DuPont Steps Up Cuts as It Swings to a Loss--Update

26 Januar 2016 - 6:56PM

Dow Jones News

By Jacob Bunge

DuPont Co. stepped up its cost-cutting efforts as slowing growth

in developing countries and the strengthening U.S. dollar continued

to challenge to the maker of seeds and chemicals, underlining

forces driving its merger with rival Dow Chemical Co.

Wilmington, Del.-based DuPont said it now plans to cut $730

million in expenses this year after announcing a broad

restructuring plan in December that will eliminate about 5,000 jobs

in an effort to improve profits and hasten integration with Dow,

executives said. That is up from a December projection of $700

million in 2016 cost reductions.

"We are obviously moving as rapidly as we can," DuPont Chief

Executive Ed Breen said on a conference call Tuesday.

DuPont, which makes products including pesticides and building

materials, swung to a loss in its latest quarter as revenue fell

across all segments. Sales were particularly hard-hit abroad due to

rising the dollar, which has gained nearly 25% against a basket of

foreign currencies in the past 18 months, making U.S. products more

expensive overseas.

Slowing sales in emerging markets also meant that more of

DuPont's profits were generated in countries with higher tax rates,

further pressuring earnings, Chief Financial Officer Nick

Fanandakis said.

DuPont's near-term outlook for China, where economic concerns

have rattled global markets, is "mixed," as declining

fourth-quarter sales in DuPont's electronic products were offset by

higher volumes in food-ingredient and health products, Mr. Breen

said in an interview. China presents longer-running challenges as

the country's economy shifts from industrial to service and

consumer sectors, Mr. Fanandakis said on the conference call.

Under Mr. Breen, who assumed leadership at DuPont in October

2015, DuPont has accelerated cost reductions to cope with a

slumping agriculture sector, where three years of declining crop

prices have squeezed farmers who buy crop seeds and pesticides.

Sales in DuPont's agriculture segment--its largest--fell 11% in the

fourth quarter. The 213-year-old company also is grappling with a

broader collapse in commodity prices that has cooled growth in many

of the developing countries where DuPont sells industrial

products.

For the quarter ended Dec. 31, DuPont reported a loss of $253

million, or 29 cents a share, from a profit of $683 million, or 74

cents a share, a year earlier. Excluding certain items, per-share

earnings fell to 27 cents from 57 cents. Sales slid 9.4% to $5.3

billion. Without currency effects, the drop would have been 1%, the

company said. Analysts projected 26 cents in adjusted earnings per

share on $5.53 billion in revenue, according to Thomson

Reuters.

DuPont shares, down 12% over the past three months through

Monday's close, were 1.2% higher in midday trading Tuesday in New

York.

The company on Tuesday forecast it would earn $2.95 to $3.10 a

share in 2016, including a higher-than-anticipated 64 cents a share

in cost savings. Analysts surveyed by Thomson Reuters have

predicted $1.31 in adjusted per-share profit this year. Previous

moves to cut expenses added 10 cents to DuPont's fourth-quarter

results, the company said.

Mr. Breen said that DuPont and Dow have formed teams to work on

aspects of the merger deal, which would create a company with a

current combined market capitalization of about $96 billion before

splitting into three separate, publicly traded companies.

Executives are analyzing ways to meld warehouse and computer

networks while setting up financial reporting frameworks of the

three spinoffs, Mr. Breen said.

Executives likely will choose a headquarters for the combined

agriculture business in the next few weeks, Mr. Breen said.

Officials representing Des Moines, Iowa, the longtime home of

DuPont's Pioneer seed division, and Indianapolis, home to Dow's

agriculture unit, are angling to land the agriculture company's

headquarters.

Executives expect the industrial materials company to be based

in Dow's hometown of Midland, Mich., and the specialty products

company, which will produce electronic components and food

ingredients, to remain in Wilmington, Del., DuPont's base for two

centuries.

Lisa Beilfuss contributed to this article.

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

January 26, 2016 12:41 ET (17:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

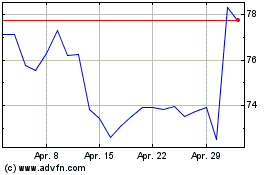

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Aug 2024 bis Sep 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Sep 2023 bis Sep 2024