0000316253

false

0000316253

2023-07-03

2023-07-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): July 3, 2023

Enzo Biochem, Inc.

(Exact

Name of Registrant as Specified in Its Charter)

New York

(State

or Other Jurisdiction of Incorporation)

| 001-09974 |

|

13-2866202 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

| 81 Executive Blvd. Suite 3 |

|

|

| Farmingdale, New York |

|

11735 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(631)

755-5500

(Registrant’s

Telephone Number, Including Area Code)

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value |

|

ENZ |

|

The New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-1 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive

Agreement

As

previously disclosed, on March 16, 2023, Enzo Biochem, Inc., a New York corporation (the “Company”), Enzo Clinical Labs, Inc.,

a New York corporation (the “Subsidiary” and, together with the Company, the “Seller”), and Laboratory Corporation

of America Holdings, a Delaware corporation (the “Buyer”) entered into an Asset Purchase Agreement (the “Purchase Agreement”)

pursuant to which the Seller agreed to sell certain assets and assign certain liabilities of its clinical labs business (the “Business”)

to the Buyer on and subject to the terms and conditions set forth therein (such transaction, the “Transaction”). On July 3,

2023, the Company, the Subsidiary and the Buyer entered into Amendment No. 1 to the Purchase Agreement (the “Purchase Agreement

Amendment”), which, among other things, adjusted the purchase price for the Business from $146 million to $113.25 million payable

as a $30 million refundable earnest money deposit on July 17, 2023 with the remainder, subject to offsetting credits and deductions as

provided in the Purchase Agreement, payable at the closing of the Transaction. The Purchase Agreement Amendment also provides that (i)

Buyer may offset from the purchase price amounts outstanding for reference testing services performed by Buyer or its Affiliates prior

to the closing, (ii) the closing, which is subject to the satisfaction or waiver of customary conditions to closing, shall, at the earliest,

occur 127 days after execution of the Purchase Agreement (or July 24, 2023), and (iii) Seller Parent shall indemnify Buyer in connection

with any proceeding challenging the Transaction (and related matters) as contemplated by the Purchase Agreement Amendment. In addition,

pursuant to the Purchase Agreement Amendment, the Parties waived all breaches that existed prior to entering into the Purchase Agreement

Amendment (provided that the parties were aware of such breach) solely for purposes of determining that closing conditions under the Purchase

Agreement have been satisfied.

The

foregoing description of the Purchase Agreement Amendment does not purport to be complete and is qualified in its entirety by reference

to the full text of the Purchase Agreement Amendment, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated

herein by reference.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits.

* Certain schedules to this Exhibit

have been omitted pursuant to Regulation S-K Item 601(b)(2) or 601(a)(5) (as applicable). The Company agrees to furnish supplementally

a copy of any omitted schedule to the SEC upon request; provided, however, that the Company may request confidential treatment pursuant

to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any document so furnished.

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

ENZO BIOCHEM, INC. |

| |

|

|

| Date: July 10, 2023 |

By: |

/s/ Hamid Erfanian |

| |

|

Hamid Erfanian |

| |

|

Chief Executive Officer |

2

Exhibit 2.1

CONFIDENTIAL

Execution Version

AMENDMENT NO. 1

TO ASSET PURCHASE AGREEMENT

This Amendment No. 1 to the Asset Purchase Agreement

(this “Amendment”) is entered into as of July 3, 2023 (the “Amendment Effective Date”), by and among

Laboratory Corporation of America Holdings, a Delaware corporation (“Buyer”),

Enzo Clinical Labs, Inc., a New York corporation (“Seller”), and Enzo Biochem, Inc., a New York corporation (“Seller

Parent”). Buyer, Seller and Seller Parent are sometimes hereinafter referred to individually as a “Party”

and collectively as the “Parties”. Capitalized terms used but not defined in this Amendment shall have the meanings

given to such terms in the Asset Purchase Agreement (as defined below), and all references to Sections herein are references to Sections

of the Asset Purchase Agreement.

