DigitalBridge Group, Inc. (NYSE: DBRG) and subsidiaries

(collectively, “DigitalBridge,” or the “Company”) today announced

financial results for the fourth quarter and full-year ended

December 31, 2022.

A Fourth Quarter 2022 Earnings Presentation and a Supplemental

Financial Report are available in the Events & Presentations

and Financial Information sections, respectively, of the

Shareholders tab on the Company’s website at www.digitalbridge.com.

This information has also been furnished to the U.S. Securities and

Exchange Commission in a Current Report on Form 8-K.

Marc Ganzi, CEO of DigitalBridge, said "We are pleased to report

a solid quarter of fundamental performance to close out 2022. Last

year, we exceeded our fundraising targets for the year, firmly

established the asset management platform as our growth driver

through a series of strategic transactions, and most importantly,

continued to support the growth of our resilient portfolio

companies. As we look ahead to 2023, we remain focused on forming

capital around the best investment opportunities in digital

infrastructure and finalizing the simplification of our business

profile to a scalable, asset-light investment manager levered to

the powerful secular tailwinds in digital infra."

The Company reported fourth quarter 2022 total revenues of $301

million, GAAP net loss attributable to common stockholders of $(19)

million, or $(0.12) per share, and Distributable Earnings of $(11)

million, or $(0.07) per share, and full-year 2022 total revenues of

$1.1 billion, GAAP net loss attributable to common stockholders of

$(382) million, or $(2.47) per share, and Distributable Earnings of

$37 million, or $0.22 per share.

Fourth quarter 2022 net loss and DE included a $53 million

non-cash valuation allowance against deferred tax assets (“DTAs”)

of a subsidiary of the Company.

Common and Preferred Dividends

On January 17, 2023, the Company paid a cash dividend of $0.01

per common share to shareholders of record at the close of business

on December 31, 2022; and paid cash dividends with respect to each

series of the Company’s cumulative redeemable perpetual preferred

stock in accordance with the terms of such series, as follows:

Series H preferred stock: $0.4453125 per share; Series I preferred

stock: $0.446875 per share; and Series J preferred stock:

$0.4453125 per share, to the respective stockholders of record on

January 10, 2023.

On February 17, 2023, the Company’s Board of Directors declared

a cash dividend of $0.01 per common share to be paid on April 17,

2023 to shareholders of record at the close of business on March

31, 2023; and declared cash dividends with respect to each series

of the Company’s cumulative redeemable perpetual preferred stock in

accordance with the terms of such series, as follows: Series H

preferred stock: $0.4453125 per share; Series I preferred stock:

$0.446875 per share; and Series J preferred stock: $0.4453125 per

share, which will be paid on April 17, 2023 to the respective

stockholders of record on April 12, 2023.

Fourth Quarter & Full-Year 2022 Conference Call

The Company will conduct an earnings conference call and

presentation to discuss the Fourth Quarter & Full-Year 2022

financial results on Friday, February 24, 2023, at 10:00 a.m.

Eastern Time (ET). The earnings presentation will be broadcast live

over the Internet and a webcast link can be accessed on the

Shareholders section of the Company’s website at

ir.digitalbridge.com/events. To participate in the event by

telephone, please dial (877) 407-4018 ten minutes prior to the

start time (to allow time for registration). International callers

should dial (201) 689-8471.

For those unable to participate during the live call, a replay

will be available starting February 24, 2023, at 3:00 p.m. ET. To

access the replay, dial (844) 512-2921 (U.S.), and use passcode

13735816. International callers should dial (412) 317-6671 and

enter the same conference ID number.

About DigitalBridge Group, Inc.

DigitalBridge (NYSE: DBRG) is a leading global digital

infrastructure firm. With a heritage of over 25 years investing in

and operating businesses across the digital ecosystem including

cell towers, data centers, fiber, small cells, and edge

infrastructure, the DigitalBridge team manages a $53 billion

portfolio of digital infrastructure assets on behalf of its limited

partners and shareholders. Headquartered in Boca Raton,

DigitalBridge has key offices in New York, Los Angeles, London,

Luxembourg and Singapore. For more information, visit:

www.digitalbridge.com.

