Strong Fiber Growth; Increased Fiber

Migrations and Fiber Penetration Best Mobile Performance in

Four Years Continued Progress in Enhancing and Expanding Our

Networks Unveiled Transformation Plan to Unlock Key Free

Cash Flow Opportunities

Altice USA (NYSE: ATUS) today reports results for the third

quarter ended September 30, 2024.

Dennis Mathew, Altice USA Chairman and Chief Executive

Officer, said: "Over the last two years, we’ve made significant

progress in strengthening our networks, stabilizing our operations,

and setting a strong foundation for long-term growth. These efforts

have resulted in positive momentum across our fiber and mobile

product lines in the third quarter. Our focus remains on

transforming our business for future growth with significant

revenue opportunities, including expanding our advanced product

portfolio, increasing penetration of our best-in-class fiber

network, and driving operational efficiencies with a sustainable

capital structure. Executing on these goals will drive free cash

flow, increase shareholder value and support sustainable long-term

growth over time.”

Third Quarter 2024

Financial Overview

- Total revenue of $2.2 billion (-3.9% year over

year)

- Residential revenue of $1.7 billion (-5.6% year over

year)

- Residential revenue per user (“ARPU”)(1) of $135.77

(-1.9% year over year)

- Business Services revenue of $366.4 million (-0.1% year

over year)

- News and Advertising revenue of $117.7 million (+9.5%

year over year)

- Net income (loss) attributable to stockholders of

($43.0) million ($(0.09)/share on a diluted basis) in Q3 2024 and

$66.8 million ($0.15/share on a diluted basis) in Q3 2023

- Net cash flows from operating activities of $436.0 million

in Q3 2024 and $474.5 million in Q3 2023

- Adjusted EBITDA(2) of $862.0 million (-5.8% year over

year), and margin of 38.7%

- Cash capital expenditures of $359.2 million (+1.7% year

over year) and Capital intensity(3) of 16.1% (13.1% excluding fiber

and new builds)

- We remained disciplined on capital spend over the course of the

year and now anticipate cash capital expenditures of $1.5 billion

in full year 2024, representing a $200 million dollar reduction

compared to full year 2023 cash capital expenditures

- Free Cash Flow(2) of $76.9 million, including $115

million of higher cash interest in Q3 2024 year over year

Third Quarter 2024 Key Operational

Highlights

- Strong Fiber Net Adds Reaching 482k Fiber Customers, a +63%

Increase in Total Fiber Customers Compared to Q3 2023

- Fiber customer growth continued in Q3 2024 with +47k fiber net

additions, of which 73% were driven by migrations of existing

customers

- Fiber network penetration reached 16.6% at the end of Q3 2024,

up from 10.8% at the end of Q3 2023

- Mobile Line Net Adds of +36k in Q3 2024, Representing the

Highest Mobile Line Net Adds in Four Years; Reaching 420k Lines

- Optimum Mobile line net additions of +36k in Q3 2024, compared

to +24k in Q3 2023

- 5.2% of broadband base converged with mobile(4) at the end of

Q3 2024, up from 3.2% at the end of Q3 2023

- Strengthening Our Go-To-Market Strategy to Leverage

Convergence Opportunities

- Simplified product offers and base management strategy to drive

convergence and provide customers more value

- Evolved our video model with the introduction of new TV

packages -- Entertainment TV, Extra TV, & Everything TV --

which drive higher margins via mutually beneficial programming

agreements, offer consumers more content flexibility and are

available alongside a customer's favorite streaming services via

Optimum Stream

- Total Broadband Primary Service Units (PSUs) Net Losses of

-50k(5)

