American Express Business Blueprint™ provides

free cash flow insights and 24/7 access to a suite of digital

financial products—all from one place

American Express (NYSE: AXP) today announced the launch of

American Express Business Blueprint™, the company’s new digital

cash flow management hub designed exclusively for small businesses,

which features cash flow insights, digital financial products, and

an easy way to reach and manage their Business Cards.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230131005085/en/

American Express Business Blueprint™ is a

new digital cash-flow management hub designed exclusively for small

businesses, featuring free cash flow insights, digital financial

products, and an easy way to reach and manage American Express

Business Cards. (Graphic: Business Wire)

Business Blueprint builds on the Kabbage platform, which was

acquired in 2020, as part of American Express’ strategy to expand

its small business offerings beyond its leading Business Cards. Any

U.S. small business may access, for free, personalized cash flow

insights to help them make financial decisions more confidently.

Small businesses may also access applications for select financial

products, like a business line of credit, and use the products, if

approved, to help them more efficiently manage their cash flow from

the Business Blueprint hub.1

“Business Blueprint marks a critical next step in American

Express's vision of becoming a digital one-stop shop for small

businesses’ financial needs, whether to manage their cash flow,

make payments, get paid, or access working capital,” said Anna

Marrs, Group President of Global Commercial Services and Credit

& Fraud Risk at American Express. “Kabbage is now fully

integrated into the suite of American Express business products,

providing business owners a wide range of digital financial

solutions to help them manage their finances efficiently and

confidently.”

American Express has a long track record of supporting small

businesses through innovative products and services to meet our

customers’ ever-changing needs, from being the number one Business

Card issuer in the U.S.2 to a leading financial services provider

for businesses of all sizes globally.

According to a new American Express survey, polling 1,100 small

businesses, 82% of respondents said a cash flow management hub

would save them time to run their business, leading to improved

efficiency (72%) and profitability (50%).3 American Express

Business Blueprint™ is designed to pair products with the daily

tasks small business owners engage in to help them manage their

cash flow, from taking a loan, to paying bills and vendors, sending

wires, checking their account balances, making mobile check

deposits, accepting card payments and more.

“My perception of American Express has greatly expanded from a

card company to a true partner that offers products that help me

with the tasks needed to run my business,” said Julie Matzen, an

American Express customer and CEO of Team MayDay, a digital

advertising agency. “With American Express Business Blueprint, I

save so much time from having to log in to different products and

tools, but instead can access my American Express Business Cards,

line of credit, and data from one place.”

An embedded feature within American Express Business Blueprint™

is My Insights, a free cash flow analytics solution,

providing small businesses personalized, 24/7 data analysis of many

of their American Express business products4—including their

American Express Business Cards—and linked external business-bank

accounts. My Insights will automatically aggregate the data across

these products and linked accounts to show:

- Money-in and money-out cash flow analyses

- Expense trends and detailed spending per account

- Up to two-years of historical transactional data

- 30-day cash-balance projections5

- Expense alerts, notifying customers of increased spend

“Historically, small businesses have been underserved when it

comes to smart, simple financial management tools. No longer. A few

financial institutions are reinventing small business banking and

delivering needed tools. American Express Business Blueprint is

raising the bar in helping small businesses manage their cash flow

from one place,” said Alenka Grealish, Principal Analyst, Emerging

Tech at Celent.

Also, from American Express Business Blueprint™ small businesses

can learn about and then, if eligible, apply for select digital

products, including1:

- American Express® Business Line of Credit for flexible

business loans.

- American Express® Business Checking* for a digital

business checking account with a 1.30% APY on balances up to

$500,000, and the ability to earn Membership Rewards® points.6

- American Express® Payment Accept7 for accepting all

major card payments from customers online.

American Express customers can reach their American Express

Business Card accounts from their Business Blueprint dashboard to

make payments and view and redeem Membership Rewards points®. Plus,

they can enjoy access to American Express’s world-class customer

service and support, always a call or click away.

Signing up for American Express Business Blueprint™ is free.

Existing American Express business customers may use their American

Express login to start today either online or via the American

Express Business Blueprint™ Android or iOS app. Learn more at

www.americanexpress.com/business-blueprint.

ABOUT AMERICAN EXPRESS American Express is a globally

integrated payments company, providing customers with access to

products, insights and experiences that enrich lives and build

business success. Learn more at americanexpress.com and connect

with us on facebook.com/americanexpress,

instagram.com/americanexpress,

linkedin.com/company/american-express, twitter.com/americanexpress,

and youtube.com/americanexpress.

Key links to products, services and corporate responsibility

information: personal cards, business cards and services, travel

services, gift cards, prepaid cards, merchant services, Accertify,

Business Blueprint, Resy, corporate card, business travel,

diversity and inclusion, corporate responsibility and

Environmental, Social, and Governance reports.

1 All American Express business products are subject to separate

eligibility, applications, approvals, and fee structures. 2 Based

on a comparison of: (i) data for U.S. Mastercard & Visa

Commercial Card Issuers Ranked by Purchase Volume in 2021 from the

Nilson Report (p. 6, Issue 1220, May 2022); and (ii) American

Express internal data. 3 Survey conducted in partnership with

Morning Consult, polling 1,100 financial decision makers, including

500 at a small small business (<10 employees), 400 at a medium

small business (11-100 employees), and 200 at a large small

business (101-500 employees). The margin of error for the full

sample is +/- 3 percentage points. 4 American Express® Business

Checking data will be available in Q1 2023. 5 Cash-balance

projections available for business checking customers in Q1 2023. 6

Terms and Conditions for the Membership Rewards® program apply.

Visit www.membershiprewards.com/terms for more information. The

value of Membership Rewards points varies according to how you

choose to use them. To learn more, go to

www.membershiprewards.com/pointsinfo 7 Kabbage Payments, LLC is a

registered Payment Service Provider/Payment Facilitator sponsored

by Fifth Third Bank, N.A., Cincinnati, OH.

*Currently accepting applications for American Express Business

Checking from U.S. American Express Consumer or Business Card

Members.

Location: U.S.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230131005085/en/

Paul Bernardini paul.bernardini@aexp.com

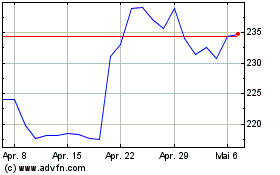

American Express (NYSE:AXP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

American Express (NYSE:AXP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024