false

0000072741

0000072741

2024-01-24

2024-01-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 24, 2024

EVERSOURCE ENERGY

(Exact name of registrant as specified

in its charter)

| Massachusetts |

|

001-05324 |

|

04-2147929 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| 300

Cadwell Drive, Springfield, Massachusetts, 01104 |

(Address of principal executive offices, including zip code)

(800) 286-5000

Registrant’s telephone number,

including area code

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Shares, $5.00 par value per share |

ES |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of the chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of the chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Section

2 | Financial Information |

| Item 2.02 | Results of Operations and Financial Condition. |

The information set forth under Item 8.01 is incorporated

by reference into this Item 2.02.

| Item 7.01 | Regulation FD Disclosure. |

On January 24, 2024, Sunrise Wind, an

offshore wind project jointly owned 50 percent by Eversource Energy (“Eversource”) and 50 percent by Ørsted, issued

a news release announcing that Ørsted has signed an agreement with Eversource to acquire Eversource’s 50 percent share of

Sunrise Wind, a 924 MW offshore wind farm, which would deliver power to New York. The acquisition is subject to the successful award

of Sunrise Wind in the ongoing New York 4 solicitation for offshore wind capacity, signing of an OREC (“Offshore Wind

Renewable Energy Certificates”) contract with the New York State Energy Research and Development Authority

(“NYSERDA”), finalization of acquisition agreements, receipt of construction and operations plan (“COP”),

and relevant regulatory approvals.

The news release is attached as Exhibit 99.1

and incorporated herein by reference.

The

information contained in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” with the Securities

and Exchange Commission (“SEC”) nor incorporated by reference in any registration statement filed by Eversource or any subsidiary

thereof under the Securities Act of 1933, as amended, unless specified otherwise.

On January 24, 2024, Sunrise Wind, an

offshore wind project jointly owned 50 percent by Eversource and 50 percent by Ørsted, issued a news release announcing that

Ørsted has signed an agreement with Eversource to acquire Eversource’s 50 percent share of Sunrise Wind, a 924 MW

offshore wind farm, which would deliver power to New York. The acquisition is subject to the successful award of Sunrise Wind in the

ongoing New York 4 solicitation for offshore wind capacity, signing of an OREC contract with NYSERDA, finalization of acquisition

agreements, receipt of construction and operations plan, and relevant regulatory approvals.

If Sunrise Wind is not successful in the solicitation,

then the existing OREC contract for Sunrise Wind will be cancelled per the state’s requirements, and Eversource and Ørsted’s

50/50 joint venture for Sunrise Wind will remain in place. In that scenario, the joint venture will evaluate its next steps. If the project

is provisionally awarded, a new contract will be negotiated with NYSERDA under the updated terms of the current solicitation.

As the most mature offshore wind project in New

York’s pipeline, Sunrise Wind is, if awarded in the New York 4 solicitation, expected to be completed in 2026, helping New York

achieve its goal of reaching 70 percent renewable energy by 2030.

The Sunrise Wind design has been reviewed and accepted by all relevant state agencies, and the project has secured all major supplier

and project labor agreements to commence construction shortly after award. Final federal permits are expected this summer.

Forward-Looking Statements

This Current Report on Form 8-K includes

statements concerning Eversource’s expectations, beliefs, plans, objectives, goals, strategies, assumptions of future events

and other statements that are not historical facts, including the progress and anticipated timing of its offshore wind investment

sale process, the potential terms thereof, participation in and outcome of rebidding in the New York RFP and its plans for building

onshore interconnection systems. These statements are “forward-looking statements” within the meaning of U.S. federal

securities laws. Generally, readers can identify these forward-looking statements through the use of words or phrases such as

“estimate,” “expect,” “anticipate,” “intend,” “plan,”

“project,” “believe,” “forecast,” “would,” “should,” “could”

and other similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual results or outcomes

to differ materially from those included in the forward-looking statements. Forward-looking statements are based on the current

expectations, estimates, assumptions or projections of management and are not guarantees of future performance. These expectations,

estimates, assumptions or projections may vary materially from actual results. Accordingly, any such statements are qualified in

their entirety by reference to, and are accompanied by, important factors that may cause our actual results or outcomes to differ

materially from those contained in our forward-looking statements, including, but not limited to: our ability to complete the

offshore wind investment sale process on the timeline or the terms we expect; the risk that we and the potential purchaser, or the

potential purchaser and Ørsted, are unable to reach definitive agreements necessary to consummate the transactions described

above; the outcome of the power purchase agreement bid process for Sunrise Wind and the risk of losing the bid to a competing offer;