- Broadband net losses were -50k(5) in Q3 2024, compared to -31k

in Q3 2023

- Performance was driven by continued low levels of switching

activity, competitive pressures across our footprint, and muted

trends in the income-constrained segment, including elevated

non-pay disconnects from prior ACP subscribers

- Continued Progress in Delivering on Multi-Year Network

Strategy; Reaching Nearly 3 million Fiber Passings

- Fiber passings additions of +52k in Q3 2024, reaching 2.9

million fiber passings, and targeting approximately 3 million fiber

passings by year-end 2024

- Total passings additions of +38k in Q3 2024, reaching 9.8

million total passings, and targeting over 175k additional passings

in full year 2024

- Capital intensity(3) of 16.1% in Q3 2024 compared to 15.2% in

Q3 2023

- Service call rate(6) improved by 11% year over year in Q3

2024

- Service visit repeat rate(7) improved by 28% year over year in

Q3 2024

- Achieved approximately 99% node health across our entire

footprint in Q3 2024 through enhanced node monitoring and proactive

maintenance

- Deploying new digital modulation technologies on our DOCSIS 3.1

HFC network to improve broadband performance with over 3 million

customers expected to benefit from better speed attainability and

reliability this year

Opportunities to Improve Free Cash

Flow(2) Over Time

- Revenue Opportunities

- Improve broadband subscriber trends

- Reach 1 million+ mobile lines by year-end 2027

- Launch additional high margin value-added services

- Expand B2B product portfolio and scalable solutions

- Fiber Penetration

- Maximize asset value and competitive positioning

- Accelerate growth of fiber base with plans to achieve 1

million+ fiber subscribers by year-end 2026

- Deliver 30%+ fiber penetration year-end 2026

- Operational Efficiency

- Achieve gross margin of ~70% by year-end 2026

- Improve other operating expenses(8) by 4-6% by year-end

2026

- Return normalized Adjusted EBITDA(2) margins to ~40%

- Sustainable Capital Structure

- Sufficient liquidity to support long-term operational

roadmap

- Deliver annual capex under $1.3bn in full year 2025

- Maintain positive annual Free Cash Flow(2)

Balance Sheet Review as of September

30, 2024

- Net debt(9) for CSC Holdings, LLC Restricted Group was

$23,180 million at the end of Q3 2024, representing net leverage of

7.2x L2QA(10)

- The weighted average cost of debt for CSC Holdings, LLC

Restricted Group was 6.9% and the weighted average life of debt was

4.4 years

- Net debt(9) for Cablevision Lightpath LLC was $1,410 million

at the end of Q3 2024, representing net leverage of 5.7x

L2QA(10)

- The weighted average cost of debt for Cablevision Lightpath LLC

was 5.4% and the weighted average life of debt was 3.3 years

- Consolidated net debt(9) for Altice USA was $24,564 million,

representing consolidated net leverage of 7.1x L2QA(10)

- The weighted average cost of debt for consolidated Altice USA

was 6.8% and the weighted average life of debt was 4.3 years

Shares Outstanding

- As of September 30, 2024, Altice USA had 461,189,373

combined shares of Class A and Class B common stock

outstanding

Customer Metrics (in thousands,

except per customer amounts)

Q1-23

Q2-23

Q3-23

Q4-23

FY-23

Q1-24

Q2-24

Q3-24

Total Passings(11)

9,512.2

9,578.6

9,609.0

9,628.7

9,628.7

9,679.3

9,746.4

9,784.7

Total Passings additions

48.4

66.4

30.4

19.7

164.9

50.6

67.2

38.3

Total Customer

Relationships(5)(12)(13)

Residential

4,472.4

4,429.5

4,391.5

4,363.1

4,363.1

4,326.8

4,272.3

4,217.5

SMB

380.9

381.0

381.1

380.3

380.3

379.7

379.7

378.4

Total Unique Customer Relationships

4,853.3

4,810.5

4,772.6

4,743.5

4,743.5

4,706.5

4,652.0

4,595.9

Residential net additions (losses)

(26.1)

(42.9)

(38.0)

(28.4)

(135.4)

(36.3)

(54.5)

(54.8)

Business Services net additions

(losses)

(0.3)

0.1

0.1

(0.8)

(0.9)

(0.7)

0.0

(1.2)

Total customer net additions (losses)