RECITALS

WHEREAS, the Parties entered into an Asset Purchase

Agreement dated as of March 16, 2023 relating to the purchase by Buyer of certain assets related to the Business (the “Asset

Purchase Agreement”);

WHEREAS, on May 1, 2023 the waiting period applicable

to the transactions contemplated by the Asset Purchase Agreement and the other Transaction Documents under the HSR Act expired;

WHEREAS, on May 22, 2023 Stockholder Approval was

obtained in accordance with applicable Law;

WHEREAS, the Parties have agreed to revise certain

terms of the Asset Purchase Agreement;

WHEREAS, the Parties desire to amend the Asset

Purchase Agreement as set forth herein to reflect such agreement; and

WHEREAS, Section 10.13 of the Asset Purchase Agreement

provides that any amendment to the Asset Purchase Agreement shall be made in writing and signed by each Party.

NOW, THEREFORE, in consideration of the foregoing

and the mutual covenants and agreements, representations, and warranties contained herein and other good and valuable consideration, the

receipt and sufficiency of which are hereby acknowledged, and incorporating the above recitals with and into this Amendment, the Parties

hereby agree as follows:

1.1

The following defined terms are hereby added to Section 1.1 of the Asset Purchase Agreement:

“Amendment” means

that certain Amendment No.1 to Asset Purchase Agreement dated as of July 3, 2023 (the “Amendment Effective Date”)

by and among the Parties.

“Buyer Receivable”

means all Liabilities of Seller, Seller Parent or their respective Affiliates to Buyer for reference testing services performed by Buyer

or its Affiliates prior to the Closing , including pursuant to invoices up to and including May 27, 2023 for client account numbers 31002760,

88040331, and 88611401.

1.2

The definition of “Debt Amount” in Section 1.1 of the Asset Purchase Agreement is hereby deleted in its entirety

and replaced with the following:

(yy) “Debt Amount” means (i) all

Liabilities of Seller or Seller Parent under any Assigned Contract outstanding as of immediately prior to the Closing (“Pre-Closing

Lease Obligations”), (ii) all Buyer Receivables outstanding as of immediately prior to the Closing and (iii) all Debt of

Seller, Seller Parent or their Affiliates that shall be paid off at the Closing pursuant to Section 2.8(a)(iv); provided

that the Debt Amount may not exceed the total amount of the Purchase Price before the exclusion of the Debt Amount.

1.3

The definition of “Retention Bonus Amount” in Section 1.1 of the Asset Purchase Agreement is hereby deleted in

its entirety and replaced with the following:

(kkkkkkk) “Retention Bonus Amount”

means an amount equal to the lesser of (x) one-half of the aggregate amount of the retention bonuses previously paid or to be paid by

Seller to Business Employees, in each case, in connection with the transactions contemplated by this Agreement, and which shall include

the retention bonus amounts paid to the employees set forth on Schedule 1.1(kkkkkkk) and (y) $1,600,000.

1.4

A new Schedule 1.1(kkkkkkk) in the form attached hereto as Exhibit

A shall be added to the Agreement Purchase Agreement.

1.5

Section 2.2 of the Asset Purchase Agreement is hereby amended by changing the reference from “120 days” to “127

days”.

1.6

Section 2.3(a) of the Asset Purchase Agreement is hereby amended and restated in its entirety as follows:

(a)

On July 17, 2023, as payment for the Acquired Assets, Buyer shall pay to Seller $30,000,000,

which amount represents an upfront payment of the Purchase Price that shall be fully credited against the amount paid by Buyer to Seller

at Closing and shall be fully refundable to Buyer within two Business Days upon termination of this Agreement pursuant to Article VIII

(the “Earnest Money Deposit”) as provided in Section 2.3(f) below. At the Closing, as payment for the

Acquired Assets, Buyer shall pay to Seller $113,250,000 minus (i) the Estimated Vacation Rollover Amount plus (ii) the Estimated

Prepaid Amount minus (iii) the Escrow Amount minus (iv) the Estimated Debt Amount minus (v) the Aggregate Ticking

