DuPont Deal Caps Turbulent Reign for Dow CEO Andrew Liveris

11 Dezember 2015 - 9:05PM

Dow Jones News

By Alison Sider

Andrew Liveris, chief executive of Dow Chemical Co., will take

the role of executive chairman in a combination of Dow and DuPont

Co., announced Friday, assuming he can pull off the marriage of the

two rivals with regulators.

The move is the latest for an executive known for having big

ambitions and a personality to match. It could prove the pinnacle

of a career marked by wide swings in his company's fortunes and

personal dramas for the 61-year-old Mr. Liveris.

A deal with DuPont has been in Mr. Liveris's sights for over

years and he moved quickly when DuPont appointed a new chief

executive earlier this year.

"Persistence is my middle name," he said in an interview with

The Wall Street Journal, crediting his upbringing in Australia's

outback.

A native of the northern Australian city of Darwin, Mr. Liveris

has said he reinvented himself three or four times in his 11 years

at the helm of the chemical giant. Trained as a chemical engineer,

Mr. Liveris joined Dow nearly 40 years ago in Australia and worked

throughout Asia in Thailand and Hong Kong, and then in the U.S.

Analysts credit Mr. Liveris with forging international

partnerships that have expanded Dow's horizons, including a joint

venture with the state-owned Saudi Arabian Oil Co., or Saudi

Aramco. Together, they built a giant petrochemical complex on the

Persian Gulf that started production earlier this week.

"He's probably the most global executive I've encountered," said

Wells Fargo analyst Frank Mitsch.

He also undertook a risky overhaul of the sprawling company,

divesting billions of dollars worth of businesses--some of which

Dow had been in for more than a century--to focus on higher-margin

products.

"He's a very strategic minded person--very determined, always

willing to make bold steps for the portfolio," said Raj Gupta, the

former CEO of Rohm & Haas, which Dow bought in 2009.

Dow was rocked by the financial crisis, which took a bite out of

world-wide demand for its products. The company's $16 billion deal

to buy rival Rohm & Haas nearly collapsed due to the downturn

when Kuwait pulled out of a joint venture that would have helped

pay for the purchase. Dow had to cut its dividend for the first

time and took $3 billion worth of rescue financing from Warren

Buffett.

Mr. Gupta said Mr. Liveris stayed cool under relentless pressure

during months of legal wrangling before that deal closed. When the

dust settled, Mr. Liveris sent Mr. Gupta a gift of Australian

wine.

More recently, Dow came under fire from activist investor Daniel

Loeb of Third Point LLC, who last year pushed Mr. Liveris to break

the company apart. Dow agreed to add two of the hedge fund's

preferred directors to its board.

Mr. Liveris also has encountered legal challenges.

In a legal fight that started in 2007, Mr. Liveris ultimately

prevailed against two former executives who admitted they had

engaged in talks aimed at selling the company behind his back.

In a separate case, the U.S. Securities and Exchange Commission

has sought documents related to the Dow chief's use of company

funds, according to a person familiar with the matter. A spokesman

for the SEC declined to comment. The company didn't respond to

requests for comment, but in the past has denied any wrongdoing by

Mr. Liveris.

Scrutiny of Mr. Liveris's use of Dow money dates back to 2011,

when the company disclosed in a filing to the SEC that the CEO

repaid more than $719,000 after what the company described as a

routine audit committee investigation.

Allegations he misspent company funds on vacations and trips to

sporting events including the Super Bowl were raised in lawsuits

brought by Kimberly Wood, a former employee who said the company

had retaliated against her for raising questions about Mr.

Liveris's spending. She settled with Dow in February on terms that

haven't been disclosed.

If the DowDupont deal goes through as planned, the combined

company would then split into three separate companies. Mr. Liveris

and Edward Breen, the CEO of DuPont who will retain that title in

the new company, said Friday they haven't determined what their

roles would be when the company splits.

Jacob Bunge contributed to this article.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

December 11, 2015 14:50 ET (19:50 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

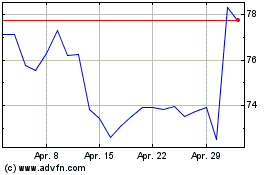

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024