, Co-Managing Partner of NewEdge

Capital Group and CEO of NewEdge Advisors. “This next

step will further deepen our ability to offer innovative solutions

and unparalleled support to growth-oriented advisors. The

integration of GSCS’s elite custodial services with our

cutting-edge infrastructure represents a significant advancement

for our advisors.”

About Goldman Sachs Custody Solutions

Goldman Sachs Custody Solutions offers clients of independent

advisors access to institutional-grade solutions and custody

services. We transform the client experience with an intuitive,

digital-forward platform to enhance your advisor’s transparency.

Our modern, nimble, and ever-evolving open architecture network

connects advisors to best-in-class services and tools. More than

just a custodian, we are a gateway to the institutional power of

Goldman Sachs.

Custody, clearing and certain brokerage services are offered by

Folio Investments, Inc., d/b/a Goldman Sachs Custody Solutions

(“GSCS”), a registered broker-dealer and member FINRA/MSRB/SIPC.

Additional brokerage services are provided by Goldman Sachs

& Co. LLC (“GS&Co.”), which is an

SEC-registered broker-dealer and investment adviser, and

member FINRA/MSRB/SIPC. Research GSCS and GS&Co.

at FINRA's BrokerCheck. The information provided here shall

not constitute an offer, solicitation, or advice by GSCS or

GS&Co. to buy or sell securities.

About NewEdge Capital Group

NewEdge Capital Group and its subsidiaries collectively trace

their roots back over 30 years and provide best-in-class

technology-enabled solutions and support services to financial

advisors and their clients. NewEdge Wealth is designed to meet

the needs of ultra high net worth, family office and

institutional clients and the advisors that serve them.

NewEdge Advisors embraces a transparent approach to educating

advisors on the independent opportunities that currently exist and

offers multiple affiliation models, including direct 1099 and

W-2.

Today, NewEdge Capital Group, a Barron’s Top 100 RIA Firm and

Forbes’ America’s Top RIA Firm*, has over $55 billion in

client assets serviced** and supports over 400 financial advisors

servicing several thousand households, family offices, and

institutions comprising of more than 75,000 client accounts.

*Barron’s rankings awarded in September 2023 based on prior 12

month data. Forbes/Shook rankings awarded in October 2023

based on data from 3/31/22-3/31/23. Neither NewEdge Capital Group

nor its employees pay a fee in exchange for these

rankings.

**Assets “serviced by” the firm includes (i) client assets for

which we provide investment advisory services, (ii) client

assets for which we provide brokerage services through our

affiliate, NewEdge Securities, Inc. and (iii) client assets

held at unaffiliated broker-dealers for which we provide

supervisory oversight and support services.

Kelsey Woodbridge

Ficomm Partners

kelsey.woodbridge@ficommpartners.com

Goldman Sachs (NYSE:GS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

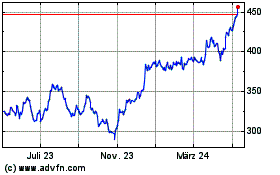

Goldman Sachs (NYSE:GS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024