Consolidated First Quarter Revenue Increases

to $69.1 Million compared with $68.4 Million in the First Quarter

of Fiscal 2024

Education Division First Quarter Revenue

Increases 11% to $16.5 Million compared with $14.9 Million in the

Prior Year

New North America Sales Force Structure Now

in Place with Sales Hiring Activities Ahead of Plan

Liquidity Remains Strong at over $115

Million, with $53.3 Million of Cash and No Drawdowns on the

Company’s $62.5 Million Credit Facility

Company Affirms Guidance for Fiscal

2025

Franklin Covey Co. (NYSE: FC), a leader in organizational

performance improvement that creates, and on a subscription basis,

distributes world-class content, training, processes, and tools

that organizations and individuals use to achieve systemic changes

in human behavior to transform their results, today announced

financial results for the first quarter of fiscal 2025, which ended

on November 30, 2024.

Financial Highlights

The Company’s consolidated revenue for the quarter ended

November 30, 2024 grew 1% to $69.1 million compared with $68.4

million in the first quarter of fiscal 2024. Rolling four-quarter

revenue for the period ended November 30, 2024 increased 3% to

$287.9 million compared with $279.6 million for the comparable

period ended November 30, 2023. The Company’s financial performance

for the first quarter of fiscal 2025 included the following:

- Enterprise Division revenues for the first quarter of fiscal

2025 were $51.6 million compared with $52.4 million in fiscal 2024.

The decrease was primarily due to decreased revenue through the

Company’s offices in China and Japan and by decreased international

licensee revenues as North America segment sales were essentially

flat for the quarter. North America segment sales were essentially

in-line with the Company’s expectations as the Company transitions

its sales force in North America to a more focused structure that

is expected to accelerate sales growth in future periods. All

Access Pass (AAP) subscription plus subscription services revenue

was $41.0 million in the first quarter of fiscal 2025 compared with

$41.6 million in the prior year.

- Education Division revenues in the first quarter increased 11%

to $16.5 million compared with $14.9 million in the first quarter

of the prior year. First quarter revenue growth was primarily due

to increased sales of classroom and training materials, due in part

to a new initiative with a state that began in the first quarter of

2025, increased coaching and consulting revenue, and increased

membership subscription revenues resulting from new schools which

started The Leader in Me during fiscal 2024. Delivery of training

and coaching days remained strong during the first quarter of

fiscal 2025, as the Education Division delivered approximately 100

more training and coaching days than the prior year.

- Total Company subscription and subscription services revenues

reached $55.8 million, a 2% increase over $54.8 million in the

first quarter of fiscal 2024. For the first quarter of fiscal 2025,

subscriptions invoiced equaled the first quarter of the prior year

at $24.7 million.

- The Company’s operating expenses for the quarter ended November

30, 2024, increased $4.3 million compared with the prior year,

which was primarily due to a $3.0 million increase in selling,

general, and administrative (SG&A) expenses and a $1.4 million

increase in restructuring expenses. The increase in SG&A

expenses was primarily due to increased associate costs related to

new personnel, including new sales and sales support personnel

hired in connection with the restructuring of the North America

sales force, compensation increases, and benefits costs; and from

advertising and promotional costs primarily related to the launch

of the Company’s refreshed The 7 Habits of Highly Effective People

offering, which was released during the first quarter.

Restructuring costs were for severance related to the execution of

sales and sales management restructuring initiatives that began in

fiscal 2024.

- Operating income for the quarter ended November 30, 2024 was

$1.5 million compared with $5.3 million in fiscal 2024, and

reflected the factors noted above. Net income for the first quarter

of fiscal 2025 was $1.2 million, or $0.09 per diluted share,

compared with $4.9 million, or $0.36 per diluted share, in the

first quarter of the prior year.

- Adjusted EBITDA for the first quarter of fiscal 2025 was

in-line with expectations at $7.7 million compared with $11.0

million in the prior year. In constant currency, Adjusted EBITDA

was $8.1 million in the first quarter of fiscal 2025. Adjusted

EBITDA for the rolling four quarters ended November 30, 2024

increased to $52.0 million compared with $47.6 million for the

comparable period ended November 30, 2023.

- Deferred subscription revenue at November 30, 2024 increased

10% to $95.7 million compared with $87.2 million at November 30,

2023. Unbilled deferred subscription revenue at November 30, 2024,

was $73.0 million compared with $82.5 million at November 30, 2023.

At November 30, 2024, 55% of the Company’s AAP contracts in North

America were for at least two years, compared with 54% at November

30, 2023, and the percentage of contracted amounts represented by

multi-year contracts at November 30, 2024 was equal to the prior

year at 60%.