the ability to qualify for investment tax credits in the amounts we expect; variability in the costs and projected returns of the

offshore wind projects and the risk of deterioration of market conditions in the offshore wind industry; cyberattacks or breaches,

including those resulting in the compromise of the confidentiality of our proprietary information and the personal information of

our customers; disruptions in the capital markets or other events that make our access to necessary capital more difficult or

costly; changes in economic conditions, including impact on interest rates, tax policies, and customer demand and payment ability;

ability or inability to commence and complete our major strategic development projects and opportunities; acts of war or terrorism,

physical attacks or grid disturbances that may damage and disrupt our electric transmission and electric, natural gas, and water

distribution systems; actions or inaction of local, state and federal regulatory, public policy and taxing bodies; substandard

performance of third-party suppliers and service providers; fluctuations in weather patterns, including extreme weather due to

climate change; changes in business conditions, which could include disruptive technology or development of alternative energy

sources related to our current or future business model; contamination of, or disruption in, our water supplies; changes in levels

or timing of capital expenditures; changes in laws, regulations or regulatory policy, including compliance with environmental laws

and regulations; changes in accounting standards and financial reporting regulations; actions of rating agencies; and other

presently unknown or unforeseen factors.

| Section

9 | Financial Statements and Exhibits |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused the report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EVERSOURCE ENERGY |

| |

(Registrant) |

| |

|

| January 24, 2024 |

By: |

/s/ Jay

S. Buth |

| |

|

Jay S. Buth |

| |

|

Vice President, Controller and Chief Accounting Officer |

Exhibit 99.1

Ørsted to acquire full ownership of Sunrise

Wind subject to award in New York 4 offshore wind solicitation

NEW YORK – JANUARY 24, 2024

– Ørsted has signed an agreement with Eversource to acquire Eversource’s 50 percent share of Sunrise Wind, a 924 MW

offshore wind farm which would deliver power to New York. The acquisition is subject to the successful award of Sunrise Wind in the ongoing

New York 4 solicitation for offshore wind capacity, signing of an OREC (Offshore Wind Renewable Energy Certificates) contract with New

York’s energy agency, NYSERDA, finalization of acquisition agreements, receipt of construction and operations plan (COP),

and relevant regulatory approvals.

If Sunrise Wind is not successful in the solicitation, the existing

OREC contract for Sunrise Wind will be cancelled per the state’s requirements, and Ørsted and Eversource’s 50/50 joint

venture for Sunrise Wind will remain in place. In that scenario, the joint venture will evaluate its next steps. If the project is provisionally

awarded, a new contract will be negotiated with NYSERDA under the updated terms of the current solicitation.

As the most mature offshore wind project in New York’s pipeline,

Sunrise Wind is, if awarded in the New York 4 solicitation, expected to be completed in 2026, helping New York achieve its goal of reaching

70 percent renewable energy by 2030.

The Sunrise Wind design has been reviewed and accepted by all relevant

state agencies, and the project has secured all major supplier and project labor agreements to commence construction shortly after award. Final

federal permits are expected this summer.

David Hardy, Group Executive Vice

President and CEO of Region Americas at Ørsted, says:

“Following a thorough risk review of our US portfolio, we’re

comfortable with taking full ownership of Sunrise Wind if the project is awarded in New York 4. This transaction is a value-accretive

opportunity for Ørsted and the best path forward for the project.

“Sunrise Wind will be our third offshore wind farm off the Northeast

coast, following South Fork and Revolution Wind, which are already under construction. The Northeast is an increasing priority for Ørsted,

including these projects, port assets, a trained workforce, and supply chain partners. We’re building a future offshore wind hub

that is strategic for Sunrise Wind, if awarded, as well as for upcoming solicitations in the region, helping us to differentiate and de-risk

potential future bids and projects.”

Joe Nolan, Chief Executive

Officer and President of Eversource Energy, says:

“We’re proud of the work we have already accomplished

for Sunrise Wind and look forward to continuing our leadership position building onshore interconnection systems for offshore wind

projects in the Northeast.”

About Ørsted

A global clean energy leader, Ørsted develops, constructs,

and operates offshore and land-based wind farms, solar farms, energy storage facilities, and bioenergy plants. Ørsted was the

first energy company in the world to have its science-based net-zero emissions target validated by the Science Based Targets

initiative (SBTi) and is recognized as the world's most sustainable energy developer in the Corporate Knights Global 100 Index.