(26.4)

(42.7)

(37.9)

(29.2)

(136.2)

(37.0)

(54.5)

(56.1)

Residential PSUs(5)

Broadband

4,263.7

4,227.0

4,196.0

4,169.0

4,169.0

4,139.7

4,088.7

4,039.5

Video

2,380.5

2,312.2

2,234.6

2,172.4

2,172.4

2,094.7

2,021.9

1,944.8

Telephony

1,703.5

1,640.8

1,572.7

1,515.3

1,515.3

1,452.1

1,391.1

1,326.0

Broadband net additions (losses)

(19.2)

(36.8)

(31.0)

(27.0)

(113.9)

(29.4)

(51.0)

(49.2)

Video net additions (losses)

(58.6)

(68.3)

(77.6)

(62.2)

(266.7)

(77.7)

(72.8)

(77.0)

Telephony net additions (losses)

(60.6)

(62.7)

(68.1)

(57.4)

(248.9)

(63.1)

(61.1)

(65.1)

Residential ARPU ($)(1)

135.32

137.44

138.42

136.01

136.80

135.67

135.95

135.77

SMB PSUs

Broadband

349.0

349.1

349.4

348.9

348.9

348.5

348.8

347.7

Video

95.3

93.7

91.9

89.6

89.6

87.3

85.4

83.3

Telephony

210.0

208.0

205.9

203.2

203.2

200.7

199.2

196.8

Broadband net additions (losses)

(0.1)

0.1

0.3

(0.5)

(0.2)

(0.4)

0.3

(1.1)

Video net additions (losses)

(2.0)

(1.6)

(1.8)

(2.3)

(7.7)

(2.3)

(1.9)

(2.1)

Telephony net additions (losses)

(2.3)

(2.0)

(2.1)

(2.6)

(9.1)

(2.6)

(1.4)

(2.4)

Total Mobile Lines(14)

Mobile ending lines

247.9

264.2

288.2

322.2

322.2

351.6

384.5

420.1

Mobile ending lines excluding free

service

223.3

257.9

288.1

322.2

322.2

351.6

384.5

420.1

Mobile line net additions

7.6

16.3

24.1

34.0

82.0

29.3

33.0

35.5

Mobile line net additions ex-free

service

14.6

34.6

30.3

34.1

113.5

29.3

33.0

35.5

Fiber (“FTTH”) Customer Metrics (in

thousands)

Q1-23

Q2-23

Q3-23

Q4-23

FY-23

Q1-24

Q2-24

Q3-24

FTTH Total Passings(15)

2,373.0

2,659.5

2,720.2

2,735.2

2,735.2

2,780.0

2,842.0

2,893.7

FTTH Total Passing additions

214.2

286.6

60.7

14.9

576.4

44.8

62.0

51.7

FTTH Residential customer

relationships

207.2

245.9

289.3

333.8

333.8

385.2

422.7

468.5

FTTH SMB customer relationships

2.7

3.9

5.7

7.6

7.6

9.4

11.4

13.1

FTTH Total Customer

Relationships(16)

209.9

249.7

295.1

341.4

341.4

394.6

434.1

481.6

FTTH Residential net additions

37.2

38.6

43.4

44.5

163.8

51.4

37.5

45.7

FTTH SMB net additions

0.9

1.2

1.9

1.8

5.8

1.9

2.0

1.7

FTTH Total Customer Net

Additions

38.1

39.8

45.3

46.3

169.7

53.2

39.5

47.4

Altice USA Consolidated Operating

Results ($ and shares in thousands, except per share data)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue:

Broadband

$

913,417

$

961,751

$

2,745,400

$

2,884,661

Video

715,117

775,818

2,210,156

2,321,557

Telephony

69,877

73,640

212,545

227,390

Mobile

30,563

20,320

82,935

53,993

Residential revenue

1,728,974

1,831,529

5,251,036

5,487,601

Business services and wholesale

366,355

366,852

1,100,506

1,095,197

News and Advertising

117,682

107,484

328,687

319,686

Other

14,689

11,335

39,161

32,968

Total revenue

2,227,700

2,317,200

6,719,390

6,935,452

Operating expenses:

Programming and other direct costs

711,330

750,538

2,174,677

2,284,537

Other operating expenses

674,564

667,278

2,019,356

1,974,651

Restructuring, impairments and other

operating items

10,871

4,453

15,525

39,303

Depreciation and amortization (including

impairments)

386,342

402,366

1,170,503

1,237,283

Operating income

444,593

492,565

1,339,329

1,399,678

Other income (expense):

Interest expense, net

(448,168)

(420,216)

(1,328,264)

(1,216,203)

Gain on investments and sale of affiliate

interests, net

—

—

292

192,010

Loss on derivative contracts, net

—

—

—

(166,489)

Gain (loss) on interest rate swap

contracts, net

(45,657)

31,972

10,220

78,708

Gain (loss) on extinguishment of debt and

write-off of deferred financing costs

—

—

(7,035)

4,393

Other income (loss), net

(1,495)

(1,470)

(4,526)

7,165

Income (loss) before income

taxes

(50,727)

102,851

10,016

299,262

Income tax benefit (expense)

9,892

(27,336)

(42,045)

(106,433)

Net income (loss)

(40,835)

75,515

(32,029)

192,829

Net income attributable to noncontrolling

interests

(2,135)

(8,676)

(16,773)

(21,825)

Net income (loss) attributable to

Altice USA stockholders

$

(42,970)

$

66,839

$

(48,802)

$

171,004

Basic net income (loss) per

share

$

(0.09)

$

0.15

$

(0.11)

$

0.38

Diluted net income (loss) per

share

$

(0.09)

$

0.15

$

(0.11)

$

0.38

Basic weighted average common

shares

460,626

454,730

459,335

454,702

Diluted weighted average common

shares

460,626

455,076

459,335

455,118

Altice USA Consolidated Statements of

Cash Flows ($ in thousands) (unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

(32,029)

$

192,829

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization (including

impairments)

1,170,503

1,237,283

Gain on investments and sale of affiliate

interests, net

(292)

(192,010)

Loss on derivative contracts, net

—

166,489

Loss (gain) on extinguishment of debt and

write-off of deferred financing costs

7,035

(4,393)

Amortization of deferred financing costs

and discounts (premiums) on indebtedness

15,470

26,334

Share-based compensation

50,351

29,368

Deferred income taxes

(7,129)

(187,295)

Decrease in right-of-use assets

33,729

34,633

Allowance for credit losses

68,433

62,148

Other

5,469

9,406

Change in operating assets and

liabilities, net of effects of acquisitions and dispositions:

Accounts receivable, trade

(24,721)

(29,403)

Prepaid expenses and other assets

(127,820)

(76,862)

Amounts due from and due to affiliates

(45,700)

56,193

Accounts payable and accrued

liabilities

(89,539)

(2,374)

Deferred revenue

8,589

9,531

Interest rate swap contracts

110,130

(1,692)

Net cash provided by operating

activities

1,142,479

1,330,185

Cash flows from investing activities:

Capital expenditures

(1,042,975)

(1,409,561)

Payments for acquisitions, net of cash

acquired

(5,748)

—

Other, net

2,743

(1,677)

Net cash used in investing activities

(1,045,980)

(1,411,238)

Cash flows from financing activities:

Proceeds from long-term debt

3,875,000

2,350,000

Repayment of debt

(3,891,175)

(2,215,112)

Proceeds from derivative contracts in

connection with the settlement of collateralized debt

—

38,902

Principal payments on finance lease

obligations

(99,426)

(112,795)

Payment related to acquisition of a

noncontrolling interest

(7,261)

(7,035)

Additions to deferred financing costs

(18,936)

—

Other, net

(6,345)

(8,521)

Net cash provided by (used in) financing

activities

(148,143)

45,439

Net decrease in cash and cash

equivalents

(51,644)

