false000171129100017112912024-02-122024-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________

FORM 8-K

__________________________________________________________________________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 12, 2024

________________________________________________________________________

CURO GROUP HOLDINGS CORP

(Exact Name of Registrant as Specified in Its Charter)

________________________________________________________________________

| | | | | | | | |

| Delaware | 001-38315 | 90-0934597 |

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

200 W Hubbard Street, 8th Floor, Chicago, IL | 60654 |

| (Address of Principal Executive Offices) | (Zip Code) |

(312) 470-2000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock | CURO | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule12b-2 of the Securities Exchange Act of 1934(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 Results of Operations and Financial Condition

As previously announced, on February 5, 2024, CURO Group Holdings Corp. (the “Company”) issued a press release announcing its preliminary financial results for the three months and fiscal year ended December 31, 2023. The Company also announced the cancellation of its earnings conference call previously scheduled for February 7, 2024. In light of such cancellation, the Company has prepared a supplemental presentation relating to its preliminary financial results for the three months and fiscal year ended December 31, 2023 (the “Supplemental Earnings Presentation”). A copy of the Supplemental Earnings Presentation is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 and Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

ITEM 7.01 Regulation FD Disclosure

Stakeholder Discussions and Cleansing Information

As previously announced, the Company and its advisors continue to be engaged in discussions with certain of its key lenders and other stakeholders (the “Recipient Parties”) regarding a potential comprehensive financial restructuring to strengthen the Company’s balance sheet and financial position.

In connection with these discussions, the Company provided the Recipient Parties access to certain information related to the Company’s projected 2024 to 2028 performance concerning potential alternative transactions and future financial and operating performance which was based on certain projections, forecasts and base case assumptions (the “Cleansing Information”). The Company has agreed with the Recipient Parties to publicly disclose the Cleansing Information. The Cleansing Information is included in the Supplemental Earnings Presentation, which is being furnished herewith as Exhibit 99.1 and is incorporated herein by reference. The information contained in this Item 7.01 and Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, and shall not be incorporated by reference into any filings under the Securities Act, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

The Cleansing Information was prepared solely to facilitate a discussion with the Recipient Parties and was not prepared with a view toward public disclosure and the Cleansing Information should not be relied upon to make an investment decision with respect to the Company. The Cleansing Information should not be regarded as an indication that the Company or any third party considers the Cleansing Information to be material non-public information or a reliable prediction of future events, and the Cleansing Information should not be relied upon as such. The Cleansing Information includes certain values for illustrative purposes only and such values are not the result of, and do not represent, actual valuations, estimates, forecasts or projections of the Company or any third party and should not be relied upon as such. Neither the Company nor any third party has made or makes any representation to any person regarding the accuracy of any Cleansing Information or undertakes any obligation to update the Cleansing Information to reflect circumstances existing after the date when the Cleansing Information was prepared or conveyed or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying the Cleansing Information become or are shown to be incorrect.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. These forward-looking statements include assumptions about various matters, such as the Company’s continued discussions with certain of its key lenders and other stakeholders and the outcome or timing of such process. In addition, words such as “estimate,” “believe,” “forecast,” “step,” “plan,” “predict,” “focused,” “project,” “is likely,” “guidance,” “expect,” “anticipate,” “intend,” “should,” “will,” “confident,” variations of such words and similar expressions are intended to identify forward-looking statements. The Company’s ability to achieve these forward-looking statements is based on certain assumptions, judgments and other factors, both within and outside of the Company’s control, that could cause actual results to differ materially from those in the forward-looking statements, including the risk that the Company will be unable to execute on a comprehensive financial restructuring and the risk that the Company’s discussions with its lenders and other stakeholders will be unduly delayed or unsuccessful, as well as other factors discussed in the Company’s filings with the Securities and Exchange Commission. These projections, estimates and assumptions may prove to be inaccurate in the future. These forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. There may be additional risks that the Company does not presently know or currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. The Company undertakes no obligation to update, amend or clarify any forward-looking statement for any reason.

ITEM 9.01 Financial Statements and Exhibits

(d). Exhibits

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 12th day of February, 2024.

CURO Group Holdings Corp.

