Brookfield Infrastructure Announces Reorganization of Brookfield Infrastructure Corporation

09 Oktober 2024 - 11:41PM

Brookfield Infrastructure Partners L.P. (NYSE: BIP; TSX: BIP.UN)

(the “Partnership”) and Brookfield Infrastructure Corporation

(“BIPC”) (TSX, NYSE: BIPC) today announced their intention to

complete a reorganization (the “Arrangement”) that maintains the

benefits of Brookfield Infrastructure’s business structure, while

addressing proposed amendments to the Income Tax Act (Canada) that

are expected to result in additional costs to BIPC if no action is

taken.

BIPC was created by the Partnership in 2020 to

provide investors with an opportunity to gain access to the

Partnership’s globally diversified portfolio of high-quality

infrastructure assets through a corporate structure. BIPC provides

shareholders with the benefits of broader index inclusion, a

differentiated investor base, improved trading liquidity, a

simplified tax reporting framework and higher after-tax yield for

certain shareholders.

Since the initial listing of BIPC, the market

capitalization of Brookfield Infrastructure has grown from $17

billion to $29 billion and the average daily trading volume has

doubled. Our investor base has tripled in size and is more diverse,

with U.S. and non-Canadian investors now representing over 55% of

our investor base.

Following the Arrangement, BIPC shareholders

will own an economically equivalent security that provides the same

economic benefits and governance of investing in our company today.

The Arrangement is also expected to be tax-deferred for the vast

majority of investors, including Canadian and U.S.

shareholders.

The Arrangement will be implemented pursuant to

a court-approved plan of arrangement and will require shareholder

approval. A management information circular outlining the

transaction in detail is expected to be mailed to BIPC shareholders

at the end of October, in advance of a special meeting of

shareholders (the “Meeting”) to be held virtually on December 3,

2024 at 8:00 a.m. (Eastern time). Shareholders of record as of the

close of business on October 21, 2024 will be entitled to vote at

the Meeting. Subject to the receipt of court and shareholder

approval, and the satisfaction of certain other customary

conditions, it is anticipated that the Arrangement will be

completed in the fourth quarter of 2024. The newly issued class A

exchangeable subordinate voting shares are expected to be listed on

the Toronto Stock Exchange and New York Stock Exchange and will

trade under the same “BIPC” symbol.

The BIPC Nominating and Governance Committee

unanimously determined that the Arrangement is in the best

interests of the corporation and recommended that the BIPC board of

directors (the “Board”) approve the Arrangement and recommend that

holders of exchangeable shares vote in favour of the

Arrangement.

The Board1, on the recommendation of the

Nominating and Governance Committee, determined that the

Arrangement is in the best interest of BIPC and unanimously

resolved to approve the Arrangement and recommend that holders of

exchangeable shares vote in favour of the Arrangement. In making

its determination, the Board considered, among other factors, the

fairness opinion of RBC Dominion Securities Inc. (“RBC”) to the

effect that, as of October 9, 2024 and subject to the assumptions,

limitations and qualifications described therein, the consideration

to be received by Public Holders (as defined in RBC’s fairness

opinion) of exchangeable shares pursuant to the Arrangement is

fair, from a financial point of view to such shareholders. A copy

of the fairness opinion will be included in the management

information circular.

Investors in the Partnership will not be

impacted by the Arrangement and are not required to approve the

Arrangement or take any other action.

Copies of the management information circular,

the arrangement agreement, the plan of arrangement and certain

related documents will be filed with the applicable Canadian

securities regulators and with the United States Securities and

Exchange Commission and will be available on SEDAR+ at

https://sedarplus.ca and on EDGAR at https://sec.gov.

– ends –

About Brookfield Infrastructure

Brookfield Infrastructure is a leading global

infrastructure company that owns and operates high-quality,

long-life assets in the utilities, transport, midstream and data

sectors across the Americas, Asia Pacific and Europe. We are

focused on assets that have contracted and regulated revenues that

generate predictable and stable cash flows. Investors can access

its portfolio either through Brookfield Infrastructure Partners

L.P. (NYSE: BIP; TSX: BIP.UN), a Bermuda-based limited partnership,

or Brookfield Infrastructure Corporation (NYSE, TSX: BIPC), a

Canadian corporation. Further information is available at

https://bip.brookfield.com.

Brookfield Infrastructure is the flagship listed

infrastructure company of Brookfield Asset Management, a global

alternative asset manager with approximately $1 trillion of assets

under management. For more information, go to

https://brookfield.com.

Contact Information

| Media: |

Investors: |

| Simon Maine |

Stephen Fukuda |

| Managing Director |

Senior Vice President |

| Corporate Communications |

Corporate Development &

Investor Relations |

| Tel: +44 739 890 9278 |

Tel: +1 416 956 5129 |

| Email:

simon.maine@brookfield.com |

Email:

stephen.fukuda@brookfield.com |

| |

|

Cautionary Statement Regarding

Forward-looking Statements

This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. The words, “will”, “intend” and “expect” or

derivations thereof and other expressions which are predictions of

or indicate future events, trends or prospects, and which do not

relate to historical matters, identify forward-looking statements.

Forward-looking statements in this news release include statements

regarding the Partnership and BIPC’s beliefs on certain benefits of

the Arrangement and the anticipated tax treatment of the proposed

transaction for BIPC and its shareholders resident in Canada and

the U.S. Factors that could cause actual results, performance,

achievements or events to differ from current expectations include,

among others, risks and uncertainties related to: obtaining

approvals, rulings, court orders, or satisfying other requirements,

necessary or desirable to permit or facilitate completion of the

Arrangement (including regulatory and shareholder approvals);

future factors that may arise making it inadvisable to proceed

with, or advisable to delay, all or part of the Arrangement; the

potential benefits of the Arrangement; and business cycles,

including general economic conditions. Although Brookfield

Infrastructure believes that these forward-looking statements and

information are based upon reasonable assumptions and expectations,

the reader should not place undue reliance on them, or any other

forward-looking statements or information in this news release. The

future performance and prospects of Brookfield Infrastructure are

subject to a number of known and unknown risks and

uncertainties.

Factors that could cause actual results of

Brookfield Infrastructure to differ materially from those

contemplated or implied by the statements in this news release are

described in the documents filed by Brookfield Infrastructure with

the securities regulators in Canada and the United States including

under “Risk Factors” in each of the Partnership’s and BIPC’s most

recent Annual Report on Form 20-F and other risks and factors that

are described therein. Certain risks and uncertainties specific to

the proposed Arrangement will be further described in the

management information circular to be mailed to shareholders in

advance of the Meeting. Except as required by law, Brookfield

Infrastructure undertakes no obligation to publicly update or

revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise. All

references to “$” or “dollars” are to U.S. dollars.

________________________________

1 Excluding Jeffrey Blidner who, as Vice Chair of Brookfield

Corporation, recused himself from voting.

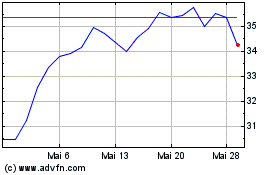

Brookfield Infrastructure (NYSE:BIPC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Brookfield Infrastructure (NYSE:BIPC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025