Fee Closing Payment plus (vi) the Retention Bonus Amount minus (vii) the Earnest Money Deposit and minus (viii) any

amounts deducted for motor vehicles as provided in Section 2.8(a)(ix)

below (such collective amount, as may be adjusted by this Section 2.3, the “Purchase Price”), by wire

transfer of immediately available funds in lawful currency of the United States of America to the account designated by Seller in writing

at least four Business Days prior to the Closing. At the Closing, Buyer shall (x) deposit the Escrow Amount in accordance with Section

2.10 and (y) deliver or cause to be delivered on behalf of Seller or Seller Parent the amount payable to each holder of Debt identified

in the Payoff Letters in order to fully discharge such Debt and terminate all applicable obligations and Liabilities of Seller or Seller

Parent related thereto, as specified in the Payoff Letters and in accordance with this Agreement. Seller shall pay the portion of the

Retention Bonus Amount payable to Business Employees (less any applicable Tax withholding) who are not Hired Employees (the “Seller

Retention Bonus Amount”) on or before the first regularly scheduled payroll date following the Closing Date (the “Bonus

Payroll Date”). If the Seller Retention Bonus Amount is not paid by Seller to such Business Employees in full on or before

the Bonus Payroll Date, then the Seller Retention Bonus Amount shall be refunded to Buyer and Seller shall deposit by wire transfer of

immediately available funds in lawful currency of the United States of America to an account designated in writing by Buyer an amount

equal to the Seller Retention Bonus Amount within two Business Days after the Bonus Payroll Date.

1.7

Section 2.3(c) of the Asset Purchase Agreement is hereby amended and restated in its entirety as follows:

(c) No

later than five Business Days prior to the Closing Date, Seller shall calculate (i) the amount of all reserves, security and other deposits,

advances and prepaid expenses and credits that are assignable to Buyer and related to the Assigned Contracts or any other Acquired Asset

(the “Prepaid Amount”), (ii) the Vacation Rollover Amount, (iii) the Debt Amount and (iv) the Retention Bonus

Amount with respect to the applicable Business Employees, and provide to Buyer a statement setting forth each such calculation in reasonable

detail with reasonable supporting documentation, including with respect to the Retention Bonus Amount the names and amounts payable to

each individual employee and the date or anticipated date of the payment of such amounts to such individual employees. The Prepaid Amount

set forth on such statement provided prior to the Closing (the “Estimated Prepaid Amount”), the Vacation Rollover

Amount set forth on such statement provided prior to the Closing (the “Estimated Vacation Rollover Amount”)

and the Debt Amount set forth on such statement provided prior to the Closing (the “Estimated Debt Amount”)

shall, in each case, be used to calculate the Purchase Price to be paid by Buyer to Seller at the Closing pursuant to Section 2.3(a).

1.8

Section 2.3(d) of the Asset Purchase Agreement is hereby amended and restated in its entirety as follows:

(d) As

soon as reasonably practicable after the Closing Date, but in any event no later than 90 days thereafter, Buyer will calculate the Prepaid

Amount, the Vacation Rollover Amount, and the Debt Amount and provide Seller with a statement (the “Post-Closing Adjustment

Statement”) setting forth each such calculation in reasonable detail with reasonable supporting documentation. The Post-Closing

Adjustment Statement will be deemed to be accepted by Seller and shall be conclusive for purposes of determining the Prepaid Amount, the

Vacation Rollover Amount, and the Debt Amount, unless Seller delivers to Buyer, within 30 days following receipt of the Post-Closing Adjustment

Statement from Buyer, a notice (each, a “Post-Closing Adjustment Objection Notice”) setting forth Seller’s

objections to such Post-Closing Adjustment Statement in reasonable detail. If Seller and Buyer fail to resolve the issues raised in the

Post-Closing Adjustment Objection Notice within 30 days of Buyer’s receipt of the Post-Closing Adjustment Objection Notice, Seller

and Buyer shall submit the items under dispute in the Post-Closing Adjustment Statement (the “Disputed Items”)

to Ernst & Young LLP (or if such firm is unable to serve, another nationally recognized independent firm jointly chosen by Buyer and

