Energy Transfer LP Announces Full Redemption Of Series E Preferred Units

20 März 2024 - 9:05PM

Business Wire

Energy Transfer LP (NYSE: ET) today issued a notice to redeem

all of its outstanding Series E Fixed-to-Floating Rate Cumulative

Redeemable Perpetual Preferred Units (the “Units”) on May 15, 2024

at a redemption price per Unit of $25.00. Holders of Units as of

May 1, 2024, the record date for quarterly distributions on the

Units, will separately receive accrued distributions to, but

excluding, May 15, 2024, in an amount of $0.4750 per Unit.

This press release shall not constitute a notice of redemption

or an offer to sell or the solicitation of an offer to buy the

securities described herein.

Energy Transfer LP owns and operates one of the largest

and most diversified portfolios of energy assets in the United

States, with more than 125,000 miles of pipeline and associated

energy infrastructure. Energy Transfer’s strategic network spans 44

states with assets in all of the major U.S. production basins.

Energy Transfer is a publicly traded limited partnership with core

operations that include complementary natural gas midstream,

intrastate and interstate transportation and storage assets; crude

oil, natural gas liquids (“NGL”) and refined product transportation

and terminalling assets; and NGL fractionation. Energy Transfer

also owns Lake Charles LNG Company, as well as the general partner

interests, the incentive distribution rights and approximately 34%

of the outstanding common units of Sunoco LP (NYSE: SUN), and the

general partner interests and approximately 45% of the outstanding

common units of USA Compression Partners, LP (NYSE: USAC).

Forward-Looking Statements

Statements in this press release that are not historical facts,

including, but not limited to, those relating to the proposed

redemption and amounts or proceeds to be used for the redemption,

are forward-looking statements that are based on current

expectations. Forward-looking statements can be identified by words

such as “anticipates,” “believes,” “intends,” “projects,” “plans,”

“expects,” “continues,” “estimates,” “goals,” “forecasts,” “may,”

“will” and other similar expressions. These forward-looking

statements rely on a number of assumptions concerning future events

and are subject to a number of uncertainties and factors, many of

which are outside the control of Energy Transfer, and a variety of

risks that could cause results to differ materially from those

expected by management of Energy Transfer, including the terms of

the redemption, other sources and uses of funds for Energy Transfer

and actions by the holders of outstanding Series E

Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred

Units. Important information about issues that could cause actual

results to differ materially from those expected by management of

Energy Transfer can be found in Energy Transfer’s public periodic

filings with the SEC, including its Annual Report on Form 10-K.

Energy Transfer undertakes no obligation to update or revise

forward-looking statements to reflect changed assumptions, the

occurrence of unanticipated events or changes to future operating

results over time.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240320254089/en/

Energy Transfer LP Investor Relations: Bill Baerg,

Brent Ratliff, Lyndsay Hannah, 214-981-0795 Media Relations:

Media@energytransfer.com 214-840-5820

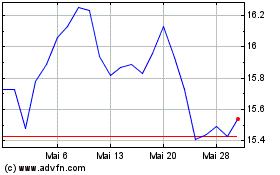

Energy Transfer (NYSE:ET)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Energy Transfer (NYSE:ET)

Historical Stock Chart

Von Jan 2024 bis Jan 2025