By: /s/ Ismail Dawood______

Ismail Dawood

Chief Financial Officer

Q4 2023 Earnings Presentation February 12, 2024

IMPORTANT: You must read the following information before continuing to the rest of the presentation, which is being provided to you for informational purposes only. Note: Prior period financial information is presented on a continuing operations basis, which excludes the results and positions of the Canada POS Lending segment due to the sale of Flexiti on August 31, 2023. Preliminary Results The financial results presented and discussed herein regarding fourth quarter and full year 2023 financial results are on a preliminary and unaudited basis. Final audited data will be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements include estimates, projections, forecasts and assumptions about various matters such as (i) our future financial and operational performance, including liquidity and capacity, the drivers of our long-term path to profitability, estimated inflection points, various target ranges and our 2024 outlook, and (ii) certain projected 2024-2028 performance information using various base case assumptions concerning potential alternative transactions and future financial and operating performance, which are provided for illustrative purposes only and were prepared by us in connection with deleveraging conversations with certain key lenders and other stakeholders for discussion purposes only (the “Cleansing Information”). These forward-looking statements should not be relied upon to make an investment decision with respect to the Company. In addition, words such as “estimate,” “believe,” “forecast,” “predict,” “project,” “intend,” “should,” "expect" and variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions, judgments and other factors, both within and outside of our control, that could cause actual results to differ materially from those in the forward-looking statements, including: risks relating to the uncertainty of projected financial information and forecasts; our level of indebtedness; our dependence on third-party lenders to provide the cash we need to fund our indebtedness and our ability to affordably access third-party financing; the risk that we will be unable to execute on a comprehensive financial restructuring; the risk that our discussion with lenders and other stakeholders will be delayed or unsuccessful; the impact of regulations on our business; the effects of competition on our business; our ability to attract and retain customers; global economic, market, financial, political or public health conditions or events; our ability to integrate acquired businesses; our ability to protect our proprietary technology and analytics; disruption of our information technology systems; improper disclosure of customer personal data; as well as other factors discussed in our filings with the Securities and Exchange Commission. The foregoing factors, as well as other existing risk factors and new risk factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. Furthermore, the Company undertakes no obligation to update, amend or clarify forward-looking statements, including the Cleansing Information. Neither the Company nor any third party has made or makes any representation to any person regarding the accuracy of any Cleansing Information or undertakes any obligation to update the Cleansing Information, even in the event that any or all of the assumptions underlying the Cleansing Information become or are shown to be incorrect. Non-GAAP Financial Measures In addition to the financial information prepared in conformity with U.S. GAAP, we provide certain “non-GAAP financial measures.” Such measures are intended as a supplemental measure of our performance that are not required by or presented in accordance with GAAP. We present these non-GAAP financial measures because we believe that, when viewed with our GAAP results and the accompanying reconciliation, such measures provide useful information for comparing our performance over various reporting periods as they remove from our operating results the impact of items that we believe do not reflect our core operating performance. These non-GAAP financial measures are not substitutes for any GAAP financial measure and there are limitations to using them. Although the Company believes that these non-GAAP financial measures can make an evaluation of our operating performance more consistent because they remove items that do not reflect our core operations, other companies in the Company’s industry may define their own non-GAAP financial measures differently or use different measures. As a result, it may be difficult to use any non-GAAP financial measure to compare the performance of other companies to our performance. The non-GAAP financial measures presented in these slides should not be considered as measures of the income generated by our business or discretionary cash available to us to invest in the growth of our business. Our management compensates for these limitations by reference to GAAP results and using these non-GAAP financial measures as supplemental measures. Reconciliation of non-GAAP metrics to the closest comparable GAAP metrics are included in the Appendix. NOTE: All dollar amounts for Canada in this presentation are in U.S. Dollars, unless otherwise noted. Tables and charts may not sum due to rounding. 2

4Q23 Highlights FoundationExecute with ExcellenceGrow Responsibly 3 • Gross Loan Receivables grew 3.3% sequentially ◦ 3.1% growth in the U.S. ◦ 3.6% growth in Canada (1.2% on a constant currency basis) • Operating expenses declined sequentially and year-over- year • Improvement in NCOs sequentially and year-over- year • Liquidity and capacity of $342 million at the end of Q41 • $85 million in unrestricted Cash and cash equivalents at December 31, 2023 1 Reference page 11 for further information on liquidity and capacity

Solid loan growth across our portfolio 4 ($ Millions, as of period end)

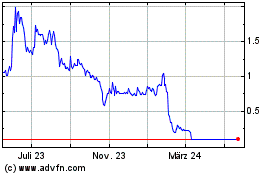

Credit quality continues to improve Highlights: • Net charge-offs improved sequentially and year-over-year primarily driven by credit tightening, servicing optimization and continued strategic mix shift to larger dollar, longer duration loans ($ Millions) NCOs by Geography 5 1 1Q23 NCOs excluding policy change. Including the change in charge-off policy, reported 1Q23 NCOs and NCO % were $47M and 15.6%, respectively, in U.S. and $10M and 8.0%, respectively, in Canada. 1 1

