0001214816AXIS CAPITAL HOLDINGS LTDfalse00012148162023-10-062023-10-060001214816us-gaap:CommonStockMember2023-10-062023-10-060001214816us-gaap:SeriesEPreferredStockMember2023-10-062023-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 6, 2023

AXIS CAPITAL HOLDINGS LIMITED

(Exact Name Of Registrant As Specified In Charter)

| | | | | | | | | | | | | | |

| Bermuda | | 001-31721 | | 98-0395986 |

| (State of Incorporation) | | (Commission File No.) | | (I.R.S. Employer

Identification No.) |

92 Pitts Bay Road

Pembroke, Bermuda HM 08

(Address of principal executive offices, including zip code)

(441) 496-2600

(Registrant’s telephone number, including area code)

Not applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e(4)(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares, par value $0.0125 per share | AXS | New York Stock Exchange |

Depositary shares, each representing a 1/100th interest in a 5.50% Series E preferred share | AXS PRE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

On October 6, 2023, AXIS Specialty U.S. Services, Inc., a subsidiary of AXIS Capital Holdings Limited (the "Company"), entered into an amendment to the employment agreement with Peter Vogt, the Company's Chief Financial Officer, to (i) extend the term of the agreement for three years to December 31, 2026, (ii) update the agreement to reflect Mr. Vogt's current base salary and annual long-term incentive award as described in the Company's Current Report on Form 8-K filed on May 8, 2023, and (iii) amend the governing law and choice of forum provisions in the agreement to the Commonwealth of Pennsylvania. In addition, the amendment provides that, if either party provides a notice of non-renewal and the employment agreement terminates upon the expiration of the term, Mr. Vogt's outstanding equity awards will vest upon the date of termination, and he will be entitled to receive his 2026 fiscal year annual bonus based on actual performance for 2026. In this scenario, the vesting of the performance-vesting restricted stock units ("PSUs") will be calculated based on actual performance at December 31, 2026 for all outstanding PSU awards.

This description is qualified in its entirety by reference to the amendment, which is included as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description of Document |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 10, 2023

| | | | | | | | | | | |

| | | |

| AXIS CAPITAL HOLDINGS LIMITED | |

| | | |

| | |

| By: | /s/ Conrad D. Brooks | |

| | Conrad D. Brooks | |

| | General Counsel | |

AMENDMENT NO. 3

to

EMPLOYMENT AGREEMENT

dated December 11, 2017

by and between

AXIS Specialty U.S. Services, Inc. (the “Company”)

and

Peter Vogt (the “Executive”)

Dated: October 6, 2023

WHEREAS, the Company and the Executive entered into an employment agreement dated December 11, 2017, subsequently amended by Amendment No. 1 dated October 2, 2020 and Amendment No. 2 dated June 17, 2021 (as amended, the “Agreement”); and

WHEREAS, the Human Capital and Compensation Committee of the Board of Directors of AXIS Capital Holdings Limited, the Company and the Executive have determined that it is in the best interests of the Company, AXIS Capital Holdings Limited and its shareholders to amend certain components of the Executive’s compensation;

NOW, THEREFORE, the Agreement is hereby amended, effective as of June 1, 2023, as follows:

1.Section 2(a) of the Agreement (Compensation and Benefits) is hereby amended to replace the reference to “$675,000” in the first line thereof with “$700,000”.

2.Section 2(c) of the Agreement (Compensation and Benefits) is hereby amended to replace the reference to “$1,200,000” in the third line thereof with “$1,400,000”.

3.Section 3(a) of the Agreement (Term of Employment) is hereby amended to replace the reference to “December 31, 2023” with “December 31, 2026.”

4.A new Section 4(h) is hereby added to the agreement as follows:

h) Non-Renewal of Employment Term. In the event that, (i) either party (you or the Company) provides a written notice that the Agreement will not be extended beyond December 31, 2026 and (ii) your employment with the Company terminates upon the end of such Employment Term, and subject to your compliance with the obligations set forth in Sections 5, 7, 8, 9 and 10 of the Agreement and the timely satisfaction of the condition precedent in Section 4(f) of the Agreement, then:

i)all of your outstanding and unvested Restricted Stock Units and other equity awards shall immediately vest upon the date of such termination and

ii)you will be paid your Annual Bonus based on actual performance for the 2026 fiscal year and you will be excused from the requirement in Section 2(b) that you must be actively employed with the Company on the date of disbursement in order to receive the Annual Bonus and such Annual Bonus will be paid during the period set forth in Section 2(b) of the Agreement.

