UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2024

Commission File Number 001-34175

ECOPETROL S.A.

(Exact name of registrant as specified in its charter)

N.A.

(Translation of registrant’s name into English)

COLOMBIA

(Jurisdiction of incorporation or organization)

Carrera 13 No. 36 – 24

BOGOTA D.C. –

COLOMBIA

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes

¨ No x

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes

¨ No x

Indicate by check mark whether

the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨ No x

If “Yes” is marked,

indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

Ecopetrol

S.A. hereby designates this report on Form 6-K as being incorporated by reference into its registration statement on Form F-3,

as filed with the SEC on April 19, 2024 (File No. 333-278823).

Ecopetrol

S.A. Announces Results and Settlement of its Previously Announced Cash Tender Offer for Any and All of its Outstanding 5.375%

Notes due 2026

BOGOTÁ,

COLOMBIA, October 21, 2024 – Ecopetrol S.A. (“Ecopetrol” or the “Company”) (NYSE:

EC) announced today the results of the previously announced cash tender offer (the “Offer”) by Ecopetrol, to purchase any

and all of its outstanding 5.375% Notes due 2026 (the “Securities”).

The Offer expired on October 16, 2024,

at 5:00 p.m., New York City time (the “Expiration Time”). The Offer was made solely pursuant to the Offer to Purchase (as

the same was amended by means of press release published on October 16, 2024, the “Offer to Purchase”) and the related

Notice of Guaranteed Delivery (the “Notice of Guaranteed Delivery”), each dated October 8, 2024.

Ecopetrol

was advised by Global Bondholder Services Corporation, the tender and information agent for the Offer, that the aggregate principal

amount of Securities, as set forth in the table below, was validly tendered and not validly withdrawn pursuant to the terms of the Offer.

The

conditions of the Offer, including the pricing and closing of Ecopetrol’s concurrent offering of notes,

were satisfied.

Ecopetrol

accepted for purchase all Securities validly tendered and not validly withdrawn in the Offer, and paid the Total Consideration for such

Securities on October 21, 2024 (the “Settlement Date”), as set forth in the table below, plus accrued and unpaid

interest on such Securities from the last interest payment date to, but excluding the Settlement Date in accordance with the terms of

the Offer.

Title of

Securities(1) | |

CUSIP/ISIN Number | |

Outstanding

Principal

Amount | | |

Principal

Amount

Tendered and

Accepted | | |

Total

Consideration(2) (3) | |

| 5.375% Notes due 2026 | |

279158 AL3 / US279158AL39 | |

$ | 1,250,000,000 | | |

$ | 802,832,000 | | |

$ | 1,011.90 | |

(1) The

Securities are redeemable at par at any time on or after March 26, 2026.

(2) Per $1,000 principal amount of

Securities validly tendered and accepted for purchase pursuant to the Offer to Purchase.

(3) Excludes accrued and

unpaid interest on their purchased Securities from the last interest payment date for the Securities to, but excluding, the Settlement

Date.

Following payment for

the Securities accepted pursuant to the terms of the Offer, Ecopetrol currently intends (but is not obligated) to redeem all or a portion

of the Securities that remain outstanding in accordance with the terms of the Indenture governing the Securities. The Offer does not constitute

a notice of redemption or an obligation to issue a notice of redemption.

BBVA Securities Inc.,

J.P. Morgan Securities LLC and Santander US Capital Markets LLC served as Dealer Managers (the “Dealer Managers”) for the

Offer.

This press release is for informational purposes

only and does not constitute an offer to purchase nor the solicitation of an offer to sell any Securities. The Offer was made only pursuant

to the Offer to Purchase and related Notice of Guaranteed Delivery.

No Recommendation

None

of Ecopetrol, BBVA Securities Inc., J.P. Morgan Securities LLC, Santander US Capital Markets LLC, Global Bondholder Services Corporation,

or the trustee or security registrar with respect to the Securities, nor any affiliate of any of the foregoing, has made any recommendation

as to whether holders should tender or refrain from tendering all or any portion of their Securities in response to the Offer or expressing

any opinion as to whether the terms of the Offer are fair to any holder. Please refer to the Offer to Purchase for a description of the

offer terms, conditions, disclaimers and other information applicable to the Offer.

