Barclays Appoints David King as Global Head of Technology M&A

22 Mai 2024 - 10:39PM

Business Wire

With approximately 25 years of Investment Banking experience,

Mr. King brings to Barclays deep client relationships and industry

knowledge that will further strengthen the firm’s M&A platform

and Technology Investment Banking franchise

Barclays today announces the appointment of David King as Global

Head of Technology M&A. Mr. King will be based in San

Francisco, will report to Ihsan Essaid, Global Head of M&A, and

will work in close partnership with Kristin Roth DeClark, Global

Head of Technology Investment Banking.

Mr. King has approximately 25 years of investment banking

experience advising management teams and boards on M&A

transactions in the Technology sector. He joins Barclays from Bank

of America where he was Global Co-Head of TMT M&A. He joined

Bank of America, then Merrill Lynch, in 2000 to focus on Technology

M&A. Prior to rejoining Bank of America in 2020, Mr. King spent

three years at Deutsche Bank, where he helped grow their Technology

M&A franchise in his role as Co-Head of Technology M&A.

Over the course of his career Mr. King has advised on over

$300bn in transactions for Technology companies across the

Software, Hardware, Semiconductor and Internet sectors, having

worked with clients on well over a hundred acquisitions, sales and

divestitures. He recently advised Intel on the sale of a minority

stake in their IMS Nanofabrication business to Bain and TSMC and

the sale of their NAND memory business to SK Hynix. He also

recently advised Amazon on the acquisition of MGM, Alphabet on the

investment in Bharti Airtel, Lumentum on the acquisitions of Cloud

Light and Oclaro, and Cisco on the acquisition of ThousandEyes. Mr.

King has further advised on successful transactions for Salesforce,

Broadcom, Seagate, HPE, eBay, Dell, AMD and Western Digital,

amongst others.

“Technology is of critical importance to our M&A franchise

and is an area where we are laser focused on succeeding and

delivering for our clients,” said Ihsan Essaid. “David’s long-term

connectivity with the Tech community, combined with his extensive

transaction execution experience and proven leadership qualities,

make him a tremendous addition to our team.”

“David’s amazing reputation in the Technology industry and his

deep M&A expertise will help us further accelerate the strong

momentum in our business,” added Kristin Roth DeClark. “This

appointment demonstrates our continued investment in Technology

Investment Banking, and our ability to attract the leading talent

in the market to best serve our clients.”

Barclays has played key roles in a number of notable recent

Technology transactions, including serving as Exclusive Financial

Advisor to Nuvei Corporation in its take private by Advent

International in a deal valued at $6.0bn. Barclays also served as

Financial Advisor to IBM in its acquisition of HashiCorp for

$7.7bn, as Active Joint Bookrunner on Rubrik Inc.’s $752m IPO, and

as Lead Left Bookrunner on OpenText Corporation’s $2.2bn Term Loan

B repricing.

About Barclays Investment Bank

Barclays Investment Bank is comprised of the Investment Banking,

International Corporate Banking, Global Markets and Research

businesses. It provides money managers, financial institutions,

governments, supranational organisations and corporate clients with

services and advice for their funding, financing, strategic and

risk management needs. For further information about Barclays

Investment Bank, please visit our website

www.ib.barclays.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240522291129/en/

Andrew Smith +1 212 412 7521 andrew.x.smith@barclays.com

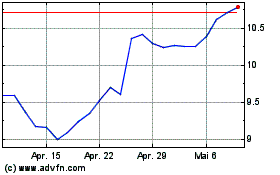

Barclays (NYSE:BCS)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Barclays (NYSE:BCS)

Historical Stock Chart

Von Jan 2024 bis Jan 2025