false000171129100017112912024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________

FORM 8-K

__________________________________________________________________________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 1, 2024

________________________________________________________________________

CURO GROUP HOLDINGS CORP

(Exact Name of Registrant as Specified in Its Charter)

________________________________________________________________________

| | | | | | | | |

| Delaware | 001-38315 | 90-0934597 |

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

200 W Hubbard Street, 8th Floor, Chicago, IL | 60654 |

| (Address of Principal Executive Offices) | (Zip Code) |

(312) 470-2000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________________________

Check the appropriate box below if the Form8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock | CURO | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule12b-2 of the Securities Exchange Act of 1934(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 Results of Operations and Financial Condition

On February 5, 2024, CURO Group Holdings Corp. (the “Company”) issued a press release announcing its preliminary financial results for the three months and fiscal year ended December 31, 2023. The Company also announced the cancellation of its earnings conference call previously scheduled for February 7, 2024. A copy of the Company’s press release announcing its preliminary financial results and its cancellation of the earnings conference call is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 and Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

ITEM 7.01 Regulation FD Disclosure

First Lien Credit Agreement

On February 1, 2024, the Company determined that as of January 31, 2024 it may not have been in compliance with the covenant set forth in that certain First Lien Credit Agreement, dated as of May 15, 2023, among the Company, the subsidiary guarantors party thereto, the lenders party thereto and Alter Domus (US) LLC, as administrative agent and collateral agent (the “1.0L Credit Agreement”), requiring that the Company maintain certain minimum liquidity as of the last day of each month. To the extent the Company’s liquidity as of January 31, 2024, once confirmed, was below the minimum liquidity requirement of $75,000,000 for that period, it would constitute an event of default under the 1.0L Credit Agreement (the “Potential 1.0L Liquidity Event of Default”). In addition, and as further described below, the Company’s failure to make the interest payments on the Notes (as defined below) due on February 1, 2024 constituted an event of default under the 1.0L Credit Agreement (the “1.0L Cross Default” and, together with the Potential 1.0L Liquidity Event of Default, the “1.0L Events of Default”). On February 2, 2024, the Required Lenders (as such term is defined in the 1.0L Credit Agreement) provided a waiver of the 1.0L Events of Default through March 1, 2024, subject to certain conditions (the “1.0L Waiver”).

7.500% Senior 1.5 Lien Secured Notes due 2028 and 7.500% Senior 2.0 Lien Secured Notes due 2028

On February 1, 2024, the Company elected not to make the interest payment due on February 1, 2024 with respect to its outstanding 7.500% Senior 1.5 Lien Secured Notes due 2028 (the “1.5L Notes”) in the amount of approximately $25.6 million and to utilize the five business day grace period (the “1.5L Grace Period”) with respect to the interest payment default under the indenture governing the 1.5L Notes, dated as of May 15, 2023 (the “1.5L Indenture”).

Also on February 1, 2024, the Company elected not to make the interest payment due on February 1, 2024 with respect to its outstanding 7.500% Senior 2.0 Lien Secured Notes due 2028 (the “2.0L Notes” and, together with the 1.5L Notes, the “Notes”) in the amount of approximately $11.9 million and to utilize the 30 day grace period (the “2.0L Grace Period” and, together with the 1.5L Grace Period, the “Grace Periods”) with respect to the interest payment default under the indenture governing the 2.0L Notes, dated as of July 30, 2021 (as so amended, supplemented or otherwise modified from time to time, the “2.0L Indenture” and, together with the 1.5L Indenture, the “Notes Indentures”).

During the applicable Grace Periods, non-payment of the interest payments under the Notes does not constitute an event of default with respect to the Notes Indentures; however, the failure to make the interest payments in respect of the Notes would result in the 1.0L Cross Default under the 1.0L Credit Agreement, which was waived pursuant to the 1.0L Waiver, as further described above.