About Ecopetrol

Ecopetrol is a mixed-economy company, the largest

company in Colombia and one of the main integrated energy companies in the American continent, with more than 19,000 employees. In Colombia,

it is responsible for more than 60% of the hydrocarbon production of most transportation, logistics, and hydrocarbon refining systems,

and it holds leading positions in the petrochemicals and gas distribution segments. With the acquisition of 51.4% of ISA’s shares,

the company participates in energy transmission, the management of real-time systems (XM), and the Barranquilla - Cartagena coastal highway

concession. At the international level, Ecopetrol has a stake in strategic basins in the American continent, with Drilling and Exploration

operations in the United States (Permian basin and the Gulf of Mexico), Brazil, and Mexico, and, through ISA and its subsidiaries, Ecopetrol

holds leading positions in the power transmission business in Brazil, Chile, Peru, and Bolivia, toll road concessions in Chile, and the

telecommunications sector.

Disclaimer and Other Important Notices

This press release and the Offer to Purchase do

not constitute an offer to purchase or the solicitation of an offer to sell Securities in any jurisdiction in which such offer or solicitation

would be unlawful. In those jurisdictions where the securities, blue sky or other laws require the Offer to be made by a licensed broker

or dealer, the Offer was deemed made on behalf of Ecopetrol by the Dealer Managers or one or more registered brokers or dealers licensed

under the laws of such jurisdiction. If materials relating to the Offer come into a holder’s possession, the holder is required

by Ecopetrol to inform itself of and to observe all of these restrictions.

The Offer to Purchase has not been filed with

or reviewed by the SEC, any state securities commission or any other regulatory authority, nor has any such commission or other regulatory

authority passed upon the accuracy or adequacy of the Offer to Purchase or any of the accompanying ancillary documents delivered thereunder.

Any representation to the contrary is unlawful and may be a criminal offense.

The Offer to Purchase has not been authorized

by the Colombian Superintendency of Finance (Superintendencia Financiera de Colombia or the “SFC” by its acronym in

Spanish) and has not been registered under the Colombian National Registry of Securities and Issuers (Registro Nacional de Valores

y Emisores) or the Colombian Stock Exchange (Bolsa de Valores de Colombia or the “BVC” by its acronym in Spanish),

and, accordingly, the Offer to Purchase may not constitute an offer to persons in Colombia except in circumstances which do not result

in a public offering under Colombian law and must be carried out in compliance with Part 4 of Decree 2555 of 2010.

This press release may contain forward-looking

statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the

United States Securities Exchange Act of 1934, as amended, including those related to the Offer. Forward-looking information involves

important risks and uncertainties that could significantly affect anticipated results in the future, and, accordingly, such results may

differ from those expressed in any forward-looking statements. Ecopetrol is not under any obligation to (and expressly disclaims any such

obligation to) update forward- looking statements as a result of new information, future events or otherwise, except as required by law.

Investor Relations

Lina María Contreras Mora

Head of Capital Markets

Carrera 13 No. 36-24, Bogotá, Colombia

e-mail: investors@ecopetrol.com.co

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Ecopetrol S.A. |

| |

|

| |

By: |

/s/ Ricardo Roa Barragán |

| |

|

Name: |

Alfonso Camilo Barco Muñoz |

| |

|

Title: |

Chief Financial Officer |

Date: October 21, 2024

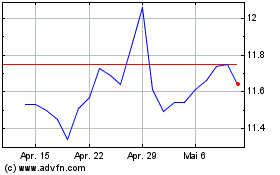

Ecopetrol (NYSE:EC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

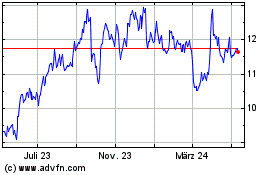

Ecopetrol (NYSE:EC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024