(35,614)

Effect of exchange rate changes on cash

and cash equivalents

(403)

(1,482)

Net decrease in cash and cash

equivalents

(52,047)

(37,096)

Cash, cash equivalents and restricted cash

at beginning of year

302,338

305,751

Cash, cash equivalents and restricted cash

at end of period

$

250,291

$

268,655

Reconciliation of Non-GAAP Financial Measures

We define Adjusted EBITDA, which is a non-GAAP financial

measure, as net income (loss) excluding income taxes, non-operating

income or expenses, gain (loss) on extinguishment of debt and

write-off of deferred financing costs, gain (loss) on interest rate

swap contracts, gain (loss) on derivative contracts, gain (loss) on

investments and sale of affiliate interests, interest expense, net,

depreciation and amortization, share-based compensation,

restructuring, impairments and other operating items (such as

significant legal settlements and contractual payments for

terminated employees). We define Adjusted EBITDA margin as Adjusted

EBITDA divided by total revenue.

Adjusted EBITDA eliminates the significant non-cash depreciation

and amortization expense that results from the capital-intensive

nature of our business and from intangible assets recognized from

acquisitions, as well as certain non-cash and other operating items

that affect the period-to-period comparability of our operating

performance. In addition, Adjusted EBITDA is unaffected by our

capital and tax structures and by our investment activities.

We believe Adjusted EBITDA is an appropriate measure for

evaluating our operating performance. Adjusted EBITDA and similar

measures with similar titles are common performance measures used

by investors, analysts and peers to compare performance in our

industry. Internally, we use revenue and Adjusted EBITDA measures

as important indicators of our business performance and evaluate

management’s effectiveness with specific reference to these

indicators. We believe Adjusted EBITDA provides management and

investors a useful measure for period-to-period comparisons of our

core business and operating results by excluding items that are not

comparable across reporting periods or that do not otherwise relate

to our ongoing operating results. Adjusted EBITDA should be viewed

as a supplement to and not a substitute for operating income

(loss), net income (loss), and other measures of performance

presented in accordance with U.S. generally accepted accounting

principles (“GAAP”). Since Adjusted EBITDA is not a measure of

performance calculated in accordance with GAAP, this measure may

not be comparable to similar measures with similar titles used by

other companies.

We also use Free Cash Flow (defined as net cash flows from

operating activities less cash capital expenditures) as a liquidity

measure. We believe this measure is useful to investors in

evaluating our ability to service our debt and make continuing

investments with internally generated funds, although it may not be

directly comparable to similar measures reported by other

companies.

Reconciliation of Net Income (Loss) to

Adjusted EBITDA ($ in thousands) (unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income (loss)

$

(40,835)

$

75,515

$

(32,029)

$

192,829

Income tax expense (benefit)

(9,892)

27,336

42,045

106,433

Other loss (income), net

1,495

1,470

4,526

(7,165)

Loss (gain) on interest rate swap

contracts, net

45,657

(31,972)

(10,220)

(78,708)

Loss on derivative contracts, net

—

—

—

166,489

Gain on investments and sale of affiliate

interests, net

—

—

(292)

(192,010)

Loss (gain) on extinguishment of debt and

write-off of deferred financing costs

—

—

7,035

(4,393)

Interest expense, net

448,168

420,216

1,328,264

1,216,203

Depreciation and amortization

386,342

402,366

1,170,503

1,237,283

Restructuring, impairments and other

operating items

10,871

4,453

15,525

39,303

Share-based compensation

20,170

16,115

50,351

29,368

Adjusted EBITDA

861,976

915,499

2,575,708

2,705,632

Adjusted EBITDA margin

38.7%

39.5%

38.3%

39.0%

Reconciliation of net cash flow from

operating activities to Free Cash Flow (Deficit) (in thousands)

(unaudited):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net cash flows from operating

activities

$

436,024

$

474,498

$

1,142,479

$

1,330,185

Less: Capital expenditures (cash)