Consent Solicitation for 7.500% Senior 1.5 Lien Secured Notes due 2028

On February 5, 2024, the Company announced a solicitation of consents (the “Consent Solicitation”) from all registered holders (individually, a “Holder,” and collectively, the “Holders”) of the 1.5L Notes. The purpose of the Consent Solicitation is to obtain the consent of the Holders to (a) waive the potential default arising from the Company’s potential failure to maintain liquidity equal to or greater than $75,000,000 as of January 31, 2024 under the 1.5L Indenture and (b) extend the 1.5L Grace Period from five business days to 30 days (which would include the existing interest payment default as further described above) (the “Proposed 1.5L Waiver and Amendment”).

The Consent Solicitation will expire at 5:00 p.m., New York City time, on February 7, 2024, unless extended or earlier terminated by the Company in its sole discretion (such date and time, as the same may be extended, the “Expiration Date”).

If the Holders of at least a majority in aggregate principal amount of the 1.5L Notes outstanding (the “1.5L Required Consents”) validly deliver consents to the Proposed 1.5L Waiver and Amendment and do not validly revoke such consents prior to the Consent Effective Time (as defined below), and all other conditions have been satisfied or waived by the Company on or prior to the Expiration Date, it is expected that the Company, the 1.5L Indenture guarantors and the 1.5L Indenture trustee will execute a supplemental indenture (the “Supplemental Indenture”) effecting the Proposed 1.5L Waiver and Amendment (such time of

execution, which may occur earlier than the Expiration Date, the “Consent Effective Time”). The Supplemental Indenture will be effective as to all Holders at the Consent Effective Time, whether or not a Holder delivered a consent.

A copy of the Company’s press release announcing the Consent Solicitation is furnished herewith as Exhibit 99.2 and is incorporated herein by reference. The information contained in this Item 7.01 and Exhibit 99.2 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, and shall not be incorporated by reference into any filings under the Securities Act, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Securitization Facilities

As a result of potential noncompliance with the respective liquidity covenants contained in the Company’s securitization facilities, each of which is described in the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 2, 2023, events of default may occur under the Company’s securitization facilities. As a result of the failure to make the interest payments in respect of the Notes described above, defaults similar to the 1.0L Cross Default have occurred under certain of the Company’s securitization facilities.

Stakeholder Discussions

The Company and its advisors are currently engaged in discussions with certain of its key lenders and other stakeholders regarding a potential comprehensive financial restructuring to strengthen the Company’s balance sheet and financial position. However, at this time, no agreement has been reached regarding such financial restructuring.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. These forward-looking statements include assumptions about various matters, such as the potential events of default as described above, the Consent Solicitation, the Company’s discussions with certain of its key lenders and other stakeholders and the outcome or timing of such process. In addition, words such as “guidance,” “estimate,” “anticipate,” “believe,” “forecast,” “step,” “plan,” “predict,” “focused,” “project,” “is likely,” “expect,” "anticipate," “intend,” “should,” “will,” “confident,” variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions, judgments and other factors, both within and outside of our control, that could cause actual results to differ materially from those in the forward-looking statements, including, the risk that the Company will determine it is not in compliance with certain financial covenants contained in the 1.0L Credit Agreement, the 1.5L Indenture and its securitization facilities and the resulting events of default and cross-default that may result therefrom, the risk that the Company will not obtain the 1.5L Required Consents with respect to the Consent Solicitation, the risk that the Company will be unable to execute on a comprehensive financial restructuring and the risk that the Company’s discussions with its lenders and other stakeholders will be unduly delayed or unsuccessful, as well as other factors discussed in our filings with the Securities and Exchange Commission. These projections, estimates and assumptions may prove to be inaccurate in the future. These forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. There may be additional risks that we presently do not know or that we currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. We undertake no obligation to update, amend or clarify any forward-looking statement for any reason.

ITEM 9.01 Financial Statements and Exhibits

(d). Exhibits

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 5th day of February, 2024.

CURO Group Holdings Corp.

By: /s/ Ismail Dawood______

Ismail Dawood

Chief Financial Officer

CURO Group Holdings Corp. Reports Preliminary

Fourth Quarter and Full Year 2023 Financial Results

-Gross loans receivables increased 3.3%, year-over-year, and 3.3%, sequentially, to $1.3 billion-

-Total fourth quarter revenue of $168.2 million-

-Net charge-off improvement of 440 bps, year-over-year, and 120 bps, sequentially, to 16.5%-

-Cancels earnings conference call previously scheduled for Wednesday, February 7, 2024 -

Chicago, Illinois--February 5, 2024 - CURO Group Holdings Corp. (NYSE: CURO) (“CURO” or the “Company”), an omni-channel consumer finance company serving consumers in the U.S. and Canada, today announced preliminary financial results for its fourth quarter and full year ended December 31, 2023.