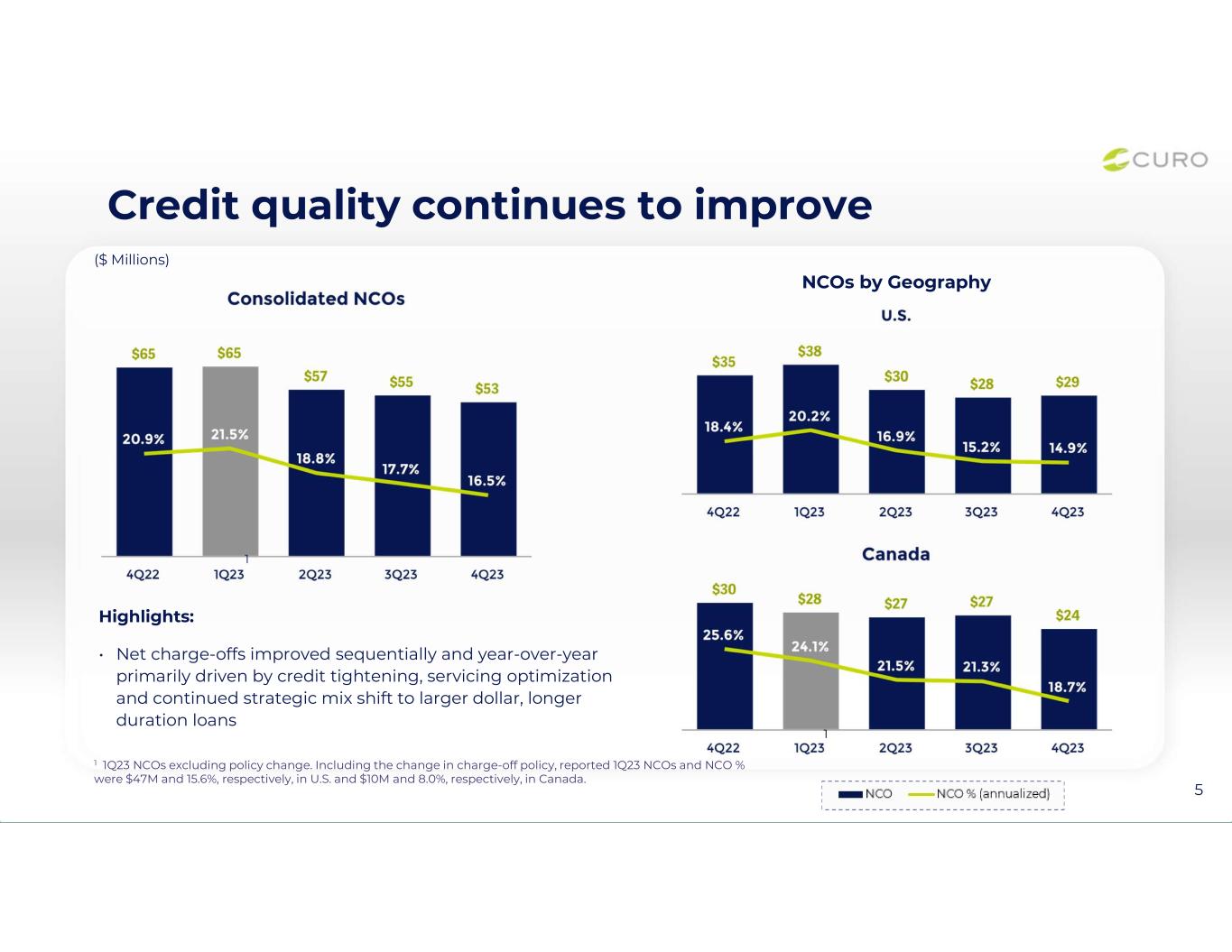

Delinquencies remain stable Highlights: • U.S. delinquency rates declined year-over-year • Canadian delinquency rates decreased sequentially driven by improvement in early stage delinquency. Year-over-year comparison not meaningful due to change in policy ($ Millions) 31+ DQs by Geography 6 1 Implemented change in charge-off policy in Canada during 1Q23 1 1

% Change Y/YQ/Q4Q223Q234Q23($Millions, except per share data) (8)%– %$182$168$168Revenue 40 %– %202828Recourse (Unsecured) Interest Expense1 43 %7 %212830Non-recourse (Secured) Interest Expense (22)%(2) %$141$112$110Net Interest Income (19) %(3) %1129491Operating Expenses (97)%#11013Other Expense #(6)%$(81)$16$15Pre-provision Income (Loss) (18) %(4)%655553Net Charge-offs (62) %#13(6)5Allowance Build (Release) (26)%18 %$78$49$58Provision for Loan Losses (73)%27 %$(158)$(33)$(42)Pre-tax Loss, Post-provison ##(16)11Provision (Benefit) for Income Taxes #26 %$(142)$(34)$(43)Net Loss from Continuing Operations $(3.52)$(0.81)$(1.05)Diluted EPS Continuing Operations Key Performance Metrics 20.9 %17.7 %16.5 %NCO % 30.9 %27.1 %26.6 %NIM, Post Charge-offs, excl. recourse interest2 36.3 %30.4 %28.6 %OpEx Ratio3 $1,229$1,241$1,275Average Gross Receivables Summary 4Q23 Results Highlights: • Sequential and year-over-year growth in Average Gross Receivables • Sequential and year-over-year OpEx ratio improvement. Incurred $7.6M of non-recurring charges during 4Q23 • Net charge-offs improved sequentially and year-over-year primarily driven by credit tightening, servicing optimization and continued strategic mix shift to larger dollar, longer duration loans # Greater than 100% or not meaningful Note: The above table may not sum due to rounding 1 Includes $5.2M and $5.0M paid-in-kind interest in 4Q23 and 3Q23, respectively 2Net Interest Margin, Post Charge-offs = ((Net Interest Income) – (Net Charge-offs)) / (Average Receivables); excluding recourse debt annualized 3 Operating Expense Ratio = (Operating Expenses / Average Receivables); annualized on a reported basis Reconciliation of non-GAAP metrics to the closest comparable GAAP metrics included within slides 15 through 17. 7