Fourth Quarter 2022 Valuation Allowance

Accounting Standards Codification (ASC) 740, Income Taxes,

provides a framework for evaluating whether the establishment of a

valuation allowance against DTAs is necessary. Following this

guidance, the Company evaluated positive and negative evidence, to

which more weight is given to evidence which can be objectively

verified, and the more negative evidence that exists, the more

positive evidence is necessary and the more difficult it is to

support a conclusion that a valuation allowance is not required. A

significant piece of objective negative evidence is the cumulative

net operating loss the Company incurred over the three-year period

ended December 31, 2022, which was largely a product of the prior

three-year transition in the Company's business to an investment

manager focused on digital infrastructure. The Company’s historical

cumulative net operating loss and the absence of tax planning

strategies represented objective evidence which limited the ability

of the Company to consider other subjective evidence, such as the

Company’s projections for growth and earnings in future years.

In future periods, this valuation allowance will be reversed as

a deferred tax benefit when the realizability of all or some

portion of these DTAs are achieved.

As of December 31, 2022, the Company had $359 million gross, or

$88 million tax-effected, in U.S. NOL carryforwards attributable to

U.S. federal losses incurred after December 31, 2017 which can be

carried forward indefinitely.

Given the availability of significant capital loss and NOL

carryforwards, the Company’s transition from a REIT to a taxable C

Corporation, in and of itself, did not result in significant

incremental current income tax expense in 2022. The Company's

primary source of income subject to tax remains its investment

management business, which was already subject to tax previously

through its taxable REIT subsidiary.

Cautionary Statement Regarding Forward-Looking

Statements

This press release may contain forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward-looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” or “potential” or the negative of these

words and phrases or similar words or phrases which are predictions

of or indicate future events or trends and which do not relate

solely to historical matters. You can also identify forward-looking

statements by discussions of strategy, plans or intentions.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and contingencies, many of which are

beyond the Company’s control, and may cause the Company’s actual

results to differ significantly from those expressed in any

forward-looking statement. Factors that might cause such a

difference include, without limitation, our ability to grow our

business by raising capital for our funds and the companies that we

manage; our position as an owner, operator and investment manager

of digital infrastructure and our ability to manage any related

conflicts of interest; adverse changes in general economic and

political conditions, including those resulting from supply chain

difficulties, inflation, interest rate increases, a potential

economic slowdown or a recession; our exposure to business risks in

Europe, Asia and other foreign markets; our ability to obtain and

maintain financing arrangements, including securitizations, on

favorable or comparable terms or at all; the ability of our managed

companies to attract and retain key customers and to provide

reliable services without disruption; the reliance of our managed

companies on third-party suppliers for power, network connectivity

and certain other services; our ability to increase assets under

management ("AUM") and expand our existing and new investment

strategies; our ability to integrate and maintain consistent

standards and controls, including our ability to manage our

acquisitions in the digital infrastructure and investment

management industries effectively; our business and investment

strategy, including the ability of the businesses in which we have

significant investments to execute their business strategies;

performance of our investments relative to our expectations and the

impact on our actual return on invested equity, as well as the cash

provided by these investments and available for distribution; our

ability to deploy capital into new investments consistent with our

investment management strategies; the availability of, and

competition for, attractive investment opportunities and the

earnings profile of such new investments; our ability to achieve

any of the anticipated benefits of certain joint ventures,

including any ability for such ventures to create and/or distribute

new investment products; our expected hold period for our assets

and the impact of any changes in our expectations on the carrying

value of such assets; the general volatility of the securities

markets in which we participate; the market value of our assets;

interest rate mismatches between our assets and any borrowings used

to fund such assets; effects of hedging instruments on our assets;

the impact of economic conditions on third parties on which we

rely; the impact of any security incident or deficiency affecting

our systems or network or the system and network of any of our

managed companies or service providers; any litigation and

contractual claims against us and our affiliates, including

potential settlement and litigation of such claims; our levels of

leverage; the impact of legislative, regulatory and competitive

changes, including those related to privacy and data protection;

the impact of our transition from a real estate investment trust

("REIT") to a taxable C corporation for tax purposes, and the

related liability for corporate and other taxes; whether we will be

able to utilize existing tax attributes to offset taxable income to

the extent contemplated; our ability to maintain our exemption from

registration as an investment company under the Investment Company

Act of 1940, as amended (the “1940 Act”); changes in our board of

directors or management team, and availability of qualified

personnel; our ability to make or maintain distributions to our

stockholders; and our understanding of and ability to successfully

navigate the competitive landscape in which we and our managed

companies operate and other risks and uncertainties, including

those detailed in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2021 and Quarterly Reports on Form

