Masonite Announces Sale of Architectural Business Segment

24 April 2024 - 2:15PM

Business Wire

Masonite International Corporation (NYSE: DOOR) today announced

that it has entered into a definitive agreement for the sale of all

assets associated with the company’s Architectural segment to

subsidiaries of IBP Solutions, Inc., a newly formed portfolio

company of Industrial Opportunity Partners. The transaction is

expected to close in the second quarter of 2024 and is subject to

customary closing conditions.

Houlihan Lokey, Inc. acted as Masonite’s financial advisor on

the transaction.

ABOUT MASONITE

Masonite International Corporation is a leading global designer,

manufacturer, marketer and distributor of interior and exterior

doors and door systems for the new construction and repair,

renovation and remodeling sectors of the residential and

non-residential building construction markets. Since 1925, Masonite

has provided its customers with innovative products and superior

service at compelling values. Masonite currently serves

approximately 6,600 customers globally. Additional information

about Masonite can be found at www.masonite.com.

ABOUT INDUSTRIAL OPPORTUNITY PARTNERS

Industrial Opportunity Partners (IOP), an Evanston, Ill.-based

private equity firm with over $1.5 billion of committed capital

since inception, is dedicated to creating value through investing

in manufacturing and value-added distribution businesses with sales

between $50 million and $500 million. IOP focuses on businesses

with strong product, customer, and market positions, and provides

management and operational resources to support sales and earnings

growth at its businesses. For more information, visit IOP’s website

at www.iopfund.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424833926/en/

Investor Contacts: Richard Leland VP, FINANCE AND

TREASURER 813.739.1808 | rleland@masonite.com Marcus Devlin

DIRECTOR, INVESTOR RELATIONS 813.371.5839 |

mdevlin@masonite.com

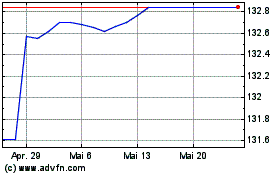

Masonite (NYSE:DOOR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Masonite (NYSE:DOOR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024