8 Increased allowance due to portfolio loan growth Highlights: • Allowance rate remains stable • Allowance for credit losses increased $6M primarily driven by portfolio growth during the quarter ($ Millions) 1 CECL was adopted effective January 1, 2023, which resulted in a one-time increase in the allowance for credit losses 1

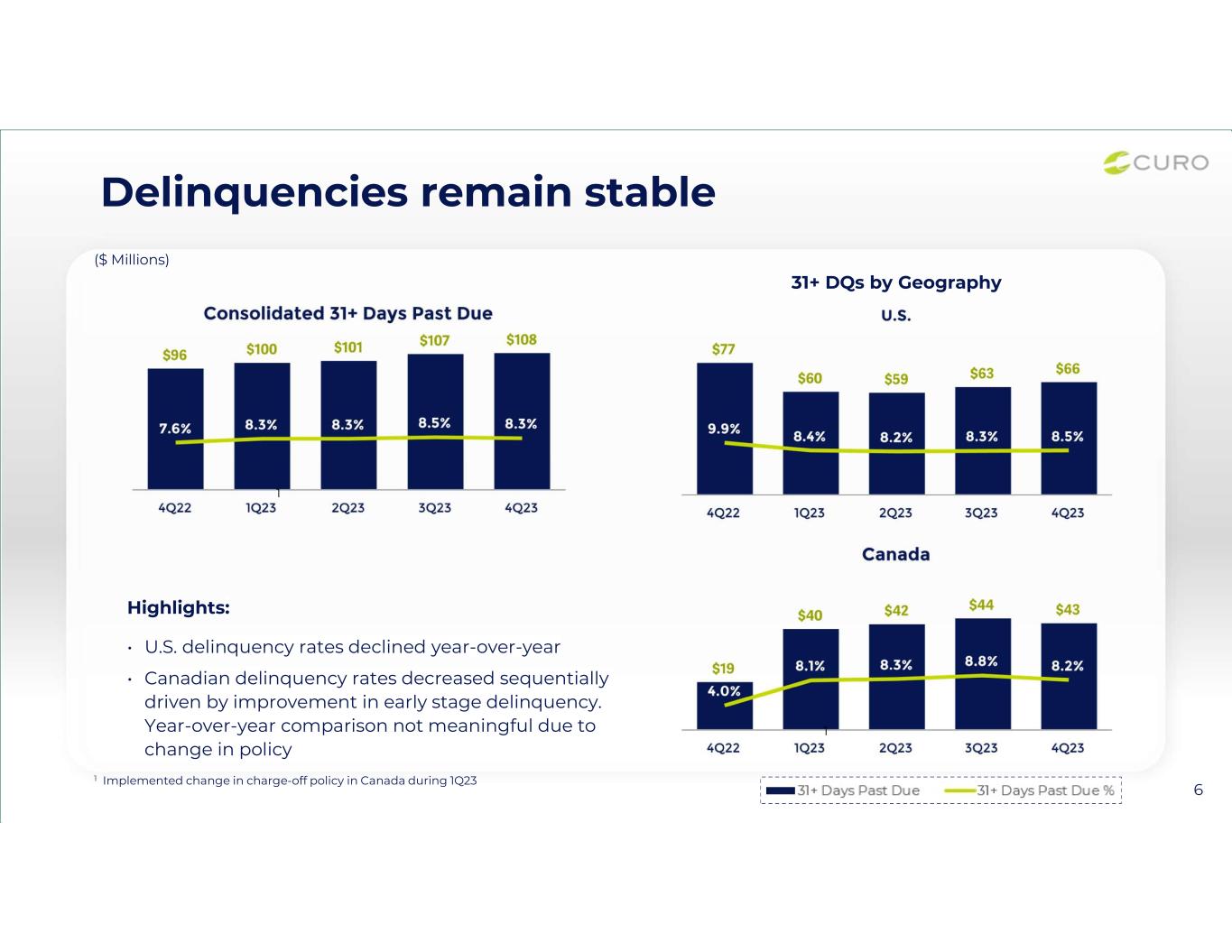

9 Net Interest Margin decreased primarily due to product mix shift ($ Millions) Highlights: • Net interest margin, Post charge-offs, excluding Recourse Interest Expense decreased sequentially due to: ◦ Decrease in yields reflects continuing product mix shift to larger balance, longer duration loans, which is resulting in improved credit ◦ Increased non-recourse debt levels ◦ All of which were partially offset by a decrease in net charge-offs Note: Net Interest Income, Post charge-offs, excl Recourse Interest Expense = (Revenue) - (Non-recourse Interest Expense)- (Net charge-offs) Net Interest Margin, Post Charge-offs, excl. Recourse Interest Expense = (Net Interest Income, Post charge-offs, excluding Recourse Interest Expense) / (Average Receivables); annualized 1 1Q23 excluding NCO policy change in Canada. Including the change in policy, reported 1Q23 Canada Direct Lending were $6.2 million and 5.5% respectively. 1