10-Q for the fiscal quarters ended March 31, 2022, June 30, 2022

and September 30, 2022, each under the heading “Risk Factors,” as

such factors may be updated from time to time in the Company’s

subsequent periodic filings with the U.S. Securities and Exchange

Commission (“SEC”). All forward-looking statements reflect the

Company’s good faith beliefs, assumptions and expectations, but

they are not guarantees of future performance. Additional

information about these and other factors can be found in the

Company’s reports filed from time to time with the SEC.

The Company cautions investors not to unduly rely on any

forward-looking statements. The forward-looking statements speak

only as of the date of this presentation. The Company is under no

duty to update any of these forward-looking statements after the

date of this press release, nor to conform prior statements to

actual results or revised expectations, and the Company does not

intend to do so.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share data)

December 31, 2022

December 31, 2021

(unaudited)

Assets

Cash and cash equivalents

$

918,254

$

1,602,102

Restricted cash

118,485

99,121

Real estate, net

5,921,298

4,972,284

Equity and debt investments

1,322,050

935,153

Loans receivable

137,945

173,921

Goodwill

761,368

761,368

Deferred leasing costs and intangible

assets, net

1,092,167

1,187,627

Other assets

654,050

740,395

Due from affiliates

45,360

49,230

Assets held for disposition

57,526

3,676,615

Total assets

$

11,028,503

$

14,197,816

Liabilities

Debt, net

$

5,156,140

$

4,860,402

Accrued and other liabilities

1,272,096

943,801

Intangible liabilities, net

29,824

33,301

Liabilities related to assets held for

disposition

380

3,088,699

Total liabilities

6,458,440

8,926,203

Commitments and contingencies

Redeemable noncontrolling

interests

100,574

359,223

Equity

Stockholders’ equity:

Preferred stock, $0.01 par value per

share; $827,779 and $883,500 liquidation preference; 250,000 shares

authorized; 33,111 and 35,340 shares issued and outstanding

800,355

854,232

Common stock, $0.04 par value per

share

Class A, 949,000 shares authorized;

159,763 and 142,144 shares issued and outstanding

6,390

5,685

Class B, 1,000 shares authorized; 166

shares issued and outstanding

7

7

Additional paid-in capital

7,818,068

7,820,807

Accumulated deficit

(6,962,613

)

(6,576,180

)

Accumulated other comprehensive income

(loss)

(1,509

)

42,383

Total stockholders’ equity

1,660,698

2,146,934

Noncontrolling interests in investment

entities

2,743,896

2,653,173

Noncontrolling interests in Operating

Company

64,895

112,283

Total equity

4,469,489

4,912,390

Total liabilities, redeemable

noncontrolling interests and equity

$

11,028,503

$

14,197,816

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per

share data)

Three Months Ended December

31,

Twelve Months Ended December

31,

2022

2021

2022

2021

(unaudited)

(unaudited)

(unaudited)

Revenues

Property operating income

$

246,408

$

189,909

$

927,506

$

762,750

Fee income

44,255

56,000

172,673

180,826

Interest income

7,717

3,532

30,107

8,791

Other income

2,701

6,416

14,286

13,432

Total revenues

301,081

255,857

1,144,572

965,799

Expenses

Property operating expense

102,165

78,950

389,445

316,178

Interest expense

55,048

69,336

198,498

186,949

Investment expense

7,625

8,230

33,887

28,257

Transaction-related costs

3,329

3,163

10,129

5,781

Depreciation and amortization

147,398

132,855

576,911

539,695

Compensation expense

Cash and equity-based compensation

61,379

53,067

245,257

235,985

Carried interest and incentive fee

compensation

92,738

25,921

202,286

65,890

Administrative expenses

39,037

34,256

123,184

109,490

Total expenses

508,719

405,778

1,779,597

1,488,225

Other income (loss)

Other gain (loss), net

(326

)

10,322

(170,555

)

(21,412

)