359,159

353,219

1,042,975

1,409,561

Free Cash Flow (Deficit)

$

76,865

$

121,279

$

99,504

$

(79,376)

Consolidated Net Debt as of September

30, 2024 ($ in millions)

CSC Holdings, LLC Restricted

Group

Principal

Amount

Coupon / Margin

Maturity

Drawn RCF

$1,700

SOFR+2.350%

2027

Term Loan B-5

2,865

L+2.500%(17)

2027

Term Loan B-6

1,972

SOFR+4.500%

2028(18)

Guaranteed Notes

1,310

5.500%

2027

Guaranteed Notes

1,000

5.375%

2028

Guaranteed Notes

1,000

11.250%

2028

Guaranteed Notes

2,050

11.750%

2029

Guaranteed Notes

1,750

6.500%

2029

Guaranteed Notes

1,100

4.125%

2030

Guaranteed Notes

1,000

3.375%

2031

Guaranteed Notes

1,500

4.500%

2031

Senior Notes

1,046

7.500%

2028

Legacy unexchanged Cequel Notes

4

7.500%

2028

Senior Notes

2,250

5.750%

2030

Senior Notes

2,325

4.625%

2030

Senior Notes

500

5.000%

2031

CSC Holdings, LLC Restricted Group

Gross Debt

23,372

CSC Holdings, LLC Restricted Group

Cash

(192)

CSC Holdings, LLC Restricted Group Net

Debt

$23,180

CSC Holdings, LLC Restricted Group

Undrawn RCF

$617

Cablevision Lightpath LLC

Principal Amount

Coupon / Margin

Maturity

Drawn RCF(19)

$—

SOFR+3.360%

Term Loan

578

SOFR+3.360%

2027

Senior Secured Notes

450

3.875%

2027

Senior Notes

415

5.625%

2028

Cablevision Lightpath Gross

Debt

1,443

Cablevision Lightpath Cash

(32)

Cablevision Lightpath Net Debt

$1,410

Cablevision Lightpath Undrawn

RCF

$115

Net Leverage Schedules as of September

30, 2024 ($ in millions)

CSC Holdings Restricted

Group(20)

Cablevision Lightpath

LLC

CSC Holdings

Consolidated(21)

Altice USA

Consolidated

Gross Debt Consolidated(22)

$23,372

$1,443

$24,814

$24,814

Cash

(192)

(32)

(240)

(250)

Net Debt Consolidated(9)

$23,180

$1,410

$24,574

$24,564

LTM EBITDA

$3,231

$248

$3,478

$3,479

L2QA EBITDA

$3,210

$248

$3,457

$3,458

Net Leverage (LTM)

7.2x

5.7x

7.1x

7.1x

Net Leverage (L2QA)(10)

7.2x

5.7x

7.1x

7.1x

WACD (%)

6.9%

5.4%

6.9%

6.8%

Reconciliation to Financial Reported

Debt

Altice USA

Consolidated

Total Debenture and Loans from

Financial Institutions (Carrying Amount)

$24,766

Unamortized financing costs and discounts,

net of unamortized premiums

48

Gross Debt Consolidated(22)

24,814

Finance leases and other notes

286

Total Debt

25,100

Cash

(250)

Net Debt

$24,850

(1)

ARPU is calculated by dividing the average

monthly revenue for the respective period derived from the sale of

broadband, video, telephony and mobile services to residential

customers by the average number of total residential customers for

the same period and excludes mobile-only customer

relationships.

(2)

See “Reconciliation of Non-GAAP Financial

Measures” beginning on page 7 of this earnings release.

(3)

Capital intensity refers to total cash

capital expenditures as a percentage of total revenue.

(4)

Broadband base converged with mobile is

expressed as the percentage of customers subscribing to both

broadband and mobile services divided by the total broadband

customer base. Excludes mobile only customers.