Seller) (the “Independent Accountant”), for resolution in accordance with the dispute resolution provisions

set forth in Section 2.3(d) and the relevant terms of this Agreement. Within ten Business Days following the final determination

of the Prepaid Amount, the Vacation Rollover Amount, and the Debt Amount, in each case, pursuant to this Section 2.3(c) (such amounts

as so finally determined pursuant to this Section 2.3(c), the “Final Prepaid Amount”, the “Final

Vacation Rollover Amount”, and the “Final Debt Amount”), (w) if the difference of (1) the Final

Prepaid Amount minus (2) the sum of (A) the Final Vacation Rollover Amount and (B) the Final Debt Amount is greater than (x) the

difference of (1) the Estimated Prepaid Amount minus (2) the sum of (A) the Estimated Vacation Rollover Amount and (B) the Estimated

Debt Amount, Buyer shall pay such difference to Seller, and (y) if the difference of (1) the Final Prepaid Amount minus (2) the

sum of (A) the Final Vacation Rollover Amount and (B) the Final Debt Amount is less than (z) the difference of (1) the Estimated Prepaid

Amount minus (2) the sum of (A) the Estimated Vacation Rollover Amount and (B) the Estimated Debt Amount, Seller and Seller Parent

shall pay such difference to Buyer. Any payments required to be made pursuant to this Section 2.3(c) shall be made by wire transfer

of immediately available funds in lawful currency of the United States of America to the account designated by Seller or Buyer, as applicable,

in writing at least four Business Days prior to the date of such payment.

1.9

Section 2.3(f) of the Asset Purchase Agreement is hereby amended by adding the following sentence to the end of Section 2.3(f):

Furthermore, if this Agreement is terminated

pursuant to Article VIII, Seller shall return the Earnest Money Deposit without interest to Buyer within two Business Days after

termination of this Agreement, and shall deposit by wire transfer of immediately available funds in lawful currency of the United States

of America to an account designated in writing by Buyer an amount equal to the Earnest Money Deposit.

1.10

Section 2.4 of the Asset Purchase Agreement is hereby amended by deleting the fifth sentence thereof and replacing such

sentence in its entirety with the following sentence:

Seller

shall be liable for all amounts apportioned to periods prior to the Closing and Buyer shall be liable for all amounts apportioned to periods

on and after the Closing. Buyer and Seller shall settle all prorations within 90 Business Days following the Closing Date; provided

that Buyer shall have the right to withhold and set-off against any amount otherwise due to be paid by Buyer to Seller pursuant

to this Section 2.4, any Pre-Closing Lease Obligations that were not otherwise

taken into account in the Debt Amount deducted from the Purchase Price paid to Seller at Closing.

1.11

Section 2.8(a)(x) of the Asset Purchase Agreement is hereby deleted in its entirety and replaced with the following:

| (x) | an agreement evidencing the termination of the STAT Services Agreement as of the Closing in a form reasonably acceptable to Buyer

(the “STAT Services Termination Agreement”), duly executed by Seller; and |

| (xi) | such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Buyer,

as may be required to give effect to this Agreement. |

1.12

Section 2.8(b)(vii) of the Asset Purchase Agreement is hereby deleted in its entirety and replaced with the following:

| (vii) | the STAT Services Termination Agreement, duly executed by Buyer; and |

| (viii) | such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Seller,

as may be required to give effect to this Agreement. |

1.13

Section 3.2 of the Asset Purchase Agreement is hereby amended by adding the following paragraph as a new Section 3.2(c):

(c)

Each of Seller and Seller Parent has all requisite power and authority to execute and deliver

the Amendment and to perform its obligations under the Amendment and this Agreement as amended by the Amendment and to consummate the

transactions contemplated by the Amendment and this Agreement as amended by the Amendment. The execution and delivery by each of Seller

and Seller Parent of the Amendment, the performance by each of Seller and Seller Parent of its obligations under the Amendment and under

this Agreement as amended by the Amendment and the consummation by each of Seller and Seller Parent of the transactions contemplated the

Amendment and this Agreement as amended by the Amendment, have been duly authorized by all necessary corporate action, and no other action,

or approval on the part of Seller or Seller Parent or the stockholders

of Seller Parent is necessary to authorize the Amendment and this Agreement as amended by the Amendment or to consummate the transactions

contemplated hereby or thereby. The Amendment has been duly executed and delivered by each of Seller and Seller Parent and, assuming the

due authorization, execution and delivery thereof by Buyer, constitutes the legal, valid and binding obligation of Seller and Seller Parent,

enforceable against Seller and Seller Parent in accordance with its terms, except as such enforceability may be limited by bankruptcy,

insolvency, reorganization, moratorium and similar Laws relating to or affecting creditors generally or by general equity principles (regardless

of whether such enforceability is considered in a proceeding in equity or at law).