Equity method earnings

25,160

85,219

19,412

127,270

Equity method earnings - carried

interest

176,944

29,878

378,342

99,207

Loss before income taxes

(5,860

)

(24,502

)

(407,826

)

(317,361

)

Income tax benefit (expense)

(31,239

)

(8,870

)

(13,467

)

100,538

Income (loss) from continuing

operations

(37,099

)

(33,372

)

(421,293

)

(216,823

)

Income (loss) from discontinued

operations

(146

)

(9,493

)

(148,704

)

(600,088

)

Net income (loss)

(37,245

)

(42,865

)

(569,997

)

(816,911

)

Net income (loss) attributable to

noncontrolling interests:

Redeemable noncontrolling interests

5,211

18,934

(26,778

)

34,677

Investment entities

(36,283

)

(57,433

)

(189,053

)

(500,980

)

Operating Company

(1,583

)

(1,946

)

(32,369

)

(40,511

)

Net income (loss) attributable to

DigitalBridge Group, Inc.

(4,590

)

(2,420

)

(321,797

)

(310,097

)

Preferred stock redemption

—

2,127

(1,098

)

4,992

Preferred stock dividends

14,766

16,139

61,567

70,627

Net income (loss) attributable to

common stockholders

$

(19,356

)

$

(20,686

)

$

(382,266

)

$

(385,716

)

Income (loss) per share—basic

Income (loss) from continuing operations

per share—basic

$

(0.20

)

$

(0.03

)

$

(1.76

)

$

(1.21

)

Net income (loss) attributable to common

stockholders per share—basic

$

(0.12

)

$

(0.15

)

$

(2.47

)

$

(3.14

)

Income (loss) per share—diluted

Income (loss) from continuing operations

per share—diluted

$

(0.20

)

$

(0.03

)

$

(1.76

)

$

(1.21

)

Net income (loss) attributable to common

stockholders per share—diluted

$

(0.12

)

$

(0.15

)

$

(2.47

)

$

(3.14

)

Weighted average number of

shares

Basic

158,837

131,241

154,495

122,864

Diluted

158,837

131,241

154,495

122,864

Distributable Earnings

(DE)

(In thousands, except per

share data, unaudited)

Three Months Ended

Twelve Months Ended

December 31, 2022

December 31, 2021

December 31, 2022

December 31, 2021

Net income (loss) attributable to common

stockholders

$

(19,356

)

$

(20,686

)

$

(382,266

)

$

(385,716

)

Net income (loss) attributable to

noncontrolling common interests in Operating Company

(1,583

)

(1,946

)

(32,369

)

(40,511

)

Net income (loss) attributable to

common interests in Operating Company and common

stockholders

(20,939

)

(22,632

)

(414,635

)

(426,227

)

Adjustments for Distributable Earnings

(DE):

Transaction-related and restructuring

charges(1)

23,772

29,977

100,989

89,134

Non-real estate (gains) losses, excluding

realized gains or losses of digital assets within the Corporate and

Other segment

(16,050

)

(52,611

)

178,769

74,747

Net unrealized carried interest

(70,541

)

(7,375

)

(117,466

)

(41,624

)

Equity-based compensation expense

7,549

19,416

54,232

59,395

Depreciation and amortization

151,666

147,137

589,582

663,026

Straight-line rent revenue and expense

(7,063

)

(1,986

)

(21,462

)

11,005

Amortization of acquired above- and

below-market lease values, net

100

(333

)

(78

)

4,002

Impairment reversal (loss)

—

(40,732

)

35,983

300,038

(Gain) loss from sales of real estate

—

(197

)

3

(41,782

)

Non-revenue enhancing capital

expenditures

(14,774

)

(1,097

)

(40,515

)

(3,436

)

Debt prepayment penalties and amortization

of deferred financing costs and debt premiums and discounts

5,572

36,685

114,902

100,159

Adjustment to reflect BRSP cash dividend

declared

4,122

(28,243

)

574

(3,282

)

Preferred share redemption (gain) loss

—

2,127

—

4,992

Income tax effect on certain of the

foregoing adjustments

55

8,195

(534

)

(50,335

)

Adjustments attributable to noncontrolling

interests in investment entities

(69,810

)

(105,150

)

(430,061

)