"Throughout 2023, we executed on our plan to enhance our underwriting and credit performance and simplify our overall operations, including consolidating our U.S. footprint onto one loan management system and further scaling our data and technological capabilities," said Doug Clark, Chief Executive Officer at CURO. "As a result, we showed improvement in our delinquency and charge-off performance, as well as a marked reduction in our operating expenses. As we continue to execute on our long-term U.S. and Canadian strategy, we are engaged in constructive dialogue with our lenders to strengthen our balance sheet and better position CURO for growth and success. We are proud of the foundation we laid in 2023 and look forward to building on this momentum in 2024. We thank our CURO employees for their dedication and hard work as we move forward.”

Preliminary Fourth Quarter 2023 Consolidated Summary Results

Current and prior period financial information is presented on a continuing operations basis, which excludes the Canada POS Lending segment due to the sale of Flexiti on August 31, 2023.

•Gross loans receivable of $1.3 billion increased $41.3 million, or 3.3%, sequentially, and $41.3 million, or 3.3%, year-over-year.

◦Gross loans receivable in the U.S. were stable year-over-year, with increases in larger balance and longer-term loans offset by reductions in smaller balance and shorter-term loans. Sequentially, Gross loans receivable in the U.S. increased $23.1 million, or 3.1%, due to increases in larger balance and longer-term loans.

◦Gross loans receivable in Canada increased by $39.7 million, or 8.3%, year-over-year, and $18.2 million, or 3.6%, sequentially, driven by increases in Canadian Revolving LOC loans and favorable foreign currency exchange rates.

•Total revenue of $168.2 million declined $13.7 million, or 7.6%, year-over-year, primarily related to the mix shift to larger, longer-term, higher credit and lower yielding loans. Sequentially, total revenue increased by $0.3 million, or 0.2%.

•Net revenue of $110.5 million increased $6.3 million, or 6.0%, year-over-year, primarily driven by a $20.0 million, or 25.8%, decrease in provision for credit loss expense related to the mix shift to larger and longer-term loans to higher credit quality customers and enhanced collections efforts, partially offset by the reduction in Total revenue. Sequentially, Net revenue decreased $8.4 million, or 7.0%, primarily driven by additional provision for credit loss expense due to new loans originated during the fourth quarter, partially offset by the improvement in net charge-off rate.

•Net charge-off rate of 16.5% improved 440 bps, year-over-year, and improved 120 bps sequentially, driven by increased credit quality as a result of the product mix shift, credit tightening and servicing optimization.

•Total operating expenses of $91.2 million decreased $20.4 million, or 18.3%, year-over-year, and $3.0 million, or 3.1%, sequentially.

| | | | | | | | | | | | | | | | | |

| As of or for the Quarter Ended |

(unaudited) | Dec 31, | Sep 30, | Jun 30, | Mar 31, | Dec 31, |

Delinquency and Loss Ratios | 2023 | 2023 | 2023 | 2023 | 2022 |

| 31-60 days delinquency ratio | 2.2 | % | 2.4 | % | 2.5 | % | 2.1 | % | 2.4 | % |

| 61-90 days delinquency ratio | 1.6 | % | 1.7 | % | 1.7 | % | 1.8 | % | 1.8 | % |

| 91+ days delinquency ratio | 4.6 | % | 4.4 | % | 4.1 | % | 4.4 | % | 3.4 | % |

| Net charge-offs | 16.5 | % | 17.7 | % | 18.8 | % | 15.6 | % | 20.9 | % |

Conference Call Cancellation and Consent Solicitation

In a separate press release issued today, CURO announced the commencement of a consent solicitation from the holders of its 7.500% Senior 1.5 Lien Senior Secured Notes Due 2028. As a result, CURO has cancelled its earnings conference call previously scheduled for 8:00 a.m. Eastern Time on Wednesday, February 7, 2024.

