Beam's Profit Surges, but Misses Est - Analyst Blog

03 November 2011 - 5:08PM

Zacks

Beam Inc.’s (BEAM) adjusted earnings of 53

cents a share for the third quarter of fiscal 2011 surged 13% from

the prior-year quarter. The Zacks Consensus Estimate for the

quarter stood at 59 cents per share.

Earnings, on a GAAP basis, were $2.65 compared with 66 cents per

share posted in the year-ago quarter. The GAAP figure includes a

gain on sale of the golf business and spin-off of Fortune Brands

Home & Security business.

Quarterly Details

Net sales, excluding excise taxes, during the reported quarter

grew 12.5% year over year to $579.3 million, surpassing the Zacks

Consensus Estimate of $564.0 million. Beam’s adjusted operating

income inched up 3.8% to $142.4 million. However, operating margin

plummeted by 210 basis points to 24.6%.

At the end of the quarter, Fortune Brands had cash and cash

equivalents of $112.0 million and total long-term debt of $1,921.0

million compared with a cash balance of $476.0 million and

long-term debt of $2,551.0 million in the prior-year quarter.

During the quarter, the company generated a free cash flow of

$247.5 million compared with $289.8 million in the prior-year

quarter.

Guidance

The company expects to sustain its growth momentum into fiscal

year 2011. Fortune Brands anticipates its fiscal 2011 to be a solid

year despite higher commodity costs and investments to support

long-term growth. Beam anticipates achieving a high-single-digit

growth in adjusted earnings against a base of $1.92 per share.

Business Restructuring

Recently, Fortune Brands splits the company into three

standalone units, giving investors pure plays in golf, home

products and alcoholic drinks. After the separation, the ongoing

company has been re-named as Beam Inc. The company has spun-off its

home and security business to shareholders in a tax-free

transaction in July 2011. The company’s home products business will

retain its name of Fortune Brands Home & Security in

future.

Consequent to the spin-off, the company continues to subsist as

a publicly traded manufacturer of distilled spirit. This unit has

parented brands like Jim Beam bourbon, Courvoisier cognac and Sauza

tequila.

The company faces intense competition from well-established

players, such as Diageo plc (DEO) and

Brown-Forman Corporation (BF.B). Besides, global

competitive conditions have also been intensified. Consequently,

risk related in operating in such a competitive environment may

undermine the company’s future operating performance.

Currently, Beam has a Zacks #5 Rank, implying a short-term

Strong Sell rating on the stock. Besides, the company retains a

long-term Underperform recommendation.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

Zacks Investment Research

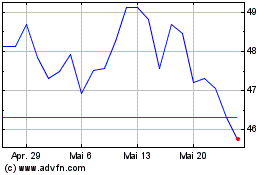

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024