- Cash flows from operating activities for the first quarter of

fiscal 2025 remained strong and totaled $14.1 million compared with

$17.4 million in fiscal 2024. Free Cash Flow for the first quarter

totaled $11.4 million compared with $13.7 million in the prior

year. The decrease in cash flows during the first quarter of fiscal

2025 was due to lower operating income than in the prior year

resulting primarily from the growth investments associated with the

realignment of the North America sales force in the Enterprise

Division.

- The Company purchased 145,768 shares of its common stock for

$6.0 million during the first quarter of fiscal 2025. These shares

were withheld to cover statutory income taxes on stock-based

compensation awards that vested and were issued during the first

quarter.

Paul Walker, President and Chief Executive Officer, said, “Our

first quarter revenue grew 1% to $69.1 million compared with $68.4

million in last year’s first quarter. This result reflects strong

growth in our Education Division where revenue grew 11% while sales

were flat in the Enterprise Division, which was in-line with our

expectations when we began the transition of our sales force to a

more focused and powerful go-to-market model in North America.

First quarter Adjusted EBITDA was $7.7 million, or $8.1 million in

constant currency, which was also in-line with our expectations for

the quarter. This result compares with $11.0 million of Adjusted

EBITDA in fiscal 2024 and includes the first quarter impact of $16

million of expected growth investments in fiscal 2025 to transform

our sales structure and accelerate sales growth in North

America.”

Walker continued, “In our earnings call held in November, we

shared that we were pleased to have substantially achieved the

three big strategic initiatives we began in previous years. These

initiatives included 1) the transition of our business model to a

subscription-based model; 2) significant prior and ongoing

investment in technology to enable our solutions to be delivered

seamlessly across all modalities and in more than 25 languages

worldwide; and 3) significant prior and ongoing investment to

ensure that our content, offerings, and solutions represent the

gold standard in our market. Now that these initiatives are

substantially in place, we are now positioned to leverage these

strategic achievements by accelerating our go-to-market efforts to

capture an even greater share of our total addressable market.”

Walker concluded, “The two key areas of focus and investment in

our go-to-market efforts are: First, to achieve significant ongoing

increases in client penetration, which is the sole focus of a large

number of our client partners, and provide them with the additional

client support resources necessary to achieve this expansion within

our existing clients; and second, to make winning a significantly

increased number of new clients the only focus of a separate,

specially trained group of client partners. Our target was to begin

the second quarter of fiscal 2025 fully transitioned into the new

sales structure and we are pleased to report that we hit that

target. Today in our Enterprise North America segment every

salesperson is either focused fully on client expansion or on

winning new clients. We expect the impact of these go-to-market

initiatives to result in a significant increase in our sustainable

revenue growth rate to consistently achieve double-digit growth and

to also generate accelerated levels of Adjusted EBITDA and cash

flows in the future.”

Fiscal 2025 Guidance

Affirmed

Based on fiscal 2025 financial results and the expected success

of investments in its sales and marketing efforts, the Company

affirms its expected fiscal 2025 revenue to be in the range of $295

million to $305 million in constant currency. The Company expects

revenue to increase even though a significant amount of the

invoiced sales from these initiatives will be recorded as deferred

subscription revenue and recognized over the lives of the

underlying contracts. Consistent with previous disclosure, the

Company believes strategic investments in projects and initiatives,

which are expected to result in long-term revenue growth and value

creation, are effective and well thought out uses of the Company’s

capital. Considering the impact of $16 million of expected

investments in additional sales, sales support, and marketing

personnel, combined with anticipated increases in revenue, the

Company currently anticipates Adjusted EBITDA for fiscal 2025 to be

in the range of $40 million to $44 million in constant currency. As

revenue growth from these initiatives accelerates, the impact of

these additional expenses is expected to be more than offset and

growth in Adjusted EBITDA and cash flows are expected to pick up

and then increase significantly in future years.

Earnings Conference Call

On Wednesday, January 8, 2025, at 5:00 p.m. Eastern (3:00 p.m.

Mountain) Franklin Covey will host a conference call to review its

first quarter fiscal 2025 financial results. Interested persons may

access a live audio webcast at

https://edge.media-server.com/mmc/p/gk9ap76y or may participate via

telephone by registering at

https://register-conf.media-server.com/register/BI388e927ba68843d696247ac1d22afb0f