(5)

Customer metrics as of September 30, 2024

reflect adjustments to align to the Company’s bulk residential

subscriber count policy, resulting in an increase of 4.7 thousand

residential customer relationships, 3.8 thousand broadband

customers and 5.2 thousand video customers. The impact of these

adjustments to customer relationships, broadband and video customer

net additions was not material for any period presented and as such

prior period metrics were not restated.

(6)

Service call rate represents technical,

care and support calls per customer.

(7)

Service visit repeat rate represents the

number of repeat visits or truck rolls per customer within 30

days.

(8)

Other Operating Expenses exclude

programming and direct costs, depreciation and amortization,

share-based compensation, restructuring, impairments and other

operating items.

(9)

Net debt, defined as the principal amount

of debt less cash, and excluding finance leases and other

notes.

(10)

L2QA leverage is calculated as quarter end

net leverage divided by the last two quarters of Adjusted EBITDA

annualized.

(11)

Total passings represents the estimated

number of single residence homes, apartments and condominium units

passed by the HFC and FTTH network in areas serviceable without

further extending the transmission lines. In addition, it includes

commercial establishments that have connected to our HFC and FTTH

network. Broadband services were not available to approximately 30

thousand total passings and telephony services were not available

to approximately 500 thousand total passings.

(12)

Total Unique Customer Relationships

represent the number of households/businesses that receive at least

one of our fixed-line services. Customers represent each customer

account (set up and segregated by customer name and address),

weighted equally and counted as one customer, regardless of size,

revenue generated, or number of boxes, units, or outlets on our

hybrid-fiber-coaxial (HFC) and fiber-to-the-home (FTTH) network.

Free accounts are included in the customer counts along with all

active accounts, but they are limited to a prescribed group. Most

of these accounts are also not entirely free, as they typically

generate revenue through pay-per-view or other pay services and

certain equipment fees. Free status is not granted to regular

customers as a promotion. In counting bulk residential customers,

such as an apartment building, we count each subscribing unit

within the building as one customer, but do not count the master

account for the entire building as a customer. We count a bulk

commercial customer, such as a hotel, as one customer, and do not

count individual room units at that hotel.

(13)

Total Customer Relationship metrics do not

include mobile-only customers.

(14)

Mobile ending lines include lines

receiving free service. Mobile ending lines excluding free service

exclude additions relating to mobile lines receiving free service

from all periods presented, and includes net additions from when

customers previously on free service start making payments.

(15)

Represents the estimated number of single

residence homes, apartments and condominium units passed by the

FTTH network in areas serviceable without further extending the

transmission lines. In addition, it includes commercial

establishments that have connected to our FTTH network.

(16)

Represents number of households/businesses

that receive at least one of our fixed-line services on our FTTH

network. FTTH customers represent each customer account (set up and

segregated by customer name and address), weighted equally and

counted as one customer, regardless of size, revenue generated, or

number of boxes, units, or outlets on our FTTH network. Free

accounts are included in the customer counts along with all active

accounts, but they are limited to a prescribed group. Most of these

accounts are also not entirely free, as they typically generate

revenue through pay-per view or other pay services and certain

equipment fees. Free status is not granted to regular customers as

a promotion. In counting bulk residential customers, such as an

apartment building, we count each subscribing unit within the

building as one customer, but do not count the master account for

the entire building as a customer. We count a bulk commercial

customer, such as a hotel, as one customer, and do not count

individual room units at that hotel.

(17)

The Incremental Term Loan B-5 bears

interest at a rate equal to Synthetic USD London Interbank Offered

Rate ("LIBOR") plus 2.50% per annum through March 31, 2025.

Thereafter, we will be required to pay interest at a rate equal to

the alternate base rate (“ABR”), plus the applicable margin, where

the ABR is the greater of (x) prime rate or (y) the federal funds

effective rate plus 50 basis points and the applicable margin for

any ABR loan is 1.50% per annum.

(18)

The Incremental Term Loan B-6 is due on

the earlier of (i) January 15, 2028 and (ii) April 15, 2027 if, as

of such date, any Incremental Term Loan B-5 borrowings are still

outstanding, unless the Incremental Term Loan B-5 maturity date has

been extended to a date falling after January 15, 2028.