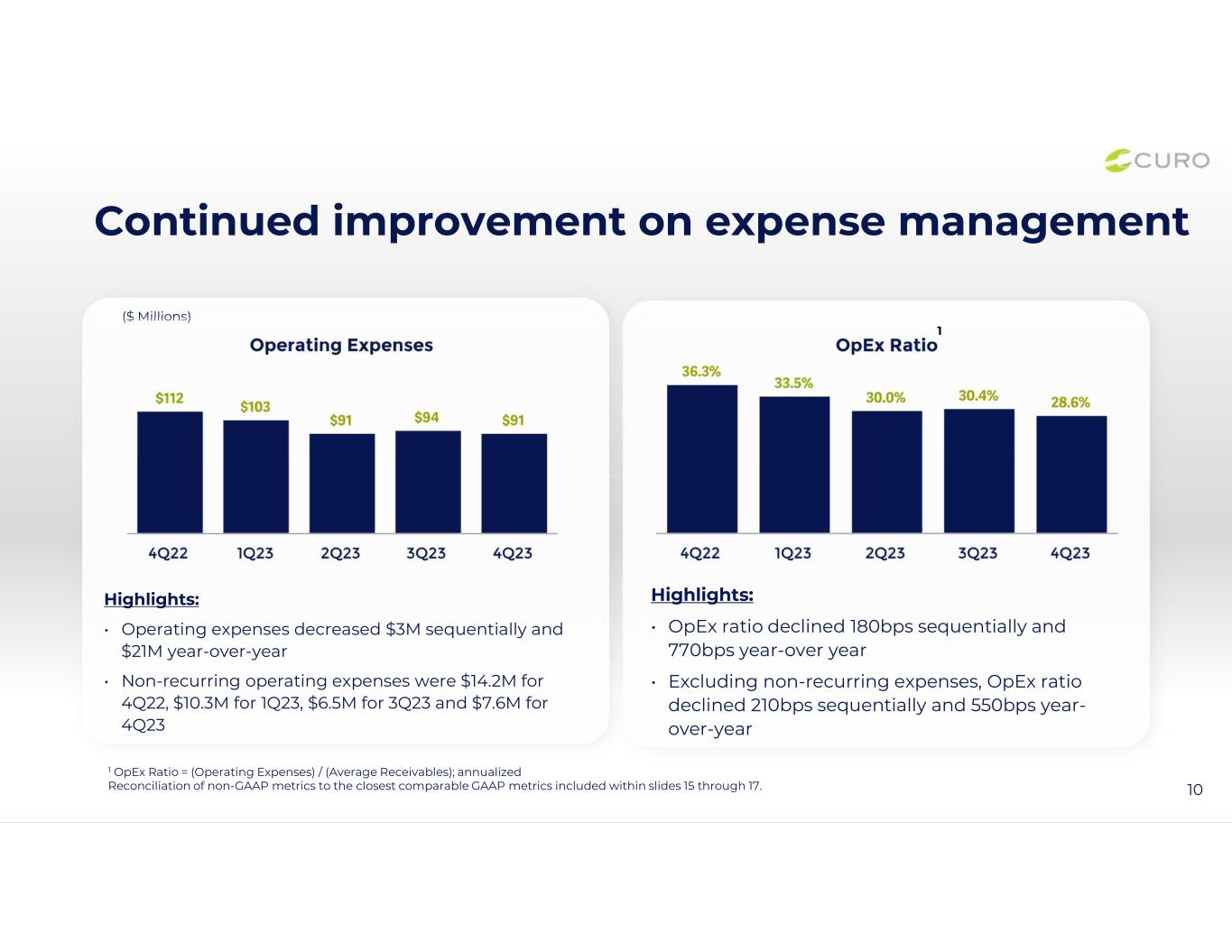

Continued improvement on expense management Highlights: • Operating expenses decreased $3M sequentially and $21M year-over-year • Non-recurring operating expenses were $14.2M for 4Q22, $10.3M for 1Q23, $6.5M for 3Q23 and $7.6M for 4Q23 ($ Millions) 10 1 OpEx Ratio = (Operating Expenses) / (Average Receivables); annualized Reconciliation of non-GAAP metrics to the closest comparable GAAP metrics included within slides 15 through 17. 1 Highlights: • OpEx ratio declined 180bps sequentially and 770bps year-over year • Excluding non-recurring expenses, OpEx ratio declined 210bps sequentially and 550bps year- over-year