Preliminary Results

The financial results presented and discussed herein are on a preliminary and unaudited basis; final audited data will be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

About CURO

CURO Group Holdings Corp. (NYSE: CURO) is a leading consumer credit lender serving U.S. and Canadian customers for over 25 years. Our roots in the consumer finance market run deep. We’ve worked diligently to provide customers a variety of convenient, easily accessible financial services. Our decades of diversified data power a hard-to-replicate underwriting and scoring engine, mitigating risk across the full spectrum of credit products. We operate under a number of brands including Cash Money®, LendDirect®, Heights Finance, Southern Finance, Covington Credit, Quick Credit and First Heritage Credit. For more information, please visit http://www.curo.com.

Table 1 - Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data, unaudited) | | Three Months Ended, | | | Year Ended, |

| Dec 31, | Sep 30, | Jun 30, | Mar 31, | Dec 31, | | | Dec 31, | |

| 2023 | 2023 | 2023 | 2023 | 2022 | | | 2023 | |

| | | | | | | | | | |

| Revenue | | | | | | | | | | |

| Interest and fees revenue | | $ | 142,239 | | $ | 143,493 | | $ | 141,766 | | $ | 144,304 | | $ | 150,350 | | | | 571,802 | | |

| Insurance and other income | | 25,940 | | 24,370 | | 25,250 | | 25,064 | | 31,575 | | | | 100,624 | | |

| Total revenue | | 168,179 | | 167,863 | | 167,016 | | 169,368 | | 181,925 | | | | 672,426 | | |

| Provision for losses | | 57,689 | | 49,009 | | 63,755 | | 48,364 | | 77,724 | | | | 218,817 | | |

| Net revenue | | 110,490 | | 118,854 | | 103,261 | | 121,004 | | 104,201 | | | | 453,609 | | |

| Operating Expenses | | | | | | | | | | |

| Salaries and benefits | | 49,537 | | 52,148 | | 53,144 | | 56,619 | | 60,149 | | | | 211,448 | | |

| Occupancy | | 11,277 | | 10,454 | | 10,885 | | 11,344 | | 11,785 | | | | 43,960 | | |

| Advertising | | 2,435 | | 2,819 | | 1,967 | | 1,999 | | 3,383 | | | | 9,220 | | |

| Direct operations | | 11,496 | | 12,176 | | 12,032 | | 9,745 | | 7,921 | | | | 45,449 | | |

| Depreciation and amortization | | 5,578 | | 5,390 | | 5,339 | | 5,390 | | 5,329 | | | | 21,697 | | |

| Other operating expense | | 10,915 | | 11,207 | | 7,918 | | 18,054 | | 23,065 | | | | 48,094 | | |

| Total operating expenses | | 91,238 | | 94,194 | | 91,285 | | 103,151 | | 111,632 | | | | 379,868 | | |

Other expense | | | | | | | | | | |

| Interest expense | | 58,341 | | 55,798 | | 50,460 | | 44,045 | | 41,180 | | | | 208,644 | | |

| Loss from equity method investment | | 3,310 | | 1,453 | | 2,134 | | 3,413 | | 1,932 | | | | 10,310 | | |

| Goodwill Impairment | | — | | — | | — | | — | | 107,827 | | | | — | | |

| Extinguishment or modification of debt costs | | — | | — | | 8,864 | | — | | 24 | | | | 8,864 | | |

| Gain on sale of business | | — | | — | | — | | 2,027 | | — | | | | 2,027 | | |

| Miscellaneous expenses | | — | | — | | 1,435 | | — | | — | | | | 1,435 | | |

Total other expense | | 61,651 | | 57,251 | | 62,893 | | 49,485 | | 150,963 | | | | 231,280 | | |

Loss from continuing operations before income taxes | | (42,399) | | (32,591) | | (50,917) | | (31,632) | | (158,394) | | | | (157,539) | | |

Provision (benefit) for income taxes from continuing operations | | 1,094 | | 1,021 | | 3,147 | | 23,277 | | (15,970) | | | | 28,539 | | |

Net loss from continuing operations | | $ | (43,493) | | $ | (33,612) | | $ | (54,064) | | $ | (54,909) | | $ | (142,424) | | | | $ | (186,078) | | |