(19)

Under the extension amendment to the

Lightpath credit agreement entered into in February 2024, $95

million of revolving credit commitments, if drawn, would be due on

June 15, 2027 and $20 million of revolving credit commitments, if

drawn, would be due on November 30, 2025.

(20)

CSC Holdings, LLC Restricted Group

excludes the unrestricted subsidiaries, primarily Cablevision

Lightpath LLC and NY Interconnect, LLC.

(21)

CSC Holdings Consolidated includes the CSC

Holdings, LLC Restricted Group and the unrestricted

subsidiaries.

(22)

Principal amount of debt excluding finance

leases and other notes.

Certain numerical information is presented on a rounded basis.

Minor differences in totals and percentage calculations may exist

due to rounding.

About Altice USA

Altice USA (NYSE: ATUS) is one of the largest broadband

communications and video services providers in the United States,

delivering broadband, video, mobile, proprietary content and

advertising services to approximately 4.6 million residential and

business customers across 21 states through its Optimum brand. We

operate Optimum Media, an advanced advertising and data business,

which provides audience-based, multiscreen advertising solutions to

local, regional and national businesses and advertising clients. We

also offer hyper-local, national and international news through our

News 12 and i24NEWS networks.

FORWARD-LOOKING STATEMENTS

Certain statements in this earnings release constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, all statements other

than statements of historical facts contained in this earnings

release, including, without limitation, those regarding our

intentions, beliefs or current expectations concerning, among other

things: our future financial conditions and performance, our

revenue streams, results of operations and liquidity, including

Free Cash Flow; our strategy, objectives, prospects, trends,

service and operational improvements, capital expenditure plans,

broadband, fiber, video and mobile growth, product offerings and

passings; our ability to achieve operational performance

improvements; our ability to achieve near and longer term revenue,

penetration, operational efficiency and capital structure

opportunities (including mobile lines, fiber subscribers, fiber

penetration, gross margin, operating expenses, EBITDA margins,

annual capital expenditures, and annual Free Cash Flow); and future

developments in the markets in which we participate or are seeking

to participate. These forward-looking statements can be identified

by the use of forward-looking terminology, including without

limitation the terms “anticipate”, “believe”, “could”, “estimate”,

“expect”, “forecast”, “intend”, “may”, “opportunity”, “plan”,

“project”, “should”, “target”, or “will” or, in each case, their

negative, or other variations or comparable terminology. Where, in

any forward-looking statement, we express an expectation or belief

as to future results or events, such expectation or belief is

expressed in good faith and believed to have a reasonable basis,

but there can be no assurance that the expectation or belief will

result or be achieved or accomplished. To the extent that

statements in this earnings release are not recitations of

historical fact, such statements constitute forward-looking

statements, which, by definition, involve risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statements including risks referred to

in our SEC filings, including our Annual Report on Form 10-K for

the fiscal year ended December 31, 2023 and subsequent Quarterly

Reports on Form 10-Q. You are cautioned to not place undue reliance

on Altice USA’s forward-looking statements. Any forward-looking

statement speaks only as of the date on which it was made. Altice

USA specifically disclaims any obligation to publicly update or

revise any forward-looking statement, as of any future date.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104860652/en/

Investor Relations John Hsu: +1 917 405 2097 /

john.hsu@alticeusa.com Sarah Freedman: +1 631 660 8714 /

sarah.freedman@alticeusa.com

Media Relations Lisa Anselmo: +1 516 279 9461 /

lisa.anselmo@alticeusa.com Janet Meahan: +1 516 519 2353 /

janet.meahan@alticeusa.com

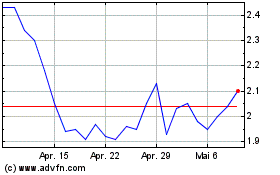

Altice USA (NYSE:ATUS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Altice USA (NYSE:ATUS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024