Liquidity and Capacity 1 Represents facility commitments to support growth, less funded amounts 1 11 ($ Millions) Highlights: • Tax refund received during 1Q24. Originally anticipated in 4Q23 • Step up in facility advance rate expected as part of 2024 refinancing

12 Long-term Target RangeInflection point14Q23 AnnualizedPerformance KPIs 28-31%28-30%27%NIM, post charge-offs (excl. recourse interest)2 20-22%20-24%29%OpEx Ratio 6-11%4-10%(2)%Pre-tax ROA3 5.0x-6.0xn/an/aNet Leverage ~$1.5B$1.28BAverage Receivables ~$100M$(29)MPro-forma Pre-tax Income4 Long-Term Path to Profitability Increased margin due to higher secured loan mix Lower NCOs Continue to scale while managing expenses Continue to build additional liquidity Key Drivers 1 Estimate of when CURO's NIM, post-charge offs excluding recourse interest expense, is able to cover 100% of our operating and interest expenses 2 Net Interest Margin, Post Charge-offs, excl. Recourse Interest Expense = (Net Interest Income, Post charge-offs, excluding Recourse Interest Expense) / (Average Receivables); annualized 3 Pre-tax ROA = (NIM post charge-offs excl. recourse interest) - (OpEx Ratio) 4 Pro-forma Pre-tax Income = Total Revenue - Net charge-offs - OpEx - Non-recourse interest; annualized

Outlook Foundation Execute with ExcellenceGrow Responsibly 13 $25-$90M quarterly unrestricted cash balance Updated Full Year 20241 7-9% EOP receivables growth NIM, post charge-offs, excl. recourse interest2: 26-28% Operating Expenses: $325-$340M 1 Based on management's expectations for business performance and current macro conditions; subject to change if macro conditions change 2Net Interest Margin, Post Charge-offs, excl. Recourse Interest Expense = (Net Interest Income, Post charge-offs, excluding Recourse Interest Expense) / (Average Receivables); annualized

14 Appendix

15 Reconciliation of Non-GAAP Metrics: OpEx Ratio, excluding non-recurring items 4Q233Q232Q231Q234Q22($Millions) $91.2$94.2$91.3$103.2$111.6Operating Expenses $(7.6)$(6.5)$0.0$(10.3)$(14.2)Non-recurring expenses $83.6$87.7$91.3$92.9$97.4Operating expenses, excluding non-recurring expenses $1,275$1,241$1,219$1,232$1,229Average Gross Receivables 26.2 %28.3 %30.0 %30.2 %31.7 % OpEx Ratio, excluding non-recurring expenses; annualized

16 Direct Lending Revenue and Receivables by Geography 4Q23 TotalCanadaU.S.($Millions) $168$79$89Revenue $53$24$29Less: Net Charge-offs $5$0$5Less: Allowance Build / (Release) $110$55$56Net Revenue $1,296$521$775Gross Loans Receivable

