Brown-Forman 4Q Misses Estimate - Analyst Blog

06 Juni 2012 - 1:16PM

Zacks

Brown-Forman Corporation’s (BF.B) adjusted

earnings of 73 cents per share for fourth-quarter 2012 missed the

Zacks Consensus Estimate of 76 cents and declined approximately

5.2% from the year-ago earnings of 77 cents. A higher excise tax

along with increased operating expenses affected the company’s

bottom line.

Including the net effect of Hopland-based wine business, the

company’s earnings were $1.13 per share during the fourth quarter

of fiscal 2011.

Quarterly Details

Brown-Forman's reported net sales inched up 1% to $801.3

million, missing the Zacks Consensus Estimate of $805 million.

However, the company’s underlying net sales registered 10% growth

year over year.

During the quarter, Brown-Forman's gross profit inched down

marginally by 0.4% from the prior-year quarter to $421.8 million,

primarily due to increased excise taxes. Consequently, gross margin

contracted 90 basis points (bps) year over year to 52.6%.

During the quarter, the company made huge advertising expenses

and registered a decline of 1% to $98.6 million. Selling, general

and administrative expenses grew 5% year over year to $175.2

million. Consequently, Brown-Forman's adjusted operating profit

declined 2% from the prior-year quarter to $152.3 million, while

adjusted operating margin contracted 60 basis points to 19.6% from

the prior-year period.

Fiscal 2012 Summary

The company’s net sales during the fiscal increased 6% to

$3,614.4 million compared with $3,404.3 million in fiscal 2011,

surpassing the Zacks Consensus Estimate of $3,453 million. However,

Brown-Forman’s earnings of $3.56 per share during fiscal 2012 fell

short of the Zacks Consensus Estimate of $3.59 as well the previous

fiscal earnings of $3.57. Including the net effect of Hopland-based

wine business, the company’s earnings were $3.90 per share during

fiscal.

Balance Sheet & Cash Flow

Brown-Forman ended the fiscal with cash and cash equivalents of

$338 million and long-term debt of $506 million (including the

current maturities) compared with $567 million and $759 million in

fiscal 2011.

During fiscal 2012, Brown-Forman generated $516 million of cash

from operations and deployed $192 million for dividend payout, $220

million toward share repurchase, $58 million on capital

expenditures and $248 million toward debt repayment.

Guidance

Moving forward, Brown-Forman expects improvement in customer

trends to continue in fiscal 2013. The company expects high-single

digit growth in net sales and operating income. However, it

anticipates that the stronger U.S. dollar value may have an adverse

impact on its bottom line.

Currently, Brown-Forman expects fiscal 2013 earnings in the

range of $3.60 to $4.00 per share. The current Zacks Consensus

Estimate for fiscal 2013 stands at $3.94 per share.

Our Recommendation

Brown-Forman is one of the leading producers and distributors of

premium alcoholic beverages in the world. The company commands a

strong portfolio of globally recognized brands, such as Jack

Daniel’s, Finlandia, Southern Comfort and Canadian Mist. We believe

this provides a competitive edge to the company and bolsters its

well-established position in the market.

Moreover, we believe Brown-Forman’s strategy of expanding Jack

Daniel's market share in developed markets, such as France and the

U.S., and emerging markets including Russia, Poland and Mexico,

where the whiskey category is in early stages of development will

boost its top line.

However, apart from macroeconomic headwinds, distilled spirits

are subject to excise tax in various countries. Rising fiscal

pressure in the U.S., European and many emerging markets may lead

to increasing risk of a potential excise tax on spirits by the

governments of respective countries. The effect of any excise tax

increase in future may have an adverse effect on Brown-Forman’s

financial performance.

Above all, the company faces intense competition from other

well-established players in the industry, including Beam

Inc. (BEAM), Constellation Brands Inc.

(STZ) and Diageo plc (DEO). Moreover, Brown-Forman

also encounters competition from local and regional players in the

respective countries. Consequently, this may dent the company’s

future operating performance.

Currently, Brown-Forman has a Zacks #4 Rank, which implies a

short-term Sell rating. However, we maintain a long-term Neutral

recommendation on the stock.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

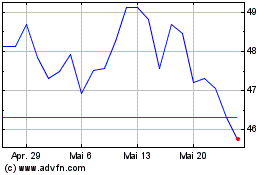

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024