Brown-Forman Stays Neutral - Analyst Blog

20 Juli 2012 - 8:55PM

Zacks

We are maintaining our long-term

Neutral recommendation on Brown-Forman Corporation

(BF.B). Moreover, the company has a Zacks #3 Rank implying a

short-term Hold rating.

Battered by higher excise tax along

with increased operating expenses, Brown-Forman reported a weak

fourth-quarter 2012 results with earnings falling 5.2% to 73 cents

per share, missing the Zacks Consensus Estimate of 76 cents.

Moreover, the company’s net sales of $801.3 million also fell short

of the Zacks Consensus Estimate of $805 million, but managed to

register a year- over-year growth of 1%.

Moreover,gross profit margin shrunk

90 basis points (bps) to 52.6% due to increased excise taxes, while

higher advertising and selling, general and administrative

(SG&A) expenses led to a contraction of 60 bps in operating

margin to 19.6%.

However, Brown-Forman expects solid

improvement in customer trends in the remaining period of fiscal

2013. Moreover, based on high-single digit growth expectation in

net sales and operating income, the company anticipates fiscal 2013

earnings in the range of $3.60 to $4.00 per share.

Further, we believe Brown-Forman’s

strategy of expanding Jack Daniel's market share in the developed

markets, such as France and the U.S., and emerging markets

including Russia, Poland and Mexico, where the whiskey category is

in early stages of development, will boost its top line. In

addition, the company’s plan to build new cooperage for

manufacturing barrels for Jack Daniel’s Tennessee Whiskey will

facilitate it in continuing supply of this premium whiskey along

with its demand.

Brown-Forman is one of the leading

producers and distributors of premium alcoholic beverages in the

world. The company commands a strong portfolio of globally

recognized brands, such as Jack Daniel’s, Finlandia, Southern

Comfort and Canadian Mist. This provides a competitive edge to the

company and bolsters its well-established position in the

market.

However, continued macroeconomic

headwinds and the resultant cutback in discretionary spending along

with intense competition from other well-established players in the

industry, including Beam Inc. (BEAM) and

Diageo plc (DEO) may weigh upon the company’s

growth prospects.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

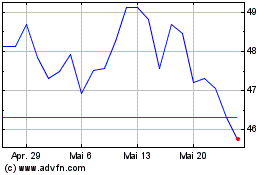

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024