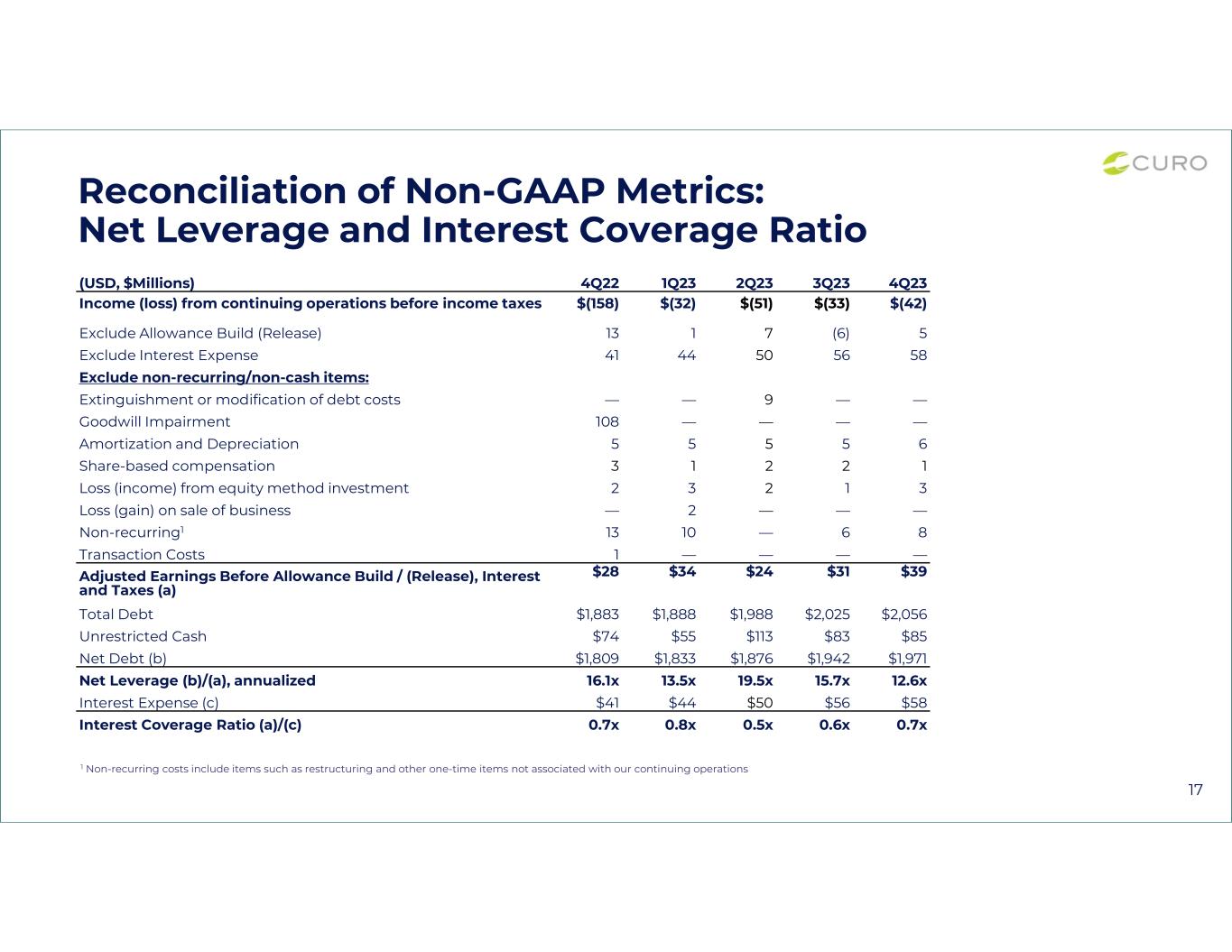

17 Reconciliation of Non-GAAP Metrics: Net Leverage and Interest Coverage Ratio 1 Non-recurring costs include items such as restructuring and other one-time items not associated with our continuing operations 4Q233Q232Q231Q234Q22(USD, $Millions) $(42)$(33)$(51)$(32)$(158)Income (loss) from continuing operations before income taxes 5(6)7113Exclude Allowance Build (Release) 5856504441Exclude Interest Expense Exclude non-recurring/non-cash items: ——9——Extinguishment or modification of debt costs ————108Goodwill Impairment 65555Amortization and Depreciation 12213Share-based compensation 31232Loss (income) from equity method investment ———2—Loss (gain) on sale of business 86—1013Non-recurring1 ————1Transaction Costs $39$31$24$34$28Adjusted Earnings Before Allowance Build / (Release), Interest and Taxes (a) $2,056$2,025$1,988$1,888$1,883Total Debt $85$83$113$55$74Unrestricted Cash $1,971$1,942$1,876$1,833$1,809Net Debt (b) 12.6x15.7x19.5x13.5x16.1xNet Leverage (b)/(a), annualized $58$56$50$44$41Interest Expense (c) 0.7x0.6x0.5x0.8x0.7xInterest Coverage Ratio (a)/(c)

18 Debt Summary Outstandin g as of 12/31/23 Borrowing Capacity Effective Interest Rate Final Maturity Date1 Fixed / Variable ($Millions, rounded) Corporate Debt: $178n/a18.0%Aug-27Fixed1.0L Term Loan $682n/a7.5%Aug-28Fixed1.5L Senior Notes $318n/a7.5%Aug-28Fixed2.0L Senior Notes Funding Debt: $300$375 1-Mo SOFR + 5.80%Jul-25VariableHeights SPV $139$140 1-Mo SOFR + 8.50%Nov-26VariableHeights SPV II $153$200 1-Mo SOFR + 4.52%Jul-25VariableFirst Heritage SPV $252$302 3-Mo CDOR + 6.00%Aug-26VariableCanada SPV(2) $77$113 3-Mo CDOR + 8.00%Nov-25VariableCanada SPV II(2) 1 Refer to Form 10-K, FN 6 Debt for additional maturity date information 2 Borrowing Capacity amounts are denominated in CAD, but were converted to USD using a 12/31/23 exchange rate of 0.7543