(this is an updated link required by the vendor). Once registered,

participants will have the option of 1) dialing into the call from

their phone (via a personalized PIN); or 2) clicking the “Call Me”

option to receive an automated call directly to their phone. For

either option, registration will be required to access the call. A

replay of the conference call webcast will be archived on the

Company’s website for at least 30 days.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

including those statements related to the Company’s future results

and profitability and other goals relating to the growth and

operations of the Company. Forward-looking statements are based

upon management’s current expectations and are subject to various

risks and uncertainties including, but not limited to: general

macroeconomic conditions; renewals of subscription contracts; the

impact of strategic projects and initiatives on future financial

results; growth in and client demand for add-on services; market

acceptance of new products or services, including new AAP portal

upgrades and content launches; the ability to achieve sustainable

double-digit revenue growth in future periods; impacts from

geopolitical conflicts; inflation; and other factors identified and

discussed in the Company’s most recent Annual Report on Form 10-K

and other periodic reports filed with the Securities and Exchange

Commission. Many of these conditions are beyond the Company’s

control or influence, any one of which may cause future results to

differ materially from the Company’s current expectations, and

there can be no assurance that the Company’s actual future

performance will meet management’s expectations. These

forward-looking statements are based on management’s current

expectations and the Company undertakes no obligation to update or

revise these forward-looking statements to reflect events or

circumstances subsequent to this press release.

Non-GAAP Financial

Information

This earnings release includes the concepts of Adjusted EBITDA,

Free Cash Flow, and “constant currency” which are non-GAAP

measures. The Company defines Adjusted EBITDA as net income

excluding the impact of interest, income taxes, intangible asset

amortization, depreciation, stock-based compensation expense, and

certain other infrequently occurring items such as restructuring

costs. Free Cash Flow is defined as GAAP calculated cash flows from

operating activities less capitalized expenditures for purchases of

property and equipment, curriculum development, and content or

license rights. Constant currency is a non-GAAP financial measure

that removes the impact of fluctuations in foreign currency

exchange rates and is calculated by translating the current

period’s financial results at the same average exchange rates in

effect during the prior year and then comparing this amount to the

prior year. The Company references these non-GAAP financial

measures in its decision-making because they provide supplemental

information that facilitates consistent internal comparisons to the

historical operating performance of prior periods and the Company

believes they provide investors with greater transparency to

evaluate operational activities and financial results. Refer to the

attached tables for the reconciliation of the non-GAAP financial

measure, Adjusted EBITDA, to consolidated net income, a related

GAAP financial measure, and for the calculation of Free Cash

Flow.

The Company is unable to provide a reconciliation of the above

forward-looking estimate of non-GAAP Adjusted EBITDA to GAAP

measures because certain information needed to make a reasonable

forward-looking estimate is difficult to obtain and dependent on

future events which may be uncertain, or out of the Company’s

control, including the amount of AAP contracts invoiced, the number

of AAP contracts that are renewed, necessary costs to deliver the

Company’s offerings, such as unanticipated curriculum development

costs, and other potential variables. Accordingly, a reconciliation

is not available without unreasonable effort.

About Franklin Covey Co.

Franklin Covey Co. (NYSE: FC) is a global leadership company

with directly owned and licensee partner offices providing

professional services in 150 countries and territories around the

world. The Company transforms organizations by partnering with its

clients to build leaders, teams, and cultures that achieve

breakthrough results through collective action, which leads to a

more engaging work experience for their people. Available through

the Franklin Covey All Access Pass, the Company’s best-in-class

content and solutions, experts, technology, and metrics seamlessly

integrate to ensure lasting behavioral change at scale. Solutions

are available in multiple delivery modalities in more than 20

languages.

This approach to leadership and organizational change has been

tested and refined by working with tens of thousands of teams and

organizations over the past 30 years. Clients have included

organizations in the Fortune 100, Fortune 500, and thousands of

small- and mid-sized businesses, numerous governmental entities,

and educational institutions. To learn more, visit

www.franklincovey.com, and enjoy exclusive content from Franklin

Covey’s social media channels at: LinkedIn, Facebook, Twitter,

Instagram, and YouTube.

FRANKLIN COVEY CO.

Condensed Consolidated Income

Statements (in thousands, except per-share amounts, and

unaudited) Quarter Ended

November 30,

November 30,

2024

2023

Net revenue

$

69,086

$

68,399

Cost of revenue

16,375

16,122

Gross profit

52,711

52,277

Selling, general, and administrative

47,204

44,205

Restructuring costs

1,984

581

Depreciation

950

1,091

Amortization

1,098

1,071

Income from operations

1,475

5,329

Interest income (expense), net

112

(53

)

Income before income taxes

1,587

5,276

Income tax provision

(406

)

(425

)

Net income

$

1,181

$

4,851

Net income per share: Basic

$

0.09

$

0.37

Diluted

0.09

0.36

Weighted average common shares: Basic

13,092

13,244

Diluted

13,271

13,636

Other data: Adjusted EBITDA(1)

$

7,674

$

10,969

(1)

Adjusted EBITDA (earnings before interest, income taxes,

depreciation, amortization, stock-based compensation, and certain

other items) is a non-GAAP financial measure that the Company

believes is useful to investors in evaluating its results. For a

reconciliation of this non-GAAP measure to a comparable GAAP

measure, refer to the Reconciliation of Net Income to Adjusted

EBITDA as shown below.

