UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

| Commission File Number: 001-37775 | Commission file number 001-41313 |

| | |

Brookfield Business Partners L.P.

(Exact name of Registrant as specified in its charter) | BROOKFIELD BUSINESS CORPORATION

(Exact name of Registrant as specified in its charter) |

| | |

73 Front Street, 5th Floor

Hamilton, HM 12 Bermuda

(Address of principal executive office) | 250 Vesey Street, 15th Floor

New York, New York 10281

(Address of principal executive office) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Brookfield Business Partners L.P. |

| | by its general partner, Brookfield Business Partners Limited |

| | | |

| | | |

| Date: November 7, 2023 | By: | /s/ Jane Sheere |

| | | Name: Jane Sheere |

| | | Title: Corporate Secretary |

| | | |

| | | |

| | BROOKFIELD BUSINESS CORPORATION |

| | | |

| Date: November 7, 2023 | By: | /s/ Jaspreet Dehl |

| | | Name: Jaspreet Dehl |

| | | Title: Chief Financial Officer |

EXHIBIT 99.1

Brookfield’s Private Equity Group Completes Sale of Westinghouse

BROOKFIELD News, Nov. 07, 2023 (GLOBE NEWSWIRE) -- Brookfield Asset Management (NYSE: BAM, TSX: BAM) and its listed affiliate Brookfield Business Partners (NYSE: BBU; TSX: BBU.UN) today announced the completion of the sale of Westinghouse Electric Company (“Westinghouse” or “the Company”).

Westinghouse is a global leading provider of mission-critical technologies, products, and services to the nuclear power industry. The sale follows a five-year repositioning of Westinghouse to refocus the business, strengthen its organizational structure and reinvest for future growth.

“We are pleased to complete the sale of Westinghouse and crystallize significant value for our investors,” said Cyrus Madon, CEO of Brookfield Business Partners. “Over the last five years, we have worked alongside the Westinghouse team to strengthen the business’ global leadership position and meaningfully enhance its profitability and cash flows by leveraging our established approach to operational value creation. Westinghouse is led by a world-class management team and is exceptionally well-positioned for future growth under its new ownership.”

Brookfield Business Partners will generate approximately $1.4 billion in proceeds from the sale of its 44% interest in the business. The proceeds will be used to redeem $750 million of preferred equity securities held by Brookfield Corporation and reduce revolving credit facilities. The annual dividend is 7% on the remaining $725 million of preferred equity securities held by Brookfield Corporation and the securities are redeemable at par, at the option of Brookfield Corporation, to the extent Brookfield Business Partners completes asset sales or equity issuances.

Brookfield Asset Management (NYSE: BAM, TSX: BAM) is a leading global alternative asset manager with over $850 billion of assets under management. We invest client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. We offer a range of alternative investment products to investors around the world — including public and private pension plans, endowments and foundations, sovereign wealth funds, financial institutions, insurance companies and private wealth investors.

Brookfield Business Partners is the flagship listed vehicle of Brookfield’s private equity group. It is a global business services and industrials company focused on owning and operating high-quality businesses that provide essential products and services and benefit from a strong competitive position.

Investors have flexibility to invest in Brookfield Business Partners either through Brookfield Business Corporation (NYSE, TSX: BBUC), a corporation, or Brookfield Business Partners L.P. (NYSE: BBU; TSX: BBU.UN), a limited partnership. For more information, please visit https://bbu.brookfield.com.

For more information, please contact:

Media:

Marie Fuller

Tel: +44 207 408 8375

Email: marie.fuller@brookfield.com | Investors:

Alan Fleming

Tel: +1 (416) 645-2736

Email: alan.fleming@brookfield.com |

Cautionary Statement Regarding Forward-Looking Statements and Information

Note: This news release contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws, including the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, include statements regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook of Brookfield Business Partners, as well as regarding recently completed and proposed acquisitions, dispositions, and other transactions, and the outlook for North American and international economies for the current fiscal year and subsequent periods, and include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “seeks”, “intends”, “targets,” “projects”, “forecasts”, “views”, “potential”, “likely” or negative versions thereof and other similar expressions, or future or conditional verbs such as “may,” “will,” “should,” “would” and “could”.

Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, investors and other readers should not place undue reliance on forward-looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause the actual results, performance or achievements of Brookfield Business Partners to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to: general economic conditions and risks relating to the economic, including unfavorable changes in interest rates, foreign exchange rates, inflation and volatility in the financial markets; global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; strategic actions including our ability to complete dispositions and achieve the anticipated benefits therefrom; the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits; changes in accounting policies and methods used to report financial condition (including uncertainties associated with critical accounting assumptions and estimates); the ability to appropriately manage human capital; the effect of applying future accounting changes; business competition; operational and reputational risks; technological change; changes in government regulation and legislation within the countries in which we operate; governmental investigations; litigation; changes in tax laws; ability to collect amounts owed; catastrophic events, such as earthquakes, hurricanes and pandemics/epidemics including COVID-19; the possible impact of international conflicts, wars and related developments including Russia’s invasion of Ukraine, terrorist acts and cyber terrorism; and other risks and factors detailed from time to time in our documents filed with the securities regulators in Canada and the United States including in the “Risk Factors” section in our most recently filed Form 20-F.

We caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements and information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

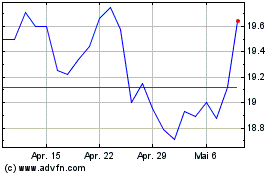

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Brookfield Business Part... (NYSE:BBU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024