1.14

Schedule 5.8 of the Asset Purchase Agreement is hereby amended by deleting references to the following therefrom:

| 6. |

4131 Richmond Avenue, Staten Island, NY 10312 |

Lease dated September 1, 2019 (as amended, restated and modified from time to time), by and between 4131 Richmond Avenue Corp. and Enzo Clinical Labs, Inc. |

| 10. |

248-260 Middle Country Road, Selden NY 11784 |

Commercial Lease (as amended, restated and modified from time to time), by and between 248-260 Middle Country Road Associates LLC and Enzo Clinical Labs, Inc. |

| 12. |

30 Newbridge Road, Suite LL2, East Meadow, NY 11554 |

Lease (as amended, restated and modified from time to time) by and between John Simon Realty LLC and Enzo Clinical Labs, Inc. |

1.15

Schedule 5.8 of the Asset Purchase Agreement is hereby amended by adding a reference to the following:

| 22. |

174 Edison Road, Lake Hopatcong, NJ 07849 |

Lease (as amended, restated and modified from time to time) by and between 174 Edison Rd, LLC and Enzo Clinical Labs, Inc. |

1.16

Section 7.6 of the Asset Purchase Agreement is hereby amended by adding the following sentence to the end of Section 7.6:

Beginning on the Saturday before the Closing Date, Seller

shall afford Buyer with unlimited access to the Assigned Locations for the express and limited purpose of facilitating Buyer’s integration

activities with respect to the Business.

1.17

Section 8.3 of the Asset Purchase Agreement is hereby amended by adding the following new clause (c) prior to the period at

the end of Section 8.3:

; or (c) a Restraint is then in effect

1.18

Section 9.1(a)(i) of the Asset Purchase Agreement is hereby deleted in its entirety and replaced with the following:

(i) any

breach of or inaccuracy in any representation or warranty made by Seller or Seller Parent in this Agreement or in any Schedule or certificate

delivered pursuant to this Agreement (other than the representations and warranties set forth in Section 3.2(c)), as of the Effective

Date or as of the Closing Date;

1.19

Section 9.1(a) of the Asset Purchase Agreement is hereby amended by adding the following clause as a new Section 9.1(a)(v)

after Section 9.1(a)(iv):

(v) (A)

any breach of or inaccuracy in any representation or warranty made by Seller or Seller Parent in Section 3.2(c), as of the Amendment

Effective Date or as of the Closing Date or (B) any Proceeding (1) challenging, disputing or objecting to the Amendment or performance

by the Parties of this Agreement, as amended by the Amendment or the consummation of the transactions contemplated by this Agreement,

as amended by the Amendment, including as a result of any failure to obtain any required approval of the stockholders of Seller Parent

or otherwise comply with Seller Parent’s governing documents or applicable Law in connection therewith, or (2) alleging violations

of fiduciary duty by any director, officer or agent of Seller Parent or Seller in connection with the Amendment or the transactions contemplated

by this Agreement or this Agreement, as amended by the Amendment.

1.20

Section 9.6(a) is hereby amended by adding the following as a new Section 9.6(a)(vi) after Section 9.6(a)(v):

(vi) with

respect to any claim by a Buyer Indemnified Party pursuant to Section 9.1(a)(v), Buyer shall be entitled to satisfy the Losses

therefrom, at Buyer’s election (in its sole discretion), (A) from the Escrow Fund in the Escrow Account, or (B) from Seller or Seller

Parent directly.

| 2. | Effect of this Amendment. |

2.1 The

Asset Purchase Agreement as amended by this Amendment comprises the entire

agreement and understanding between the Parties with respect to the subject matter hereof and thereof. Except as specifically provided

in this Amendment, and as the context of this Amendment otherwise may require to give effect to the intent and purposes of this Amendment,

the Asset Purchase Agreement shall remain in full force and effect without any other amendments or modifications and all references to

“this Agreement” set forth in the Asset Purchase Agreement shall refer to the Asset Purchase

Agreement as amended by this Amendment.