FRANKLIN

COVEY CO. Reconciliation of Net

Income to Adjusted EBITDA (in thousands and unaudited)

Quarter Ended

November 30,

November 30,

2024

2023

Reconciliation of net income to Adjusted EBITDA: Net income

$

1,181

$

4,851

Adjustments: Interest (income) expense, net

(112

)

53

Income tax provision

406

425

Amortization

1,098

1,071

Depreciation

950

1,091

Stock-based compensation

2,167

2,897

Restructuring costs

1,984

581

Adjusted EBITDA

$

7,674

$

10,969

Adjusted EBITDA margin

11.1

%

16.0

%

FRANKLIN COVEY CO.

Additional Financial

Information (in thousands and unaudited) Quarter

Ended

November 30,

November 30,

2024

2023

Revenue by Division/Segment: Enterprise Division: North

America

$

40,137

$

40,293

International direct offices

8,239

8,730

International licensees

3,203

3,423

51,579

52,446

Education Division

16,464

14,891

Corporate and other

1,043

1,062

Consolidated

$

69,086

$

68,399

Gross Profit by Division/Segment: Enterprise

Division: North America

$

32,821

$

32,764

International direct offices

6,113

6,613

International licensees

2,864

3,081

41,798

42,458

Education Division

10,410

9,475

Corporate and other

503

344

Consolidated

$

52,711

$

52,277

Adjusted EBITDA by Division/Segment: Enterprise

Division: North America

$

8,744

$

10,441

International direct offices

(224

)

1,158

International licensees

1,644

1,916

10,164

13,515

Education Division

266

110

Corporate and other

(2,756

)

(2,656

)

Consolidated

$

7,674

$

10,969

FRANKLIN

COVEY CO.

Condensed Consolidated Balance

Sheets (in thousands and unaudited)

November 30,

August 31,

2024

2024

Assets Current assets: Cash and cash

equivalents

$

53,294

$

48,663

Accounts receivable, less allowance for credit losses of $2,141 and

$3,015

61,419

86,002

Inventories

3,828

4,002

Prepaid expenses and other current assets

20,247

21,586

Total current assets

138,788

160,253

Property and equipment, net

8,733

8,736

Intangible assets, net

37,163

37,766

Goodwill

31,220

31,220

Deferred income tax assets

834

870

Other long-term assets

23,168

22,694

$

239,906

$

261,539

Liabilities and Shareholders'

Equity Current liabilities: Current portion of notes payable

$

835

$

835

Current portion of financing obligation

2,166

3,112

Accounts payable

5,961

7,862

Deferred subscription revenue

88,868

101,218

Customer deposits

21,815

16,972

Accrued liabilities

23,893

32,454

Total current liabilities

143,538

162,453

Notes payable, less current portion

789

775

Financing obligation, less current portion

1,312

1,312

Other liabilities

10,707

10,732

Deferred income tax liabilities

2,913

3,132

Total liabilities

159,259

178,404

Shareholders' equity: Common stock

1,353

1,353

Additional paid-in capital

227,273

231,813

Retained earnings

124,385

123,204

Accumulated other comprehensive loss

(970

)

(768

)

Treasury stock at cost, 13,867 and 14,084 shares

(271,394

)

(272,467

)

Total shareholders' equity

80,647

83,135

$

239,906

$

261,539

FRANKLIN COVEY CO.

Condensed Consolidated Free Cash

Flow (in thousands and unaudited) Quarter Ended

November 30,

November 30,

2024

2023

(unaudited) CASH FLOWS FROM OPERATING ACTIVITIES Net income $

1,181

$

4,851

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

2,048

2,162

Amortization of capitalized curriculum costs

1,033

691

Stock-based compensation

2,167

2,897

Deferred income taxes

(216

)

(1,048

)

Amortization of right-of-use operating lease assets

162

199

Changes in working capital

7,770

7,686

Net cash provided by operating activities

14,145

17,438

CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property

and equipment

(998

)

(1,072

)

Curriculum development costs

(1,432

)

(2,668

)

Reacquisition of license rights

(324

)

-

Net cash used for investing activities

(2,754

)

(3,740

)

Free Cash Flow $

11,391

$

13,698

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108056330/en/

Investor Contact: Franklin Covey Boyd Roberts 801-817-5127

investor.relations@franklincovey.com

Media Contact: Franklin Covey Debra Lund 801-817-6440

Debra.Lund@franklincovey.com

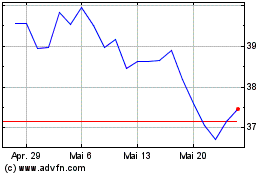

Franklin Covey (NYSE:FC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Franklin Covey (NYSE:FC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025