MFS Announces Closed-End Fund Distributions

03 Juni 2013 - 10:15PM

Business Wire

MFS Investment Management® (MFS®) announced today monthly

distributions of the following closed-end funds, all with

declaration dates of June 3, 2013, ex-dividend dates of June 18,

2013, record dates of June 20, 2013, and payable dates of June 28,

2013:

Fund (ticker)

Income/Share

Other

Sources/Share*

Total

Amount/Share

MFS® California Municipal(AMEX: CCA) $0.0510

$0.0000 $0.0510 MFS® Charter Income(NYSE: MCR)

$0.0510 $0.0000 $0.0510

MFS® Government Markets Income(NYSE: MGF) $0.0000

$0.039970 $0.039970 MFS® High Income

Municipal(NYSE: CXE) $0.0270 $0.0000

$0.0270 MFS® High Yield Municipal(NYSE: CMU)

$0.0240 $0.0000 $0.0240 MFS®

Intermarket Income(NYSE: CMK) $0.0340

$0.0000 $0.0340 MFS® Intermediate High Income(NYSE:

CIF) $0.0190 $0.0000

$0.0190 MFS® Intermediate Income(NYSE: MIN) $0.0000

$0.042740 $0.042740 MFS® Investment

Grade Municipal(NYSE: CXH) $0.0460

$0.0000 $0.0460 MFS® Multi Market Income(NYSE: MMT)

$0.0370 $0.0000 $0.0370

MFS® Municipal Income(NYSE: MFM) $0.0370

$0.0000 $0.0370 MFS® Special Value(NYSE: MFV)

$0.0000 $0.059610

$0.059610

*Distribution from "Other Sources" may contain sources of income

other than ordinary income, such as short term capital gains, long

term capital gains, or return of capital, which can not be

determined until the close of the fund's fiscal year end.

Distributions that are treated for federal income tax purposes as a

return of capital will reduce a shareholder‘s tax basis in his or

her shares and, to the extent the distribution exceeds a

shareholder‘s adjusted tax basis, will be treated as a gain to the

shareholder from a sale of shares. Please see the fund's most

recent dividend source information available from payable date at

MFS.com for the breakdown of the distribution.

Investors who want to make changes to their accounts should

contact their financial advisor, brokerage firm, or other nominee

with whom the shares are registered. If shares are registered with

the funds’ transfer agent, Computershare, the transfer agent may be

contacted directly at 800-637-2304, or www.computershare.com.

MFS manages approximately $358.8 billion in assets on behalf of

individual and institutional investors worldwide as of April 30,

2013. The company traces its origins to 1924 and the creation of

America’s first "open end" mutual fund.

The Trusts are closed-end investment products. Shares of the

Trusts are only available for purchase/sale, at the current market

price, on the NYSE, with the exception of the MFS California

Municipal Fund which is available for purchase only on the American

Stock Exchange. Shares may trade at a discount to NAV.

MFS Investment Management111

Huntington Ave, Boston, MA 02119

15812.56

MFSShareholders or Advisors (investment product

information):Justin Miller, 800-343-2829, ext. 57702orMedia

Only:John Reilly, 617-954-5305orDan Flaherty, 617-954-4256

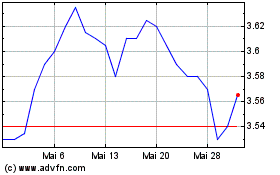

MFS High Income Municipal (NYSE:CXE)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

MFS High Income Municipal (NYSE:CXE)

Historical Stock Chart

Von Jul 2023 bis Jul 2024