1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 2024E 2025E 2026E 2027E 2028E Cash & Cash Equivalents $53.5 $78.3 $87.9 $89.9 $70.2 $79.4 $67.4 $86.3 $89.9 $86.3 $93.9 $114.9 $144.1 Restricted Cash 61.3 66.2 65.0 71.7 68.3 73.2 74.1 74.9 71.7 74.9 76.5 83.2 88.3 Total Cash, Consolidated $114.8 $144.5 $152.9 $161.6 $138.5 $152.6 $141.5 $161.2 $161.6 $161.2 $170.4 $198.1 $232.4 Total Non-recourse Debt 883.5 946.6 994.8 1,039.8 1,021.0 1,055.5 1,092.9 1,129.9 1,039.8 1,129.9 1,239.1 1,351.3 1,463.4 Total Recourse Debt 1,153.3 1,159.7 1,165.8 1,171.9 1,178.2 1,184.5 1,190.9 1,197.5 1,171.9 1,197.5 1,224.8 1,252.4 1,278.9 Total Debt $2,036.8 $2,106.4 $2,160.5 $2,211.7 $2,199.2 $2,240.0 $2,283.8 $2,327.4 $2,211.7 $2,327.4 $2,463.8 $2,603.7 $2,742.3 Gross receivables, Direct Lending 1,249.1 1,296.8 1,353.1 1,404.9 1,394.1 1,436.1 1,482.2 1,528.5 1,404.9 1,528.5 1,662.7 1,807.7 1,962.3 Total Revenue 168.1 166.1 173.0 177.5 177.8 180.5 189.1 193.5 684.7 740.9 797.0 863.3 927.1 Net Revenue 118.9 112.2 113.6 121.6 128.0 123.1 127.7 129.0 466.3 507.7 544.5 590.9 632.6 Operating Expenses 85.3 83.6 82.5 77.7 75.3 80.1 78.9 79.2 329.1 313.5 323.8 333.8 346.0 Recourse Interest 28.6 28.8 29.0 29.2 29.4 29.6 29.8 30.0 115.7 118.9 122.3 124.5 125.5 Non-recourse Interest 29.4 31.1 30.1 31.2 28.8 28.0 28.6 29.0 121.8 114.4 121.7 126.4 133.4 Interest Expense $58.0 $59.9 $59.1 $60.4 $58.2 $57.7 $58.4 $59.0 $237.5 $233.3 $244.0 $251.0 $258.9 Net Income ($20.4) ($27.5) ($24.6) ($11.6) ($4.5) ($13.2) ($8.4) ($6.1) ($84.0) ($32.2) ($19.7) $4.6 $20.5 19 Long-Range Plan (Base Case) Note: Note: 2024 interest rates held constant from December 2023; Forward curve: 1 Month SOFR of 5.36 and 3 Month CDOR of 5.465%. For FY25, interest rate uses the forward curve 1 Restricted cash is comprised of deposits related to our reinsurance program, deposits in collateral accounts with financial institutions, and funds related to loans collateralizing our facilities. 2 Net Revenue is Total Revenue less Provision Expense. ($ Millions) o Improved advance rates in our financing facilities o Improvement in NCO rates driven by improved underwriting and product mix shift o Continued focus on cost optimization 1 2

1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 2024E 2025E Cash & Cash Equivalents $44.4 $29.3 $34.4 $45.6 $31.4 $58.7 $39.9 $57.2 $45.6 $57.2 Restricted Cash 60.4 62.8 64.1 66.6 65.0 66.0 68.6 74.3 66.6 74.3 Total Cash, Consolidated $104.8 $92.1 $98.6 $112.2 $96.5 $124.7 $108.5 $131.6 $112.2 $131.6 Total Non-recourse Debt 883.8 903.5 948.8 992.2 959.3 975.4 1,039.3 1,083.1 992.2 1,083.1 Total Recourse Debt 1,153.7 1,160.1 1,166.1 1,172.3 1,178.5 1,184.9 1,191.3 1,197.9 1,172.3 1,197.9 Total Debt $2,037.5 $2,063.6 $2,115.0 $2,164.5 $2,137.9 $2,160.3 $2,230.6 $2,281.0 $2,164.5 $2,281.0 Gross receivables, Direct Lending 1,239.6 1,288.9 1,344.3 1,395.5 1,362.8 1,383.3 1,467.5 1,525.9 1,395.5 1,525.9 Total Revenue 167.7 166.3 173.2 177.8 173.7 172.4 182.7 188.4 685.0 717.2 Net Revenue 117.5 111.7 113.8 123.6 129.5 124.1 124.1 129.6 466.5 507.3 Operating Expenses 85.1 81.6 81.7 77.9 74.2 75.6 76.7 76.8 326.4 303.2 Recourse Interest 28.6 28.8 29.0 29.2 29.4 29.6 29.8 30.1 115.7 119.0 Non-recourse Interest 29.4 31.1 30.1 31.2 27.2 25.9 26.5 27.0 121.8 106.6 Interest Expense $58.0 $59.9 $59.1 $60.4 $56.7 $55.5 $56.4 $57.0 $237.5 $225.6 Net Income ($29.3) ($33.1) ($30.3) ($19.5) ($1.8) ($7.5) ($10.3) ($5.8) ($112.2) ($25.5) 20 Long-Range Plan (Constant SPV Advance Rates) ($ Millions) o These projections show the Base Case (slide 19) adjusted for no improvement in advance rates. Note: Note: 2024 interest rates held constant from December 2023; Forward curve: 1 Month SOFR of 5.36 and 3 Month CDOR of 5.465%. For FY25, interest rate uses the forward curve 1 Restricted cash is comprised of deposits related to our reinsurance program, deposits in collateral accounts with financial institutions, and funds related to loans collateralizing our facilities. 2 Net Revenue is Total Revenue less Provision Expense. 1 2

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

CURO (NYSE:CURO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

CURO (NYSE:CURO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024