Net loss from discontinued operations | | — | | (70,830) | | (5,263) | | (4,562) | | (43,969) | | | | (80,655) | | |

Net loss | | $ | (43,493) | | $ | (104,442) | | $ | (59,327) | | $ | (59,471) | | $ | (186,393) | | | | $ | (266,733) | | |

| | | | | | | | | | |

Basic loss per share: | | | | | | | | | | |

| Continuing operations | | $ | (1.05) | | $ | (0.81) | | $ | (1.32) | | $ | (1.35) | | $ | (3.52) | | | | $ | (4.53) | | |

| Discontinued operations | | $ | — | | $ | (1.72) | | $ | (0.13) | | $ | (0.11) | | $ | (1.09) | | | | $ | (1.96) | | |

| | | | | | | | | | |

Diluted loss per share: | | | | | | | | | | |

| Continuing operations | | $ | (1.05) | | $ | (0.81) | | $ | (1.32) | | $ | (1.35) | | $ | (3.52) | | | | $ | (4.53) | | |

| Discontinued operations | | $ | — | | $ | (1.72) | | $ | (0.13) | | $ | (0.11) | | $ | (1.09) | | | | $ | (1.96) | | |

| | | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | |

| Basic | | 41,317 | | 41,267 | | 41,002 | | 40,783 | | 40,428 | | | | 41,093 | | |

| Diluted | | 41,317 | | 41,267 | | 41,002 | | 40,783 | | 40,428 | | | | 41,093 | | |

Table 2 - Consolidated Balance Sheets

| | | | | | | | | | | | | | | | | |

| As of |

| Dec 31, | Sep 30, | Jun 30, | Mar 31, | Dec 31, |

| (in thousands, unaudited) | 2023 | 2023 | 2023 | 2023 | 2022 |

| ASSETS |

| Cash and cash equivalents | $ | 84,594 | | $ | 82,550 | | $ | 101,033 | | $ | 40,449 | | $ | 50,856 | |

| Restricted cash | 48,008 | | 53,818 | | 76,375 | | 90,211 | | 59,645 | |

| Gross loans receivable | 1,295,660 | | 1,254,401 | | 1,227,615 | | 1,209,576 | | 1,254,395 | |

Less: Allowance for credit losses | (206,227) | | (199,739) | | (210,292) | | (202,757) | | (81,185) | |

| Loans receivable, net | 1,089,433 | | 1,054,662 | | 1,017,323 | | 1,006,819 | | 1,173,210 | |

| Income taxes receivable | 54,986 | | 58,064 | | 20,854 | | 22,737 | | 23,984 | |

| Prepaid expenses and other | 45,221 | | 61,441 | | 42,131 | | 45,592 | | 51,081 | |

| Property and equipment, net | 22,206 | | 23,903 | | 25,826 | | 27,244 | | 29,232 | |

| Investment in Katapult | 13,605 | | 16,915 | | 18,368 | | 20,502 | | 23,915 | |

| Right of use asset - operating leases | 49,606 | | 51,413 | | 53,042 | | 51,615 | | 58,177 | |

| Deferred tax assets | 13,248 | | 14,194 | | 15,304 | | 13,623 | | 18,138 | |

| Goodwill | 276,951 | | 276,269 | | 277,069 | | 276,487 | | 276,269 | |

| Intangibles, net | 75,301 | | 74,336 | | 74,007 | | 71,798 | | 70,913 | |

| Other assets | 9,745 | | 9,387 | | 6,673 | | 6,785 | | 8,370 | |

| Assets, discontinued operations | — | | — | | 1,016,832 | | 947,925 | | 945,403 | |

| Total Assets | $ | 1,782,904 | | $ | 1,776,952 | | $ | 2,744,837 | | $ | 2,621,787 | | $ | 2,789,193 | |

LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY |

| Liabilities | | | | | |

| Accounts payable and accrued liabilities | $ | 56,800 | | $ | 62,992 | | $ | 54,169 | | $ | 60,890 | | $ | 45,595 | |

| Deferred revenue | 2,298 | | 2,358 | | 3,370 | | 3,493 | | 3,467 | |

| Lease liability - operating leases | 51,715 | | 51,579 | | 53,182 | | 52,061 | | 59,396 | |

| Income taxes payable | 3,552 | | 2,537 | | (1,242) | | — | | — | |

| Accrued interest | 40,792 | | 20,953 | | 39,306 | | 20,090 | | 38,460 | |

| Debt | 2,055,853 | | 2,024,934 | | 1,988,173 | | 1,888,407 | | 1,882,608 | |

| Other long-term liabilities | 7,595 | | 9,620 | | 10,017 | | 10,045 | | 11,736 | |

| Liabilities, discontinued operations | — | | — | | 866,235 | | 815,617 | | 802,065 | |

| Total Liabilities | $ | 2,218,605 | | $ | 2,174,973 | | $ | 3,013,210 | | $ | 2,850,603 | | $ | 2,843,327 | |

Total Stockholders' Deficit | (435,701) | | (398,021) | | (268,373) | | (228,816) | | (54,134) | |

| Total Liabilities and Stockholders' (Deficit) Equity | $ | 1,782,904 | | $ | 1,776,952 | | $ | 2,744,837 | | $ | 2,621,787 | | $ | 2,789,193 | |

| | | | | |

|

Table 3 - Consolidated Portfolio Performance

| | | | | | | | | | | | | | | | | | | | |

| (in thousands, except percentages, unaudited) | | Q4 2023 | Q3 2023 | Q2 2023 | Q1 2023 | Q4 2022 |

Gross loans receivable | | | | | | |

| Revolving LOC | | $ | 488,932 | $ | 469,041 | $ | 472,902 | $ | 461,443 | $ | 451,077 |

| Installment loans | | 806,728 | 785,360 | 754,713 | 748,133 | 803,318 |

| Total gross loans receivable | | $ | 1,295,660 | $ | 1,254,401 | $ | 1,227,615 | $ | 1,209,576 | $ | 1,254,395 |

| | | | | | |

| Lending Revenue | | | | | | |

| Revolving LOC | | $ | 50,794 | $ | 51,039 | $ | 49,483 | $ | 49,092 | $ | 49,915 |

| Installment loans | | 91,445 | 92,454 | 92,283 | 95,212 | 100,435 |

| Total lending revenue | | $ | 142,239 | $ | 143,493 | $ | 141,766 | $ | 144,304 | $ | 150,350 |

| | | | | | |

| Lending Provision | | | | | | |

| Revolving LOC | | $ | 20,131 | $ | 19,031 | $ | 27,089 | $ | 15,539 | $ | 29,620 |

| Installment loans | | 36,269 | 28,464 | 35,171 | 31,139 | 46,442 |

| Total lending provision | | $ | 56,400 | $ | 47,495 | $ | 62,260 | $ | 46,678 | $ | 76,062 |

| | | | | | |

NCOs | | | | | | |

| Revolving LOC | | $ | 19,989 | $ | 22,023 | $ | 21,780 | $ | 6,234 | $ | 26,715 |

| Installment loans | | 32,908 | 33,342 | 35,483 | 41,078 | 38,168 |

| Total NCOs | | $ | 52,897 | $ | 55,365 | $ | 57,263 | $ | 47,312 | $ | 64,883 |

| | | | | | |

NCO rate (annualized) (1) | | | | | | |

| Revolving LOC | | 16.6% | 18.6% | 18.7% | 5.5% | 23.8% |

| Installment loans | | 16.4% | 17.2% | 18.9% | 21.5% | 19.3% |

| Total NCO rate | | 16.5% | 17.7% | 18.8% | 15.6% | 20.9% |

| | | | | | |

ACL rate (2) (3) | | | | | | |

| Revolving LOC | | 25.0% | 25.4% | 26.6 | % | 25.6 | % | 8.4 | % |

| Installment loans | | 10.4% | 10.3% | 11.2 | % | 11.3 | % | 5.4 | % |

| Total ACL rate | | 15.9% | 15.9% | 17.1 | % | 16.8 | % | 6.5 | % |

| | | | | | |

31+ days past-due rate (2) | | | | | | |

| Revolving LOC | | 8.0% | 8.6% | 8.5 | % | 8.4 | % | 4.1 | % |

| Installment loans | | 8.6% | 8.5% | 8.1 | % | 8.2 | % | 9.6 | % |

| Total past-due rate | | 8.3% | 8.5% | 8.3 | % | 8.3 | % | 7.6 | % |

| | | | | | |

| (1) We calculate NCO rate as total quarterly NCOs divided by Average gross loans receivable, then we annualize the rate. The amount and timing of recoveries are impacted by our collection strategies, which are based on customer behavior and risk profile and include direct customer communications and the periodic sale of charged off loans. |

