Caterpillar Returns to Growth as Global Recovery Continues

25 Januar 2018 - 3:07PM

Dow Jones News

By Andrew Tangel

Caterpillar Inc.'s revenue rose 18% in 2017, breaking a

four-year streak of declining sales for the world's largest maker

of heavy machinery.

This year the Deerfield, Ill.-based manufacturer expects its

construction, mining and energy markets around the globe to

continue gaining strength.

Still, Caterpillar reported a loss in the fourth quarter, as it

booked a one-time charge related to changes to the U.S. tax code

signed into law by President Donald Trump in late December.

The company booked a $2.4 billion charge related to repatriation

of foreign profits and write downs of reduced deferred tax assets.

Still, the company told investors that it would benefit in the long

term through a lower corporate tax rate, greater ability to access

overseas cash and a more equal playing field between it and foreign

competitors. Caterpillar had $16 billion in overseas profits at the

end of 2016.

"After four challenging years, many key markets improved in

2017," Chief Executive Jim Umpleby said.

Shares rose 3.1% in premarket trading.

Caterpillar's mining and construction markets around the world

showed signs of turnaround throughout 2017. The company said

Wednesday a rolling three-month average of global retail sales of

its machinery rose 34% in December, up from 26% in November.

Mr. Umpleby, who took over his current job at that start of

2017, has said a prime focus under his watch would be profitable

growth, rather than only increasing revenue.

For 2018, the company expects to report adjusted earnings per

share of $8.25 to $9.25, above both the $8.19 that had been

expected by Wall Street analysts and the $6.88 in adjusted earnings

per share in 2017.

While the company cheered the new tax law's benefits,

Caterpillar's earnings report said nothing about a Swiss subsidy

that is at the center of a tax structure that has been under

criminal investigation. Federal agents raided Caterpillar's

headquarters and two other locations last year in the probe, which

is focused on taxes and exports. The company hasn't been accused of

wrongdoing and has said it believes its tax position is

correct.

Overall for the fourth quarter, the company reported a loss of

$1.3 billion, or $2.18 per share, compared with a loss of $1.17

billion, or $2 a share, a year ago. On an adjusted basis, which

strips out the impact of the tax charge and other factors, the

company earned $2.16 a share

Wall Street analysts expected adjusted earnings per share of

$1.79, according to Thomson Reuters.

Caterpillar said revenue rose 35% in the quarter to $12.9

billion. Analysts expected $11.98 billion. In 2017, revenue

increased to $45.5 billion.

The company added 4,800 jobs in the U.S. last year, a shift

following years of deep cuts in its domestic workforce. Caterpillar

said its domestic workforce rose to 50,500 employees, up from

49,700 at the end of September.

Austen Hufford contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

January 25, 2018 08:52 ET (13:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

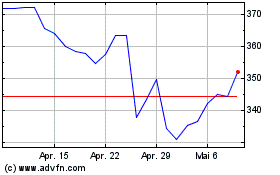

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

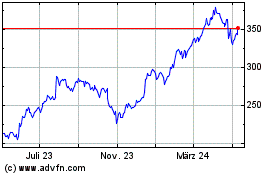

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024