Ennis, Inc. (the “Company”), (NYSE: EBF), today reported

financial results for the first quarter ended May 31, 2024.

Highlights include:

- Revenues were $103.1 million for the quarter compared to

$111.3 million for the same quarter last year, a decrease of $8.2

million or 7.4%.

- Earnings per diluted share for the current quarter were

$0.41 compared to $0.45 for the comparative quarter last

year.

- Our gross profit margin for the quarter was 30.0% compared

to 30.6% for the comparative quarter last year.

Financial Overview

The Company’s revenues for the first quarter ended May 31, 2024

were $103.1 million compared to $111.3 million for the same quarter

last year, a decrease of $8.2 million, or 7.4%. Gross profits

totaled $30.9 million for a gross profit margin of 30.0%, as

compared to $34.0 million, or 30.6%, for the same quarter last

year. Net earnings for the quarter were $10.7 million, or $0.41 per

diluted share, as compared to $11.6 million, or $0.45 per diluted

share for the same quarter last year.

Keith Walters, Chairman, Chief Executive Officer and President,

commented by stating, “Our results for the quarter were within our

expectations given softening demand amidst an uncertain economic

environment. While we experienced a decline compared to the first

quarter of our previous fiscal year, our gross profit margin showed

a 160-basis point increase over the previous quarter as revenues,

profits and earnings per share all increased this quarter. Our

EBITDA increased from $18.1 million last quarter to $19.0 million

this quarter. While revenues have decreased compared to the same

quarter last year, our EBITDA as a percentage of sales has held

steady at 18.4%.

"In the first quarter we completed the integration of our ERP

system at two of our recent acquisitions and are beginning to see

improved performance. This along with our disciplined cost

management and pricing strategies contributed to our improved

margins over the sequential quarter, despite continued pressure

from soft market conditions with increasingly competitive

pricing.

"We believe we have one of the strongest balance sheets in the

industry, with no debt and significant cash. During the quarter,

with cash on hand we repurchased 91,883 shares of our common stock

in the open market at an average price of $19.79 per share and

increased our investment in U.S. government treasury bills $2.6

million while we continue to pursue greater returns through

additional acquisition opportunities. Our profitability and strong

financial condition will allow us to continue operations and fund

acquisitions without incurring debt. Given those strengths, we also

anticipate timely access to credit should larger acquisition

opportunities materialize. We continue to focus on delivering

profitability and returns to our shareholders."

Reconciliation Non-GAAP

Measure

To provide important supplemental information to both management

and investors regarding financial and business trends used in

assessing its results of operations, from time to time the Company

reports the non-GAAP financial measure of EBITDA (EBITDA is

calculated as net earnings before interest expense, tax expense,

depreciation, and amortization). The Company may also report

adjusted gross profit margin, adjusted earnings and adjusted

diluted earnings per share, each of which is a non-GAAP financial

measure.

Management believes that these non-GAAP financial measures

provide useful information to investors as a supplement to reported

GAAP financial information. Management reviews these non-GAAP

financial measures on a regular basis and uses them to evaluate and

manage the performance of the Company’s operations. Other companies

may calculate non-GAAP financial measures differently than the

Company, which limits the usefulness of the Company’s non-GAAP

measures for comparison with these other companies. While

management believes the Company’s non-GAAP financial measures are

useful in evaluating the Company, when this information is reported

it should be considered as supplemental in nature and not as a

substitute or an alternative for, or superior to, the related

financial information prepared in accordance with GAAP. These

measures should be evaluated only in conjunction with the Company’s

comparable GAAP financial measures.

The following table reconciles EBITDA, a non-GAAP financial

measure, for the three-months ended May 31, 2024 and 2023 to the

most comparable GAAP measure, net earnings (dollars in

thousands).

Three months ended

May 31,

May 31,

2024

2023

Net earnings

$

10,687

$

11,635

Income tax expense

4,054

4,525

Interest expense

—

—

Depreciation and amortization

4,243

4,344

EBITDA (non-GAAP)

$

18,984

$

20,504

% of sales

18.4

%

18.4

%

In Other News

On June 14, 2024 the Board of Directors declared a quarterly

cash dividend of 25.0 cents per share on the Company’s common

stock. The dividend is payable on August 5, 2024 to shareholders of

record on July 5, 2024.

About Ennis

Founded in 1909, the Company is one of the largest private-label

printed business product suppliers in the United States.

Headquartered in Midlothian, Texas, Ennis has production and

distribution facilities strategically located throughout the USA to

serve the Company’s national network of distributors. Ennis

manufactures and sells business forms, other printed business

products, printed and electronic media, integrated forms and

labels, presentation products, flex-o-graphic printing, advertising

specialties, internal bank forms, plastic cards, secure and

negotiable documents, specialty packaging, direct mail, envelopes,

tags and labels and other custom products. For more information,

visit www.ennis.com.