(2) We calculate (i) ACL rate and (ii) 31+ days past-due rate as the respective totals divided by gross loans receivable at each quarter end. |

(3) We adopted ASU 2016-13, "Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments" on January 1, 2023, which requires us to estimate the lifetime expected credit loss on financial instruments. Our previous model required the recognition of credit losses when it was probable that a loss had been incurred. |

Forward-Looking Statements

This press release contains forward-looking statements. These forward-looking statements include projections, estimates and assumptions about various matters, such as future financial and operational performance, including our plans to address our liquidity and debt obligations and executing on our long-term U.S. and Canadian strategy. In addition, words such as “guidance,” “estimate,” “anticipate,” “believe,” “forecast,” “step,” “plan,” “predict,” “focused,” “project,” “is likely,” “expect,” "anticipate," “intend,” “should,” “will,” “confident,” variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions, judgments and other factors, both within and outside of our control, that could cause actual results to differ materially from those in the forward-looking statements, including: risks relating to the uncertainty of projected financial and operational information and forecasts, including errors in our internal forecasts; our ability to manage growth; our dependence on third-party lenders to provide the cash we need to fund our loans and our ability to affordably access third-party financing; our level of indebtedness; the effects of competition on our business; our ability to attract and retain customers; global economic, market, financial, political or health conditions or events; actions of regulators and the impact of those actions on our business; our ability to protect our proprietary technology and analytics and keep up with that of our competitors; disruption of our information technology systems that adversely affect our business operations;

ineffective pricing of the credit risk of our prospective or existing customers; inaccurate information supplied by customers or third parties that could lead to errors in judging customers’ qualifications to receive loans; improper disclosure of customer personal data; failure of third parties who provide products, services or support to us; disruption to our relationships with banks and other third-party electronic payment solutions providers as well as other factors discussed in our filings with the Securities and Exchange Commission. These projections, estimates and assumptions may prove to be inaccurate in the future. These forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. There may be additional risks that we presently do not know or that we currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. We undertake no obligation to update, amend or clarify any forward-looking statement for any reason.

Investor Relations:

Email: IR@curo.com

(CURO-NWS)

CURO Group Holdings Corp. Announces Consent Solicitation for 7.500% Senior 1.5 Lien Secured Notes Due 2028

Chicago, Illinois – February 5, 2024 – CURO Group Holdings Corp. (NYSE: CURO) (“CURO” or the “Company”), an omni-channel consumer finance company serving consumers in the U.S. and Canada, today announced that it is soliciting consents (the “Consent Solicitation”) from all registered holders (individually, a “Holder,” and collectively, the “Holders”) of its outstanding 7.500% Senior 1.5 Lien Secured Notes due 2028 (the “Notes”), issued pursuant to the Indenture, dated as of May 15, 2023 (the “Indenture”), among the Company, the guarantors party thereto (the “Guarantors”) and U.S. Bank Trust Company, National Association, as trustee and collateral agent (the “Trustee”).

The purpose of the Consent Solicitation is to obtain the consent of the Holders to (a) waive the potential default under the Indenture arising from the Company’s potential failure to maintain liquidity equal to or greater than $75,000,000 as of January 31, 2024 and (b) extend the grace period for an interest payment default under the Indenture to 30 days (which would include the existing default that has occurred under Section 7.01(a) of the Indenture as a result of the Company’s failure to make the interest payment due under the Indenture on February 1, 2024) (the “Proposed Waiver and Amendment”).