For the avoidance of doubt, a non-renewal of the Agreement by the Company at the end of the December 31, 2026 Employment Term will not be considered a termination by the Company without Cause. The parties acknowledge and agree that good faith negotiations related to such renewal will commence no later than January 1, 2026.

5.A new Section 4(i) is hereby added to the agreement as follows:

i) Treatment of Performance-Vesting Restricted Stock Units. In the event that you become entitled to accelerated vesting of your Restricted Stock Units upon your termination of employment in accordance with Sections 4(d), (e) and (h) herein, the performance-vesting achievement for your performance-vesting Restricted Stock Units which remain outstanding as of such employment termination date shall be calculated based on actual performance achievement through such termination date, as determined by the Human Capital and Compensation Committee of Parent’s Board in good faith.

6.Section 14 (Choice of Forum) and Section 15 (Governing Law) of the Agreement are hereby deleted and replaced with the following new Sections 14 and 15 as set forth below:

14) Choice of Forum

The Parent is an international company and has subsidiaries that conduct business in the United States (including Pennsylvania) and other countries. You and the Company are desirous of having any disputes resolved in a forum having a substantial body of law and experience with the matters contained herein. As a result, you and the Company have a strong interest in providing a single forum and governing law for the convenience of you and the Company to resolve any and all legal claims. In addition, you recognize that the Company's and the Parent’s savings from limiting the forum for legal claims allow them and their affiliates to maintain lower business expenses, which help all of them provide more cost effective and competitive insurance products and services. For all of these reasons, you and the Company agree that any action or proceeding brought in any court or other forum with respect to this Agreement and Employee’s employment shall be brought exclusively in any court of competent jurisdiction sitting in the Commonwealth of Pennsylvania, and the parties agree to the personal jurisdiction thereof. The parties hereby irrevocably waive any objection they may now or hereafter have to the laying of venue of any such action in the said court(s), and further irrevocably waive any claim they may now or hereafter have that any such action brought in said court(s) has been brought in an inconvenient forum. The parties recognize that, should any dispute or controversy arising from or relating to this agreement be submitted for adjudication to any court or other third party, the preservation of the secrecy of Confidential Information or Trade Secrets may be jeopardized. Consequently, the parties agree that all issues of fact shall be tried without a jury.

15) Governing Law

You and the Company agree that for the reasons recited in the foregoing paragraph 14, this Agreement shall be governed by, and construed in accordance with, the laws of the Commonwealth of Pennsylvania, without regard to its conflict of laws provisions.

7.Section 10 (Governing Law) of the General Release and Waiver (attached as Exhibit A to the Employment Agreement) is hereby deleted and replaced with the following new Section 10 set forth below:

10.Governing Law. This General Release and Waiver shall be governed by, and construed and enforced in accordance with, the laws of Pennsylvania, without reference to its choice of law rules. The parties hereby irrevocably consent to the jurisdiction of Pennsylvania and courts located in Pennsylvania for purposes of resolving any dispute under this General Release and Waiver and expressly waive any objections as to venue in any such courts

11.Except as set forth herein, all other terms and conditions of the Agreement shall remain in full force and effect.

IN WITNESS WHEREOF, the undersigned have executed this Amendment No. 3 as of the date first above written.

AXIS SPECIALTY U.S. SERVICES, INC.

By: /s/ Noreen McMullan

Name: Noreen McMullan

Title: Executive Vice President

Accepted and Agreed:

/s/ Peter Vogt

Peter Vogt

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

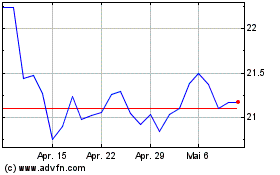

Axis Capital (NYSE:AXS-E)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Axis Capital (NYSE:AXS-E)

Historical Stock Chart

Von Mai 2023 bis Mai 2024