Safe Harbor under the Private

Securities Litigation Reform Act of 1995

Certain statements that may be contained in this press release

that are not historical facts are forward-looking statements that

involve a number of known and unknown risks, uncertainties and

other factors that could cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievement expressed or implied by

such forward-looking statements. The words “anticipate,”

“preliminary,” “expect,” “believe,” “intend” and similar

expressions identify forward-looking statements. The Private

Securities Litigation Reform Act of 1995 provides a “safe harbor”

for such forward-looking statements. In order to comply with the

terms of the safe harbor, the Company notes that a variety of

factors could cause actual results and experience to differ

materially from the anticipated results or other expectations

expressed in such forward-looking statements. These statements are

subject to numerous uncertainties, which include, but are not

limited to, the erosion of demand for our printer business

documents as the result of digital technologies, risk or

uncertainties related to the completion and integration of

acquisitions, and the limited number of available suppliers and

variability in the prices of paper and other raw materials. Other

important information regarding factors that may affect the

Company’s future performance is included in the public reports that

the Company files with the Securities and Exchange Commission,

including but not limited to, its Annual Report on Form 10-K for

the fiscal year ending February 29, 2024. The Company does not

undertake, and hereby disclaims, any duty or obligation to update

or otherwise revise any forward-looking statements to reflect

events or circumstances occurring after the date of this release,

or to reflect the occurrence of unanticipated events, although its

situation and circumstances may change in the future. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. The inclusion

of any statement in this release does not constitute an admission

by the Company or any other person that the events or circumstances

described in such statement are material.

Three months ended

Condensed

Consolidated Operating Results

May 31,

2024

2023

Net Sales

$

103,108

$

111,294

Cost of goods sold

72,204

77,253

Gross profit

30,904

34,041

Selling, general and administrative

17,170

18,343

Loss (gain) from disposal of assets

4

—

Income from operations

13,730

15,698

Other income

1,011

462

Earnings before income taxes

14,741

16,160

Income tax expense

4,054

4,525

Net earnings

$

10,687

$

11,635

Weighted average

common shares outstanding

Basic

26,156,928

25,839,651

Diluted

26,279,646

25,979,533

Earnings per

share

Basic

$

0.41

$

0.45

Diluted

$

0.41

$

0.45

May 31,

February 29,

Condensed

Consolidated Balance Sheet Information

2024

2024

Assets

Current Assets

Cash

$

91,363

$

81,597

Short-term investments

32,326

29,325

Accounts receivable, net

43,909

47,209

Inventories, net

41,003

40,037

Prepaid expenses

2,537

3,214

Total Current Assets

211,138

201,382

Property, plant & equipment, net

55,106

54,965

Operating lease right-of-use assets,

net

8,836

9,827

Goodwill and intangible assets, net

130,747

132,676

Other assets

340

340

Total Assets

$

406,167

$

399,190

Liabilities and Shareholders’

Equity

Current liabilities

Accounts payable

$

15,542

$

11,846

Accrued expenses

17,176

17,541

Current portion of operating lease

liabilities

4,075

4,414

Total Current Liabilities

36,793

33,801

Other non-current liabilities

15,001

15,548

Total liabilities

51,794

49,349

Shareholders' Equity

354,373

349,841

Total Liabilities and Shareholders'

Equity

$

406,167

$

399,190

Three months ended

May 31,

Condensed

Consolidated Cash Flow Information

2024

2023

Cash provided by operating activities

$

23,105

$

21,726

Cash used in investing activities

(5,052

)

(7,129

)

Cash used in financing activities

(8,287

)

(6,459

)

Change in cash

9,766

8,138

Cash at beginning of period

81,597

93,968

Cash at end of period

$

91,363

$

102,106

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240617232741/en/

Mr. Keith S. Walters, Chairman, Chief Executive Officer and

President Ms. Vera Burnett, Chief Financial Officer Mr. Dan Gus,

General Counsel and Secretary

Ennis, Inc. Phone: (972) 775-9801 Fax: (972) 775-9820

www.ennis.com

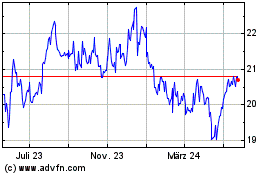

Ennis (NYSE:EBF)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

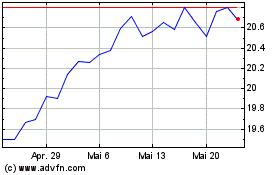

Ennis (NYSE:EBF)

Historical Stock Chart

Von Dez 2023 bis Dez 2024