In the United States, the company has approximately 700 employees

and a portfolio of clean energy assets and partnerships that includes offshore wind energy, land-based wind energy, solar, battery

storage and e-fuels. Ørsted is a U.S. leader in offshore wind energy with approximately 3 gigawatts in development and

operates America’s first offshore wind farm, located off the coast of Block Island. Ørsted has a total U.S. land-based

capacity of 5 gigawatts across wind, solar, storage technologies and e-fuels. To learn more about the Ørsted U.S. business,

visit us.orsted.com or follow the company on Twitter (@ØrstedUS), Instagram, and Facebook.

About Eversource

Eversource (NYSE: ES), celebrated as a national leader for its corporate

citizenship, is the #1 energy company in Newsweek’s list of America’s Most Responsible Companies for 2024 and recognized as

a Five-Year Champion, appearing in every edition of the list. Eversource transmits and delivers electricity and natural gas and supplies

water to approximately 4.4 million customers in Connecticut, Massachusetts and New Hampshire. The #1 energy efficiency provider in the

nation, Eversource harnesses the commitment of approximately 9,900 employees across three states to build a single, united company around

the mission of safely delivering reliable energy and water with superior customer service. The company is empowering a clean energy future

in the Northeast, with nationally recognized energy efficiency solutions and successful programs to integrate new clean energy resources

like a first-in-the-nation networked geothermal pilot project, solar, offshore wind, electric vehicles and battery storage, into the electric

system. For more information, please visit eversource.com, and follow us on X, Facebook, Instagram, and LinkedIn. For more information

on our water services, visit aquarionwater.com.

Forward-Looking Statements

This release includes statements concerning

Eversource’s expectations, beliefs, plans, objectives, goals, strategies, assumptions of future events and other statements

that are not historical facts, including the progress and anticipated timing of its offshore wind investment sale process, the

potential terms thereof, participation in and outcome of rebidding in the New York RFP and its plans for building onshore

interconnection systems. These statements are “forward-looking statements” within the meaning of U.S. federal securities

laws. Generally, readers can identify these forward-looking statements through the use of words or phrases such as

“estimate,” “expect,” “anticipate,” “intend,” “plan,”

“project,” “believe,” “forecast,” “would,” “should,” “could”

and other similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual results or outcomes

to differ materially from those included in the forward-looking statements. Forward-looking statements are based on the current

expectations, estimates, assumptions or projections of management and are not guarantees of future performance. These expectations,

estimates, assumptions or projections may vary materially from actual results. Accordingly, any such statements are qualified in

their entirety by reference to, and are accompanied by, important factors that may cause our actual results or outcomes to differ

materially from those contained in our forward-looking statements, including, but not limited to: our ability to complete the

offshore wind investment sale process on the timeline or the terms we expect; the risk that we and the potential purchaser, or the

potential purchaser and Ørsted, are unable to reach definitive agreements necessary to consummate the transactions described

above; the outcome of the power purchase agreement bid process for Sunrise Wind and the risk of losing the bid to a competing offer;

the ability to qualify for investment tax credits in the amounts we expect; variability in the costs and projected returns of the

offshore wind projects and the risk of deterioration of market conditions in the offshore wind industry; cyberattacks or breaches,

including those resulting in the compromise of the confidentiality of our proprietary information and the personal information of

our customers; disruptions in the capital markets or other events that make our access to necessary capital more difficult or

costly; changes in economic conditions, including impact on interest rates, tax policies, and customer demand and payment ability;

ability or inability to commence and complete our major strategic development projects and opportunities; acts of war or terrorism,

physical attacks or grid disturbances that may damage and disrupt our electric transmission and electric, natural gas, and water

distribution systems; actions or inaction of local, state and federal regulatory, public policy and taxing bodies; substandard

performance of third-party suppliers and service providers; fluctuations in weather patterns, including extreme weather due to

climate change; changes in business conditions, which could include disruptive technology or development of alternative energy

sources related to our current or future business model; contamination of, or disruption in, our water supplies; changes in levels

or timing of capital expenditures; changes in laws, regulations or regulatory policy, including compliance with environmental laws

and regulations; changes in accounting standards and financial reporting regulations; actions of rating agencies; and other

presently unknown or unforeseen factors.

Media Contact

Meaghan Wims

mwims@duffyshanley.com

401-261-1641

###

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

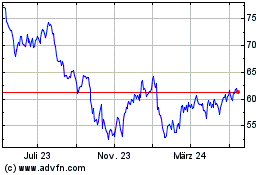

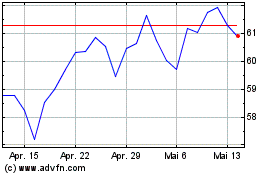

Eversource Energy (NYSE:ES)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Eversource Energy (NYSE:ES)

Historical Stock Chart

Von Mai 2023 bis Mai 2024