Certain information regarding the Notes is set forth in the table below.

| | | | | | | | |

| Title of Security | CUSIP and ISIN Numbers | Principal Amount Outstanding |

| 7.500% Senior 1.5 Lien Secured Notes due 2028 | 23131L AE7 and U12727 AD2; US23131LAE74 and USU12727AD21 | $682,298,000 |

The Consent Solicitation will expire at 5:00 p.m., New York City time, on February 7, 2024, unless extended or earlier terminated by the Company in its sole discretion (such date and time, as the same may be extended, the “Expiration Date”).

If the Holders of at least a majority in aggregate principal amount of Notes outstanding (the “Required Consents”) validly deliver consents to the Proposed Waiver and Amendment and do not validly revoke such consents prior to the Consent Effective Time (as defined below), and all other conditions have been satisfied or waived by the Company on or prior to the Expiration Date, it is expected that the Company, the Guarantors and the Trustee will execute a supplemental indenture (the “Supplemental Indenture”) effecting the Proposed Waiver and Amendment (such time of execution, which may occur earlier than the Expiration Date the “Consent Effective Time”). The Supplemental Indenture will be effective as to all Holders at the Consent Effective Time, whether or not a Holder delivered a consent.

Consents may be validly revoked at any time prior to the Consent Effective Time, but not thereafter. Consents to the Proposed Waiver and Amendment shall not be revoked at any time after the Consent Effective Time, even if the Expiration Date is later than the Consent Effective Time.

Holders who deliver their consents pursuant to the Consent Solicitation Statement will not be entitled to any consent payment.

For a complete statement of the terms and conditions of the Consent Solicitation and the Proposed Waiver and Amendment, Holders should refer to the Consent Solicitation Statement.

Any questions or requests for assistance concerning the Consent Solicitation or requests for additional copies of the Consent Solicitation Statement may be directed to Epiq Corporate Restructuring, LLC, the information agent and tabulation agent in connection with the Consent Solicitation, at Epiq Corporate Restructuring, LLC, 777 Third Avenue, 12th Floor, New York, New York 10017, Attention: Solicitation

Group, by telephone at (646) 362-6336 or by email at tabulation@epiqglobal.com (with the reference to “CURO” in the subject line).

This press release is for informational purposes only and is neither an offer to sell nor a solicitation of an offer to buy any security. This announcement is also not a solicitation of consents with respect to the Proposed Waiver and Amendment or otherwise. The Consent Solicitation is being made solely through the Consent Solicitation Statement referred to above and related materials. The Consent Solicitation is not being made to Holders in any jurisdiction in which the Company is aware that the making of the Consent Solicitation would be unlawful. In any jurisdiction in which applicable law requires the Consent Solicitation to be made by a licensed broker or dealer, the Consent Solicitation will be deemed to be made on the Company's behalf by the information agent and tabulation agent or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements. These forward-looking statements include assumptions about various matters, such as the Consent Solicitation. In addition, words such as “guidance,” “estimate,” “anticipate,” “believe,” “forecast,” “step,” “plan,” “predict,” “focused,” “project,” “is likely,” “expect,” "anticipate," “intend,” “should,” “will,” “confident,” variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions, judgments and other factors, both within and outside of our control, that could cause actual results to differ materially from those in the forward-looking statements, including the risk that the Company will not obtain the Required Consents with respect to the Consent Solicitation, as well as other factors discussed in our filings with the Securities and Exchange Commission. These forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. There may be additional risks that we presently do not know or that we currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. We undertake no obligation to update, amend or clarify any forward-looking statement for any reason.

About CURO

CURO Group Holdings Corp. (NYSE: CURO) is a leading consumer credit lender serving U.S. and Canadian customers for over 25 years. Our roots in the consumer finance market run deep. We’ve worked diligently to provide customers a variety of convenient, easily accessible financial services. Our decades of diversified data power a hard-to-replicate underwriting and scoring engine, mitigating risk across the full spectrum of credit products. We operate under a number of brands including Cash Money®, LendDirect®, Heights Finance, Southern Finance, Covington Credit, Quick Credit and First Heritage Credit.

(CURO-NWS)

Investor Relations:

Email: IR@curo.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

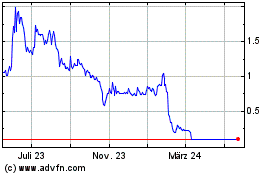

CURO (NYSE:CURO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

CURO (NYSE:CURO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024