(610,382

)

DE from discontinued operations

(5,070

)

11,467

(13,223

)

(149,873

)

After-tax DE

$

(11,411

)

$

(5,352

)

$

37,060

$

(20,443

)

DE per common share / common OP

unit(2)

$

(0.07

)

$

(0.04

)

$

0.22

$

(0.15

)

DE per common share / common OP

unit—diluted(2)(3)

$

(0.07

)

$

(0.04

)

$

0.22

$

(0.15

)

Weighted average number of common OP units

outstanding used for DE per common share and OP unit(2)

173,182

146,276

169,042

138,141

Weighted average number of common OP units

outstanding used for DE per common share and OP unit—diluted

(2)(3)

173,182

146,276

172,083

138,141

_________

(1)

Restructuring charges primarily represent costs and charges

incurred as a result of corporate restructuring and reorganization

to implement the digital evolution. These costs and charges include

severance, retention, relocation, transition, shareholder

settlement and other related restructuring costs, which are not

reflective of the Company’s core operating performance.

(2)

Calculated based on weighted average

shares outstanding including participating securities and assuming

the exchange of all common OP units outstanding for common

shares.

(3)

For the three months ended December 31,

2022, and three and twelve months ended December 31, 2021, excluded

from the calculation of diluted DE per share are Class A common

stock or OP units issuable in connection with performance stock

units, performance based restricted stock units and Wafra’s

warrants, of which the issuance and/or vesting are subject to the

performance of the Company's stock price or the achievement of

certain Company specific metrics, and the effect of adding back

interest expense associated with convertible senior notes and

weighted average dilutive common share equivalents for the assumed

conversion of the convertible senior notes as the effect of

including such interest expense and common share equivalents would

be antidilutive. For the twelve months ended December 31, 2022,

included in the calculation of diluted DE per share are Class A

common stock or OP units issuable in connection with performance

stock units, performance based restricted stock units and Wafra’s

warrants, of which the issuance and/or vesting are subject to the

performance of the Company's stock price or the achievement of

certain Company specific metrics, and excluded from the calculation

of diluted DE per share is the effect of adding back interest

expense associated with convertible senior notes and weighted

average dilutive common share equivalents for the assumed

conversion of the convertible senior notes as the effect of

including such interest expense and common share equivalents would

be antidilutive.

Distributable Earnings (DE)

DE is an after-tax measure that differs from GAAP net income or

loss from continuing operations as a result of the following

adjustments, including adjustment for our share of similar items

recognized by our equity method investments: transaction-related

and restructuring charges; realized and unrealized gains and

losses, except realized gains and losses from digital assets in

Corporate and Other; depreciation, amortization and impairment

charges; debt prepayment penalties, and amortization of deferred

financing costs, debt premiums and debt discounts; our share of

unrealized carried interest, net of associated compensation

expense; equity-based compensation expense; equity method earnings

from BrightSpire Capital, Inc. (BRSP) which is replaced with

dividends declared by BRSP; effect of straight-line lease income

and expense; impairment of equity investments directly attributable

to decrease in value of depreciable real estate held by the

investee; non-revenue enhancing capital expenditures; income tax

effect on certain of the foregoing adjustments. Income taxes

included in DE reflect the benefit of deductions arising from

certain expenses that are excluded from the calculation of DE, such

as equity-based compensation, as these deductions do decrease

actual income tax paid or payable by the Company in any one period.

There are no differences in the Company’s measurement of DE and

AFFO. Therefore, previously reported AFFO is the equivalent to DE

and prior period information has not been recast. DE is presented

on a reportable segment basis and for the Company in total.

We believe that DE is a meaningful supplemental measure as it

reflects the ongoing operating performance of our core business by

generally excluding items that are non-core in nature and allows

for better comparability of operating results period-over-period

and to other companies in similar lines of business.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230224005110/en/

Investor Contacts: Severin White Managing Director, Head

of Public Investor Relations severin.white@digitalbridge.com

212-547-2777

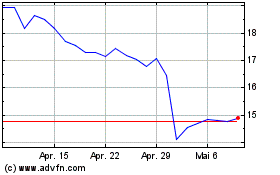

DigitalBridge (NYSE:DBRG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

DigitalBridge (NYSE:DBRG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024