2.2 Each

Party agrees and acknowledges that, solely for purposes of determining whether the conditions to Closing set forth in Article VI of the

Asset Purchase Agreement, as amended by this Amendment, are satisfied and not for any other purpose, each Party waives any breaches of

any representations, warranties or covenants by the other Parties occurring prior to the Amendment Effective Date; provided that such

Party was aware of the breach prior to the Amendment Effective Date. Each Party further agrees and acknowledges that, except as set forth

in the foregoing sentence, the Closing of the transactions contemplated by the Asset Purchase Agreement, as amended by this Amendment,

does not and shall not operate as a waiver or be deemed to relieve any other Party or any of their respective Affiliates of any of their

obligations under the Asset Purchase Agreement, this Amendment or any other Transaction Document that were to be taken

or satisfied prior to or on the Closing and that were not complied with prior to Closing (whether or not such Party was aware

of such non-compliance). The Parties further agree and acknowledge that, except as set forth in the first sentence of this Section

2.2, (i) any amendments, restatements, eliminations, replacements or deletions of any of the provisions of the Asset Purchase Agreement

by virtue of this Amendment shall not operate as a waiver of or consent to any breach or default of any Party’s obligations under

any such provisions occurring prior to the Amendment Effective Date and (ii) no such amendments, restatements, eliminations, replacements

or deletions of any such provisions shall relieve a defaulting or breaching Party from any Liability arising out of or relating to a breach

or default of a Party’s obligations under any such provisions occurring prior to the Amendment Effective Date.

3.

Amended STAT Services Agreement Term Extension. The Parties hereto acknowledge and agree that this Amendment constitutes

written notice of Buyer’s intention to exercise its right to extend the Amended STAT Services Agreement term through August 17,

2023, pursuant to Section 13 of the Amended STAT Services Agreement, and that such term is so extended.

4.

Incorporation. The provisions of Sections 10.1 (Notices), 10.2 (Interpretation), 10.3 (Rules of Construction), 10.5

(Jurisdiction; Governing Law), 10.6 (Waiver of Jury Trial), 10.7 (Severability), 10.10 (Assignment), 10.11 (No Third-Party Beneficiaries),

10.13 (Amendments and Waivers), and 10.16 (Counterparts) of the Asset Purchase Agreement are hereby incorporated into, and shall be deemed

to apply to, this Amendment, mutatis mutandis.

(Signature pages follow)

IN WITNESS WHEREOF, the Parties have executed

this Amendment No. 1 to Asset Purchase Agreement as of the date first written above.

| |

BUYER: |

| |

|

|

| |

LABORATORY CORPORATION OF AMERICA HOLDINGS |

| |

|

|

| |

By: |

/s/ William B. Haas |

| |

Name: |

William B. Haas |

| |

Title: |

Senior Vice President |

[Signature Page to Amendment No. 1 to Asset Purchase Agreement]

IN WITNESS WHEREOF, the Parties have executed

this Amendment No. 1 to Asset Purchase Agreement as of the date first written above.

| |

SELLER: |

| |

|

| |

ENZO CLINICAL LABS INC. |

| |

|

| |

By: |

/s/ Hamid Erfanian |

| |

Name: |

Hamid Erfanian |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

SELLER PARENT: |

| |

|

| |

ENZO BIOCHEM, INC. |

| |

|

|

| |

By: |

/s/ Hamid Erfanian |

| |

Name: |

Hamid Erfanian |

| |

Title: |

Chief Executive Officer |

Exhibit A

Schedule 1.1(kkkkkkk)

10

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

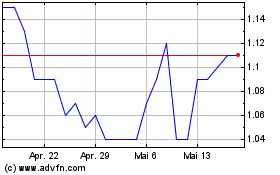

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

Von Mai 2023 bis Mai 2024