BBVA 1Q Profit Rose Above Views on Higher Revenue, Lower Provisions -- Update

29 April 2022 - 9:15AM

Dow Jones News

By Xavier Fontdegloria

Banco Bilbao Vizcaya Argentaria SA said Friday that it posted

its highest recurring quarterly profit ever, beating expectations

on the back of increasing revenues and lower provisions.

The Spanish lender posted a net profit of 1.65 billion euros

($1.73 billion), a 36% increase compared with the EUR1.21 billion a

year earlier. Analysts expected BBVA to report a profit of EUR1.24

billion, according to a consensus forecast provided by the

bank.

BBVA said net interest income--the difference between what

lenders earn from loans and pay for deposits--rose 21% on year to

EUR4.16 billion supported by a strong performance in Mexico, Turkey

and South America amid higher interest rates.

Net fees and commissions income increased 9.5% to EUR1.24

billion. Impairments on financial assets declined 20% to EUR738

million.

The bank's fully-loaded common equity Tier 1 ratio, a key

measure of resilience, fell to 12.70% in March from 12.75% in

December.

BBVA said that it is on track to achieve its long-term goals for

2024. For this year, the lender said in February that it expects a

double-digit growth in core revenues and a cost of risk--the ratio

of provisions to expected loan losses--of around 1%. The cost of

risk stood at 0.82% in March, down from 0.93% in 2021.

Write to Xavier Fontdegloria at xavier.fontdegloria@wsj.com

(END) Dow Jones Newswires

April 29, 2022 03:00 ET (07:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

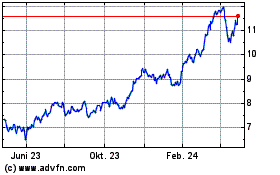

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

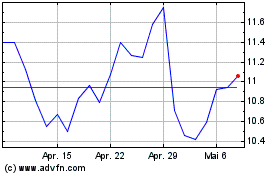

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024